Good morning, it's Paul & Jack here with the last SCVR for this week. Today's report is now finished.

Jack & I are going to trial an end of week podcast this afternoon. If it's any good, I'll publish a link to it here later today, probably this evening.

EDIT: Here it is, the first (and maybe last!) SCVR Podcast.

Agenda -

Paul's section:

Quiz (LON:QUIZ) (I hold) - small and illiquid. This ladieswear retailer is recovering well. December trading and year-to-date (FY 3/2022) is in line with mgt expectations. Not the best business in the world, but with shops now on short leases & cheap turnover rents, it should move back into profit in calendar 2022. Plenty of cash in the bank, which is up to £6m. So this is a value/turnaround micro cap situation, which I imagine won't appeal to most readers.

Xaar (LON:XAR) - trading update from yesterday. H2 moved into profit, recouping the losses in H1. Commentary sounds upbeat, and has plenty of net cash. I don't know how to value this share, due to erratic performance.

Cineworld (LON:CINE) - Q4 trading update, which glosses over the desperate debt position. Extremely high risk of heavy dilution or insolvency.

Equals (LON:EQLS) - a short section from earlier this week.

Sensyne Health (LON:SENS) - top faller today, down 69%. It's a high cash burner, and has almost run out of cash. I see if this was predictable (it was, it was obvious from the accounts), and compare it with the dot.com boom & bust from 1998-2002. Conditions now seem uncannily similar for speculative tech/growth.

Jack's section:

Senior (LON:SNR) - group says full year will be in line with expectations. Net debt reduced by £49m to £80m, cash flow positive, new contracts announced, and notes the start of a recovery in its markets. Margins were falling pre-Covid, but might subsequent restructuring and cost-cutting arrest that trend? It’s beginning to look a little more interesting now.

Smartspace Software (LON:SMRT) - short in line update ahead of more detailed announcement next month. Micro cap, so a lack of liquidity. Forecasts have been considerably downgraded over the past year. There’s still a lot to prove, so I don’t see any rush to jump in.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Quiz (LON:QUIZ) (I hold)

15.7p (yesterday’s close) - mkt cap £20m

QUIZ, the omni-channel fashion brand, is pleased to announce an update on trading for the period between 1 December 2021 to 31 December 2021 ("the Period") and its current cash position.

No surprises here, the recovery continues. QUIZ is a ladieswear retailer, which specialises in special occasionwear (weddings, parties, etc) - the worst possible niche to be in when the pandemic struck.

What’s interesting, is that QUIZ did a pre-pack administration in mid-2020, which enabled it to exit all unprofitable stores. The remaining stores are now on turnover rents, which has halved the rents payable, and made them flexible - so that in quiet months little rent is payable, and in busier months the rent goes up. This is a wonderful structure (I’ve got a lot of experience of turnover rents, as in my CFO days, “Pilot” operated about 50 sites on turnover rents, and 100 on conventional leases. 49 of the turnover rent sites made a profit, but lots of the conventional leases resulted in losses).

QUIZ also has a well developed online offering, although in the past it relied too heavily on third parties, e.g. Debenhams (where a lot of its physical concessions used to be based). Hence the demise of Debs has hit QUIZ quite hard.

This is what it says today -

Dec 2021 revenues +20% on last year at £8.8m for the month

Stores/concessions +64% (LFL revenues are now “broadly consistent” with pre-covid levels)

Online down 26%, but this is due to termination of 3rd party arrangements, own website revenues (higher margin) are flat

Gross margins good, at pre covid level (checking back, this was c.60% - which is high)

Year-to-date revenues (9m to end Dec 2021) £61.0m (+88% on last year, which was harder hit with lockdowns)

Note that April & May 2021 were impacted by some covid restrictions on gatherings, so the £61m YTD revenues will be somewhat below normalised, unrestricted trading. I estimate that this should be a £80-100m p.a. Revenues, and profitable, business post-covid. Which makes the £20m market cap look interesting, with possible upside?

International (Ireland & franchises) - up 11% to £1.5m for the month of December.

Pandemic - impacted Dec revenues, and increased customer returns rate, as people cancelled parties, especially in the 2nd half of the month. So not a bad outcome in the circumstances.

