Good morning from Paul! Today's report is now finished. Have a great weekend!

I prepared some sections last night & early this morning, to get us off to a flying start.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

This star performer once again beats forecasts, with another upgrade. I crunch the numbers below, and reiterate my very positive stance on this rapidly growing make-up company, that seems to be in a long-term uptrend for profits.

Whitbread (LON:WTB) 3632p (£6.8bn) - Q3 Results [in line] - Paul - GREEN

One of my favourite mid-caps, so I've reviewed its Q3 (Sep-Nov 2023) update below, which is in line. I run through the reasons why I like this decent margin, growing, securely financed, and reasonably-priced hotels/hospitality group.

GYM (LON:GYM) - 106p (£190m) - Trading Update - Paul - RED

Talks up its performance, but it's still loss-making, with improved KPIs on membership being absorbed by higher staff & energy costs. We just don't see a particularly viable business model here, unless performance can be drastically improved. Debt down a bit, but still too high.

Gresham Technologies (LON:GHT) - up 3% to 120p y’day (£100m) - FY23 Trading Update - Paul - GREEN

One of my top 20 share ideas for 2024, which put out a reassuring, in line update yesterday, with upbeat outlook comments. As explained below, it looks like I picked up an incorrect broker forecast figure, so it's not actually as cheap as I previously thought. Overall though, I'm still happy that it looks reasonably priced, with potential upside, so I'm happy to stay at green.

Vistry (LON:VTY) - up 3% to 995p (£3.4bn) - Trading Update - Paul - AMBER/GREEN

It's a slight beat against (lowered) guidance for FY 12/2023. A very detailed update, which I've summarised below. I like its differentiated housebuilding model, doing larger developments for third parties such as local authorities. This seems to cushion it somewhat from the downturn in private housing sales. Generous divis & buybacks are planned. Looks good, but c.50% recent rise means I'll only be watching, not chasing the price up any higher, for now.

Premier Miton (LON:PMI) - up 8% to 65p (£102m) - Q1 AuM Update - Paul - AMBER/GREEN

Q1 (Oct-Dec 2023) assets under management (AuM) rose 3%, thanks to favourable market movements. Although clients were still net withdrawals of about 2% of AuM. I run through the numbers, and conclude that this share looks cheap, and could have recovery potential. We like the whole sector actually, with bargains galore, if a cyclical recovery does gather strength.

Paul’s Section:

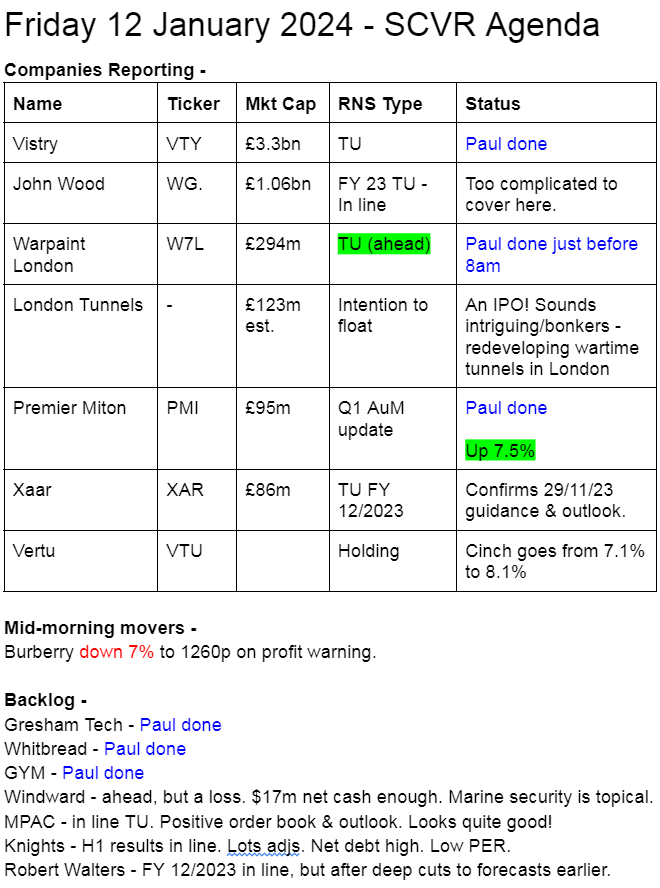

Warpaint London (LON:W7L)

382p (pre-market) £295m - Trading Update [ahead exps] - Paul - GREEN

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to announce a trading update for the year ended 31 December 2023.

