Good morning from Paul!

This is my last report from Gozo, am flying back to the UK tomorrow evening.

Today's report is now finished! Podcast this weekend as usual, not sure if it will be Saturday or Sunday, due to travelling.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries - I won't do any today, see sections below.

Paul's Section:

Here's something I prepared earlier -

Halfords (LON:HFD)

Up 19% to 216p y’day - Betaville rumour - Paul - AMBER

Once again the absurdity of the rules on disclosure of takeover approaches is shown. A subscription website called Betaville tips people off about price sensitive information, which personally I think should not be legal.

It apparently revealed that Halfords has received bid approaches, and I think a figure of 271p was mentioned. Although ThomsonReuters appears to have now pulled this initial report, which apparently came via Sharecast.

If Halfords has been in bid talks with a credible buyer or buyers, then the shares have been in a false market, which is what I strongly object to with the ridiculous UK takeover rules. It’s not right to keep shareholders in the dark. Required disclosure is only driven by someone randomly leaking details to the press, then companies have to comment. This is absurd.

Obviously speculative, or fanciful bid approaches shouldn’t need to be disclosed, but credible ones should - because it is clearly price-sensitive information, that should not be traded on subscription websites - surely that’s insider dealing, which is illegal?! We play by the rules here on Stockopedia, and never gossip about inside information. Shouldn’t everyone have to do that too? Otherwise what's the point of having these rules?

Is Halfords any good? We don’t have a strong view either way here, with me & Graham having reviewed it 3 times this year, coming out as AMBER each time -

23 June (211p) it issued FY 3/2023 results which were OK, but towards the lower end of the forecast range. Outlook was mixed. PER of 11.2x looked about right at the time.

6 Sept (191p) in line TU. Graham flagged low margins, and thought it priced fairly.

Is it credible as a takeover target? Given that we had a very unexpected bid for Restaurant (LON:RTN) today, I’d say anything is possible! I can see strategic value in Halfords, which dominates its retail niche, and also has successfully developed a services business (MoT, repair, tyre centres) which is now a significant part of the group, and can easily be grown with many potential bolt-on acquisitions.So yes, I think it’s credible as a potential bid target, although must admit the thought hadn’t occurred to me before.

Good luck to holders here, whatever happens! As we all keep saying, all these bid approaches reinforce the fact that UK shares are cheap. Each successful bid injects more liquidity into the market, so could be seen as part of the solution for low valuations maybe?

EDIT at 08:55 - no statement from HFD management as yet - Thomson Reuters news feed said last night that a Halfords spokesperson says they don't comment on rumours. I see the share price has reversed, down 8% to 199p at the time of writing, giving up about half of yesterday's surge on the bid rumour. Quite interesting to watch.

Finsbury Food (LON:FIF) - 109.5p (£143m) - SKY News re Fidelity - Paul

Interesting piece on Sky News, saying that 10% shareholder Fidelity has come out against the 110p takeover bid from DBay, saying that the premium is too small, and it undervalues a decent business, valuing it on only 11x forward earnings.

I completely agree, and noted in the SCVR of 20 Sept that I thought the deal wasn’t enough. If companies want to take over a listed company, they need to pay up, not try and pull off an opportunistic, low ball offer. So I hope shareholders reject the deal, or force DBay to come up with a more sensible price. I’d say 120p+ would be more realistic.

D4t4 Solutions (LON:D4T4) is changing its rather daft name to “Celebrus Technologies” - which is the name of its core product. That makes sense to me. If approved by shareholders at a GM on 9 Nov, then the ticker will also change, to CLBS.

Victoria (LON:VCP) - quite a rollercoaster ride for shareholders in this acquisitive, highly indebted floorcoverings group. I’ve covered this a lot recently, with the initial highly critical FT article flagging concerns over the audit report. Then VCP itself issuing a strong rebuttal shortly afterwards. Shares spikes down sharply on the FT news, but then rallied to a full recovery. This has only proven temporary, as it’s slipped all the way back down again to 400p now.

As mentioned before, I’m wary of VCP’s weak, overly indebted balance sheet, whilst recognising that the shares have been a stunning long-term multibagger. I’ve decided to steer clear, to be on the safe side, and view it as AMBER/RED.

FW Thorpe (LON:TFW)

Down 2% to 380p (£446m) - FY 6/2023 Results - Paul - AMBER

This owner-managed specialist lighting group has been a stunning multibagger over the last c.20 years. However in recent years its growth hasn’t been exciting enough to justify a PER of over 20x, in my view. Definitely not more recently, when everything else has got so much cheaper.

