Good morning from Paul!

I'll leave it there for today, as there's a webinar at 14:00 from SDI (LON:SDI) that I want to listen to. Thanks for tuning in, and contributing this week, with excellent reader comments! My podcast should be up tomorrow afternoon.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

I'm rather pleased there's no news today, as there are plenty of backlog items I want to look at, so I'll focus on that today.

Also if you've spotted anything particularly interesting, then do leave a comment below, with reasons why it's worth a look, and I could be persuaded to cast an eye over it!

Paul’s Section:

Zotefoams (LON:ZTF)

380p (£185m) - Interim Results (8 Aug) - Paul - GREEN

8 August 2023 - Zotefoams plc ("Zotefoams", the "Company" or the "Group"), a world leader in cellular materials technology, today announces its interim results for the six months ended 30 June 2023.

Strong sales growth and recovery in gross margin drives record H1 profit

Zotefoams makes specialist foam products, which are used where light weight and performance factors are important - eg the biggest product is special soles for trainers (NIKE - exclusivity agreement recently extended to end 2029), aircraft seats (recovery in the sector underway), lots of other things, and a blue-sky development project called ReZorce - for fully recyclable drinks cartons. It has freehold factories in the UK and USA, and a leased (from memory) site in Poland. A recent capex programme saw all the factories modernised, largely completed now.

I need to properly read through the results statement, and watch the recording of its IMC webinar on 8 August. So this section is just my preliminary thoughts, for a share I already like, and have on my top 20 watchlist for 2023 (which is still doing quite well considering market conditions - up 8% YTD - the 13 winners have more than offset 3 profit warnings). I’m hoping to find a spot where I can pick up a few ZTF myself, but the price remains stubbornly high!

Key numbers -

- H1 revenue up 9% to £64.6m

- Profit before tax up 30% to £7.4m, a healthy 11.5% PBT margin, indicating fairly good pricing power - something that has been proven over the last couple of years with higher input prices being passed on successfully to clients.

- Profit is stated after absorbing around £1.5m in development costs for the innovative ReZorce fully recyclable drinks carton project. So underlying profit is about £9m in H1.

- Basic EPS in H1 is 11.5p (up 22%).

Outlook - nicely balanced commentary here, but overall it sounds reassuring that forecasts should be met -

The short-term outlook for the remainder of the year is somewhat tempered by market expectations of squeezed consumer spending and industrial deflation, resulting in inventory reductions in some of our markets.

Other markets, such as aviation, are not expected to be impacted by this trend, with underlying structural growth drivers remaining robust.

We expect energy and polymer input costs to be more beneficial while the US dollar, at a current rate of around $1.28, will provide a headwind to profitability for the remainder of the year, after benefitting operating profit by £1.1m in H1 2022, despite being partially hedged.

Overall, the Board is pleased with the recent performance and current positioning of our business. We remain confident that the Company can deliver a full year performance in line with market expectations, underpinned by a strong first half performance.

We remain optimistic that we can continue our positive momentum in the medium term.

Investors are also watching ReZorce carefully - the recyclable drinks carton project. The upside on that could be really exciting, if it technically succeeds, and drinks manufacturers decide to buy it. Although as readers here have commented before, there must be numerous other companies innovating in this field too. So I’m not seeing ReZorce as a sure thing at this stage, more speculative upside. Also, if the project were to be abandoned, profits would actually rise, because of the costs associated with developing it stopping.

Balance sheet - it’s a capital-intensive business, with £91m in fixed assets (properly, plant & equipment), but this includes freehold properties of £32m (which I see as a huge positive, but some investors focus on ROCE and similar measures, which can be harmed by owning freeholds, although IFRS16 has arguably lessened that - about the only positive thing it has achieved).

Both inventories and receivables look a little high.

Working capital looks very healthy, with a £20m surplus of current assets over current liabilities, especially impressive since all the bank debt of £35m is within current liabilities.

There’s a small £2.7m pension deficit. This is possibly a little light compared with reality, which is £860k pa deficit recovery payments (which I’ve picked up from the cashflow statement).

Overall NAV is £113m, less intangibles of £8m, gives a very robust NTAV of £105m.