The Board was pleased with the performance achieved in the Period given the challenging trading conditions, notably the widespread cancellation of social events and the introduction of formal restrictions on social activities in Scotland, Wales, and across Ireland following the continued rise in COVID-19 cases throughout December. For the same reason, footfall during the second half of the Period was also notably reduced. This impacted demand for, and increased customers' returns of, QUIZ's partywear products in the second half of the Period.

Cash - liquidity is fine, with £6.0m cash at 13 Jan 2022 (a seasonal high, in my experience), plus undrawn £2.9m bank facility, due to expire in Sept 2022. It has been renewed in the past with no issues, and there are no covenants on the bank facility, so clearly there is a supportive bank (the founding family are wealthy, so that’s probably why the bank perceives little risk).

Outlook - rather odd wording, and doesn’t include any footnote as to what expectations are, so could have been clearer -

The Group is encouraged by the positive performance delivered during the Period, which highlights the strength and awareness of the QUIZ brand, and the growing customer demand for its trademark dressy and occasion wear offering.

The Board remains confident that, in the absence of any further substantial disruption from COVID-19, this demand will support continued profitable revenue growth and deliver a full year to 31 March 2022 performance in line with Board expectations.

Valuation - the last note I have is from early Dec 2021, which forecasts £74m revenue for FY 3/2022, and a loss of £(2.9)m. Not great, but my impression is that management see this year as a transitional year, when the company has still been impacted by covid (esp. April & May 2021), and has been in recovery mode.

It’s forecast to move into a profit of £0.9m for FY 3/2023 (forecast raised in early Dec 2021), doubling to £1.8m in FY 3/2024. I’m hoping to see upside on those forecasts.

My opinion -

If there are no more restrictions, then the business should enjoy a sustained period of buoyant demand for partywear - with a store portfolio now operating on cheap, flexible leases (average length on signing is only 2 years). They want to build up online through own website sales, which is higher margin. Then the international, and franchising operations could be useful contributors too.

All in all, I think it’s a potentially promising business, which has been highly profitable in the past, before things went wrong (pre covid, it has to be said). At £20m market cap, it looks a cheap recovery situation to me, with very experienced management.

What went wrong pre-covid? From what I can gather, it’s down to this -

- Over-reliance on third parties, e.g. Debenhams used to be about a quarter of revenues, and was highly profitable, that’s gone now. Hopefully QUIZ could recover some business, with Boohoo (I hold) online version of Debenhams in future.

- Mistakes over product historically - wrong product, and in wrong quantities. Improvements have since been made to the buying/merchandising team

- Onerous leases - which have since been ditched in the pre-pack administration in 2020, so won’t be a problem any more, as the company is only signing short, and cheap turnover-based leases now.

With those issues sorted, and a much lower cost base for the store rents, high gross margins, and not much physical competition left in some towns, QUIZ has everything to play for. Note that Next said in its recent trading update that demand for partywear is coming back, and Sosandar (I hold) said something similar. Hence QUIZ's niche is now a good place to be.

This should be a profitable business in future, which the company alludes to today in a rather oddly worded outlook section.

As I’ve said before, this is not the best business in the world, but it does look cheap, for a credible, securely financed recovery situation. My price target is 40-50p per share, with a 2-year view. As always, that’s not set in stone, and would change if the facts change.

Note the shares are illiquid, and tightly held (founding family still owns about 50%, and I’m told are totally committed to turning it around, and haven’t taken it private when it was very cheap).

Due to the share price going up, and other things going down, it’s become a top 3 holding for me personally.

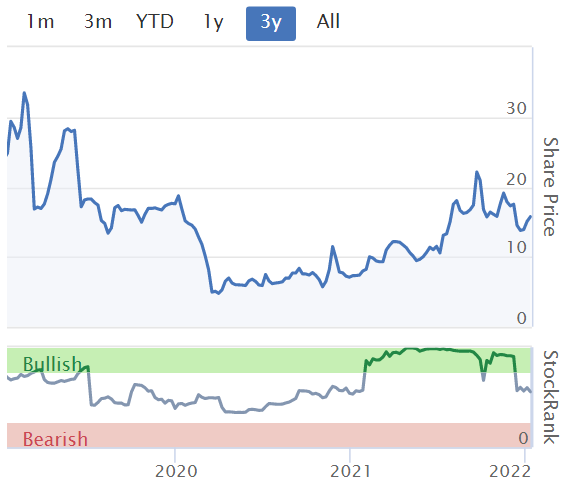

The 3-year chart looks encouraging, and reflects gradually improving fundamentals since the pandemic began. Initially it was all about just survival, which the restructuring in mid-2020 dealt with. Since then, it's about gradual recovery. So far, so good.

