Good morning, it's Paul here!

OK that's me done for the day and the week! Have a lovely weekend :-)

There's hardly any news today, so I'll do some backlog items.

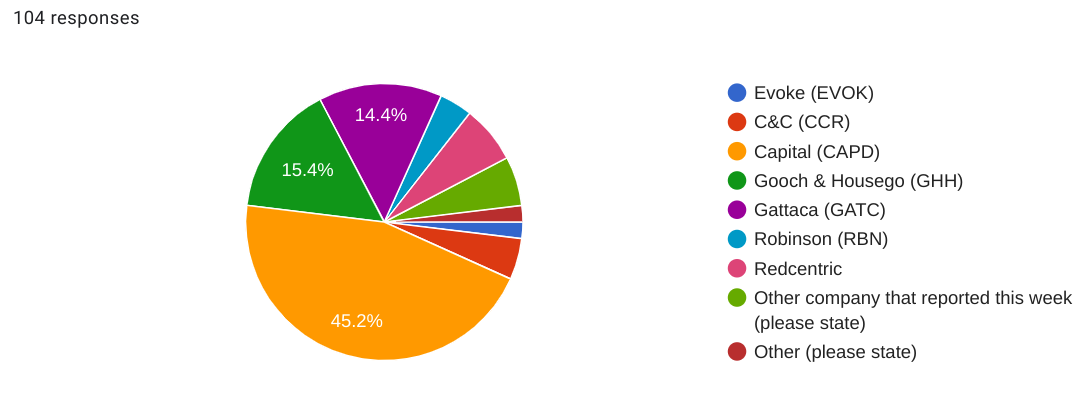

Let's have a reader poll!

Vote for your favourite backlog item (companies which have reported this week) - and I'll cover at least the top two chosen by you collectively -

VOTE HERE Poll now closed, thank you for your votes!

Results so far at 09:11 - a very clear preference for me to look at Capital (LON:CAPD). Done.

Update at 12:36 - there's clear appetite for Gooch & Housego (LON:GHH) and Gattaca (LON:GATC) so I'll do shorter sections on both of them next (finish time will be a bit later, est. 2-3pm). Done.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Summaries

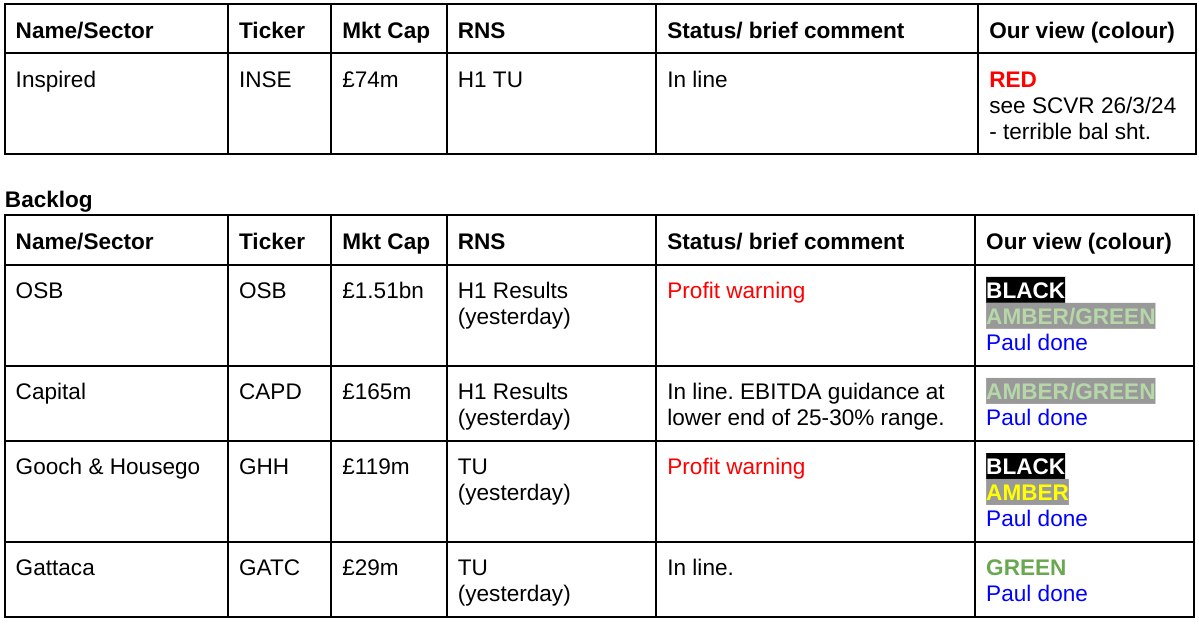

Osb (LON:OSB) - down 19% y’day to 392p (£1.51bn) - Interim Results & £50m Buyback - Paul - BLACK / on fundamentals: AMBER/GREEN

It trimmed guidance yesterday, met with a hefty 19% down move in share price. Not my sector, but on a superficial review I see a lot to like here. Accounts are quite simple, and it's paying an 8.8% yield with hefty share buybacks on top. Solid balance sheet, and a good discount to NTAV. This looks interesting to me.

