Good morning from Paul!

UK interest rates rose yet again yesterday, but as expected. I can feel another rant coming on for tomorrow's podcast.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

With it being a Friday, I'm off to a leisurely start. This is what I'm planning on looking at first -

Eurocell (LON:ECEL)

Down 12% to 112p

Market cap £126m

Trading Update (profit warning)

Eurocell plc, the market leading, vertically integrated UK manufacturer, recycler and distributor of innovative window, door and roofline PVC products, provides the following update for the first four months of 2023.

The current financial year is FY 12/2022.

I like this company, but am wary of the building supplies sector generally, as we’ve been discussing in recent weeks, with the brick suppliers reporting strangely upbeat trading, which was contradicted by a recent profit warning from Marshalls (LON:MSLH) . With housing starts sharply down this year, and repair/maintenance activity also said to be subdued, further profit warnings in the sector do seem quite likely. ECEL mentions both those points today, reinforcing a negative current sector outlook for building supplies companies.

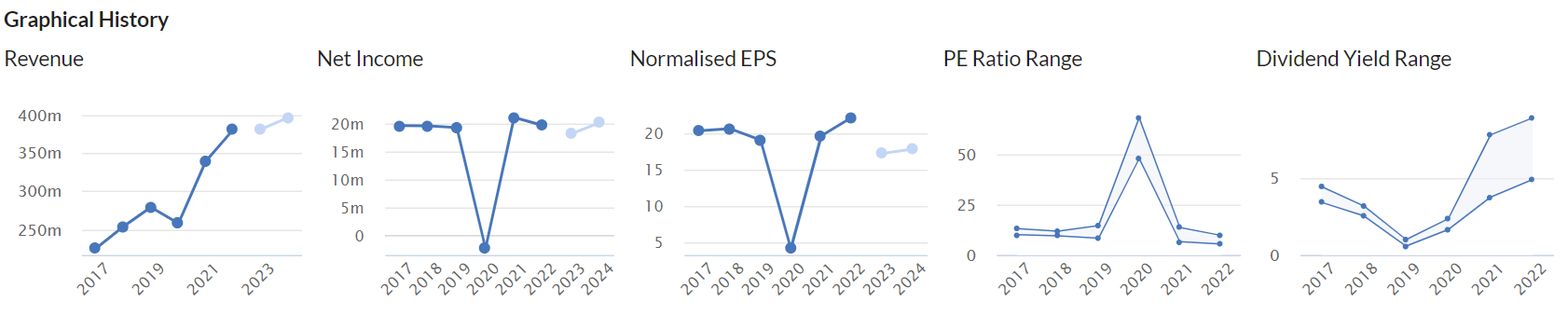

But, at some point I think we’ll have a nice entry point for several decent companies in this sector. After all, trading is likely to recover at some stage, and when we own shares in a company, we’re not just buying this year’s earnings, but all future earnings. Hence Eurocell shares have just got more attractive to me, hitting a new all-time low today, for a business that historically has been reliable at generating EPS of c.20p, and paying nice divis of around 9p pa.

This is what it says today (for Jan-Apr 2023) -

Revenues down 2% against “very strong” prior year comparative.

Volumes of product sold down, partly offset by price rises.

Inflation - electricity cost is noted as a particular cost increase (hedged forwards 12-months)

Passing on cost increases, but competitive pressure on margins.

Latest industry data shows a greater decline of -17% (previously -11%) in new housebuilding in 2023, before recovering in 2024.

H2 weighting expected in 2023, so interims likely to look bad (as 2022 saw a strong H1) - with lower costs feeding through to benefit H2 2023.

Overall -

Taking the above factors into account, we now expect adjusted profit before tax for 2023 to come in below current market expectations (1).

(1) Eurocell-calculated analyst consensus profit before tax forecast for 2023 of £22.0 million.

How much below? We’re not told and I haven’t yet seen any broker updates, so it’s pure guesswork at this stage. I’ll go with maybe something like 12-15p EPS this year, possibly? Then a rebound to nearer 15-20p next year. I’m just guessing there, based on the tone of the announcement today.