.

.

Xaar (LON:XAR)

1847p (up 3% at 11:21) - mkt cap £144m

Xaar plc ("Xaar", "the Group" or "the Company"), the leading inkjet printing technology group, today announces a trading update for the year ended 31 December 2021.

Strong end to the year -

.

H1 revenue was £26.3m, so that makes H2 £32.7m, a useful uplift.

H1 adj loss before tax was £(2.3)m, so H2 must be at least £2.3m positive, to create a profit for the full year.

The rest of the update talks positively about operational progress, and supply chain improvements - e.g. stocking up on key components.

Cash position looks strong, with £25.2m net cash at 31 Dec 2021 - boosted by receipt of £9.3m “initial consideration” from divestment of Xaar 3D.

Outlook -

"We ended the year well with an improved second half performance which shows the positive momentum we have in the business . Strong order intake over the last few months gives us confidence of maintaining this momentum into 2022. The investment in working capital gives increased certainty in our ability to maintain supply to our customers throughout the year, a year in which we expect to see further growth. We will continue to invest in capability and capacity to drive growth and deliver further opportunities to grow the business and accelerate our strategy."

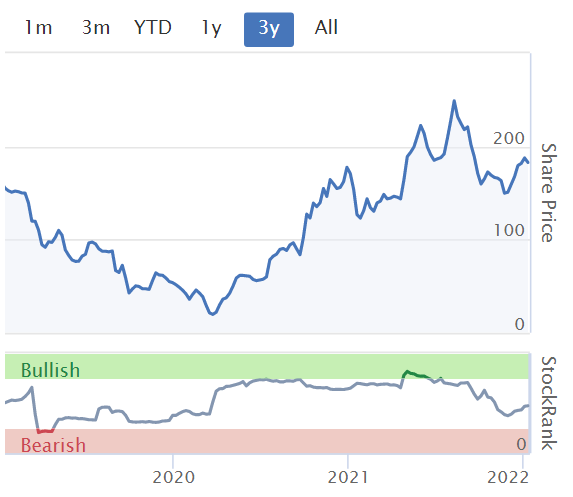

My opinion - no current view, as I wouldn’t know where to start in valuing this share. I've followed XAR since it listed, in the late 1990s, and have made good money on it a couple of times, when products have hit a sweet spot and the shares rocketed. Only to come back down again when those products (e.g. Chinese ceramic tile printers) succumbed to competitive pressure. A reminder that growth is not necessarily forever, and products often have a life cycle before larger competitors come up with something better/cheaper.

Current performance doesn’t justify a market cap of £146m (at 186p per share), so investors must see good potential for future profits to improve.

Performance has been feast & famine in the past, so it’s a very difficult company to assess from the numbers, it would need much more detailed research on the products, the competition, etc.

Investors have enjoyed a fantastic % gain since the Mar 2020 low, but it's not likely to deliver the same % gain again.

.

.

Cineworld (LON:CINE)

38.7p (flat, at 10:37) - mkt cap £533m

Cineworld, the second largest cinema exhibitor in the world with operations in 10 countries including the United States and the United Kingdom and 751 sites and 9,188 screens globally, today provides the following update on trading across the Group for the six months to 31 December 2021.

Revenues have “steadily grown”, although still quite volatile, and below pre-pandemic levels. The timings of film releases, and varying covid restrictions, are given as reasons, so it’s not back to normal yet -

.

Positive cashflow -

As a result of this improvement in revenue and the cost measures implemented, the Group generated positive cash flow in Q4 2021.

Remember that this company is drowning in debt, so it needs to generate huge cashflows, just to service, let alone repay, its debt.

Cineplex legal action - the company lost a large legal case (previously announced), which has resulted in damages (£730m) which could bankrupt the company in my opinion. It’s lodged an appeal.