Preliminary results for FY 6/2023 came out yesterday, with shares ending the day down 2%, having recovered most of the earlier 7% intra-day loss. It’s thinly traded for a £446m market cap company though, because shares are tightly held by the controlling family.

The figures look good to me - £26.9m PBT (up 12%), giving 18.7p EPS (up 9%). That’s a PER of 20.3x - quite an aggressive valuation for fairly sedate earnings growth. Although any growth in a tough macro environment is good.

In line current trading. Outlook comments read like an internal memo, chastising under-performing parts of the group - great stuff! Some caution, with “orders slightly lower”, and “some evidence of projects slowing”, revenue growth to be slower than in recent years, but helped by margin improvements.

Very strong balance sheet with £89m NTAV, and £35m cash (less a small bit of debt).

Cashflow is very clean, with £32m post-tax cash generation, all spent on a mixture of capex, acquisitions and dividends.

Paul’s opinion - a very nice group, that’s generating high margin profits & cashflows, and using it to pay modest divis, and make acquisitions.

The valuation looks full to me, especially given the cautious outlook comments. In a stock market full of bargains, this is looking too expensive for my taste, although I do like the business, management, and great long-term track record. So maybe it’s a coffee can share to buy & forget, and come back in 20 years to find yourself rich?! That’s what’s happened over the last 20 years with TFW shares,after all! Mind you, business models change so fast these days, nobody has any idea what the world will be like in 20 years’ time. If we’re all wandering around with metaverse headsets strapped to our faces, then we may not need any lighting at all!

Marks Electrical (LON:MRK)

Down 6% to 103p (£108m) - Trading Update - Paul - AMBER/RED

This fast-growing online electrical retailer updates us on the 6 months to 30 Sept 2023.

It’s more of the same really - key points being impressive organic revenue growth of +25%, to £53.9% in H1. Market share gains. Strong start to October.

Not so good is - higher than expected cost pressures impacted H1 margins, but pressure expected to ease in H2. Is this a profit warning? It dodges the question of how it’s trading vs market expectations, which is not good enough - that’s the key information we need from a trading update, so to omit it is most unsatisfactory. The nearest we get is “Continued trading momentum” in the headline. Also “Strong first half trading period” in the first bullet point, but that refers to revenues, not profit. So I think this update raises more questions than it answers.

Healthy net cash position of £10.9m.

To answer my own question, is this a profit warning today, the answer is yes! Cavendish has reduced FY 3/2024 forecast EBITDA from £9.3m to £8.1m, and adj EPS is now forecast at only 4.4p. The StockReport is currently showing broker consensus of 5.47p, so this is a significant reduction in forecasts.

Paul’s opinion - I’m seriously unimpressed, with how a profit warning has been glossed over in this update, instead being released through lower broker forecasts. I find that misleading. It also means, despite all the upbeat talk and growth in revenues, MRK is set to deliver a second year of reduced profits. The share price of 103p is 23.4x the new, reduced forecast EPS. This thing is way too expensive now, I think. It could grow into the valuation though, and I do like management and strategy here, but a cunningly concealed profit warning has not impressed me, and nor has the aggressive valuation. It’s only worth about half the current share price to me, so I won’t be getting involved.

STM (LON:STM) - 57.5p (£34m) - Recommended takeover - Paul

I forgot to mention this the other day, so am flagging it up now, so it gets recorded as another takeover on my summary spreadsheet (for quick reference).

The takeover price is 60p cash, plus an unusual extra - “Deferred Consideration Units” which might be worth up to an additional 7p each.

60p is a big premium of 118% to the price just before bid interest was previously announced, which strikes me as a cracking deal, for a peculiar little company that specialises in controversial QROPS - overseas pensions for UK ex pats. I remember researching, and meeting the company years ago. It looked cheap, but had question marks over it, possibly resolved now, I don’t know as I lost interest in it ages ago.

It seems to have 36% support so far.

I see the bidder seems to be something to do with financier Edi Truell, who wowed us at Mello years ago with a presentation on the billions and trillions that Tungsten was going to generate from its automated invoice processing. Turns out he wildly overpaid for Tungsten, and it was a multi-year disappointment, but eventually got bought out. I expect STM shareholders are likely to grab this generous offer with grateful thanks.

