Good morning from Paul.

All done! Have a lovely weekend, and I'll be podcasting tomorrow as usual.

Agenda

This is what I'll be looking at today (with apologies for the late start) -

.

Latest interview here with Christopher Mills of Harwood Capital, from Paul Hill at Vox Markets. I listened to this last night, and really enjoyed it, hence me mentioning it now. Some terrific insights, as usual from Mr Mills, and he makes good points about very poor market liquidity and delistings. Also some terrific small cap stock ideas, from this highly accomplished, shrewd fund manager. Well worth a listen.

Paul's Section:

Rank (LON:RNK) - Graham normally covers this, but I've had a look today at its latest profit warning. It now looks (as Graham predicted) to be trading at around breakeven for FY 6/2023. I can see the case for a recovery in the bombed out share price, once the consumer & costs squeeze begins to ease. However in the meantime, I'm not happy with its weak balance sheet (over-laden with intangibles). Also I have some ESG concerns over the gambling sector, which might cause problems with investors avoiding the shares, and banks maybe less happy to lend? It's not for me.

Fulham Shore (LON:FUL) - a profit warning is blurred by vague and rather long-winded commentary. A broker update note reveals that adj PBT is being slashed to barely above breakeven for FY 3/2023. Rail strikes have particularly harmed the many sites in London, and city centres, for weekday lunch demand. FUL is one of those shares where I like the trading updates usually, but am less keen when I see the full numbers, with lots of adjustments, and not much statutory profit. Overall, as last time I reported, I'd want this share significantly cheaper to tempt me into buying now. Longer-term though, it should be a decent recovery share.

Hollywood Bowl (LON:BOWL) - cracking numbers for FY 9/2022, and outlook comments suggest the boom in ten pin bowling is continuing. It's a high margin, highly cash generative business model. The cash generation is being used to pay generous divis, and self-fund new site openings. Also it's expanding into Canada now. It all looks fantastic, let's hope it continues. Thumbs up.

Dev Clever Holdings (LON:DEV) [quick comment] - a very peculiar situation. It burned through a ton of cash, a Director banked nearly £6m from selling shares, then it was suspended a year ago, pending a reverse takeover. That hasn’t happened, and today we’re told that it’s de-listing, as nobody is interested in refinancing it in the public markets. I don’t blame them! Yet another reminder that, in this bear market, speculative, cash burning junk companies are likely to de-list, so we don’t want to be holding anything of this ilk. Follow-on funding just isn’t happening, so there’s no point in maintaining a listing.

Sutton Harbour (LON:SUH) [quick comment] Another bizarre company. It’s been listed since 1996, and owns Sutton Harbour (as the name suggests). The market cap is only half the NAV, which is made up of property assets, along with £27m net debt. Negligible profit from its operating activities, including a marina & car parks, as finance charges eat up the operating profit. With higher interest rates, that could become more problematic. Could be a special situation if there’s hidden value in the properties, but it would need a lot of work. Largest shareholder owns 73%, so looks a prime candidate for a delisting. Looks like the bank isn't keen to extend lending facilities, so it needs to de-gear. I wouldn't go near this share - why get involved?

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Rank (LON:RNK)

74p (down 8% at 08:27)

Market cap £346m

I’m not terribly familiar with this gambling company, which owns Grosvenor Casinos, and Mecca Bingo. Its website is here, for more background. Coverage in the SCVRs has been light, because a lot of the time its market cap has been too high. However, as you can see from the long-term chart below, it’s almost back down to 2008 financial crisis lows -

.

To get up to speed, we have our trusty archive, which we can look up for any share covered here by clicking on the “Discussion” tab on the StockReport. This brings up articles for Rank here.

Graham covered the profit warning here on 20 June 2022, where he (correctly) predicted that there could be more trouble ahead for the company, but that the net cash position, and lowly valuation was starting to look interesting as a long-term recovery situation.

Graham again reported on a disappointing trading update here on 13 October 2022, although that seems to have been where the shares bottomed out short-term, with a strong bounce since. Graham’s view then was that RNK would be lucky to make any meaningful profit this year, FY 6/2023. Energy costs of £34m are strikingly high.

That sets the scene, what’s the latest news today?

The Rank Group Plc (LSE: RNK) (Rank or the Group) provides an overview of trading performance for the five months to 30 November 2022 and an update on its profit expectations for the year ending 30 June 2023.

It’s another profit warning I’m afraid -

We now expect Group LFL underlying operating profit for the year ending 30 June 2023 to be in the range of £10m to £20m, with the main variable being the performance of Grosvenor venues. Due to the high operating leverage within Grosvenor, and its relative importance to the Group as a whole, movements in its NGR will have a significant impact on the Group's operating profit for the year.

