Good morning from Paul!

Hardly any news today, but I've caught up on some backlog items, 2 full sections, and 4 quick comments (I do look at the numbers carefully!)

All done for today & the week! Have a lovely weekend. Podcast probably on Sunday, as I'm escaping to Gozo tomorrow morning.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Summaries

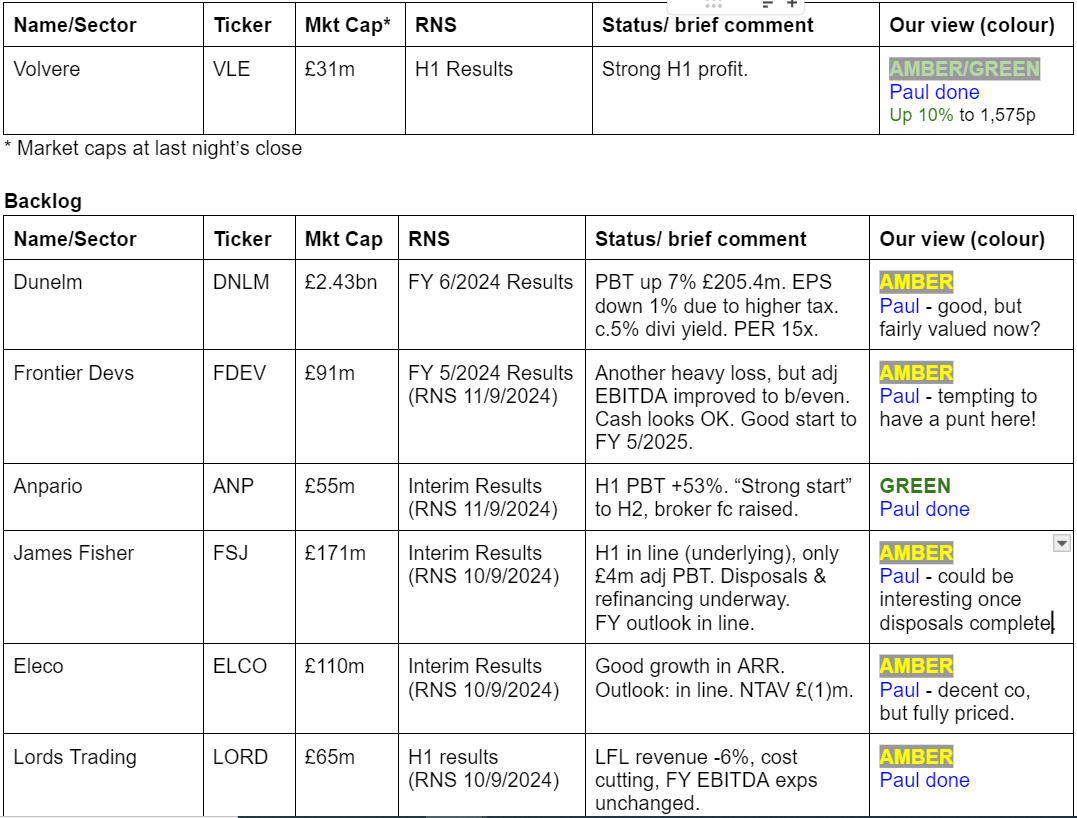

Volvere (LON:VLE) - 1,410p (£31m) - Interim Results [30/6/2024] - Paul - AMBER/GREEN

Profitable pie-maker and cash pile (69% of mkt cap). Traded well in H1. Doesn't sound like any more deals are imminent. Shares are good value but illiquid and the company is a bit sleepy with very little happening for an investment company, so only for very patient investors. It's not really a turnaround company now, more a stand still company!

Anpario (LON:ANP) - 325p (£66m) - Interim Results (published 11/9/2024) - Paul - GREEN

Strong H1 numbers, plus a good outlook, and broker forecasts increased. Superb balance sheet with surplus cash. Valuation looks reasonable still. Put that together, and I'm happy to move up from amber to GREEN. Although the business is still small and niche, so it needs to see growth accelerating to become a proper growth company.