Net debt of £28.3m, is little changed. This is fine, as the bank has ample security over the freeholds and receivables (see note 11), and it’s only an EBITDA multiple of 1.1x, considered low.

It seems strange that the bank borrowings are shown in current liabilities (repayable within 12 months), but note 11 says the borrowings are technically repayable within 3-6 month periods, which seems to contradict another section saying it refinanced in 2022 with a £50m+£25m accordion, expiring March 2027. I must ask management to clarify this point. It’s only a technical thing, because debt is not a problem.

Overall, I’m fine with the balance sheet, but would prefer the company to reduce inventories and receivables if they can, to reduce bank debt, which is becoming a lot more costly now that interest rates have risen. Companies didn’t need to worry about that in the previous near-zero interest rate environment, but nowadays, they need to question why they’re funding customers’ late payments, and inventories?

Cashflow statement - it’s a nicely cash generative business, although negative working capital movements temporarily absorbed a fair bit of the cash in H1. That should stop, or reverse, so it’s not a massive concern.

Note that capex has reduced considerably, and was only £1.6m in H1, less than the depreciation charge of £4.1m. So assuming nothing is going wrong behind the scenes, then ZTF should be able to considerably reduce bank debt from internal cashflows.

“Purchases of intangibles” were £1.0m in H1 - is this capitalised development spend? It's not that much anyway.

Dividends only cost £2.2m in H1, and £3.2m for the last full year FY 12/2022, so combined with the large potential cash generation mentioned above, I think ZTF has a much higher future dividend paying capacity than at present. The rather ungenerous current divi yield of c.2% is almost 3-times covered by earnings, and I’d expect to see more generous divis in future.

Valuation - it doesn’t look cheap, but it’s a good quality company, performing well. Pre-covid the rating was much higher, and profits now are higher.

Also the Re-Zorce development project is suppressing current profitability somewhat, but could have exciting upside if it commercially succeeds. So I think there’s a valid case for valuing the shares on adjusted profits that subtract the costs of this project.

Singers (many thanks) has adj EPS of 19.3p this year FY 12/2023, rising to 22.5p in 2024, and 29.4p in 2025. Hence we’re just shy of a PER of 20x for 2023, which does look punchy in a bearish stock market. Hence I think it’s important that ZTF at least meets forecasts, and preferably beats them. A profit warning here would be very bad news for the share price, since it’s not factored in any room for disappointment, unlike many other shares right now where recession is seemingly priced-in already.

Paul’s opinion - the H1 numbers are excellent, showing strong profit growth, albeit helped somewhat by favourable currency movements.

I think it needs to beat forecasts, to justify the punchy rating.

Re-Zorce could be exciting, and a manufacturing partner has been signed up, so news on this front could apparently be in early 2024.

Incidentally, ZTF comes up on the James O Shaugnessy cornerstone growth screen, which has all sorts of good companies on it - I recognise many companies as being ones we’ve reported positively about here in the SCVRs (unsurprising really, as this screen picks up shares which are out-performing the market).

Despite the full valuation, I think ZTF has enough positive characteristics to make me remain GREEN. More as a GARP, than a value share.

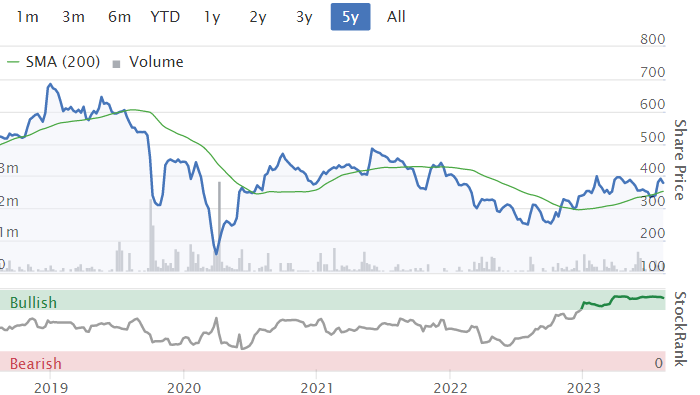

Stockopedia likes ZTF too - note how the StockRank has been rising

CML Microsystems (LON:CML)

433p (£67m) - AGM Statement - Paul - GREEN

CML Microsystems Plc, which develops mixed-signal, RF and microwave semiconductors for global communications markets…

This update for FY 3/2024 strikes me as positive in tone, which combined with a drifting down share price, has caught my attention.

