Good morning, it's just Paul here with you today, with it being Friday.

Today's report is now finished. Have a lovely weekend, let's hope the warm weather continues (with some heavy showers overnight, for the garden!)

It's been great having Roland here this week, covering for Graham's holiday, so many thanks to Roland. Also I saw that Roland did an interview with Paul Hill, which I listened to last night - lots of interesting (mostly mid cap) share ideas. Here it is -

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

As it's quiet for small cap news today, I'll stray into larger territory too (our usual £1bn upper market cap limit already covers about 40% of mid caps anyway) -

Tesco (LON:TSCO)

265p (£19.0bn)

Q1 Trading Statement (13 weeks to 27 May 2023) -

“Strong performance” across the business.

LFL sales up 8.2%, including +9.0% in the UK - roughly matching inflation.

Inflation -

There are encouraging early signs that inflation is starting to ease across the market and we will keep working tirelessly to ensure customers receive the best possible value at Tesco.

Outlook -

We are well-positioned for the months ahead and are reiterating our guidance for the full year."

We expect to be able to deliver a broadly flat level of retail adjusted operating profit in 2023/24 and retail free cash flow within our target range of £1.4bn to £1.8bn. We expect Bank adjusted operating profit of between £130m and £160m.

Paul’s opinion - none really, as I don’t tend to invest in supermarkets. I just thought it would be interesting on a quiet day for news, to see how the sector giant (27% market share) is trading. The market cap of £19.0bn doesn’t make it too big to receive a takeover bid from abroad. Competitors Morrisons and ASDA are both saddled with excessive debt, or at least their owners are, following leveraged buyouts, which might indirectly help Tesco maybe? Tescos share price is back to where it was 20 years ago, with the main attraction being dividends, which are currently 4.2%, and the PER is 11.9x - probably about right.

Mears (LON:MER)

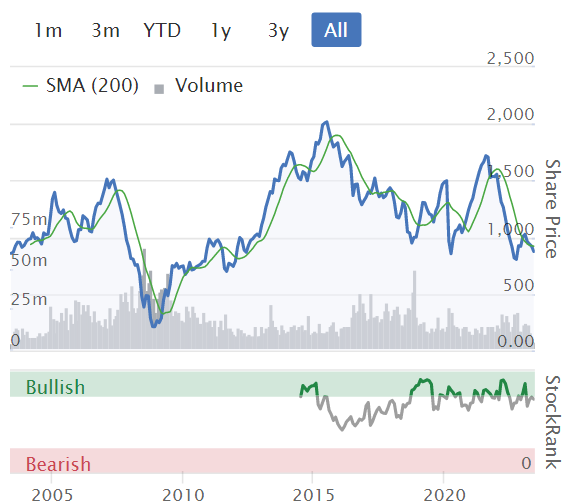

263p (pre market) (£290m) - Trading Update - Paul - GREEN - EDIT: (ended the day up 8%)

Mears (LSE: MER), the leading provider of services to the Housing sector in the UK…

Background - checking my SCVR summary spreadsheet, our most recent comments on Mears have been -

28 April 2023 - Mears - up 6% to 222p (£245m) - Good results from FY 12/2022. In line current trading. Modest valuation & sound finances. Paul likes it. (GREEN)

8 Dec 2022 - Mears - Looks good - positive TU. Cheap. Generous divis. Thumbs up. (GREEN)

So I’m starting out today with a positive view of the company. What’s the latest?

Trading Update

Continued strong momentum

It’s good news! -

...is pleased to report that the Group has experienced strong trading in the first five months of its financial year, with continued elevated revenues, improving operating margins and excellent cash performance. As a result of this continued strong momentum, the Board expects full year profits to be materially ahead of current market expectations.

Materially ahead usually means about 10%+ ahead. Why can’t they publish profit guidance (in a range if necessary)? Plenty of other companies do, and that’s best practice. Start the year with a wide range, then gradually adjust, and narrow the range as the year progresses.

Particularly as in this case, I can’t find any broker notes on Research Tree.

So I’ll have to guess instead.

Here’s the wonderful little graph from the StockReport, showing the trend of broker consensus EPS forecasts - as you can see, the FY 12/2023 (darker line) was raised from 20.9p to 23.39p in May 2023.

So if they’re now saying “materially ahead”, then that suggests to me something like 26p is now on the cards. That’s a big increase, and very impressive.

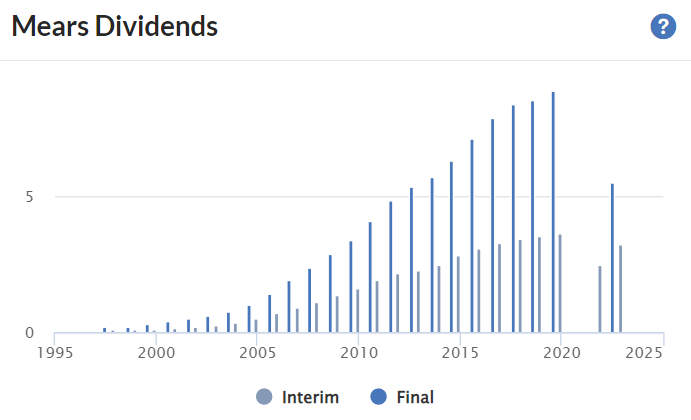

Valuation - this sector tends not to command high valuations, but I think a PER of at least 12x is fair. That suggests 312p share price target is reasonable. The current price is 263p, which says to me there could be a fairly easy 19% upside on this share. Plus 4.2% divis whilst you wait.