Diary date - 17 March 2022 for FY 12/2021 results. That’s when the full horror of the balance sheet will be revealed, which is glossed over in trading updates.

My opinion - this company is teetering on the brink of insolvency. I ran through the numbers here on 15 Dec 2021 - total debt is now over $5bn!

Plus the legal case it lost has incurred £730m damages. So if CINE loses its appeal, that could tip it over the edge.

If things turn out well, this share could recover, but the risk of a large, or total wipe out of equity, looks very high indeed. The holders of debt are in the driving seat, and equity holders could end up being an afterthought, if the debt holders play aggressively, and force a big debt for equity swap. Or take control completely, who knows? It's very much a special situation, where I feel private investors are at an informational disadvantage - we don't know what's being said behind closed doors, nor what the debt holders are likely to do.

Why take the risk?

I don’t know what the outcome is likely to be. All I’m flagging is that this is one of the highest risk shares of its size on the UK market, due to excessive debt. If you have a punt on it, just be aware that the downside scenarios are very grim, and it could be a 100% loss. So this is very much not a simple re-opening trade recovery situation, it's much more complex, and high risk. So buyer beware, and only risk money you can afford to lose.

.

.

Equals (LON:EQLS)

Up 9% to 73p (on Weds 12 Jan 2022)

Equals (AIM:EQLS), the fintech payments group focused on the SME marketplace, is pleased to announce a strong trading performance for the financial year ended 31 December 2021 ('FY-21') resulting in unaudited revenue of £44.1 million, an increase of 52% on FY-20.

Earnings are only in line with mgt expectations though.

Cash - has £13.2m at end Dec 2021.

Current trading - continued strong trend from late 2021.

“Managing costs proactively” - mentions payroll, and utilities.

Spending 20-25% of payroll on product development, should drop below 20% in 2023

Planning to increase sales & marketing spending

Expecting a recovery in “travel money” revenues.

My opinion - none, as I haven’t researched the company. Jack wrote up its positive trading update here on 8 Dec 2021.

I’ve been meaning to look at this company for a while, as a friend flagged it as an interesting growth company, that looks to be tipping into profitability, after poor performance in the past.

Do any readers know EQLS, and have a view?

.

.

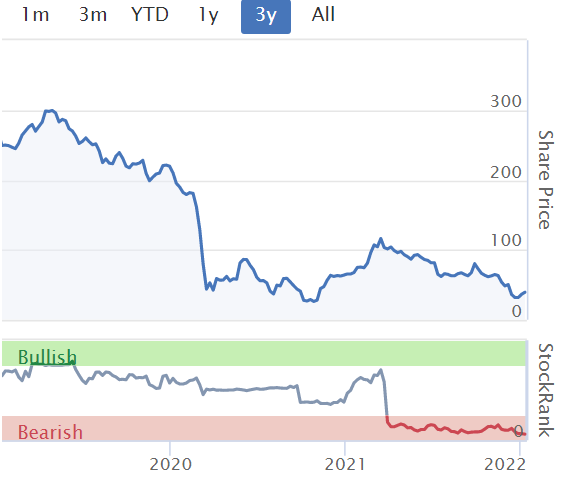

Sensyne Health (LON:SENS)

24p (down 68% at 12:10) - mkt cap £40m

We’ve never covered this company before here at the SCVR, because it’s a heavily loss-making jam tomorrow type of company.

It’s come up on the top % fallers list, so I’ve taken a quick look.

There’s a lengthy explanation of what’s gone wrong, but in a nutshell, it’s run out of cash (only £2.8m left, but it’s a heavy cash burner), and says it’s about to cease trading in early February, without an emergency fundraise.

Institutional shareholders have signed a “non-binding term sheet” for a £6.35m loan, and a further possible £5.0m loan, with a 25% repayment premium in lieu of interest by the looks of it. No dilution from loans, but there is dilution from warrants exercisable at 10p, for up to 17.7% of the company.

The company is also in a FSP (formal sales process), hoping to sell itself before it goes bust by the looks of it. Why would anyone pay anything for the equity? It’s often the case, in distressed situations, that a buyer negotiates with the debt holders, gets them to take a haircut, and wipes out the equity completely. The key point being that equity ranks behind debt in law.