I’ve previously covered CML a lot here, and won’t go through all the detail again, it’s in our archive ("Discussions" tab on every company's StockReport). The key points are that the core business is trading well (strong results for FY 3/2023), and the balance sheet is stuffed full of surplus cash, and surplus freehold property (planning permission finally achieved to develop this land earlier this year, after many years trying!).

Note a 50p special dividend was paid in 2021.

Latest news was yesterday at the AGM, key points being -

FY 3/2024 has “started positively”, on course to increase “operational profit” further.

(note that FY 3/2023 saw normal PBT of £3.16m, plus £2.1m exceptional gain on land)

Acquisition of US-based Microwave Tech for up to $18m (mis of cash & shares) announced in Jan 2023, is still undergoing US regulatory approvals, expected by 30 Sept.

Mgt say they have returned >£24m to shareholders through divis and buybacks. Although I would check how much offsetting dilution there has been through share options.

Paul’s opinion - I see that a lot of the surplus cash is ear-marked for the US acquisition, which seems to be a small, and slightly loss-making US company. Therefore we have to trust that CML’s management knows what it’s doing here, as there’s nothing obviously attractive about this acquisition from the limited financial info provided (FY 12/2022 revenues $6.5m, Loss of $132k), paying up to $18m to acquire it. CML does say that it "will be earnings enhancing in its first full year of ownership within CML", which reassures. They've got to compare it with foregone interest income on the cash though.

Shore Capital (many thanks) thinks CML should grow EPS by 24% to 27.3p this year FY 3/2024. If achieved, that would make the PER 15.9x. Plus support (although less once the acquisition completes) from the cash pile, and surplus property.

I’d say this share is starting to look tempting after recent falls, so I’ll remain GREEN. Roland did the last review of it, and marked it amber - citing the lowish ROCE, but this goes back to my earlier point above with ZTF, that companies with surplus assets may look inefficient, but have hidden value in them, which matters more to me.

Risk:reward has changed somewhat, in that surplus cash being used for an acquisition, reduces the comfort blanket of excess cash.

After giving up the recent spike up, and with another reassuring trading update in the bag, I think this looks a tempting entry point, possibly (and only if you understand what the company does, and its competitive position, etc) -

Sorry, this was meant to be a short section, but ended up being large!

Zoo Digital (LON:ZOO)

64p (£63m) - Audited FY 3/2023 Results - Paul - AMBER

Everything seemed to be going well for this TV/film “localisation” services group (e.g. dubbing, subtitles, etc) - with revenues roughly tripling in recent years, driven it seems by the free spending of the TV streaming services in the US. After years of lacklustre financial performance, ZOO broke through into meaningful profits in 2021 & 2022.

However, in the last few months, the wheels seem to have come off very suddenly, as you can see from this 5-year chart, and horrible relative strength numbers -

Is it now a value share, as the “John Neff Value” screen suggests?

What has gone wrong? Consulting my quick notes spreadsheet here, I looked at ZOO -

28 April 2023 - down 9% to 166p in a placing (13% discount, but a great price for the company, but not investors, with hindsight). This came with a mild profit warning, that strangely the market seemed to initially ignore. I noted that I was cooling on ZOO, due to dilution & the profit warning, so went down to amber. That was too optimistic though…

14 July 2023 - bombshell, large profit warning, slipped out via brokers, despite a positive-sounding, highly misleading RNS. I reduced my view again, to AMBER/RED, although did note the healthy cash pile - isn’t it lucky when placings happen shortly before profit-warnings?!

Anyway, on to the latest announcement, FY 3/2023 audited results - there was an 8% bounce yesterday on publication of these numbers.