Looking at the Stockopedia shareholder list, I can see some value investor blasts from the past, including Peter Gyllenhammar, and David Barry, who both specialise in deep value special situation micro caps. So nice to see them get a decent win here. I think some friends of mine hold this one too, so it's always good to see mates make a bob or two!

Eneraqua Technologies (LON:ETP)

39p (£13m) - Profit Warning - Paul - RED

This energy and water (hence the name) related business looked good when it first floated in Oct 2021 (alarm bells re 2021!), with a lovely trend of growing revenues and profits. The share price remained robust throughout 2022. I remember listening to a podcast version of its results webinar in late 2022, whilst going for a brisk walk, and thinking to myself that it sounded quite a good company.

Checking our notes here, I was AMBER on 13/3/2023, noting that the mild profit warning for FY 1/2023 seemed to be mitigated by claimed high visibility for FY 1/2024.

That all went out of the window on 23/5/2023, when ETP plunged 36% to 168p on good FY 1/2023 results, but a big profit warning for FY 1/2024 was cunningly buried in the outlook comments. In the SCVR for 23 May, I thundered that this announcement seemed highly misleading, and I went RED due to completely losing trust in the company, and its rapidly deteriorating performance.

It’s since collapsed to just 39p, so let’s take a look with fresh eyes. There might be a bargain here in the wreckage of this 2021 float, especially if institutions are selling out at any price. £13m market cap is peanuts compared with the growth & profits it delivered in FY 1/2022 and FY 1/2023 - if it can get back on track, even partially, then there could be nice upside maybe?

Offsetting that, is the harsh reality that many shares which are disappointing in this bear market look cheap, then they look really cheap, then insanely cheap, then some new disaster is announced! Turns out they weren’t cheap after all.

Also, what is its solvency like? Are we looking at covenant breaches and an emergency placing?

H1 Results -

Revenue £26.0m (up 7%)

Small H1 adj loss before tax of £(0.4)m, vs £3.0m profit in H1 LY. Disappointing, but not a disaster I’d say.

Net cash of £0.5m, slightly better than a year earlier. So it would need some bank facility to give it headroom.

Massive “order book” of £146m, but only c.25% expected to be delivered in H2. So how real are these orders?

Outlook - this is the killer. It says order delays mean that revenues & profit for FY 1/2024 will be “substantially below market expectations”. Also FY 1/2025 forecasts need to be lowered.

It still expects a (presumably small) profit for FY 1/2024 and net cash at the year end.

It blames order delays on public sector housing having to tighten budgets to deal with cladding, and other things.

Is it likely to go bust or need a placing?

Balance sheet - a giant number jumps out at me, £26.8m receivables - that’s all of H1 revenue (although receivables includes VAT and revenue doesn’t, so not quite).

Note 6 gives a breakdown, and says that £16.2m is prepayments and accrued income - so this is the money owed (not paid yet), for revenues booked to the P&L. It’s just a ridiculous number that stands out like a sore thumb. The commentary says that 83% of this £16.2m has been collected as cash by 30 Sept, and the rest “due in the coming weeks”. Sorry, I just don’t believe it. Surely if all that cash had come in, then the outlook statement would state that our cash balance has now risen to £10m, or whatever, but I can’t see anything like that.

NTAV is about £16m.

Paul’s opinion - I’ll stick my neck out here, and say that the balance sheet seems so outlandish, that I don’t believe these figures are real, or at the very least there is a high risk of a big write-off being needed against excessive receivables.. Remember these are not audited, they’re unaudited interim results.

I think it’s booked a load of revenue, which hasn’t been paid for - which is why receivables are so huge relative to revenues. We’ve only got their word for the cash coming in later, and given that I don’t trust the company, as mentioned here back in May, their word doesn’t convince me. Another possibility is that they might be persuading customers to press ahead with orders in return for extended payment terms (hence high receivables)?

Overall though, I would not consider investing in this share, at any price, until we have audited figures in 2024, confirming that the receivables have actually turned into cash.

I did some more digging last night, into the FY 1/2023 Annual Report, and it mentions the excessive receivables, saying -

An enhanced assurance process introduced by the Government in November 2022 was initially under-resourced caused backlogs in the approval process of completed projects increasing the level of accrued income at the year end. The issue is now unwinding following additional resourcing by the Government in the approval process. Following the period end, 54% of accrued income has unwound and been received as cash by the Company…

As previously stated, the working capital position at year end is unwinding as expected with 54% of accrued income converting into cash post period end.