Capital (LON:CAPD) - 83p (£164m) - H1 Results - Paul - AMBER/GREEN

A few problems in H1 see it deliver unexciting results. Most of the cashflows are absorbed by heavy capex on its heavy machinery rental fleet. Higher debt looks fine to me, nothing to worry about, and is coming down rapidly from disposals. I like the low fwd PER, and discount to NTAV. The company seems too busy, with too many moving parts.

Gooch & Housego (LON:GHH) - 453p (£119m) - Trading Update [profit warning] - Paul - BLACK/ AMBER

Another profit warning, with FY 9/2024 estimate reduced by 16% as orders slip past the year end. There's talk of a turnaround, and raising margins significantly, but no sign of that as yet in the numbers. I think the shares have got off lightly, considering this latest disappointment.

Gattaca (LON:GATC) - 90p (£29m) - Trading Update [in line] - Paul - GREEN

In line performance, in a very tough sector. The stand-out feature is its strong balance sheet, with about two thirds of the market cap sitting there in net cash! Performance seems to be stabilising, and the outlook comments seem reasonably good. So we have cyclical recovery potential, and the enterprise value is only about £7m - rather interesting I'd say!

Paul’s Section:

Gattaca (LON:GATC)

90p (£29m) - Trading Update [in line] - Paul - GREEN

We’re overdue a look at this, having last covered it a year ago.

Gattaca plc, the specialist staffing business, today provides the following trading update for the year ended 31 July 2024 ("FY24").

No surprises - which is good news in a tough sector -

“Resilient performance in line with market expectations”

Net fee income down 5% vs LY, to £40m, “as anticipated”.

Profit guidance is very clear -

“FY24 Group underlying Profit before Tax expected to be in line with the Group's previously announced guidance of £2.4m to £2.7m. “

It claims to have almost two thirds of the market cap in net cash! That sounds distinctly fishy to me, so I’m going to investigate this bit -

“Statutory net cash at 31 July 2024 of £21m (31 July 2023: net cash of £21.6m).”

Well, as it turns out, there’s nothing fishy here at all. GATC does indeed have the bulk of its market cap sitting on the balance sheet in genuine net cash. NTAV was £27m at the last balance sheet date of 31/1/2024. Which begs the question, why isn’t it doing more aggressive share buybacks? It did a paltry £0.5m last year, but has ample firepower to do many multiples of that size in further buybacks.

The only point I would make is that with almost £400m pa in gross revenues (mainly contractors pass-through wages), the working capital swings could be very large intra-month, depending on when customers pay their invoices, and when GATC itself does its payroll runs.

Sense-checking this, the finance income line on the P&L was about £1.3m annualised (doubling the H1 figure of £671k), which assuming credit interest received of about say 4% pa, suggests an average daily net cash position of c.£33m, which is a good bit larger than the year end net cash figure of £21m.

Amazing though it is, this large net cash position looks real.

Outlook - it confirms FY 7/2025 expectations too -

“With our growing momentum we expect to increase market share in our target sectors and are well positioned for both investment and further growth as market conditions improve. Whilst mindful of the macro-economic headwinds affecting the recruitment sector, the Board believes it will meet market expectations for FY25.”

Paul’s opinion - this looks quite interesting, I’m glad readers flagged it for me to look at.

GATC may not be the best in the sector, but its shares are amazingly well cash-backed, meaning the EV is trifling. That gives lovely downside protection, and the upside almost thrown in for free, very much up my alley.

I see the major shareholder list includes 25.6% owned by George Materna, who seems to have founded the business in 1984. Could there be a retirement sale of the group in due course? In the past we’ve done well on companies where a founder wants to polish things up for a sale to maximise their retirement funds.

A further 22.6% of GATC is owned by MMGG Acquisition, which seems to be involved in the staffing sector, from doing a bit of googling.

So my hunch is that there’s a chance of a takeover/sale here, which could be done using GATC’s own cash pile, plus a bit of debt.

