Good morning from Paul!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Hardly any news today, so that's ideal as it gives me a chance to work through some backlog items -

Other mid-morning movers (with news)

Petrofac (LON:PFC) - down 30% to 23.2p (£123m) - Update on strategic & financial options - Paul - RED

This sounds ominous. I’ve not looked at PFC before, but it used to be a huge company, with a mkt cap of £5bn in 2013 for example (click on the “print” button on any StockReport, to look back over c.11 years historic StockReports, incredibly useful for viewing the historic numbers). In 2012 it made $764m operating profit on $6.2bn revenues.

It’s in a real mess now. Today it says that “all options remain under consideration” as it negotiates with lenders over a debt for equity swap, and talks to investors about raising more equity, plus possible asset disposals, and trying to secure guarantees to support recent contract wins.

Paul’s view - PFC is clearly a financially distressed situation (which was already known), and in these situations it's a lottery whether it recovers, or if existing equity could be worth little to nothing. It has an $8bn order backlog, so the business looks likely to survive, but existing equity could be seriously damaged in any restructuring deals. Whoever puts in the new money calls the shots, that’s the trouble with all financial distressed restructurings. For small shareholders the safest option is just to sit on the sidelines and wait to see what sort of deal is done. Why take the risk of being a lamb to the slaughter in a deal where existing small shareholders have the weakest hand? It’s just for gamblers at this stage, as there’s such a wide range of potential outcomes, depending on how negotiations/deals go. Note that net debt was $584m (£467m) at June 2023, almost 4 times the current market cap. So heavy dilution to fix the balance sheet seems likely. I’ve got to mark it RED, to flag the high risk, but I have no idea what the outcome will be.

R&Q Insurance Holdings (LON:RQIH) - down 45% to 3.0p (£11m) - Trading Update & Disposals - Paul - no view.

Says that a disposal should complete in Q2 2024, and will allow “material financial de-leveraging”.

The trading update sounds poor -

Based on preliminary and unaudited information R&Q anticipates that it will realise a significant pre-tax loss for the year driven by the adverse development in Legacy and a material increase in corporate costs in relation to the Sale of Accredited.

Paul’s view - none, as it’s way too complicated for a quick review. One for special situations experts only I’d say. The share price has almost completely collapsed, so the market clearly thinks it’s in serious trouble. The shareholder register surprises for having some big name, credible institutions with >3% holdings.

Summaries of main sections

Churchill China (LON:CHH) - 1,150p (£121m) - FY 12/2023 Results - Paul - AMBER/GREEN

Maker of robust pottery for the hospitality sector. Very sound finances, with a strong balance sheet. 2023 results are solid, profit up 12% on 2022. Valuation has historically been excessive, but now looks reasonable, so overall I quite like it.

Epwin (LON:EPWN) - 86p (£122m) - FY 12/2023 Results [in line] - Paul - AMBER/GREEN

Decent performance in 2023, despite macro headwinds. Valuation seems modest still, despite 21% recent share price rise. Generous, well covered divis, and it's doing buybacks. Finance costs imply that bank debt might be higher during the year on average, than the year end snapshot possibly? No sign of cyclical recovery in its end markets, but does that matter given EPWN is trading OK in depressed macro conditions? Cyclical upside could be good maybe, when it happens.

Iqe (LON:IQE) - 28.5p (£274m) - FY 12/2023 Results - Paul - RED

Terrible 2023 results, but a strong improvement in the year from H1 to H2. Shored up its balance sheet with a placing, I doubt that will be the last. A long track record of disappointing. It's a capital-intensive, capex hungry business, that (so far) doesn't seem to generate any return from its investments. So what's the point? Performance needs to greatly improve to justify anything near the current market cap.

Futura Medical (LON:FUM) - 36p (£109m) - FY 12/2023 Results - Paul - RED

Lousy figures for 2023 from this startup, although the first revenues have started for its Eroxon product. Slight problem - it doesn't work, according to both the majority of reviews online, and I confirmed this in my own mystery shopping the product. "Material uncertainty" in going concern. I suspect this share could be heading for disaster, as a product that doesn't work won't sell.