Therefore I think a price of 0p is looking a high probability here.

It says there is a substantial debtor, being chased for payment. So the company might be able to save the day by collecting in that money. Maybe they should offer the debtor a discount, to cough up quickly?

Were the problems predictable? Very much so. Looking at the FY 4/2021 accounts, the company ran up a loss for the year of £(28.4)m before tax. Admin, and R&D expenses totalled £31m, which dwarfs gross profit of £5.9m.

There was £23.6m cash at 30 April 2021, but that was below the annual operational cash burn shown on the cashflow statement. Hence, without another fundraise after April 2021, it was obvious that the company would run out of cash about now.

Further, note 2 (going concern) to the FY 4/2021 accounts specifically explains that there is a “material uncertainty” over the company’s viability (which is generally stated on a 12 month basis from signing of the accounts). It said this at the conclusion -

In the scenario of the Group and the Company not being able to generate any new revenues, we would need to seek alternative sources of funding to the support the Group and the Company through a combination of some, or all, of the following: equity offerings, collaborations, strategic alliances, grants, debt financings, and marketing, distribution of licensing arrangements. Although we consider that there are strong grounds for believing that such funding could be secured, as demonstrated by the successful fund raise in January 2021, there can be no guarantee that would be the case. While the Group and the Company believes it will be able to enter into new commercial agreements to generate new revenues or secure alternative sources of funding within the next 12 months, there can be no assurances that the Group and the Company will be able to do so on a timely basis, or at all. These circumstances mean a material uncertainty exists that may cast significant doubt on the entity's ability to continue as a going concern.

The downside scenario played out, and it has indeed run out of cash. Demonstrating how important it is for investors to read going concern notes & take them seriously.

The new debt being raised from institutions, looks to be only enough to keep the lights on for a few more months. That they're offering debt, not fresh equity funding, also speaks volumes.

My opinion - this is a great example of why I try to avoid investing in any heavy cash burning company. If I do, then my rule of thumb is to only invest if there’s at least 2 years’ cash burn sitting in the bank account.

Companies that rely on round after round of fresh financing can, sooner or later, run into a brick wall when shareholders refuse to pour in any more money.

There’s a fantastic book on that, highly recommended, called Boo Hoo: A dot.com Story from Concept to Catastrophe, by Ernst Malmsten, an early internet startup star, who came a cropper in the dot.com crash of 2000.

Here’s the wikipedia page about Boo.com. NB. this has nothing to do with Boohoo (LON:BOO) (I hold), it’s a completely different company & people.

Younger readers need to read up on the dot.com boom & bust of 1998-2002, which peaked in early 2000, as we’re arguably seeing something similar, on a much larger scale, right now!

So many things are similar (and I’m thinking mainly in the USA) -

- Lots of massively over-valued IPOs of barely profitable, or loss-making high growth tech companies

- Animal spirits running out of control

- Cocky, often young, management who seem dynamic & clever, but turn out to be full of BS and financially clueless (e.g. Adam Neumann of Wework - another fantastic story that’s worth reading up on)

- Multiple speculative bubbles based around new technology (e.g. Bitcoin, cloud, apps, etc)

- Valuations detached from reality, and new metrics invented to justify nosebleed valuations

- Growth expectations assumed to be open-ended, when actually they turn out to have limits

The good bit, is that value shares tend to come back into fashion, when growth valuations blow up, as people stop chasing speculative stuff, and focus more on solid earnings & divis. Personally, I regard some reasonably-priced mega tech shares as value/GARP shares (specifically Google & Facebook (I hold), which are not expensive, particularly when you factor in that they’re expensing a lot of startup losses from venture capital type activities within the group).

The only hope for SENS now seems to be that someone might buy it in the FSP, and/or the large debtor (no figure provided today) might be collected in. But that could still end up being a 0p outcome for shareholders.

Personally, if I held, I’d ditch them at any price based on today’s news, and learn from the experience - not to hold any cash burning company, which is going to run out of cash imminently - easily checked by some basic time spent reading the accounts.

.

.

Jack’s section

Senior (LON:SNR)

Share price: 141.9p (pre-open)

Shares in issue: 419,418,082

Market cap: £595.2m

Senior’s an international manufacturer of high technology components and systems for the worldwide aerospace & defence, land vehicle and power & energy markets. It’s a decent size, with operations in 12 countries and pre-Covid annual revenues of more than £1bn.