The headline figures look really good -

- Revenue up 28% to £90.3m

- Operating profit up 330% to $8.1m

- Profit before tax $7.9m (boosted by a $2.0m prior year adj)

- Negative tax charge helps boost EPS to 8.3 US cents (diluted - note share options are generous).

Balance sheet is OK, but not great. NAV of $35m becomes about $25m once intangible assets are written off. Cash of $11.8m seems to be offset by “borrowings” but note 7 shows that these $7.0m+$1.4m borrowings are actually lease liabilities. That should be explained on the face of the balance sheet, as most companies do, so a presentational own-goal there. Shareholders might want to point this out to ZOO management.

Overall then it looks OK to me.

Going into the detail more, I see that the 160p placing which raised $15.5m happened after the year end. So the cash pile should now be c.$28m (but was actually $23m at June 2023), assuming no operational cash burn since March 2023. The money was earmarked for a Japanese acquisition, but it sounds to me as if that might fall through, as it hasn’t yet completed. Given industry challenges, let’s hope ZOO hasn’t signed anything, and can pull out without penalty.

With strong numbers for FY 3/2023, and plenty of cash in the bank, why is the share price currently bombed out? I’d say it’s mainly these issues -

Industry factors, eg the Hollywood strikes, causing productions to halt/delay

Streaming giants cutting back spending - was the big FY 3/2023 profit for ZOO a one-off perhaps?

Massive profit warning on 14 July that saw forecasts slashed from 9.6c to only 2.9c for FY 3/2024.

Outlook - ZOO says the current disruption is temporary. I can see why that would make sense for the Hollywood strike, but the streaming services cutting back sounds more permanent to me -

Current trading has been impacted by several major streaming companies carrying out strategic reviews to refocus on profitability and the first simultaneous strike of US writers and actors in 60 years. This has created short-term market disruption and temporarily lower volumes of localisation and media services work.

Cost-cutting is being implemented.

Expects market share gains from customers rationalising their supplier bases - sees upside from this in H2 2024 (Oct 2023- Mar 2024).

Current guidance unchanged -

The Board remains confident in ZOO's medium and long-term fundamentals and expects to deliver revenue growth over FY23 in the following years. Our guidance for FY24 remains unchanged and our 2030 strategy remains on track.

Paul’s opinion - with the market cap now being only £63m, and a net cash pile of $23m (£18m), that’s 29% of the market cap supported by net cash. Let’s just hope it doesn’t spend the cash on the mooted Japanese acquisition. The delay suggests to me they might be trying to renegotiate on price perhaps?

A lot of that cash came from investors who supported the placing earlier this year, at 160p. We can now buy in the open market for about 65p. The value investor side of me is drawn to that, although the fundamentals have drastically deteriorated this year.

Taking everything into account, I’m happy to go from AMBER/RED, to plain AMBER. That view is based on me being neutral about how temporary, or structural the problems are. Industry experts should have a better idea on this. Once the Hollywood strike is over, I can imagine sentiment improving towards ZOO.

Downside risk looks fine, given plenty of cash, but I would see the Japanese acquisition going ahead as a negative risk factor.

Lease liabilities are quite high, and capex fairly hefty too, suggesting that ZOO isn’t as capital-light as I would have expected.

Being low gross margin, and using thousands of freelancers (so flexible cost base), I would have expected ZOO to be able to absorb a downturn in business much better than it has. So that’s a question mark, as to why the recent profit warning was so severe, when it shouldn’t have been? Maybe a lot of the profit might be coming from a handful of key customers?

I don’t believe the story that ZOO has big competitive advantages, because there must be numerous other companies offering dubbing, which is reflected in ZOO’s low gross margin.

Finally AI! Who knows whether this is a threat or an opportunity? Given how good the text to speech software is becoming, then I don’t know whether AI could help, or hinder ZOO. The section in its results emphasises the limitations of AI, but does see some applicability for it, e.g. in dubbing documentaries, or other older content, where a slightly crude literal translation might suffice. In summary, it says similar things to what everyone is more-or-less obliged to say! -

In summary, AI is an exciting field of computing that is being developed at pace and holds much potential, including in the field of ZOO's business. Its successful application in media and entertainment, particularly for premium content, will inevitably be alongside traditional practices and the use of creative talent, and where ZOO's heritage as an innovator and trusted partner to the leading names in the industry places it well to become a leader in the field. Consequently, the Board regards AI as an opportunity for ZOO's business rather than a threat.

