Good morning from Gozo*! Just Paul here today, with it being a Friday.

I've done a few catch up items to get us off to a flying start below.

Update at 13:20 - I'm going to do one more company, 888, then wrap up.

Update at 14:56 - right that's me done for the day, and the week! Have a lovely weekend, and remember I'll be podcasting tomorrow, so tune in for the next thrilling instalments!

(* don't be jealous, it's windy & overcast here!)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Main section summaries

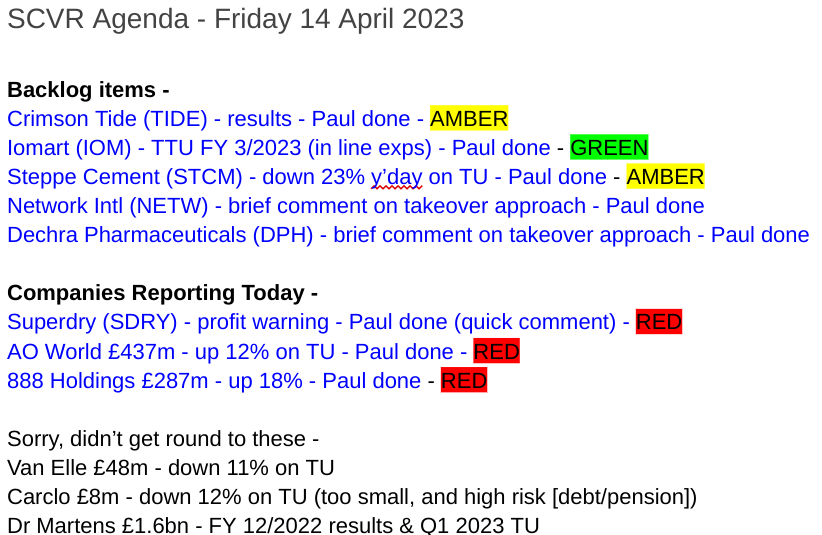

AO World (LON:AO.)

Up 12% to 75.5p (£437m) - TU FY 3/2023 (top end of guidance) - Paul - RED

Another good trading update, with adj EBITDA at top end of previous guidance, at £45m. The trouble is, this only translates into about £4m real profits (PBT) by my calculations. Good news on bank borrowings though - these were cleared by year end 3/2023, with small net cash. And £80m RCF renewed until 2026. So considerable improvements, but still a very poor quality business, trading a whisker above breakeven. So it's a thumbs down from me at this valuation. Although as mentioned here last time, the shares clearly have momentum, so could be a nice trade, but it's built on flimsy foundations (as was proven with previous bull runs with this share). More detail below.

888 Holdings (LON:888)

888 Holdings (LON:888) - 74.4p (up 20% at 14:35) (£335m) - FY 12/2022 results & Q1 TU - Paul - RED

A complicated special situation, due to a disastrous balance sheet, laden with excessive debt.

Shares have bounced nicely today, due to in line 2022 results, and an encouraging Q1 update. Ignore the nonsense EBITDA figures, as heavy debt interest, and a large depreciation charge, mean that there's no actual profit. Net debt of £1.7bn dwarfs the £335m market cap, so investors need to understand special situations, and debt, otherwise it's just a trading punt. Very high risk, so has to be RED from me, thumbs down. Could multi-bag if the debt issues recede, or it could end up having to dilute, or even go bust, if things go badly. I'm just flagging up the risks, so you're aware and can take the facts into account in your decision-making. I'm not trying to predict what's going to happen, as I don't know. More detail below.

Quick comments -

(no sections below)

Superdry (LON:SDRY)

107p (£88m) pre market open - Profit warning - Paul - RED

Withdraws guidance for “broadly breakeven” (i.e. a small loss) in FY 4/2023. Says it is “challenging” to determine what FY 4/2023 losses will be - no wonder, since the auditors have been publicly flagging, for years, that its accounts department is totally incompetent.

Retail sales in Feb & Mar below expectations. Wholesale “continues to be challenging”.

Sale of IP in Far East not completed yet, shareholder circular expected in May. Lender has relaxed covenants, but sounds dependent on this deal completing, a key uncertainty I would say. Large cost savings of £35m identified (seems very high, how realistic is that? Potential equity raise for 20% of existing shares, so that would only be c.16m shares, say at £1 or less, maybe up to £16m - not a massive worry I’d say, if they stick to that level of dilution. Enthusiastic founder CEO, Julian Dunkerton, says he’ll “fully support” up to 20% of the fundraise, which is c.£3.2m.

Jam tomorrow - expecting a big uplift in profit in the medium term.

Paul’s opinion - as regulars know, I’m sceptical about this share. The over-promotional CEO has been promising a turnaround, brand reset, for a long time, but it’s just not working so far. Accounting/audit, and funding problems haven’t gone away. The smallish placing being considered might help, but I wonder at what price?