Aerospace is traditionally the group’s largest segment. Clearly, Covid has hit trading.

Today’s update suggests a recovery is in sight however, and the group has managed to get through the past year or two with no equity dilution.

It’s an in line trading update for the full year - consensus estimates suggest around £661m of revenue and a net loss of £3.11m (set to improve to net profit of £13.5m the following year). Senior itself says revenue is now expected to come in at around £659m.

The Aerospace division is expected to be around 12% lower on a constant currency (cc) basis, while Flextronics revenue is up 10% cc, with improved profitability in both divisions.

The group has generated positive net cash flow of £58m, and net debt is ‘modestly’ better than expectations at c£80m (down by £49m).

Restructuring and cost cutting has improved profitability, while the group notes a recovery in core markets including civil aerospace.

Conclusion

I’m not familiar with Senior, so if anyone else knows it well feel free to jump in.

FY19 revenue was £1.11bn and diluted net income was just over £50m, meaning a 4.5% profit margin. That’s on the low side, but if the group can bounce back to FY19 levels then the 12.2p of normalised EPS generated in that year would value the group at 11.6x recovered earnings. Reasonable, but not an outright bargain.

Good cash conversion though, with free cash flow often in excess of reported earnings per share in the past.

There hasn’t been any equity dilution - in fact, shares in issue have fallen slightly over the past five or so years from 423m to 418m. Perhaps the shares could get back above the £2 mark then, assuming the current recovery persists.

I can’t see any obvious reason for the drop in 2018. Perhaps just the valuation getting ahead of itself? While revenue had been steadily increasing pre-Covid, profits were not keeping up, so perhaps that’s the reason.

There’s a chance that might change with this recovery, given the cost-cutting and restructuring initiatives, so it’s potentially worth checking to see if this is now a fundamentally more profitable enterprise on the cusp of recovery. Meanwhile, the big risk of equity dilution looks to have reduced.

Senior announced a couple of contract wins a few days ago with Honda and Boeing (see here and here), which is encouraging. I’m still neutral for now, but this is becoming more interesting.

Smartspace Software (LON:SMRT)

Share price: 74.3p

Shares in issue: 28,941,234

Market cap: £21.5m

Very short update today. For context, Smartspace owns software that helps flexible work offices run their operations (‘integrated space management software’). It’s very small and illiquid.

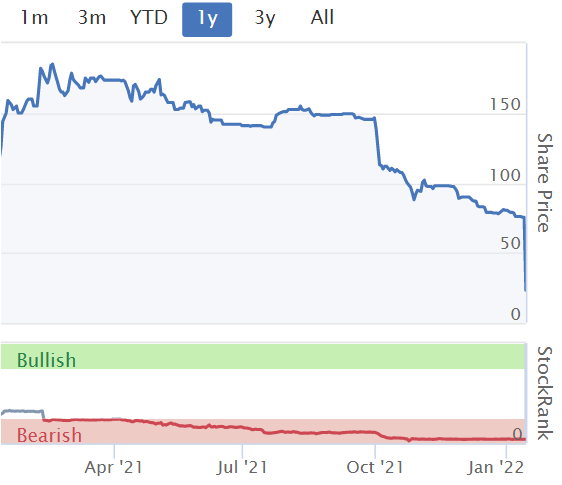

The shares had last year before disappointing the market on trading. Profit guidance has been considerably lowered, as have broker EPS forecasts.

The same lack of liquidity that led to the rise has seen the shares subsequently fall from 182.5p to 74.3p.

Trading update for the 11 months to 31 December

Smartspace expects results to be in line with expectations of revenue of c£5.2m and adjusted EBITDA losses of not more than £2.7m. Group cash stands at £2.8m.

That’s it. We’ll have a more detailed update sometime in the middle of February.

Conclusion

Not much to say here, for now. The growth story has taken a knock, as has investor confidence. It’s very small at c£20m market cap with a track record of net losses and sentiment is poor after the downgrades.

The shares have settled in the 70-80p range and there has been a small level of buying this year, but it’s negligible really. Happy to sit on the sidelines ahead of a more detailed update next month.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.