Overall, I can see that ZOO shares might be coming into speculative buying range, providing it keeps hold of the cash pile. Although having disappointed so badly this year, there must be plenty of shareholders smarting at their losses, and maybe not so keen on management. That could mean a protracted overhang, if institutions are dribbling out stock into the market. That's an issue with lots of small caps right now.

Goodwin (LON:GDWN)

4745p (£356m) - FY 4/2023 Prelims (from 8 Aug)- Paul - AMBER/GREEN

It’s been a while since we’ve looked at this family-controlled engineering group.

Roland wrote a superb summary of the interim results here on 20 Dec 2022.

Shares are up 42% YTD, and it’s one of the top performers in my 2023 watchlist.

Key numbers for FY 4/2023 -

Revenues £186m, up an impressive +29%

Gross margin is down from 29.6% LY, to 24.9% - that’s a big drop, we need to investigate this.

Adj PBT rose 10% to £18.9m

Reported PBT is higher (unusual!) thanks to a £3.2m gain on the inspired decision to fix some borrowing costs at 1% for ten years!

Diluted EPS is up 22% to 206.8p - this includes the non-trading benefit of the profit on interest rate swap. Note there don’t seem to be any share options, as basic and diluted EPS are exactly the same!

The PER is a punchy 22.9x - high for an engineering group. Although talking to investors, people seem more interested in the large & growing order book.

Shareholding structure - it’s completely controlled by Goodwins! So you need to be comfortable about being along for the ride, with no say in anything -

Where are the institutional shareholders? There don’t seem to be any!

Could that be upside potential, if the market cap continues growing, forcing some institutions to start buying into an illiquid market?

Broker forecasts - don’t seem to be any. Although it’s encouraging to see Shore Capital (house broker) has been issuing short summary updates (but without forecasts) for about a year. The most recent one says “NB. We intend to publish a detailed report on the company in due course”.

Forward order book - has grown to £271m. I am assuming it’s grown, as I can’t find actual numbers in the last interims, or prior year results, but plenty of bullish commentary about big order intake.

It’s frustrating at the vagueness and lack of figures from the company. Hopefully when “due course” is up, the anticipated note from Shore will shine a light on things rather than it being shrouded in mystery, and only occasional updates to outside shareholders.

If they do suddenly start getting more transparent, it’s probably because one of the family members wants to cash out! (being cynical).

Nuclear decommissioning and naval markets are said to be the main driver of order intake being 68% up on last year. This bit sounds rather good too -

The programmes of work, that are actively ramping up now, are being exploited to win more and more of the same, supporting projects that will still be ongoing in a decade's time… after a long drought, they should now meaningfully contribute to the Group's performance going forward.

Balance sheet - looks fine to me. NAV of £129m becomes £104m once we write off intangible assets. It’s using a fair bit of debt (gross: £54m), but that’s partly offset by gross cash of £19.7m, so £33m net debt. It’s not clear if that’s just bank debt, or might include leases as well?

Cashflow statement - nicely cash generative business, which it’s mainly spending on capex. Plus about £8m p.a. cost of divis.

Paul’s opinion - GDWN looks good, but I don’t really have enough information to value the shares.

It seems clear from the commentary with the last 3 sets of results, that development of new products is beginning to pay off with large orders. Management talked about regaining peak levels of performance which it had previously achieved in the oil boom c.2014, targeting new sectors now. Peak profits in those days were £20-24m, so it’s not far off that already, at £19m adj PBT for FY 4/2023.

So personally I wouldn’t want to chase the share price any higher, without having much more detailed, and reliable knowledge about what level of profits we should expect to see in the coming few years. If any readers have more detail on that future outlook, do please share it, and what your share price targets are? I believe we have some very knowledgeable members here on GDWN.

As the shares have risen a lot recently, I’ll moderate my view slightly, to AMBER/GREEN.

Very impressive long-term -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.