Strong trading performance continues and results for the year ending 31 December 2023 now expected to be ahead of market expectations

Revenue guidance is now £89.5m (up from >£85m) for FY 12/2023.

Gross margin is up on LY.

Profit before tax (PBT) guidance raised to £18m+ (up from previous guidance of £16m+), and also massively up on £7.7m LY.

Cash is up, to £9.0m (LY: £5.9m), which is a clean number, as there is no financial debt.

Paul’s opinion - remains highly positive, we’ve been raving here about W7L shares for a long time now. It’s a great, and really simple, scaleable business model - selling good, value make-up products into increasing numbers of large retailers, globally. The products sell well, so the retailers order more, and increase the number of stores they’re in. Production is outsourced. W7L sits in the middle, and collects in rapidly growing profits.

Shore Capital updates us (many thanks) with a 12.5% upgrade to 18.0p - so a PER of 21.2x - which I think is fully justified, given the outstanding growth, consider this earnings progression -

FY 12/2021: 7.8p adj EPS

FY 12/2022: 11.2p adj EPS

FY 12/2023: 18.0p adj EPS

Forecast FY 12/2024: 18.6p adj EPS - why would growth almost stop?!

Forecast FY 12/2025: 20.5p adj EPS - again, only very modest forecast growth.

There are no outlook comments today, but I’ve not come across any reason as to why W7L would see its profits suddenly stop growing. So it seems to me that we should maybe be ignoring these forecasts, and instead making our own guesses, of possibly up to 25p EPS in this new year FY 12/2024? Then perhaps 30-35p in 2025? That’s just extrapolating out the existing growth trend.

If that positive scenario plays out, then this share could be heading up to the 500-600p range I would say, and more longer term? As always though, there are no guarantees that a positive scenario will definitely play out. Something could go wrong.

Overall though, sticking at GREEN is a no-brainer for me. Just wish I’d bought some when we first spotted the opportunity here back in 2022! Never mind. Well done to holders, it’s good to see people making a bob or two!

Whitbread (LON:WTB)

3632p (£6.8bn) - Q3 Results [in line] - Paul - GREEN

Whitbread is one of my favourite mid-caps, which we looked at twice in 2023, turning positive as the figures & valuation became more attractive -

SCVR 22/6/2023 3355p - AMBER - Good TU & outlook. Expensive at 19.7x PER.

SCVR 19/10/2023 3366p - GREEN - Superb H1, adj PBT up 44%. Strong balance sheet. Better value now at 16x PER.

Whitbread’s business is now Premier Inns (revenue: 94% UK, 6% Germany), but it includes branded bar/restaurants within this, as they are either in, or next door to Premier Inn sites, according to the 2023 Annual Report, which I’ve just been reviewing. Note 3 shows that of the £2.63bn revenues for FY 2/2023, 72% was hotel accommodation, and 28% was food, beverage, and other.

I think WTB is a very good business, with decent quality, but affordable hotel rooms, and the food/drink offering is also very good, in my experience. Overnight stays include unlimited buffet breakfast - a key point for me when I’m travelling! There’s one just round the corner from me here in Bournemouth, so I might mystery shop it for an overnight stay, as it’s only £58 including breakfast.

Premier Inn is the UK market leader in budget hotels, and scores way above others for quality/price/value. It has 849 UK hotels, and is seeing a structural growth opportunity from the exit of independent operators, of which c.70% premises have been sold and re-purposed, taking capacity out of the hotel market (especially over the pandemic). The UK is under-supplied with branded hotels, hence why Premier Inns is doing so well, with a lovely strong profit margin - forecast FY 2/2024 revenues c.£3.0bn, and net (after tax) PAT £419m.