This is increasingly looking like Joules to me - great brand, lots of promise, but poorly managed. Lots of punters seem to like speculating on this share, but personally I want to see much more firm evidence of a turnaround before getting involved. Also, I wouldn’t touch it unless both the placing has been done (price uncertainty), and the £34m (net) IP sale in the Far East completes - that deal seems almost too good to be true, so I want the money in the bank before seeing this share as acceptable risk. Having said all the above, nobody can question the commitment and determination of the founder to turn it around. Overall, it could go either way. Something tells me the outcome is likely to be spectacular, but I can’t decide if it’s going to be awful, or a multibagger! I’m leaning more towards awful at the moment, but things might change for the better, who knows?

Crimson Tide (LON:TIDE)

3.1p (£20m) - Preliminary results - Paul - AMBER

Results came out 2 days ago. It’s a tiny software company, with an interesting-looking product called mpro5. A more aggressive growth strategy was adopted 2 years ago, after a placing (£6m at 3.0p). For FY 12/2022: revenue up 30% to £5.4m, mostly recurring (ARR at end year was £5.8m). Loss after tax was £(1.1)m. Sound balance sheet with cash of £3.6m, no debt.

The bull case is interesting - winning contracts with big organisations, and has a foothold in USA via Cisco.

Bear case is that it’s been around a long time, with only limited progress.

Paul’s opinion - I wouldn’t pay £20m for it at this stage. Management didn't inspire me on recent IMC webinar, it all felt a bit flat. Although could be a bid target, to quickly bolt on what looks like a decent product. Product seems similar to Touchstar (LON:TST) and Smartspace Software (LON:SMRT) . Might be worth a look for sector experts, who understand the product and the competitive landscape. Is it special, or just an also-ran?

iomart (LON:IOM)

121p (£134m) - Trading update FY 3/2023 (in line) - Paul - GREEN

I don’t recall ever looking at this cloud computing software company before. Graham reported on it here in Oct 2022, on a mild profit warning.

This week it issued a reassuring TU for FY 3/2023 - profits in line with expectations (in middle of analysts range). Guidance is £115m revenues, and £14.6m adj PBT - note the decent profit margin there. 92% of revenues are recurring, with stable customer renewals.

Outlook sounds OK - stronger bookings in H2, so good momentum for the new year just started, FY 3/2024. £7m hit from higher energy prices in Fy 3/2023, but largely passed on to customers, a good sign. This headwind could maybe become a tailwind now, as energy prices plunge. Balance sheet is rather flimsy, with only £4m NTAV at interims results.

Paul’s opinion - looks quite good. A decent business, on a value rating - PER only 11.2, and good dividend yield of 4.6%. Doing your own research, I suppose a key question would be whether all-powerful Amazon might erode its customer base over time?

Steppe Cement (LON:STCM)

Dropped 23% to 34p y’day (£74m) - Q1 update FY 12/2023 - Paul - AMBER

I looked at this Kazakhstan cement producer here on 16 Jan 2023. However strange it might seem to be listed in London, a good characteristic is that the divis paid have been generous since 2018. Also some Director buying. So it doesn't seem to be a fraud, unlike a lot of overseas companies listing in the UK in the past (which is why I nearly always steer clear of overseas companies on AIM).

Q1 was not so good, with Q1 revenues down 22% on last year. Partly macro demand factors, but also logistical problems with overloaded trains, so priority given to transporting other more essential products. Uncertain demand due to geopolitical situation.

Paul’s opinion - I rarely touch overseas companies that list in London,, as there’s usually something wrong with them. The history of good divis from STCM means it could be one of the good ones possibly? Investors would need to understand properly how the sharp drop in sales would feed through to profits/cashflows/divis? Is it temporary or a longer-term problem? I’ve got no idea, so will just say I’m neutral on this share.

Takeover approaches

A couple of mid-caps have received bid approaches, so I’ll mention them here for background interest, and to get them onto my spreadsheet which records takeover approaches. In both cases, they’re mid-cap growth companies, showing that there’s still appetite for deals in that space particularly, despite big rises in interest rates & banking turmoil -

Network International Holdings (LON:NETW) - confirmed yesterday afternoon that it is in discussions with a consortium of CVC Capital Partners, and Francisco Partners, about a possible offer for the company. I’m not familiar with NETW, but looking at its StockReport, it looks a good business, with a high profit margin, strong growth, and high quality scores. Looking at the valuation, and the chart, I wouldn’t be surprised if a bid comes in above the current level, so this share looks quite interesting.

Dechra Pharmaceuticals (LON:DPH) - again, not something we cover here, as it’s too big & a specialist sector. Last night, after hours, it announced a possible takeover approach at 4070p cash (47% premium to 2776p close last night). Possible bidder is EQT and Abu Dhabi Inv Auth. DPH’s Board says minded to recommend it, if possible bid becomes firm. The total value of a bid at 4070p would be £4.65bn.

AO World (LON:AO.)

Up 12% to 75.5p

Market cap £437m

AO World plc ("the Company" or "AO"), a leading online electrical retailer, today issues the following trading update for the 12 months to 31 March 2023.