Net Gaming Revenue ('NGR') represents Gross Gaming Revenue after customer incentives.

Detailed reasons are provided, but it’s all pretty obvious - reduced demand from cash-strapped customers, colliding with higher costs. Some divisions are doing better than others, with Spain, and Digital divisions being robust. Grosvenor sounds like the division which is struggling, and some recent weakness in Mecca too.

There’s no broker research available to me unfortunately, which is annoying.

Looking back at the accounts for FY 6/2022, the comparable number is an underlying operating profit of £40.4m, so the current year is half, to a quarter of last year’s operating profit.

What about leases though? IFRS 16 means that some of the rents now go through finance costs as a notional interest charge. So operating profit cannot be relied upon for multi-site businesses like this. Sure enough, the finance costs line is quite big, at £13.4m for FY 6/2022, which means underlying PBT was lower, at £26.4m.

If a similar finance cost line applies this year too, then the u/l PBT would be in a range of £(3)m to 7m. Therefore, as Graham predicted, Rank is heading for a negligible profit, or even a small loss this year. Given that the company has also been under-estimating the deterioration in performance this year, what’s the betting that it could have yet another profit warning, and end up properly loss-making this year? Quite likely I’d say, and remember that casinos & similar are highly operationally geared businesses, with a lot of costs that are not actually fixed, they’re moving up due to inflation (especially wages, and energy costs). That’s happening at the same time as consumers cut back on discretionary spending, creating a double whammy that lots of cyclical/consumer companies are currently facing.

Then an economic/consumer recovery starts, and shares like this tend to do very well.

So timing is everything when gambling on shares like this.

What are they doing in response? Cost-cutting, and measures to drive revenues (e.g. upgrading the gaming options in some casinos, improving online offering).

Is it likely to go bust? Probably not, but the balance sheet is weak - NTAV is negative, at £(67)m. There doesn’t seem to be much property within fixed assets - note 12 to the last annual report shows £36.2m land & buildings, but it’s not clear if that is freehold or not? Most fixed assets of £76.9m are fixtures & fittings, as I would expect.

Also note that intangibles are huge at £494m, which is £220m goodwill (I write this off), £219m “Casino and other gaming licences and concessions” which sounds as if they might have some value, hence maybe we shouldn’t write this off? Also note £49.3m is software previously capitalised.

There was £98m cash at 30 June 2022, but also bank borrowings of £78m, so it looks as if the business needs bank facilities. Presumably some of the cash sits at site level in their safes, for the casino operations.

In August 2022, the going concern statement reassured us about bank covenants, although trading has since significantly deteriorated -

The Directors have considered two downside scenarios which reflect a reduced trading performance and inflationary impacts on the cost base. In these events, the Group will generate sufficient cash to meet its liabilities as they fall due and meet covenant requirements for the period to 31 August 2023.

Note also a large deficit on the lease entries, with £102m RoUA, less £182m lease liabilities - that’s telling us that it has a significant problem with loss-making sites.

Overall then, I’m not comfortable with this balance sheet, which makes this share higher risk than I’d previously realised.

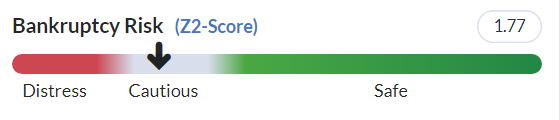

The Z-score is urging caution, but not ringing alarm bells, which is my view too -

My opinion - I’m not keen on this. Yes there’s likely to be a consumer recovery at some stage, but it doesn’t feel like we’re anywhere near that yet.

In the meantime, RNK looks as if it’s only running at around breakeven, and that’s assuming nothing gets any worse.

The balance sheet looks weak to me, not a disaster, but it looks dependent on bank facilities, so you would need to check the bank covenants - if those are breached, then risk goes through the roof potentially.

Finally, there are ethics. Bingo I don’t have a problem with, it’s harmless fun. But casinos are a different matter altogether. Plenty of people ruin, or at least blight their lives, losing money they can’t afford to lose once addiction has set in. So you have to decide whether or not you’re comfortable taking their money. I can see both points of view on that issue, so am not virtue-signalling. However, in this ESG world, it might become an issue with banks, who are already reluctant to lend to other sectors perceived as socially damaging (rightly or wrongly), could gambling become another unfashionable sector for banks and fund managers?