Premier Miton (LON:PMI) - up 3% to 61p (£99m) - Q2 AuM Update - Paul - GREEN

Some promising signs in this fund managers' update that equity fund outflows are finally drying up. I could be wrong, but this seems a good time to be looking at these cyclical shares, and anticipate a recovery that's starting to look increasingly likely that it might be in the early stages. Decent balance sheet with plenty of cash, and a nice yield too. I like it.

Sigmaroc (LON:SRC) - 64p (£711m) - AGM Statement - Paul - AMBER

My first time looking at this rapidly expanding limestone quarrying group. It all boils down to whether management's dash for growth will deliver shareholder value in the long run or not. It's taken on a lot more debt in 2024, and there are no divis as yet. Not really my type of thing, but good luck to holders.

Paul’s Section:

Churchill China (LON:CHH)

1,150p (£121m) - FY 12/2023 Results - Paul - AMBER/GREEN

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its Final Results for the year ended 31 December 2023.

The company headline is maybe too brief, at just two words! -

Improved profitability

That’s a PER of 16.4x for 2023 actual results.

70.2p actual EPS seems below consensus of 82.5p shown on the StockReport.

Solar panels now provide “up to 100% of the main factory’s electricity requirement on sunny days”. I wonder if kilns still use gas though? Note it has forward purchased energy to Q2 2025, to lock in current lower prices - sensible.

The tax charge in 2023 almost doubled, which blunted EPS growth vs PBT growth.

Balance sheet is very good, with a striking surplus of working capital (current assets £47m incl £14m cash), current liabilities £14m.

NAV £60m, less intangibles of £1m, gives a very decent £59m NTAV. That’s half the market cap supported by tangible net assets, a good position to be in for the company and investors.

Note the pension scheme is shown as an accounting asset, but actually requires £1.75m pa in cash contributions from the company - reminding us how absurd pension scheme accounting rules are. Although it sounds like the cash payments might not be needed for much longer maybe?

Cashflow - looks fine to me.

Outlook -

We have delivered an improvement in operating profit and margins during the year despite flat revenues and strong headwinds particularly in our hospitality markets. Volumes were down year on year, driven by softer demand in the second half of 2023. We believe this trend will continue into the first half of 2024 and the first quarter of 2024 has seen demand as expected.

We are confident that the continuous improvement in our product range and market position, backed up by our ongoing investment programme, has placed the Company in a strong position to take advantage of a market recovering from current weakness, which we expect to see in the second half of 2024.

I don’t have access to any broker notes, but the StockReport here shows 79.6p EPS forecast for FY 12/2024, which would be a PER of 14.4x - which strikes me as a fair valuation.

Paul’s opinion - I’ve never understood why CHH shares attracted such a premium valuation in the past (often PER c.20x), which didn’t really seem justified for a mature business that performs OK, but no great shakes.

It’s now come down to a much more reasonable 14.4x 2024 consensus forecast. Combined with its strong balance sheet meaning there’s no solvency risk (unlike Portmeirion (LON:PMP) I’m afraid to say), then I’m happy to shift up to a more positive view, so it’s AMBER/GREEN for me. Hopefully business should grow more strongly once the economy is in recovery mode.

Epwin (LON:EPWN)

86p (£122m) - FY 12/2023 Results [in line] - Paul - AMBER/GREEN

Epwin Group Plc (AIM: EPWN) ("Epwin" or the "Group"), the leading manufacturer of energy efficient and low maintenance building products, with significant market shares, supplying the Repair, Maintenance and Improvement ("RMI"), new build and social housing sectors, announces its full year results for the year ended 31 December 2023.

Company headline -

Well placed after another year of strong profit growth and strategic delivery

I last looked at this building products group here on 27/11/2023, AMBER/GREEN at 71p, on an in line trading update, concluding that it looked very interesting, and seemed to be performing well despite tough macro/sector. 7% divis were twice covered and buybacks announced. I should have been bolder and gone green, but other companies in the sector were warning on profits and reporting subdued demand at the time.

It says 2023 trading was strong, and “modestly ahead of expectations”. Shore confirms that operating profit beat consensus estimate by 4.5%, good news.