Overall, I think this looks quite interesting, both for a cyclical recovery in staffing, plus the self-help measures already taken, and it remaining profitable. Then there’s all that cash piled up on the balance sheet too.

I think it has to be GREEN, as risk:reward looks good.

A poor long-term track record though -

Gooch & Housego (LON:GHH)

453p (£119m) - Trading Update [profit warning] - Paul - BLACK/ AMBER

Gooch & Housego PLC (AIM: GHH), the specialist manufacturer of photonic components and systems, provides an update on trading.

I had to google photonics. It’s things to do with light, so lasers primarily here I understand.

The story so far this year through the lens of the SCVR -

21/2/2024 - 610p - BLACK/AMBER - Paul - profit warning. Forecasts lowered c.24%, blamed on customer destocking.

4/4/2024 - 529p - AMBER - Graham - H1 TU in line.

4/6/2024 - 550p - AMBER - Graham - H1 results lacklustre, but more confident outlook.

I think it’s fair to say that we just haven’t found anything to get excited about in GHH shares this year to date.

Stockopedia agrees, with a middling StockRank of 48.

This looks a bit like a former growth share that has since gone flat, with the shares having peaked in 2018.

Trading update - from yesterday.

FY 9/2024.

Oh dear, this sounds like another profit warning -

"Some delay of revenue from the second half but continued progress with the execution of our strategic plan"

Yes it is a profit warning -

“Whilst the Group still expects to deliver an increase in output in the second half of the financial year, we now expect some revenues to be delayed out of the current reporting period, principally as a result of both supplier and customer delivery delays. As a result, the Group's full year adjusted PBT may be c.£1.5m lower than previously expected. “

Order book - is up very slightly from H1 end -

“The Group's order book has continued to grow in the second half of the financial year and at the end of July 2024 stood at £116.8m (31 March 2024: £115.8m).”

Net debt is down a bit -

“the Group's bank borrowings have reduced to £18.0m at the end of July (31 March 2024: £22.2m).”

This rings alarm bells -

“We are also mindful of growing low-cost competition for the Group's components sold into the medical laser market and are taking steps to address our cost base in this area of our business.”

One of its turnaround actions is to outsource production of some products to low cost contract manufacturers.

Outlook - sounds confident, but they said this kind of stuff last time too, but missed those numbers -

“Despite the macro-economic and geopolitical outlook remaining uncertain we continue to prepare for the sustained recovery in our industrial laser and semi-conductor markets in the early part of the coming calendar year. The Group's healthy order book along with a large high-quality pipeline of new business opportunities provides good visibility and confidence for next year. The Group's expectations for FY2025 trading remain unchanged.”

The Group continues to deliver on its strategic growth plan that sets a path to mid-teens profitability.

Broker update - thanks to Zeus for updating its estimates, with a 16% drop to 24.5p (FY 9/2024). At 453p/share that’s a PER of 18.5x - hardly a bargain I would suggest. The valuation only stacks up if you rely on the FY 9/2025 estimate, now trimmed slightly to 35.1p (PER 12.9x).

Paul’s opinion - GHH is becoming a serial disappointer. Talk of low cost competition, and the need to become more efficient worries me, and as an outsider I have no way of determining the likelihood of its mid-teens profit margin target being achieved. Maybe it's just become uncompetitive against stiffer competition?

The last balance sheet looks adequate with NTAV of £53m. Although I note inventories & receivables both look high, so it needs a tighter focus on working capital to reduce debt I think - it looks like customers might be taking advantage of it, and using GHH like an interest-free bank, moving the finance costs onto GHH's P&L instead!

I wish them well with the turnaround, but I need to see some evidence that performance is improving, rather than just an aspiration to improve margins. I think it’s too early for me to want to get involved here, but am happy to keep monitoring it. Let’s stick with AMBER on fundamentals.

Capital (LON:CAPD)

83p (£164m) - H1 Results - Paul - AMBER/GREEN

Clearly the top result in our reader poll today, and you’re a shrewd lot, so there must be something interesting here!

I last looked at CAPD on 15/3/2024, with a GREEN view - summarised as -

“Capital (LON:CAPD) - 91p (£176m) - FY 12/2023 Results - Paul - GREEN - Low PER, strong balance sheet, and upbeat outlook make this seem interesting at a first glance. Although profit/cashflow seems to end up being spent on heavy capex, with only modest shareholder returns.”