Lords Trading (LON:LORD) - 42.3p (£70m) - Interim Results [30/6/2024] - Paul - AMBER

Soft H1 results, with adj EPS down 52%. Although FY 12/2024 outlook is unchanged. Only really operating around breakeven. So the question is how much will profits recover, as the widely expected cyclical building/repairs recovery begins in 2025? I think there are better options in the sector.

Paul’s Section:

Lords Trading (LON:LORD)

42.3p (£70m) - Interim Results [30/6/2024] - Paul - AMBER

Lords (AIM:LORD), a leading distributor of building materials in the UK, today announces its unaudited Interim Results for the six months ended 30 June 2024 ('H1 2024' or the 'Period').

It’s an acquisitive distributor of building products, with a good clear self-description provided -

“Lords is a specialist distributor of building, plumbing, heating and DIY goods. The Group principally sells to local tradesmen, small to medium sized plumbing and heating merchants, construction companies and retails directly to the general public.

The Group operates through the following two divisions:

Merchanting: supplies building materials and DIY goods through its network of merchant businesses and online platform capabilities. It operates both in the 'light side' (building materials and timber) and 'heavy side' (civils and landscaping), through 31 locations in the UK.

Plumbing and Heating: a specialist distributor in the UK of plumbing and heating products to a UK network of independent merchants, installers and the general public. The division offers its customers an attractive proposition through a multi-channel offering. The division operates over 17 locations enabling nationwide next day delivery service.

Lords was established over 35 years ago as a family business with its first retail unit in Gerrards Cross, Buckinghamshire. Since then, the Group has grown to a business operating from 48 sites.”

Have any readers mystery shopped Lords? If so, do let us know what you think. I see it has lots of brands within the group, website here.

I raised an amber flag on 11/1/2024, with the abrupt departure of CFO. However, I listened to a webinar with management last night, and the new CFO has been in the job 3 months, and reassured me by saying (credibly I thought) that he was happy with everything so far, and he had found the business was exactly as he expected. I know that doesn’t mean anything, but I do like to think I’ve got quite a good nose for management, and can usually (not always sadly!) smell when something isn’t quite right. My antennae were relaxed during this webinar, with management coming across well as straightforward entrepreneurs who know their business inside-out. That’s the type of thing I like to invest in, so it passed my sniff test.

A reminder that our snapshot comment on Tuesday’s results was -

Lords Trading | LORD | £65m | H1 results | LFL revenue -6%, cost cutting, FY EBITDA exps unchanged |

Going into a bit more detail now -

H1 revenue down 4% to £214m

Gross margin is low at only 20.2%, down 20 bps vs H1 LY

Adj EBITDA margin down 90 bps to 5.9%, £12.6m

Adj diluted EPS is down 52% to 1.57p

Tough market conditions, as we know from other building supplies companies, but also a Q1 hit from CHMM -

"Trading conditions have remained challenging throughout the first half of 2024 with like-for-like (LFL) revenue 6.1% lower. The introduction and subsequent deferral of the Clean Heat Market Mechanism (CHMM) disrupted the Plumbing and Heating market and we experienced a 15% LFL revenue reduction in the first quarter, but a stronger second quarter resulted in a resilient first half with divisional revenue 3.2% down overall.”

Cost-savings of £2.6m annualised put in place.

Mgt said in the webinar that branches have considerable local autonomy (“within a framework”) on pricing, etc.

Expecting a sector-wide recovery next year -

"Whilst the outlook for the Construction sector is beginning to improve, the Board is not expecting any change to trading conditions in the second half of 2024 and, recognising the important Autumn season ahead, particularly in Plumbing and Heating, expect that Adjusted EBITDA, will be in line with management expectations."