On to the FY 12/2023 results, some key numbers -

Revenue down 3% to £345m

Adj PBT £18.0m (up 9%), helped by higher margins.

Adj EPS up 8.5% to 9.71p (PER 8.9x)

Adjustments look reasonable, being mainly goodwill-related.

Bank net debt £14.4m (down by 20% vs end 2022), modest at 0.5x EBITDA.

Tons of headroom >£60m on bank facilities extended to Aug 2026.

Extending share buybacks.

Total divis for 2023, 4.8p yielding 5.6%

Inflationary pressures being “actively managed”, but are easing.

Extending product ranges, and making acquisitions.

Outlook - no sign of any cyclical recovery yet, which is what we’re hearing from most other sector participants too -

Broker forecasts - thanks to Zeus and Shore, which both publish updates via Research Tree. Shore sees a modest increase to 10.3p in FY 12/2024. I wonder if there might be upside on forecasts, given that EPWN has proven so resilient in the current downturn, and a cyclical sector upturn likely to happen at some stage? Later this year, or in 2025, who knows?

Balance sheet - looks OK. NAV £102m, less intangibles (acqusition-related) of £95m, so there’s only £7m NTAV.

Working capital looks well under control, with both inventories and receivables looking quite modest relative to revenues.

As with all companies, I’d like them to disclose average daily net debt, not just the year end snapshot. Note 4 shows £3.1m “interest expense on borrowings”, so if we assume an interest rate of say 6% payable by EPWN (c.2% above average SONIA of about 4% in 2023), then I reckon gross bank debt would have been c.£52m averaged throughout 2023. That’s much higher than the year end snapshot, so this needs to be queried on any webinars - what is their average daily net debt?

Also I don’t see any finance income, which seems odd given it reports gross cash of £13m at 31/12/2023. So another question to ask management is why they don’t seem to earn any credit interest on cash balances?

For these reasons I suspect the year end balance sheet might have been window-dressed to show a flatteringly low net debt figure that may not be representative of the average net debt position throughout the year. Hence we need to query this with the CFO if they do a webinar.

Cashflow statement - the post-tax operating cashflow looks amazing at £37.6m (similar in 2022), but there are large lease-related costs further down, of £3.4m+£10.9m, so I adjust those out to get a more realistic cash generation figure of £23.3m, still very good indeed for a company with a market cap of £122m.

About half of that cashflow was spent on capex, interest costs, and a small amount of deferred consideration re acquisitions.

Dividends and buybacks cost c.£7m, and debt was reduced by £5m.

In summary then, EPWN is self-funding capex and generous divis, which looks a healthy cash generative business.

Going concern statement is fine, no issues.

As you can see from the StockReport below, there’s a lot of green - with a StockRank almost on maximum, and low valuation metrics.

Quality rank is high at 88, but the individual metrics (ROCE, ROE and operating margin) are only middling, so I don’t quite understand that mismatch.

Paul’s opinion - I was previously amber/green on EPWN back on 27/11/2023, when the share price was 71p. I should have been more bold and gone green, as the value was more stark then than it is now it’s bounced 21% to 86p.

It looks as if the market is now anticipating a cyclical recovery, and the chart is looking more encouraging too (not that I’m a chartist, but it’s simple enough to spot a change in trend).

We also now have a slight beat against forecasts for the 2023 results, and an OK outlook statement, and that’s before any cyclical recovery has even started.

So I remain enthusiastic about EPWN shares. I don’t imagine it will multi-bag, but I could see it gaining a decent amount if the sector improves in the next couple of years. And paying a 6% dividend to investors whilst they wait isn’t a bad setup.

Since EPWN shares have always looked cheap, I wonder if the institutional holders might pressurise it to negotiate a takeover deal with private equity, as we’re seeing happening a lot? Takeovers are great, but they need to be at a decent premium, rather than just providing a convenient liquidity event for institutions.

The stock market just doesn’t seem interested in EPWN, and doesn’t give it credit for resilient financial performance in recent years, despite all the macro issues.