The extensive multi-year TV advertisements stick in peoples’ minds for many years - there’s an argument that previously heavy ad spending is an intangible asset - this TV ad was 16 years ago for example, but I still remembered it enough to look it up.

?si=19Agcv9n1Db_VJPc

Premier Inns is also expanding in Germany, but that’s loss-making for now. The expected move into profit, as it continues to expand, will of course have a favourable effect on the group results in future. It says that longer term, Germany has the same potential as the UK market for Premier Inns, on top of further gains in UK market share. So nice growth potential here for sure.

Unlike GYM (LON:GYM) , Premier Inns has made a commercial success of a value for money customer offering, so it’s a proven business model, being rolled out further.

Going through its accounts, WTB is very well-financed. Slightly over half its hotels are freehold, with book value of £3.65bn.

The pension schemes look fully funded, but still with some company guarantees.

There’s a big cash pile, mostly offset by bonds (which are now cheap, as issued when interest rates were much lower). So it has ample funding to continue expansion, and could be geared up, if private equity decides to bid for it.

NTAV was £3.74bn when last reported on 31/8/2023. The market cap of £6.77bn gives it a healthy price to tangible book of 1.81x so there’s strong asset backing here.

Stockopedia shows a ROCE of only 6.4%, but the last annual report shows 13%, so there must be some difference in how that’s calculated.

Occupancy levels have bounced back to pre-pandemic.

Staff costs are 30% of revenues, so April 2024’s living wage increase is likely to be a nasty headwind, as with all hospitality businesses, but that will be factored into the guidance.

Large share buybacks are underway, the share count now having fallen from 203m to 186.5m.

Broker forecasts have been significantly rising -

Stockopedia has the forward PER as 16.0x currently, which I think is a fair price for a growth company with a strong market position, and a high profit margin.

Shares were a star performer until 2015, but have only gone sideways overall in the last 8 years. Although divis of roughly £1 per year do increase the total shareholder return, if manually added on top of the share price.

On to yesterday's update -

This sounds in line with expectations, and makes positive noises about the new year FY 2/2025 -

Paul’s opinion - as you’ve probably gathered, I think Whitbread looks a very good share. I like that it’s strongly asset-backed, with secure finances.

Also I like the high profit margin, and structural growth from new site openings (self-funded), declining independent competition in an under-served market with buoyant demand, and German expansion set to move from losses into profit.

This strikes me as an ideal share for a long-term no tinkering portfolio.

Personally I’m reluctant to buy any after the strong recent run, but it’s on my watchlist as the type of share I’d want to buy if some market fall or general crisis causes it to sell off.

Downside risk? The only thing I can think of, is if we have another pandemic & lockdowns. Travel, and hospitality shares are vulnerable in that regard, so maybe they should have permanently lower valuations?

GYM (LON:GYM)

106p (£190m) - Trading Update - Paul - RED

The Gym Group was a pioneer of the low-cost gym model, and now operates 233 high quality sites across the UK. These gyms offer 24/7 opening and flexible, no-contract membership.

… is pleased to announce that the positive trading trends highlighted in our H1 results have continued throughout the remainder of the year, resulting in good growth in both membership and yield…

It talks up the positives, but the end result is trading in line with expectations - which is a forecast loss -

We have delivered good growth in both membership and revenue which will underpin FY23 results in line with guidance

It sounds like extra energy and wages costs have absorbed the upside from more members and higher revenue per member.

I can’t find any broker notes, so the only data I have is the consensus of 6 brokers, which shows a sorry tale of continuing losses -

Net debt has come down a bit - but is still high for a loss-making company - the danger is that they might have to curtail capex to enable debt to fall - or breach bank covenants, if profit performance continues to deteriorate? We have to think about interest cover covenants these days, not just EBITDA cover.