You can see from this table that plumbing/heating is about half revenues, but c.40% of total EBITDA. Also it was responsible for two thirds of the drop in group EBITDA in H1 -

A one-off gain of £1.7m seems to have been achieved in H1 from a deal on surrendering a lease, which looks a nifty bit of negotiation. This shows up within “other operating income”, near the top of the P&L. So this softened the blow of reduced profits, which would have been £1.7m worse otherwise.

Adj operating profit of £7.1m is not a good measure, since it includes the £1.7m boost above from the lease surrender (without which PBT would have been a slight loss), but it also ignores the heavy finance costs (debt and leases) - eg. (H1 figures) -

I think it’s fine to adjust out the £1.8m goodwill amortisation, but everything else above is a real world cost.

Overall then, the way I view this, underlying profitability is currently c.breakeven.

Given that market conditions are difficult, that’s not a disaster, and hopefully we should see a cyclical recovery move profits upwards in 2025 - that’s the investment case here. The trouble is, there are other building supplies companies that are faring much better, and still making decent profits now, even in a downturn (Alumasc (LON:ALU) springs to mind), reinforcing that as just a distributor, LORD has little if any product differentiation or pricing power.

It’s also got a lot of bank debt, and it’s quite expensive - running at about £4m annualised interest cost (excl leases) -

Broker consensus has dropped by about three-quarters from original expectations - no wonder the share price has been so weak -

Balance sheet - NAV is £50m, but that includes £45m of goodwill & similar. So only £5m NTAV, or 7% of the market cap is asset-backed. No assets, and not really making any profit either, not a good combination I have to say. So the valuation of this share rests entirely on hopes that future trading will improve.

It’s got £13m “land & buildings” within fixed assets, which seems to be freeholds I think, as leases are shown separately as right-of-use assets, so that’s a positive.

Bank facilities look ample, and on reasonable terms -

There was also £11.9m cash partially offsetting bank debt, so net debt was £36m at 30/6/2024. A bit too high for my liking, but not into danger territory.

Broker update - from Cavendish dated 10/9/2024, thanks for that. Obviously broker notes nearly always present the bull case. Although it is worth remembering that a lot of work and thought goes into modelling the forecasts - a very tricky thing to do, since often profit is the sliver left between several large numbers, so small changes can cause a big impact on profit.

Cavendish estimates 4.5p adj EPS in FY 12/2024, rising to 5.7p in 2025. So at 42p/share the PERs are 9.3x and 7.4x, which sounds cheap, but probably isn’t once you allow for all the debt. Also with big revenues and tiny margins, the profit outcome could be a lot higher (or lower) than forecast.

Paul’s opinion - I really liked the webinar recording, and listened to it walking along the beach yesterday, as I do most days to attempt to de-stress. I got home thinking this is great, and really cheap. After digging through the numbers though, I’m now less convinced!

It seems likely that building supplies companies should see a market recovery beginning next year, that’s what they’re pretty much all telling us. So I think we can take our pick from the whole sector, where there are some much better quality, higher margin, and better funded alternatives. So far my favourites remain Alumasc (LON:ALU) and Eurocell (LON:ECEL) . LORD doesn’t make my shortlist I’m afraid, as it’s too low margin, generic products with little pricing power, and negligible balance sheet strength.

It could still do well though, but it’s just not for me. AMBER.

It was an opportunistic, overpriced float in the lockdown DIY boom, with hindsight. However, it's a fundamentally OK business, and at some stage these things stop falling, and can be nice trades for a bounce. So who knows what happens next?!

Founders seem to hold c.half the shares, maybe more?