Iqe (LON:IQE)

28.5p (£274m) - FY 12/2023 Results - Paul - RED

IQE plc (AIM: IQE, "IQE" or the "Group"), the leading global supplier of compound semiconductor wafer products and advanced material solutions, today announces its results for the full year ended 31 December 2023.

The company’s headline completely glosses over the reality that these figure are terrible, saying -

Strategic progress in a challenging market with a return to growth in H2

FY 12/2023 numbers -

Revenue down 31% to £115m

Adj EBITDA has largely disappeared, down 82% to £4.3m

Adj loss before tax went from £(6)m in 2022, to £(29)m in 2023.

Is it going bust then? Probably not. Adj net debt is only £2.2m, improved from £15.2m a year earlier, so that looks OK. This was achieved through an £29.8m equity raise in May 2023. I suspect that may not be the last equity raise.

Balance sheet - shows £170m NAV, less £35m intangibles = NTAV £135m. Although most of that is tied up in £130m fixed assets - IQE is a capital intensive business, that doesn’t generate any return from the assets it owns. Year after year, the ROCE and free cashflow have been negative.

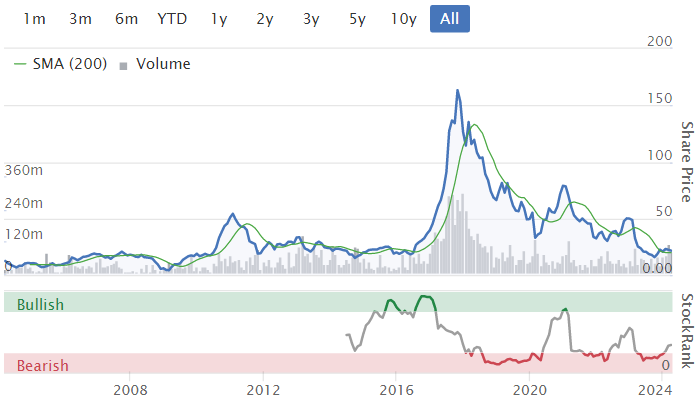

The shares have had bursts of activities when the company from time to time manages to excite investors about its future prospects. Long term though, it always disappoints.

On a more positive note, It highlights a significant improvement in H2 vs H1 -

Outlook - it talks about the semiconductor industry now recovering.

Revenue and adjusted EBITDA are expected to be within the range of analyst forecasts for FY 2024 1 .

1. The analyst range of expectations for FY 2024 revenue are from £133.7m to £153.7m and for adjusted EBITDA from £11.1m to £16.6m .

That level of EBITDA is nowhere near good enough, because IQE is a heavy capex spender every year. Hence no real profits (PBT) are likely in 2024 again.

Paul’s opinion - I’ve followed IQE for years, and it’s always disappointed, but seemed to hold out the potential for great things in future, which fail to happen. Profits seemed to collapse in 2018-19, which suggests to me competitors have eaten its lunch since then.

It doesn’t seem to have any pricing power, or competitive advantage, but needs to spend continuously on heavy capex to make products that it doesn’t seem to be able to sell in sufficient quantity or margin to generate any cash overall. That’s why it doesn’t pay dividends.

It’s difficult to see why this company exists. Of course I have no idea what the future holds, but why IQE is valued at £274m, given its lamentable track record, eludes me. Maybe performance might improve in future? We're not predicting the future here remember, just reporting on the facts & figures as of today.

Futura Medical (LON:FUM)

36p (£109m) - FY 12/2023 Results - Paul - RED

Futura Medical plc (AIM: FUM), the consumer healthcare company behind Eroxon®, that specialises in the development and global commercialisation of innovative and clinically proven sexual health products, is pleased to announce its final results for the year ended 31 December 2023 ("FY23").

Revenues have just started, from nil in 2022, to £3.1m in 2023.

Loss before tax was £(6.9)m, which includes a £2.7m charge for share based payments. Remarkable greed there, considering they haven’t even achieved any profits yet, but they're helping themselves to free or cheap shares anyway.

Cash is £7.7m, with it talking about the “cash runway” lasting into 2025 when it launches in the USA. Shouldn’t it be generating cash now, from the UK/Europe launches?