Money laundering is another potential risk. Where does all that cash that punters bring into the casinos each night actually come from? Anyone who (like me) had a mis-spent youth in casinos, will have noticed the influx of customers when the takeaways close at 1-2 am, as the owners head to the nearest casino to blow the money and socialise!

Therefore overall, I think this one’s a thumbs down from me.

The StockRank is perplexingly high. Maybe this might drop once yet another forecast reduction comes through?

The quality and value scores are high, but these are likely to come down, once poor current trading feeds through into the reported numbers, I suspect.

Fulham Shore (LON:FUL)

9.5p (down 16% at 10:18)

Market cap £60m

The Directors of Fulham Shore, the owner and operator of The Real Greek and Franco Manca restaurant businesses, are pleased to announce unaudited interim results for the six months ended 25 September 2022.

FUL is joining the growing list of companies where the big November bounce in share price has turned out to be spurious, as you can see - we’re back down at the October lows -

.

Checking our archive, here on 1 Nov 2022 I reviewed FUL’s impressive update - in line with expectations for H1. Rapid expansion of new sites, and a net cash position, all looked good. Although I was worried that going into a recession, it might issue a profit warning, so only added it to my watch list, rather than buying.

H1 numbers seem to be in line, so I’ll concentrate first on the outlook comments, as that’s what has hit the share price today by 16%.

Today’s update is frustratingly vague, and difficult to unpick, with too much narrative, and not enough hard numbers - e.g. FUL doesn’t disclose LFL revenue growth (or decline), it just says sales are up, which of course they would be from the large number of new sites that have opened. My attitude is that, if LFL sales were good, they would have told us! So keeping it secret suggests not good.

This sounds like a profit warning - but again it’s vague, as seasonality could result in Jan-Mar 2023 (Q4) being naturally lower than previous quarters.

Due to these challenges, the Company expects that trade in the final quarter of the current financial year is likely to be behind any of the Group's first three quarters…

Conserving cash for our shareholders, proceeding with openings cautiously and taking advantage of the ever-decreasing rents which are still prevalent will be our aim over the next 12 months.

Reasons given for deteriorating trading -

- Transport disruption (rail strikes) - fewer people coming into offices, and heavy bias to London locations at Franco Manca.

- Consumer downturn impacting early & midweek trading

- Increased costs

- Energy price fixes ended in early Oct 2022, causing energy costs to double

- Political & economic instability

New openings - pace of expansion will be slowed to 5-10 new sites per year.

Refurbishments will be undertaken in 2023, as some restaurants are now 10 years old.

Key H1 numbers - I’ll keep this brief, as it’s in line with expectations -

Revenue £49.9m (up 26%)

Profit - pick a number, any number!

This table below shows how £10.5m EBITDA turns into just £0.9m statutory profit. So it’s difficult to decide which number we should be using to value the company on -

.

The £860k profit figure I’ve highlighted above is well down on the H1 LY equivalent, which was £3.1m - boosted by reduced VAT, and business rates relief.

Balance sheet - badly presented, with apparently huge debt actually being almost entirely lease liabilities, but wrongly described as “Borrowings” on the face of the balance sheet. Why score such an obvious own-goal every time it reports? The lease liabilities should be split out from the negligible bank borrowings, and shown on a separate line. That’s how most companies report, and it’s really important because the lease figures are so large.

NAV is £39.7m. Writing off £22.8m intangible assets gets us to £16.9m NTAV - which is probably OK, but not what I would call strong.

Trade payables seems unusually high at £27.7m, I'd like to know what is in there, and when it has to be paid. Some of it might be related to landlord reverse premiums, which are not actually liabilities.

Working capital looks tight, with the current ratio being very low at 0.38

So it looks to me as if the company will need to draw on its bank facilities, although the liquidity headroom looks ample, so shouldn’t be a problem unless trading deteriorates badly in 2023. I'd like them to disclose average daily net cash/debt, all companies should.

Cashflow statement - it does look highly cash generative, and is then using that cash to finance new site capex. That gives shareholders good downside protection - ie. if trading goes badly wrong, it could just stop opening expensive new sites, and run the business for cashflow. So it looks fairly safe to me.

Broker update - good old Singers gets a helpful update note out to us, via Research Tree, many thanks for that. It’s slashing forecasts quite heavily, with FY 3/2023 now only forecast at £0.8m adj PBT. the previous forecast was £3.6m!

Although it does say that a resolution of rail strikes could provide some upside for Q4 (Jan-Mar 2023).

My opinion - I do like the value priced restaurant formats of FUL, and until today, it seemed to be shrugging off the bad macro conditions. It now seems to be trading just above breakeven, although the large depreciation charge means that this is still a decently cash generative level.