Anpario (LON:ANP)

325p (£66m) - Interim Results (published 11/9/2024) - Paul - GREEN

I’m returning to look at Anpario, as it rose 16% to 315p on Weds, when its H1 results were published, but we ran out of time on the day. So we just flagged it very briefly on the day -

My impression of Anpario is that it’s a good quality, niche small business, making decent profits most years, with a lovely cash-rich balance sheet. But it’s never demonstrated any ability to really scale up, in what must be massive international markets (animal feed). Hence I question whether a growth company rating (PER of 20+ most of the time in recent years) can be justified? Hence why I was only AMBER on an in line update on 25/6/2024.

“Anpario plc (AIM:ANP), the independent manufacturer of natural sustainable animal feed additives for animal health, nutrition and biosecurity is pleased to announce its unaudited interim results for the six months to 30 June 2024 ("H1 2024").”

It’s interesting how a good, but not astounding 11% increase in revenues, plus an improved gross margin, triggers gradually larger percentages in each profit measure below, ending up at a whopping +84% increase in EPS -

Something looks odd here. PAT is +40%, so why is EPS up 84%? Note 6 reveals why - there’s been a very big reduction in the share count, see below.

Also, the adjustments to EPS, whilst small, are favourable in H1 2024, and unfavourable last year (so a 74% rise in EPS becomes an 84% rise in adj EPS). Remember that these factors won’t necessarily repeat next year (as the reduced share count annualises), so don’t get carried away with the 84% adj EPS increase!

I don’t see any “transaction in own shares” announcements, so how come the share count has dropped from 20.7m to 16.8m? There’s an announcement last year 23/6/2023 which says ANP bought back 4m of its own shares in a slightly oversubscribed tender offer at 225p, using £9m surplus cash. That’s looking a really good move now by the company, with the share price now 44% higher, and H1 EPS having been boosted c.24% by my calculations.

Outlook - sounds positive, assuming they can successfully deal with logistics as indicated, but it is a risk - “we do not currently expect a significant impact on the Group's performance.”

I like this bit too -

“The more positive outlook for producers is stimulating them to increase their use of specialty feed additives and, as our more immediate business development initiatives start to pay off, we look forward to our other initiatives with longer gestation periods contributing to future organic growth.”

And this -

“The use of antibiotics in the food supply chain must be reduced if we are to curb the spread of drug-resistant 'superbugs'. Orego-Stim® and other products are already being used to help reduce antibiotic use by controlling enteropathogens and supporting gut health. We therefore believe well researched specialty feed additives will play a crucial role in weaning the world off the overuse of antibiotics. The Group is well placed and has the balance sheet to benefit from this crucial trend both organically and supplemented with complementary corporate opportunities.”

Balance sheet - looks superb, even after spending £9m on the tender offer last year.

It now has £13.5m net cash (20% of the market cap). NTAV £25m is more than ample.

Cashflow statement - is good again, but note that inventories have been reduced considerably, helping boost cash (mainly last year). That may not continue, or might even reverse a little possibly? But it’s splitting hairs, everything is fine.

Webinar details -

“Richard Edwards, Chief Executive Officer, and Marc Wilson, Group Finance Director, will provide a live presentation relating to the Company's unaudited interim results for the six months to 30 June 2024 via Investor Meet Company on 25 September 2024, 15:00 BST.”

Broker update - our thanks go to Shore Capital, who raise FY 12/2024 from 17.8p to 20.0p - which is higher than the consensus figure on the StockReport of 15.6p upped to 17.0p. Maybe one of the two brokers contributing to consensus is asleep? I’ll go with Shore’s 20.0p. That gives us a 2024 PER of 16.3x, which I think is fair, or even good value since net cash makes up 20% of the market cap (but remember cash earns interest now, so it’s not as simple as it used to be in zero interest rate period, when we didn’t have to lower earnings when we strip out the cash).

Paul’s opinion - this looks good to me. ANP traded strongly in H1, the outlook indicates continuing growth in H2, and Shore has upgraded forecasts. There’s a lovely strong, cash-rich balance sheet. Plenty to like here, so I’m happy to move up from amber to GREEN. I’d like to see a step change upwards in revenues, which could drive a multibagger, but we’ve been waiting a long time for that, and strong growth still seems elusive. However, the respectable growth currently being delivered is good enough to well support the current share price I think, so risk:reward looks good to me, and better than it’s been for a while actually.