The trouble is, the receivables figure did not drop much between Jan 2023 and July 2023, only falling from £29.2m to £26.8m. So it looks as if the reassurance in the last Annual Report about most of the deferred income turning into cash has actually not made much difference - receivables remains excessive.

Something similar is said in the interim results, about collecting in the cash post period end -

The Company returned to a net cash position at the end of H1 FY24. As at 30 September, over 83% of the accrued income had been collected as cash with the remaining balance due in the coming weeks. Overall, we expect to end FY24 in profit and with a net cash positive position.

If so, why aren’t they telling us what the current, presumably substantially higher cash position is? I reckon probably because it isn’t substantially higher, and the cash hasn’t been collected. Or, accrued income that’s been paid has just been replaced with freshly booked accrued income, so an ongoing problem of ETP apparently having to wait a long time for customers to approve projects for invoicing, let alone receiving payment! If the company is to be believed of course. I can’t recall ever seeing a similar problem at other companies supplying projects to the public sector. Actually they usually get paid promptly, often on agreed stage payments, sometimes up-front. So this just doesn’t stack up for me.

Although the FY 1/2023 Annual Report contains no concerns expressed by the auditors.

It’s got to be a continuing RED for me, completely uninvestable at this stage, but hope I’m wrong for the sake of shareholders. There could be a nasty write-off coming, if the massive receivables turn out to sales booked, but where the cash is uncollectable. The problem seems to have emerged in H2 last year, when receivables shot up from an already high £13.1m, to a ridiculous £29.2m at 31 Jan 2023. Why get involved? Why take the risk?

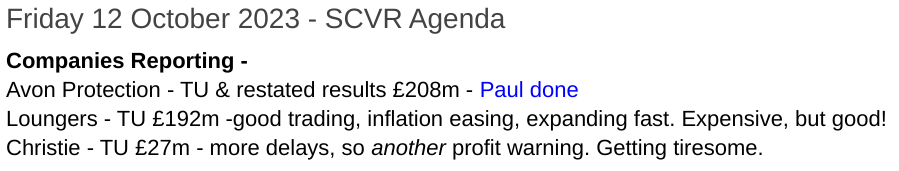

Avon Protection (LON:AVON)

Up 7% to 716p - Trading Update - Paul - AMBER

This might be worth a fresh look, as the market has responded positively to today’s reassuring update, and the chart might be putting in an attempt at changing direction, who knows? Often similar rebounds get snuffed out though, in this very difficult market.

The recent rebound barely registers on the 5-year chart, as you can see here -

Note there hasn’t been any dilution from share issuance over this timeframe, which is a nice positive - so theoretically if company performance recovers, then it’s possible the shares could seriously re-rate again.

Trouble is, profitability collapsed, and seemed to start that plunge before the pandemic, I seem to remember there being problems, and restructuring at AVON, but it’s not one I follow closely.

Today’s update -

Avon Protection announces a trading update for the financial year ended 30 September 2023 ("FY 2023") ahead of the publication of its Year End Results on 21 November 2023.

This sounds quite good -

"Full year performance in line with expectations, with a stronger H2 reflecting good strategic progress"

“As expected, trading in the second half of 2023 was stronger than in the first half, with order book growth and higher underlying earnings.”

The year end order book is up 10% vs a year ago.

Debt sounds a bit warm, but with encouraging news about year end receivables turning into cash afterwards -

Net debt:EBITDA on a covenant basis at the end of FY 2023 is expected to have reduced to around 2.0 times, compared to 2.6 times at the end of H1 2023. This improvement is the result of our successful exit from the Armour business and the improved profitability in the second half of the year.

The year end net debt position on a covenant basis is now expected to be approximately $65m, as a result of the timing of cash receipts from the shipment of several large orders in the last month of the financial year. We expect the receivables associated with these orders to be paid during the first quarter of the 2024 financial year, which will further reduce net debt by up to $20m.

It’s changing reporting to two divisions - respiratory protection, and head protection. I think it sold off the old cow milking business, maybe that would have been called udder protection? Or could have just been filed under “udder”? Sorry, I couldn’t resist.

Paul’s opinion - no strong view either way, as I haven’t researched it properly.

This update seems to show things getting back on track. What puts me off a bit, is debt being a bit warm still maybe, and the lumpiness of the business with regards to large contracts - so possibly more of a share to trade the ups and downs rather than hold long-term?

Anyway, the reassuring tone, and in line with expectations performance for FY 9/2023, could make it worth readers taking a closer look, possibly? It would help if the company ensured that broker notes were available for us, but there’s nothing recent on Research Tree.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.