Going concern statement - you have to click through another link to find the full accounts and notes. No wonder they're coy about showing us the figures, as they're bad. Note 2.2 on going concern concludes there is a “material uncertainty” over whether it can survive beyond June 2025 - a big red flag for me.

Paul’s opinion - if this product was a genuine breakthrough in treating erectile dysfunction (as it claims) then of course the shares would go to the moon, and the company would be worth billions.

As mentioned before though, there’s a fairly serious problem - Eroxon doesn’t work! It’s completely useless for most people who left reviews here on Amazon after buying the product. I also mystery shopped it, and it does absolutely nothing, it’s just a placebo. Which is what most reviewers online also say.

Therefore I imagine it’s likely to achieve modest initial sales as customers try it out once, then fail to get much in the way of repeat orders, as most customers abandon it as a waste of money, you can see from customer reviews.

I could be wrong of course, but that’s what all the evidence suggests to me. Hence this one is a bargepole share for me, and I suspect it’s likely to end in disaster for shareholders. Why take the risk, when most customers say the product doesn’t do anything? Ignoring customer feedback isn’t a good way to make money, in my experience - companies that fail often have warning signs all over the internet from dissatisfied customers, as FUM clearly does.

Premier Miton (LON:PMI)

- up 3% to 61p (£99m) - Q2 AuM Update - Paul - GREEN

Premier Miton Investors is focused on delivering good investment outcomes for investors through relevant products and active management across its range of investment strategies, which include equity, fixed income, multi-asset and absolute return.

Company headline -

Stronger environment for mid and small cap stock supports outlook for improving fund flows

Assets under Management (AuM) rose by 9% to £10.7bn in the quarter to £10.7bn

Two thirds of the rise is due to an acquisition of Tellworth Investments, plus a new mandate to manage money for GVQ Investment Funds.

Net fund flows out of the equity funds have slowed to a trickle, only about 1% of FuM in Q2 (Jan-Mar 2024), offset by an impressive 5.5% gain in market performance in Q2 for their equity funds.

Encouraging noises made about small/mid caps - useful info for all of us -

It has also been encouraging to see shorter term performance on an improving trend as market breadth improves and mid and small cap stocks recover…

"The backdrop for active fund sales in the UK retail market has been challenging over the Period, as it has been since interest rates began to rise at the end of 2021. We are now at a point where interest rates are likely to trend lower as we move through 2024 and we believe this will support an improving environment for fund flows and asset values that should particularly benefit Premier Miton.

The only caveat I would add is that Gervais at Miton is a perma-bull on small caps! He’s got to be, otherwise nobody would invest in their small cap funds!

Balance sheet - nothing is said today, but checking its last reported balance sheet at 30/9/2023 it looks healthy. Adjusting out lots of intangible assets and removing deferred tax, I get to NTAV of £37m, which is almost exactly its cash pile. That makes sense, as there’s almost nothing in physical fixed assets (probably just some desks & computers), and trade receivables & payables are both large but roughly offset. All as expected.

With the cash pile being 38% of the market cap, this is reasonably well supported with the best asset: cash.

Broker forecasts - nothing available, but consensus on the StockReport shows 6.21p for FY 9/2024, and 7.66p for FY 9/2025. That would put the PER in high single digits.

Forecast divis of 6.0p suggest a yield of c.10%, which might be a stretch, but given its strong balance sheet liquidity, I can’t see any reason why it wouldn’t be possible to pay out all the earnings in divis. I don’t know what regulatory capital it is required to keep though, that would be the only potential limiting factor. But when a yield is as high as 10%, it’s sometimes best to proceed with caution, and factor in the possibility it might be cut.

Paul’s opinion - we’re starting to see the signs of a market recovery, and fund outflows ending. Those are exactly the pointers that a bull sitting on the sidelines for an entry point would want to see. Combined with a strong balance sheet, a history of generous divis, I think this looks very good.

Not sure why I’ve looked at PMI twice this year, when it’s Graham’s specialist area, probably just because he’s been on day off when PMI has reported! So I’d like to hear his view next week maybe. In the meantime, I’m upping my view from amber/green previously on 12/1/2024, to GREEN today.