Volvere (LON:VLE)

1,410p pre-market (£31m) - Interim Results [30/6/2024] - Paul - AMBER/GREEN

Volvere plc (AIM: VLE), the growth and turnaround investment company, announces its unaudited Interim Results for the six months ended 30 June 2024.

A very small investment company, but it’s got a terrific long-term track record, and management seem highly regarded. Although note that the last four years have only resulted in it regaining 2020 highs. Can it power on to new highs? That looks a possibility after strong H1 figures today.

Results show performance of its one trading subsidiary, Shire Foods, which makes pies - website here. I find the current standard of pies in the UK to be a disgrace! All you tend to buy in supermarket (even the premium ones) pies is a lot of pastry, gravy, a few tiny scraps of gristle masquerading as meat, and air. It would be good to mystery shop Shire’s pies, which hopefully are better than this, but its website doesn’t seem to be transactional. Shire says it invented football’s famous chicken balti pie -

It looks a decently profitable little business over the last 3 years. There seems to have been a heavy H2 weighting to 2023 results, which enables it to show a +180% growth in H1 profit this time, 6/2024. It says H2 is seasonally stronger, due to colder weather. I’m wondering whether H1 2024 got a boost from being a mostly cooler/rainy year, apart from the occasional heatwave?

If H2 2024 is like H2 2023, then Shire could be on track to make about £5m adj PBT in FY 12/2024 - not to be sniffed at.

Cash pile - apart from Shire, VLE is sitting on a pile of cash, £21.4m net of some small loans. It earns interest on this, which gave net finance income of £479k in H1, which annualises to £958k, implying a 4.5% interest rate on cash received, which looks about right. The market cap is £31m, so its cash pile is 69% of the total valuation, and we’re only being asked to pay about £10m for Shire - which could make c.£5m profit this year possibly. Sounds interesting!

NAV is £38.6m, all tangible. I think this would be a sensible share price target, that’s 1,740p per share, 23% higher than the current share price.

Therefore in total I reckon FY 12/2024 profit in total could be about £6m (£5m from Shire, and £1m from interest received on the cash pile). It will presumably invest the cash at some point in another acquisition, when it finds something suitable. Oh I forgot central costs, which look to be about £0.8m pa, so just above £5m overall PBT for this year is my best guess.

Outlook -

“Whilst we are continuing to review potential investment opportunities, deal flow has been patchy in recent months. This may reflect the summer period, but the reduction in interest rates may be easing pressure on debt servicing and levels of distress. We know our experiences in this regard are not unique but broadly reflect the wider M&A market.

The Group has continued to make significant purchases of its own shares in the market, reflecting the discount that the share price has represented to the net asset value per share. We intend to continue to do this in so far as we are able and when it makes sense to do so in order to provide liquidity for shareholders who wish to reduce their shareholdings.”

There’s another asset, of £2.2m called “available for sale investments”, I’m not sure what this is. Sounds like listed shares maybe?

Paul’s opinion - limited upside here, which combined with the illiquidity, probably rules it out for me.

Although the valuation does look attractive, I think this would only appeal to very patient special situation investors.

Upside could come from future acquisitions, although it doesn’t sound as if anything is imminent.

Overall, I quite like it - you’ve got a decently profitable, growing pie-maker, and a £21m pile of cash, controlled by prudent management with an excellent long-term track record. So the chances of them squandering the cash on something daft are pretty low I imagine.

I think they should change strategy, and start paying decent divis, instead of hoarding cash for deals that hardly ever seem to happen. Also too small to be listed really.

Rather niche & illiquid, so I can’t go fully green, but the figures are good so let’s call it AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.