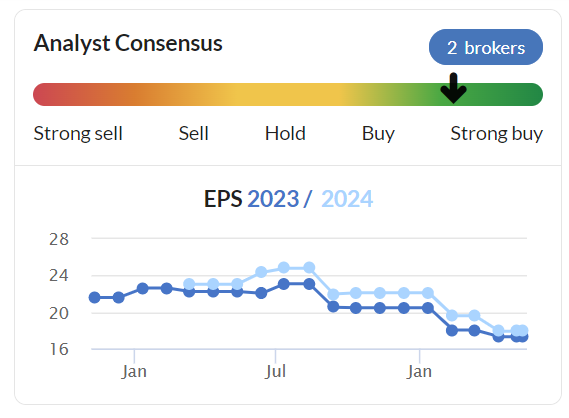

Broker forecasts have already been cut a fair bit, so it’s disappointing that ECEL is missing this lowered forecast -

(as of last night, so the darker line and probably 2024 as well, will drop again once updates come throug i the coming days, hopefully)

Outlook - good points here, and a reminder that it’s often the tough decisions that are taken in downturns that result in a better, leaner, and more profitable business in an economic recovery -

Our balance sheet is strong and the actions we have taken and plan to implement will improve our efficiency and resilience, and position us well to benefit when our end markets recover.

Is the balance sheet strong? Yes, it’s good actually, with £98m NTAV at 12/2022. Only modest net bank debt of £14.4m (ecluding leases). So shareholders don’t have to worry about dilution or insolvency risk.

A new CEO started yesterday, as planned.

Paul’s opinion - I’ve been looking for a good value entry point in Eurocell, so will ponder whether it’s time to buy a small starter position here or not. I think this is a fundamentally good company, with sound finances, and under-performance seems obviously macro-driven, rather than anything specifically going wrong at the company.

That said, buying after a profit warning can often be a mistake, with shares continuing to drift, so maybe it’s better to continue watching from the sidelines? Who knows!?

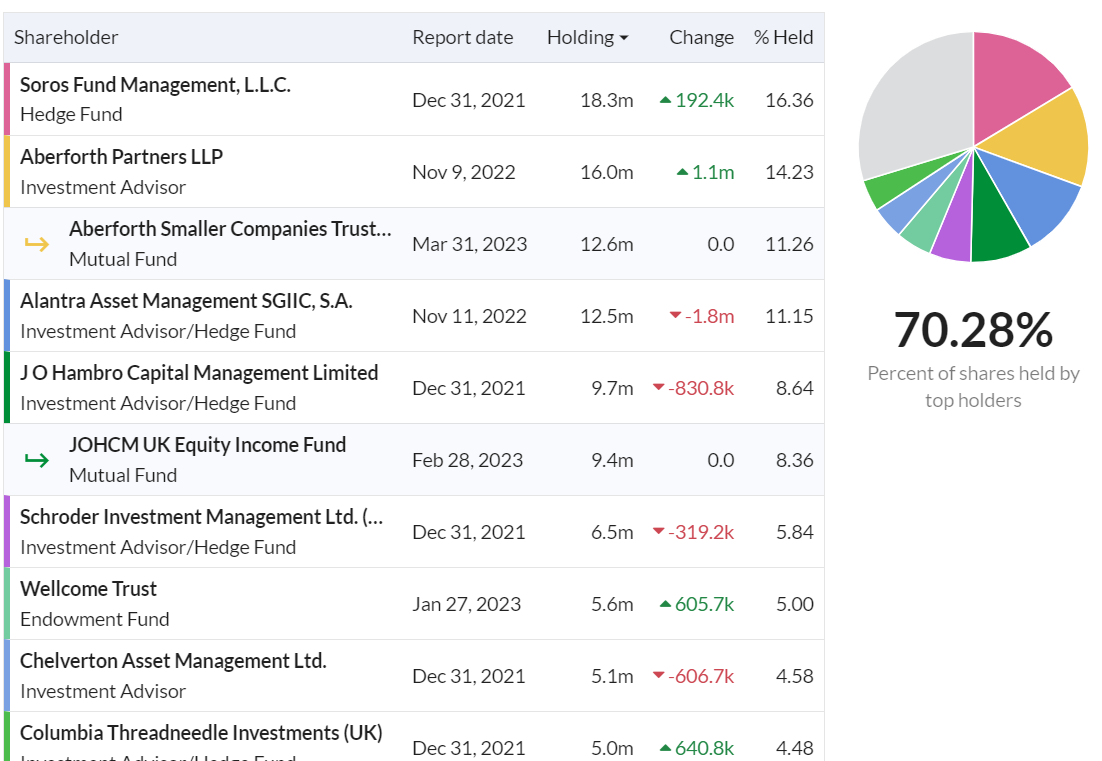

The shareholder register is quite concentrated, with 5 institutions owning just over half -