Capital Limited (LSE: CAPD), a leading mining services company, today provides its results (unaudited) for the half-year period 1 January to 30 June 2024 (the "Period").

H1 results overall don’t look madly exciting - and note that the big EBITDA turns into very little PAT at the bottom of the table -

The core business buys & rents out mining equipment. A look through its website shows that this includes drilling rigs, and heavy duty diggers, etc.

Key information is utilisation rate, which wasn’t great in H1, as explained here -

“H1 2024 average rig utilisation was 69%, a decrease of 8.0% on H1 2023 (75%). The decrease was primarily driven by lower utilisation in Q1 2024, which rebounded into Q2 2024 (72%) driven by increased rig counts at Belinga and the beginning of the ramp-up at Nevada Gold Mines. The Group's target average utilisation is ~75%;”

Another key metric is revenue per day/week/month, which has shown a useful improvement -

“Average monthly revenue per operating rig ("ARPOR") was $204,000 in H1 2024, up 8.5% on H1 2023 ($188,000). This strengthening in ARPOR is primarily the result of the ramp-up of high-quality contracts, as well as a continued focus on efficiency at our more established sites.”

Sukari contract has been extended into Q3, but is then scheduled to come to an end. It says this was the largest contract ever won in 2020, so it sounds financially significant. Does anyone know the financial impact of this dropping out of the numbers soon? How lucrative has this contract been, and how much of a drop in 2025 profits is it likely to cause? If anyone knows, please do post a comment. CAPD says it is actively selling the equipment, which should further reduce debt.

Net debt rose to $86.4m, but post period end it sold an investment for $31.2m, with more disposals to reduce debt further, so I don’t see debt as a problem here. That’s good because in H1, finance costs consumed a third of operating profit.

Remember that it owns a whacking great load of heavy equipment, with fixed assets being $229m. Therefore with net debt down to c.$55m post disposal above, this looks a very modest level of gearing.

NTAV looks very robust for an equipment hire business at $276m, about £214m, which is greater than the market cap of £164m.

Dividends are OK, at c.3.5% yield, but that’s very well covered by earnings. Management strategy seems to be focusing on expansion ahead of divis, but there hasn’t really been much to show for it in the last 5 years, either in EPS or in share price appreciation -

Paul’s opinion - readers here will know far more than me about CAPD, so I’ve only done a quick overview, rather than delving into all the various projects, and trying to assess their prospects - that’s your job!

Bull points -

Low forward PER of 5.7x

Good discount to NTAV

Strong balance sheet with modest debt.

Bear points -

H1 seems to have encountered some setbacks, and the commentary is a bit mixed (better H2 expected).

Are they trying to do too much? Generally I prefer more focus, in a profitable niche.

Unexciting dividends, as heavy capex absorbs most of the cashflows.

Higher tax.

Capital-intensive business.

I can’t help compare CAPD with GMS (I hold). It seems to me that GMS is a much more compelling investment story, generating prodigious cashflows and enabling rapid debt reduction. Whereas CAPD looks to have some attractive features, but lacks the jaw-dropping free cash generation of GMS.

Think I’ll moderate to AMBER/GREEN with CAPD, but you guys know a lot more than me about it, so feel free to ignore me!

Osb (LON:OSB)

Down 19% y’day to 392p (£1.51bn) - Interim Results & £50m Buyback - Paul - BLACK / on fundamentals: AMBER/GREEN

I last looked at this specialist (buy to let) mortgage lender here on 14/3/2024 (at 386p, down 16% on a profit warning), and quite liked the look of it - low PER, generous divis, and a discount to NTAV. Although the same could be said of many lenders.

Shares had been recovering nicely, but it’s back to square one again with another profit warning yesterday.

Last time it reported the net interest margin (NIM) down from 303bps to 251bps in FY 12/2023.

Today’s guidance shows it’s reduced a bit more -

“Underlying net interest margin is expected to be in a range of 230 - 240bps for the full year as increased competition in the subdued mortgage market leads to maturing fixed term mortgages redeeming or switching onto lower prevailing spreads more quickly…”

Interim Results (6 months to 30 June 2024)

The headline profit number is very impressive, given this is only 6 months, and the market cap is £1.5bn -

“Underlying profit before tax1 increased to £249.9m (H1 2023: £116.6m) and statutory profit before tax was £241.3m (H1 2023: £76.7m) primarily due to non-recurrence of the H1 2023 adverse EIR adjustment partially offset by lower prevailing spreads from mortgages and deposits and an impairment credit compared to a loss in the prior period”

What is EIR? It looks like an accounting entry to estimate the Effective Interest Rate, and seems to have been mostly a one-off hit to last year’s profit -

“In the prior period, the adverse EIR adjustment related to the expectation that Precise borrowers would spend less time on the higher reversionary rate before refinancing, based on observed customer behavioural trends.