Net debt as at 31 December 2023 was £66.4m, compared with £76.1m at 31 December 2022. The reduction reflects strong working capital performance and the timing of spend on new site openings and other capital expenditure projects.

As anticipated in our previous guidance for FY23, revenue growth has offset utility-driven cost inflation and leverage2 is expected to remain within the range of 1.5 to 2.0x.

2 Calculated as Non-Property Net Debt : Group Adjusted EBITDA Less Normalised Rent

Paul’s opinion - checking our previous reviews, usually from Graham, we’ve been consistently negative at red, because GYM has so far failed to return to pre-covid profitability, and still has too much debt.

There’s nothing unique about low cost gyms, plenty of other companies do the same thing, it's difficult to make money.

ROCE was low pre-pandemic, and is negative now. It strikes me as a not very good business model - expensive sites to rent and equip, then not charging customers very much to use them.

It’s already achieved scale, with 233 UK sites, so there won’t be any significant further improvement to margins from opening more.

I just don’t see the point of this business, from an investment perspective.

Performance would have to dramatically improve to make it something I’d want to buy shares in. So I’ll stick with RED.

There could be a trade in this, for a rebound, but on fundamentals, we think it's weak - also note the share count has gone up from 129m to 179m shares in issue over this period -

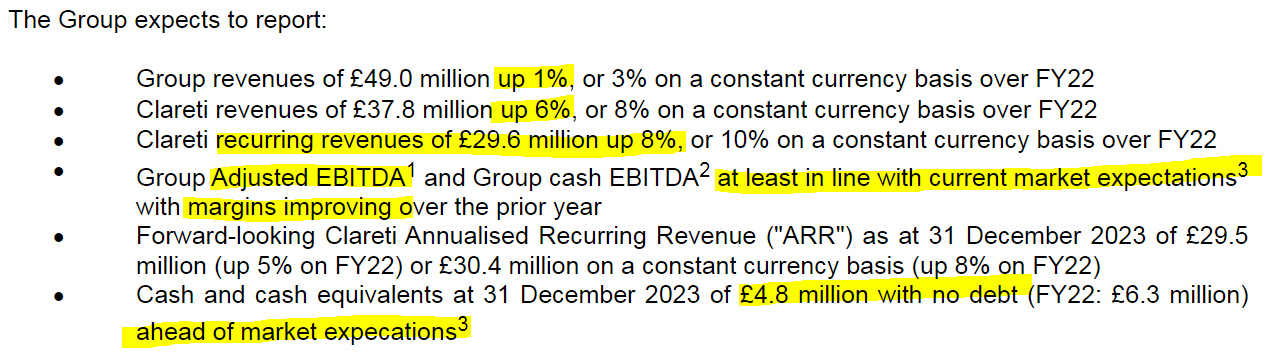

Gresham Technologies (LON:GHT)

Up 3% to 120p y’day (£100m) - FY23 Trading Update - Paul - GREEN

Gresham Technologies plc (LSE: "GHT", "Gresham", "Group", "Company"), the leading software and services company that specialises in providing solutions for data integrity and control, Sbanking integration, payments and cash management, is pleased to provide a trading update for the financial year ended 31 December 2023 ("FY23").

Growth in strategic subscription business driving recurring revenues and enhanced profitability

It reports a “strong close to the year”.

Unfortunately, the reporting below uses EBITDA (two different versions!) -

3 The Company believes that current market expectations for the year ending 31 December 2023 are Group revenues of £50.2m, Group adjusted EBITDA of £11.0m and Group cash EBITDA of £4.6m.

Let me add the missing information we need. Singers (many thanks, for note 17/11/2023) has adj EBITDA of £11.0m, and it becomes adj PBT of £7.4m, and adj EPS of 7.7p (slightly up on 7.5p in 2022) - a PER of 15.6x, which is higher than I thought it was.

The forward PER of 12.0x on the StockReport seems to be based on a FY 12/2024 EPS forecast of 9.66p, but that doesn’t tie in with Singers’ 2024 EPS of 7.0p.