Guiding to the top-end of the previously issued profit range

Revolving Credit Facility renewed

Revenues for FY 3/2023 £1.13bn, an impressive 32% of online electricals spend for “Major Domestic Appliances” (MDA).

Previous guidance (see SCVR 28 Feb 2023) was raised to a range between £37.5m to £45.0m. So it’s now today saying guidance is “around the top end” of that range, very good, so that’s c.£45m adj EBITDA.

The big problem is of course that adj EBITDA is a nonsense number! Consider that in H1, adj EBITDA was £8.8m positive. But profit before tax was a loss of £(11.6)m. That’s a huge £20.4m difference between adj EBITDA and real profits, PBT, just in a half year! Double that, to c.41m, and it means the fully year’s healthy-looking £45m adj EBITDA turns into a paltry £4m PBT. So this is a business that is actually trading a whisker above breakeven, with a profit margin of just 0.4% of revenues. Why would anyone be interested in investing in that? Let alone value it at £437m?

The only reason I can come up with, is maybe investors hope the profit margin can be improved in future? There are actually quite good reasons to imagine that might happen. Sterling has improved strongly against the dollar, which makes imported good cheaper in sterling terms. Also, there’s been a massive reduction in freight costs, so bulky items like fridge/freezers, coming in probably mostly from the Far East, will be very much cheaper to import now, once hedges have worked through.

Hence I can see that there’s an argument for assuming AO might be able to improve margins this year and in future.

Although as we saw when I looked at smaller, growing competitor, Marks Electrical (LON:MRK) in yesterday’s report, MRK is trouncing AO for profitability, generating a much better profit margin, and MRK doesn’t have any of AO’s on-balance-sheet risk from commissions on extended warranties.

Net debt - looks good, with a small net cash position expected to be reported at end March 2023. An £80m RCF has been renewed with a syndicate of 3 major UK banks, to April 2026 - so the previously precarious financial position now looks fully sorted, greatly reducing the risks for investors.

Paul’s opinion - I can see that the share price has momentum, and the newsflow is improving. So as mentioned last time, there’s a good chance this share could keep rising. But be aware of the risks, and that it’s all built of very wobbly foundations, in my view - negligible actual, real world profits, and a lurking risk that the large balance sheet entries re warranties could turn nasty at some point.

I would back MRK as a long-term, growing, better quality player in this space. Whereas I see AO as just a momentum trade on improving sentiment, but with little substance behind it.

Good luck whatever you decide!

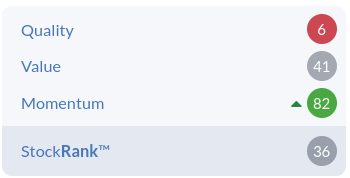

As usual, the StockRank system expresses everything I've said above in just 4 numbers! Here we are - a very low quality business, that's not cheap, but has great momentum -

888 Holdings (LON:888)

74.4p (up 20% at 14:35) -

FY 12/2022 results & Q1 TU - Paul - RED

We’ve covered this gambling group before - it’s a special situation, which made an insanely high risk, debt-fuelled acquisition in July 2022 of William Hill’s non-US operations. That has left things in a real mess, with net debt now 5.6x EBITDA. So no divis until that is reduced to 3x. Very low PER, but that’s because it has £1.73bn of net debt! (only £89m of which is leases) Although interest costs are fixed for 3+ years on 70% of that, it says today.

The good news is that FY 12/2022 results out today are in line with expectations. Also an encouraging Q1 for 2023. Middle East problems seem to be getting resolved. EBITDA figures are absolute nonsense, because there are large depreciation and finance charges - e.g. £218m EBITDA for 2022 turned into a £121m loss before tax! (although that includes £93m of exceptional costs).

The accounts are complex, so it’s very difficult to work out what’s going on, and would be at least a whole day’s work I think.

Balance sheet is one of the worst I’ve ever seen. £159m NAV, but that includes £2.2bn in intangible assets. So the NTAV is negative by about £2bn, which is close to the £1.7bn net debt. In other words, the entire business is funded by debt. It’s difficult to see how the debt maturities which are not until 2027-8 will be handled, but maybe that’s sufficiently far in the future that equity holders might not be worrying about it yet?

The 7.8% bonds for 2028 are trading below par, at 86 - not a disaster, but maybe our bond experts could comment on this with more expertise than me?

Paul’s view - quite an extreme special situation. Not a safe long-term investment, but could be an interesting trading share, because there’s so much leverage, combined with a bombed out share price, that a lasting improvement in performance might violently resuscitate the shares, possibly?

Investors need to focus primarily on the debt covenants, as any breach could end up turning equity to dust. Also, what free cashflow will the enlarged group generate, and is that enough to get debt down to more sensible levels? If the share price recovers strongly, then management would be well advised to strengthen the balance sheet with an equity raise.

Please be careful with this one, it’s definitely not a regular investment. High risk, potentially high reward? Time will tell!

Management who presided over this debt-fuelled acquisition in 2022 should be barred from being Directors again, in my opinion. It looks like a similar approach that the numpties in charge of Cineworld adopted, with disastrous end results.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.