It’s worth looking at the whole fund management sector though, as there are plenty of bargains around. I think this seems the right time to be getting into this sector, given the clear (albeit early) signs of market dynamics now improving. It’s very cyclical, and this is looking a lot like a potential cyclical low point.

I bought some Cavendish Financial (LON:CAV) recently, and might see if I can free up a bit of cash to buy some fund manager stocks now too.

Bottom of the cycle, or permanently broken? You decide! I'm inclined towards the former.

Sigmaroc (LON:SRC) - 64p (£711m) - AGM Statement - Paul - AMBER

SigmaRoc, the Northern European quoted lime and limestone group, is pleased to announce an update on its first quarter trading for its 2024 financial year ('Q1' or the 'Period'), in advance of the Annual General Meeting to be held at 12.30 p.m. today…

Started FY 12/2024 well, trading in line with expectations.

Acquisitions - absolutely key, this is a highly acquisitive group, buying up limestone companies across Europe. It says acquisitions are going well. A large acquisition from CRH in the UK has recently completed (announced on 27/3/2024). So it all boils down to management skill in executing, and then managing the multiple acquisitions. Key information would therefore be what is management track record in their previous jobs?

Outlook is unchanged.

Balance sheet - looking at the last one at Dec 2023, it’s very top heavy with physical fixed assets of £573m, and intangible assets of £188m.

Working capital is OK with a current ratio of 1.14, and includes gross cash of £56m.

Long-term liabilities included £201m borrowings, which I think will have risen a lot in 2024 from the latest acquisition. Net debt was £182m, which is a lot, but not excessive when compared with the £117m adj EBITDA in 2023.

NAV was £515m. I’ll adjust this by removing intangible assets of £188m, giving NTAV of £327m, which seems OK.

I’m never quite sure whether we should remove deferred tax too, as often it relates to goodwill. So I’ll leave a question mark over this £72m balance sheet liability. If we removed that as well, then adj NTAV would improve to £399m.

Going concern statement is clean.

Cashflow statement - isn’t great. In both 2023 and 2022, it spent about two thirds of operating cashflow on capex. Cash is also flowing out to fund the multiple acquisitions. £30m equity was raised in 2023, which was used to repay a similar amount of bank debt.

Interest costs are rising, and fairly hefty at £14.5m in 2023.

Dividends are negligible at only £1.3m.

The key question is therefore what is the nature of the capex, since that is consuming most of its cashflows. If these are say one-off improvements to worn-out equipment that came with the acquisitions, and won’t repeat, then fine. If however it’s an ongoing heavy spend required just to keep its facilities running, then not so good. That would be a key question to ask management - what is the split between expansion, and maintenance capex?

Paul’s opinion - I’m struck by the very rapid growth at SRC. Its 2023 results showed £71m adjusted PBT on £580m revenues, so lime seems to be a lucrative area. Big adjustments though, with statutory PBT being much lower at £28m.

This is certainly an ambitious project, building up a substantial group from a very small starting position just a few years ago.

Although I question whether it has actually created any shareholder value yet? There have been no divis, fair enough it’s focusing on growth. But the share count has ballooned to fund all this expansion (with a fair bit of debt on top too)

The latest figure is 1.11bn shares in issue, a more than 7-fold increase in share count since 2018. The litmus test of shareholder value is the share price itself, which doesn’t impress over a very long 10-year horizon, with no divis remember either -

Looking at Liberum (many thanks) research, I can see that if SRC achieves its growth targets, then EPS of 9.8p in 2025 and 11.3p in 2026, with very high net debt at end of 2024 (£580m) but falling to £351m by end 2026, might justify a higher share price.

Since I know absolutely nothing about lime, other than I particularly like the fruit in my drinks, then I cannot possibly determine how this share is likely to do in the future.

So it’s no opinion from me. Hopefully the above has been a useful review of its finances for you.

In summary - very rapid growth via multiple acquisitions, capital-intensive business, funded through lots of dilution and taking on a substantial amount of additional debt in 2024.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.