So it looks like I might have dropped a clanger here, and relied on an out-of-date or incorrect broker forecast on the StockReport. I’ve flagged it on the green blob, asking the team to challenge the 2024 forecast with the data provider. The fwd PER would be 17.1x using Singers 2024 forecast, which is not especially cheap, although it’s still pretty good for a high recurring revenues software business, which are often more highly valued.

As mentioned in my top 20 shares ideas list for 2024, I included GHT because it looks good value for a software company that has reliable recurring revenues, and established a very nice revenue & EPS growth (graph 3 below) track record over the last 5 years - and the previously very high PER has come down (graph 4).

Although as explained above, it’s actually not as cheap as I thought, because the latest broker forecast of 7.0p for FY 12/2024 is lower than shown here (9.7p).

Outlook - strikes me as positive -

The business starts the year with over £38 million of Group revenues already under contract and a strong pipeline of opportunities. The Board is confident in the Company's ability to deliver planned growth which, supported by cost reduction initiatives during FY24, will further accelerate the business towards its objective of best-in-class EBITDA margins and cash generation in FY25, and beyond…

There is good momentum coming into the year with a strong pipeline of opportunities at varying stages of negotiation. This, alongside other growth and cost management initiatives, provides us with a high degree of confidence in delivering further profitable growth in the coming years."

Another negative is the use of the almost meaningless "profitable growth" phrase that PRs like to use, to fudge things.

New NED - separately announced, Kestrel (23.9% shareholder) gets a NED (with good relevant experience) on the Board. Relationship agreement includes: arms length transactions, won’t try to delist shares, and won’t try to take control by the back door.

Paul’s opinion - quite a good update I think.

Although as explained above, GHT shares are not as stunningly cheap as I originally thought. They’re not bad though, and I still like the business, strong visibility from recurring revenues, and positive outlook comments yesterday.

The cessation of low margin subcontracting business has dented 2024 forecasts a bit, masking growth in the core business, but the company & broker argue it’s becoming a higher quality, higher margin SaaS business, so deserves a higher rating.

Still looks interesting to me, so I’m happy to stick at GREEN.

Vistry (LON:VTY)

Up 3% to 995p (£3.4bn) - Trading Update - Paul - AMBER/GREEN

Vistry Group PLC ("Vistry" or the "Group") announces a scheduled trading update for the year ended 31 December 2023 (the "period"), ahead of the publication of its full year results on 14 March 2024.

Housebuilder with a differentiated business model. We only looked at it once in 2023, concluding “worth a look” on 11/9/2023. That was near a short-term peak, with this share being quite volatile, and like other housebuilders has had a marked surge c.46% in the last couple of months. I’m leaning towards Liberum’s sector view that the good news (lower mortgage rates, build cost inflation easing) could now be fully priced in, for the time being, maybe?

It’s a long-winded update today, so let me summarise the key points, along with my comments -

FY 12/2023 adj PBT c.£418m (flat vs LY), c.2% above (lowered) guidance of £410m (23/10/23 TU).

2023 completions only down 5.4% vs LY, much better than competition (due to “partnership model”, rather than just direct to consumer sales).

Cost reductions achieved in H2.

Net debt greatly reduced, to only £90m. Doesn’t really matter, as balance sheet is bulletproof with about £2bn NTAV.

Share buybacks - targeting £1bn shareholder distributions (divis + buybacks presumably?) in next 3 years - strikingly high, for a £3.4bn market cap, in a subdued market.

Forward sales looks impressive at £4.5bn, up 12% vs LY.

As with other housebuilders this week, comments favourably on lower mortgage rates.

“Well positioned” to provide affordable housing, high on political agenda.

Fire safety remediation works - I’d forgotten about this issue, affecting the sector. Vestry says it’s made adequate provisions on its balance sheet.