THG (LON:THG)

Down 9% to 68p

Market cap £919m

This heavily loss-making eCommerce business was floated at a crazy price in the recent tech boom, and is still valued at almost a £billion at today’s bombed out price -

This is despite it never having made any significant, or sustained profits.

I looked at the accounts for FY 12/2022, published on 18 April 2023, but unfortunately my notes seem to have got lost in the system. Taking another quick look now, the 2022 results are truly awful. Massive losses, and a rapidly declining balance sheet, now with negligible NTAV. Awful cashflow too. Unless performance improves, this share could end up at zero in my view.

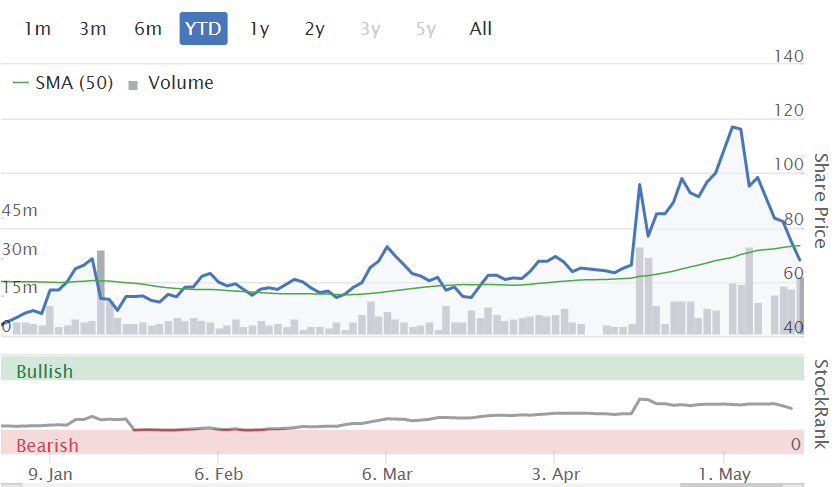

The day before results were announced, THG announced that it had received a preliminary bid approach from Apollo, causing a spike up in share price, which is clearer on this YTD share price chart -

Anyway, today we’re told that bid talks with Apollo have been terminated, because its indicative offer was too low. Major shareholders were consulted, and holders of over 50% of the shares rejected the deal. That’s annoying, because the big shareholders know what price was offered, but the rest of us don’t. That strikes me as a false market, and it breaches the general principle of all information being available to all shareholders simultaneously.

There’s also some jam tomorrow commentary today about trading - it makes positive noises about current trading, saying this further supports full year guidance. But look what’s happened to broker forecasts! -

Continued losses. Remember that THG’s accounting is ludicrous - it focuses on adj EBITDA which is pure fantasy, and bears no relation at all to real world cashflows.

It reckons that THG will be cashflow neutral (on what definition, I wonder?) in 2023.

Outlook/aspirations it says -

The Company reiterates its expectations to deliver positive free cash flow in FY 2024 and adjusted EBITDA margins of around 9.0% over the medium term.

Falling price of whey (a key ingredient) is helping margins. And on £2bn of revenues, each 1% margin improvement is £20m more profit to the bottom line. So if this turnaround gains traction, then the shares could become interesting - that's clearly what bulls are betting on.

Paul’s opinion - extremely negative. To date, the whole thing has been hype, with no sign of this being a viable business.

Management needs to turn it around, before the money runs out. Note that in 2022, THG went from a net cash position of £44m to a net bank debt position of £181m!

We now have evidence that a potential acquirer wasn’t prepared to pay what management & major shareholders wanted, but we’re not given any idea what price that was. Maybe it will get leaked out through broker notes?

Anyway, it’s all academic, because I wouldn’t go near this share at pretty much any price.

It will be interesting to see if management is able to turn this around. It reminds me a bit of Asos - another former stock market darling that actually turned out to be a pretty rubbish business, once the hype wore off.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.