With weaker trading, and management caution about the outlook resulting in a slower pace of expansion too, it’s difficult to see much immediate upside on this share, given that a £60m market cap doesn’t look cheap.

However, once the economy is recovering again, and consumers have more cash, I imagine FUL would be a beneficiary. It’s also very unlikely to go bust, in my opinion. So it’s your choice whether to hold long-term and ride out this downturn, or wait and hope that the shares get cheaper. It bottomed out around 5p at the worst point of the pandemic in March 2020.

Hollywood Bowl (LON:BOWL)

236p (up 3% at 12:16)

Market cap £404m

I last covered this ten pin bowling group positively here on 10 Oct 2022, at 205p per share, when it issued an ahead of expectations trading update for FY 9/2022. It’s trading really well, so the only question investors need to decide on is whether the current popularity of bowling is going to continue, or fizzle out? That’s what will drive the share price up or down.

Today we get the -

These figures seem to be well ahead of the flash figures provided on 10 Oct 2022, which is odd. Revenue of £184.9m was guided, but actual is £193.7m.

Adj EBITDA (pre IFRS 16) was guided at about £53.5m, and has come in well above, at £60.6m. I’d like to know why the actual results are so much stronger than the trading update in Oct suggested? It might be buried in the commentary somewhere, but I don’t have time to read everything. It’s the right way round anyway - a beat against guidance, nobody ever complains about that.

Ah I’ve found it, note 5 shows exceptional items, which includes a £5.8m boost to revenues from favourable settlement of a VAT dispute.

Profit - I think it makes sense to value the shares on the (lower) pre-exceptional profit before tax (PBT) of £43.0m, less tax of £8.1m gives £34.9m PAT. Divide that by the average number of shares shown in note 10, of 171.9m, and we get EPS of 20.3p by my calculations. At 236p per share, that works out at a PER of 11.6

My PER calculation is lower than the broker consensus figure of 22.3p. The company leaves a blank space where EPS should be under the pre-exceptional results, preferring to show a higher 21.9p EPS figure which includes the one-off VAT exceptional item. It’s up to you whether you want to value the shares on the company’s more aggressive EPS figure of 21.9p (slightly below broker consensus), or my more conservative 20.3p EPS calculation.

Depreciation is obviously a big cost, around £25m, so the massive EBITDA figures come down to earth a bit at the PBT level, but are still superb, and this is a high margin business, making a superb PBT margin of 23% using the pre-exceptional numbers. In other words, right now, bowling sites are generating fantastic returns for investors, so I would expect more of them to be built, probably diluting returns long-term.

Balance sheet - is excellent. Big lease entries, with a deficit, suggest there must be some under-performing sites. Pots of cash, at £56.1m

Negligible inventories or receivables, so this is a very attractive business model which could easily operate with negative working capital - making it attractive to a bidder I would say, that could then leverage it up. Although higher interest rates don't help for that type of deal. With its fragmented shareholder base, I could see BOWL being an attractive takeover bid target, maybe from overseas or private equity, so it would be nice to hold this if a premium-priced bid came in - speculative upside there?

Cashflow statement - amazingly cash generative, which is comfortably funding expansion capex of new sites. Lots of capacity to pay…

Dividends - interim 3.0p, final 8.53p, and a special of 3.0p gives shareholders a total yield of 14.53p = 6.2% - very attractive. Moreover, the big net cash pile means that BOWL has considerably more dividend paying capacity in my view. Unless trading falls off a cliff that is.

Outlook - all sounds positive, so the bowling boom is continuing it seems -

Strong trading momentum at the start of FY2023 with encouraging pre-bookings for the Christmas period… demonstrating the continued strong demand for high quality, great value leisure experiences that families and friends can enjoy together."..

The strength of our balance sheet, alongside our highly cash generative business model, means we are in an excellent position to pursue our growth strategy, and we see the potential in the future to grow our business to more than 110 centres, through our Hollywood Bowl and Puttstars brands in the UK, and Splitsville in Canada.

Energy costs - nicely hedged, to 9/2024. Solar panels also being fitted.

My opinion - I really like this share, based on the facts & figures we have today. Obviously, with any share, things can change. The main risk is that demand might be enjoying a boom that has a shelf life. Or, it might be that investment in nice sites & new products/services might have caused a step change in the attractiveness of bowling to groups of families/friends, as an affordable and enjoyable leisure activity.

Even if we are at peak earnings, BOWL is opening new sites, so that could well counteract any downturn in demand at existing sites.

With figures this good, I haven’t got any option than to give it a thumbs up again!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.