Balance sheet - as mentioned last time, this is fairly simple. OSB is mostly financed by taking in retail deposits totalling £24.3bn. Total liabilities are £28.56bn.

Assets total £30.75bn, with the largest item being £26.12bn of loans to customers (ie mortgages).

Total equity is £2,187m, less intangible assets of £38m, giving NTAV of £2.15m.

The market cap is usefully lower at £1.51bn. So I make that £639m of NTAV thrown in for free, not bad! Is there any reason to doubt that NTAV is real? Not that I’m aware of.

Although having a look through the financials sector, there are plenty of other smaller banks valued at discounts to NTAV - eg. Metro Bank 0.4x NTAV, Georgia Capital 0.46x, Secure Trust Bank 0.46x, even Barclays at 0.53x, Standard Chartered 0.57x. NatWest is near par at 0.96x - those are just some that caught my eye.

What I like about OSB is that it’s simple. Whereas something like Barclays has a balance sheet that is totally incomprehensible. In particular, the vast figures for derivatives could contain all manner of horrors, it’s impossible to know what risks are lurking under the surface at Barclays. Whereas with OSB the main risk would be a run of depositors, or customers defaulting on their mortgages (very unlikely for BTL investors, and in any case the lending is secured), or fraud.

Outlook - this clearly disappointed the market yesterday, causing a 19% drop in share price -

“We have seen an improvement in the macroeconomic outlook recently which supports our cautious re-entry into more cyclical, higher margin sub-segments, which will contribute to returns in the medium term. We are now past peak interest rates, which will also provide a much-needed stimulus to the mortgage market.

Based on current market activity and our disciplined approach to lending and retention, the Group now expects to deliver underlying net loan book growth of c.3% for 2024.

Underlying net interest margin is expected to be in a range of 230 - 240bps for the full year as increased competition in the subdued mortgage market leads to maturing fixed term mortgages redeeming or switching onto lower prevailing spreads more quickly, and as we continue to monitor customer behaviour in reversion on the Precise book for any potential impact on the measurement of the EIR.

The underlying cost to income ratio is expected to be c.36%, commensurate with the NIM guidance and as we continue to maintain our cost discipline while we invest in the business.

The Group is well-capitalised and well-positioned to successfully leverage our unique multi-brand structure and benefit from the opportunities as they arise. I remain confident in the outlook for the Group and our ability to deliver sustainable and attractive returns for our shareholders.”

The newswire service on Stockopedia not only contains the RNSs, but also very useful quick summaries, such as this one yesterday morning for OSB -

Broker notes - nothing available I’m afraid, so all we can do is monitor the broker consensus number on the StockReport, and see if it drops in the coming days/weeks. Hence I’m in the dark. On the existing forecasts, the forward PER is only 4.2x, although broker consensus has been drifting down, and I assume another drop is in the pipeline after yesterday's news -

Dividends - the best bit is the dividend yield, of a thumping 8.8%, which amazingly is 2.6x covered by earnings. The balance sheet strength also supports the idea that this level of yield looks sustainable.

Paul’s opinion - as you know, I don’t usually look at financials, because it’s a specialist area, fraught with hidden risks. However, if I had to buy something in this sector, OSB would be high on my wishlist, because the business model and the numbers are relatively simple.

Who wouldn’t want an 8.8% dividend yield too!? The outlook for mortgages is improving, now that interest rates have peaked, although it sounds as if there’s also more competition from other lenders, so it’s possible OSB might see its margins squeezed further maybe? That could be offset by greater volumes though?

I’d be interested to look into the terms it offers to depositors - are deposits locked in for fixed periods, or capable of being withdrawn on demand (making it potentially vulnerable to a run on deposits in an extreme macro scenario)? Let me know if you’ve looked into that.

Overall, I think this week’s sell-off might be presenting a reasonable entry point, so I’d be happy to go AMBER/GREEN - but please do bear in mind that’s on a fairly superficial review, in a sector I’m not particularly familiar with.

Share buybacks - I almost forgot, on top of your 8.8% dividend yield, OSB has also been shrinking its share count through buybacks, and announced another new £50m buyback yesterday.

If you add up the generous divis over the last 5 years, the total shareholder return has been better than the chart suggests -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.