Good morning from Paul! I'm off to a slow start today, with it being Friday. Hardly any fresh news today, so I'll focus on looking at interesting companies on the backlog list.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Porvair (LON:PRV) 598p (£277m) - Nine Month Trading Update - Paul- GREEN

A Q3 YTD trading update from Tuesday this week is rather light on specifics, but I reckon it could be heading for a forecast busting 40p EPS in FY 11/2023 - half has already been achieved in H1, so broker consensus of 33p seems too low. Nice quality company, growing (helped by acquisitions), strong balance sheet, highly regarded management, and finally a valuation that I find appealing (after years of being over-priced in my view). So I think this could be a good entry point for a quality company. Could be a bid target, it looks the type of thing that private equity would find attractive at a 30% premium.

Wickes (LON:WIX) - 147p (£378m) - Interim Results - Paul - AMBER

H1 profit is down, but FY 12/2023 guidance is maintained. A thin profit margin of only 3%, and a lack of revenue growth (but rising costs) doesn't leave much room for any potential macro downturn. On the upside, Wickes is paying generous divis of 7.4%, and buybacks on top. Healthy balance sheet, although cash is a seasonal spike due to a build up of trade creditors. After a good run recently, I think the price is probably up with events for now.

Paul’s Section:

Porvair (LON:PRV)

598p (£277m) - Nine Month Trading Update - Paul- GREEN

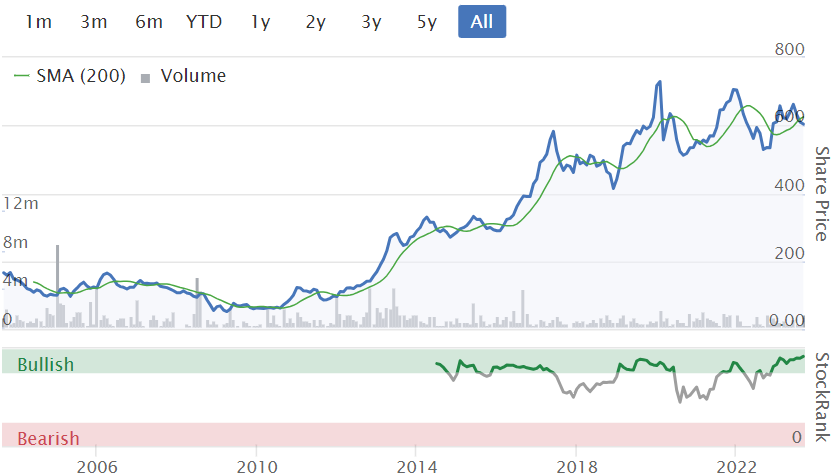

Checking our previous reports, we consistently say the same thing about this specialist filters business - that the business is good, but shares look expensive. You can see that from graph 4 below, where the PER is usually above 20, with the PER of 17.1, being relatively speaking the cheapest it’s been over the 6-year range shown below -

It’s good news on the trend for broker earnings estimates too, which have been rising - impressive in a tough macro environment -

Here’s the latest news -

Trading Update for the 9 months to 31 August 2023, for the FY 11/2023.

- Q3 trading “satisfactory”

- Full year guidance - “full year earnings to be above those for 2022.”

Looking up last year’s results they were good -

Revenue £172.6m (up 13% at CC)

Adj PBT £19.4m (up 31%) - note the decent profit margin of 11.2%, demonstrating pricing power.

Adj basic EPS 33.2p (up 32%).

Adjustments historically were only small, and look valid to me, being acquisition-related.

It’s a pity they didn’t say on Tuesday’s latest update how much they think FY 11/2022 results will be beaten by. So very vague guidance, albeit reassuring that this year is another year of profit growth.

The latest broker consensus for FY 11/2023 is 33.7p, only slightly up on last year, so it seems to me there’s more likelihood of results beating expectations, than missing them.

H1 profit was up 20% vs H1 LY, so unless it had a poor H2, then I’d guess that something nearer 40p EPS might be on the cards for this year (it did 20.1p aEPS in H1).

Nothing is said about cash, or the balance sheet in the latest update. I’ve checked it, and it’s very good, with net cash, and a strong overall NTAV position. Small pension deficit would need checking.

Paul’s opinion - if I’m right, and a forecast-busting 40p EPS is possible, then at 598p the PER is 15x.

For a high quality, growing business, I think that’s a decent entry price, so I’ll shift from AMBER to GREEN.

There might also be potential upside from a takeover bid - this strikes me as the sort of growth company that might attract private equity, or an overseas trade buyer.

Multibagger in the long-term, although nothing much has happened in the last 4 years. Divis are modest, so not an income stock, as cashflows are spent on acquisitions.

£WIX

147p (£378m) - Interim Results - Paul - AMBER

for the 26 week period to 1 July 2023

Strategy continues to deliver, with positive first half LFL sales; full year expectations maintained

H1 revenue only up slightly 0.7% to £828m

Adj PBT £31.1m, down 25% on H1 LY

It presents another profit measure, adjusting out SaaS IT costs, but I’m not interested in this measure, so am ignoring it.

Share buybacks happening every day at the moment.

Adj EPS in H1 was 9.4p (down 29%)

Interim divi 3.6p - held flat vs LY.

Outlook - very detailed guidance is provided, which is impressive I think -

It’s worth pointing out that £45-48m aPBT is a thin profit margin on forecast revenues of almost £1.6bn, only about 3% at best. Worth bearing in mind, as the company would suffer if the economy goes into a full blown recession (I’m not sure that’s likely, but who knows?). Since home improvements are I imagine mostly done by homeowners, then higher mortgage costs could squeeze Wickes’ main customers as time goes on and more peoples’ fixed rates expire, leading to a loss of disposable income.

Forecasts - I can’t find any broker notes, but have manually worked out EPS for FY 12/2023 at 13.5p.

(Workings: aPBT £46.5m, 25% tax = PAT £34.9m, divided by 259.2m shares).

This gives a PER of 10.9, which is probably high enough for now, given macro headwinds.

The PER on the StockReport doesn’t look right to me, so I’ve just flagged it through the green blob, for checking with the data provider. It looks like the 1 Jan year end might have confused the data provider possibly?

Dividends & buybacks - a stand out feature of this share. It’s strong finances enable it to be generous with divis. As stated above, Wickes is planning on maintaining total divis of 10.9p for FY 12/2023. Giving a yield of a healthy 7.4%, but with cover of only 1.4x, so that yield could come under pressure to be reduced if 2024 profits continue falling.

A share buyback totalling £12.5m was announced on 28 July 2023, with transactions happening daily, as you can see from the RNS.

Balance sheet - looks pretty good. NAV is £164m, including £23m intangible assets, resulting in NTAV of £141m.

Lease liabilities are heavy, at £670m, with less on the debit side with Right of Use Assets of £529m, giving a leases deficit of £(141)m. If we eliminate all lease entries, then the balance sheet NTAV doubles to £282m.

The cash of £190m looks a seasonal high, and I can see that year end balances are about half this. Note that trade creditors seem unusually high at June period ends.

Paul’s view - the main attraction is income from a 7.4% divi yield, plus buybacks help enhance per share figures.

Shares have a had a nice run recently, and I’d say on fundamentals, in a period of tough macro conditions, the price is probably up with events for now. Hence I’ll go AMBER here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.