Paul’s opinion - this looks very interesting, although personally I’m not interested in chasing the price up any higher. If there’s another sector sell off though, it would be high up on my personal wishlist. What I like is that its partnership model, where it builds houses for local authorities, housing associations, etc, seems to be effective at cushioning downturns in consumer demand.

Valuation looks about right for now, forward PER of 10.8x, 5.0% yield (plus buybacks), and c.1.7x NTAV. I’ll go with AMBER/GREEN - to reflect that it’s a really good company, but probably priced about right now after a very recent c.50% rise in share price.

Premier Miton (LON:PMI)

Up 8% to 65p (£102m) - Q1 AuM Update - Paul - AMBER/GREEN

...today provides an update on its unaudited statement of Assets under Management ('AuM') for the first quarter of its current financial year (the 'Quarter' or 'Period').

This is for FY 9/2024 to date.

Assets under management (AuM) rose 3% in Q1 (Oct-Dec 2023) to £10.1bn, despite £0.2bn of net client withdrawals. That implies about 6% market gains from the Santa rally (see table below).

It claims relatively good fund performances -

… our investment performance remains relatively strong with 75% 2 of funds in the first or second quartile of their respective sectors since launch or fund manager tenure."

With a long footnote, which maybe allows them to cherry-pick some good numbers, being cynical?! -

2 The quartile performance rankings are based on Investment Association sector classifications where applicable. This covered a total of 36 open-ended funds since manager inception. Data is sourced from FE Analytics FinXL using the main representative post-RDR share class, based on a total return, UK Sterling basis. All data is as at 31 December 2023 and the performance period relates to when the fund launched or the assumed tenure of the fund manager(s).

Here’s the reconciliation of the quarter’s moves in AuM -

Paul’s opinion - doesn’t mean much, as it’s not my sector, Graham normally covers these, so he might add a comment next week perhaps?

It strikes me that PMI is an interesting-looking value share. The forecasts have been slashed in the last year, but even so, the fwd PER is only 9.0x, and a 10% dividend yield forecast. It’s well asset-backed at 2.9x NTAV. I can't find any specific broker notes, so hope those consensus figures are valid - they seem to tie in quite well with the last full year accounts that I just had a quick look at for reasonableness checking purposes.

If financial markets continue in bullish mode, then I imagine fund outflows could stop, or even reverse into inflows. With AuM then going up, the fees and hence profits would presumably also rise.

We always point out that this sector is highly cyclical, and with share prices on the floor now, and the potential for this being at or near the bottom of the cycle, I think this could be an excellent time to pick up some fund management and stockbroker sector shares. Based on the numbers on the StockReport, I think PMI would be high on my sector watchlist.

FY 9/2023 results weren’t too bad, it actually looks quite resilient, considering how awful markets were in 2022 and for much of 2023.

Graham was green earlier in 2023, but went amber on 7/12/2023. I hope he doesn’t mind, but I’m going to split the difference and up it to AMBER/GREEN, for a potential recovery now AuM have started rising.

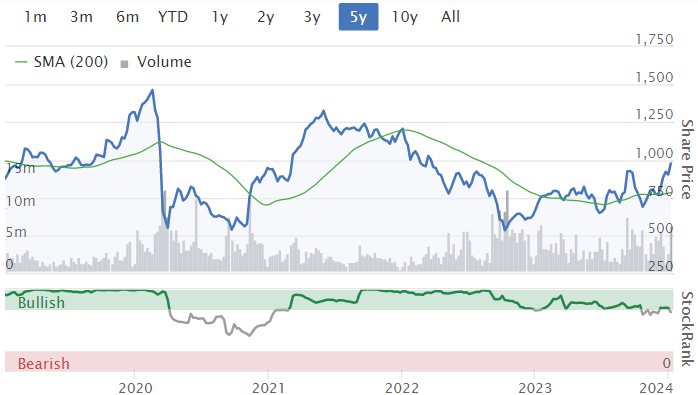

It must be near a cyclical low, surely?! Note that the share count rose from 106m to 158m during the pandemic. Chart below is since listing in Oct 2016 -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.