I’ve also commented before how I like the balance sheet at Mears, and have no concerns over dilution or solvency.

Paul’s opinion - this looks very good! So a continued thumbs up. Despite the share price having performed well recently, it seems to me there could be further upside. Although in this nervous market, we often see people banking gains.

I would have liked some explanation on what is driving the big increase in earnings expectations for FY 12/2023, from c.20p a while ago, to around 26p now? Are those factors one-offs, or sustainable?

At this modest valuation though, I’d say it looks well worth doing some more detailed research on Mears, so a thumbs up from me, on a quick review.

An uninspiring long-term track record, although the total return (adding divis) would be a lot better.

.

CT Automotive (LON:CTA)

Up 16% to 40.5p (£30m) - FY 12/2022 Results - Paul - GREEN

CT Automotive, a leading designer, developer and supplier of interior components to the global automotive industry, today announces its results for the year ended 31 December 2022 ("FY22").

CT Automotive is engaged in the design, development and manufacture of bespoke automotive interior finishes (for example dashboard panels and fascia finishes) and kinematic assemblies (for example air registers, arm rests, deployable cup holders and storage systems), as well as their associated tooling, for the world's leading automotive original equipment suppliers ("OEMs") and global Tier One manufacturers.

The Group is headquartered in the UK with a low-cost manufacturing footprint. Key production facilities are located in Shenzhen and Ganzhou, China complemented by additional manufacturing facilities in Mexico, Turkey and the Czech Republic.

CT Automotive's operating model enables it to pursue a price leadership strategy, supplying high quality parts to customers at a lower overall landed cost than competitors.

This was a disastrous float in Dec 2021, which developed serious problems shortly afterwards, due mainly to car production being so disrupted by the global shortage of semiconductors. Previously nicely profitable, it lurched into heavy losses, and had to do a placing recently at 34p, to keep the lights on.

For background, my last notes on this (28 April 2023) commented - CT Automotive - 43p (£22m) - disastrous float. Now loss-making. Does a discounted placing. But possible recovery from carmakers on-shoring? Paul's keeping an eye on it.

The fundraise in April was at 34p.

There’s a strong bounce today, so let’s see what’s going on! I’m more interested in the outlook, than the historic numbers, as it’s outlook that will drive any recovery!

Audited Results for the year ended 31 December 2022

Encouraging trading in 2023 - well positioned as operating conditions stabilise

Current trading -

Trading in FY23 to date has been encouraging as market conditions have improved, with increasing stability and visibility from customers. Meanwhile, our roadmap to drive further efficiencies in the business is on track. While macroeconomic uncertainty remains, the Board remains confident of achieving its expectations for FY23 and delivering significant growth in the medium-term."

Outlook - in more detail, some very interesting comments here -

The report referenced from KPMG is very interesting, here’s an excerpt re the likely coming surplus of semiconductors -

Profit margins - this is the most important sentence in the outlook comments, so let’s circle back to it -

Efficiency initiatives have started to come on stream and are delivering run rate pre tax profit margin of approximately 7.6 per cent, in line with plan

I can’t find any broker notes, but Stockopedia shows consensus revenue forecast for FY 12/2023 of $130m. So a 7.6% PBT margin implies profit of $9.9m, or £7.7m.

If achieved, that would be a strong recovery from the heavy losses in 2022, and would make the £30m market cap look much too low.

This is starting to look interesting!

Turning £7.7m profit into EPS, I would deduct 25% corporation tax, so £5.8m PAT, and divide that by 73.6m shares currently in issue = 7.8p EPS for FY 12/2023. Put that on a PER of say 10-12, and we would be at a theoretical share price of 78-94p - or about double the current price.

Risk - with bank facilities. Although given strong current trading, this risk should be receding, we hope - but it’s still important to consider that this share still looks higher risk, unless & until properly committed bank facilities are secured -

HSBC facilities

The Group uses HSBC post-despatch trade loans and invoice financing facilities as an additional working capital lever. These facilities have been committed for 12 months since the IPO, however starting from January 2023 the facilities are provided on a rolling 3-months basis, and these are expected to be renewed going forward in light of the current trading and the post year end fundraise. As at 31 December 2022 the amounts drawn on the Group's trade loans and invoice finance facilities were $16.7m (FY21: $16.5m) against a total facility of c.$22m. The Directors believe that should the HSBC facilities be withdrawn, alternative funding options would be available to the Group.

Going concern note - very interesting, these are essential reading. It says the group could cope with a downside scenario similar to 2008, and a withdrawal of bank facilities, through taking mitigating actions over working capital.

So maybe it’s not high risk after all?

FY 12/2022 Results -

Look awful as expected, as it was such a badly disrupted year.

Revenue $124.3m

Extremely low gross margin of only 12%

EBITDA negative $(7.1)m, Loss before tax of $(18.8)m. Another year of trading like that, and the company would probably be bust. But it says above that 2023 has returned to profits, so everything hinges on that being correct.

Balance sheet - fixed assets (PPE) seem low at $7.3m, I was expecting to see a more capital-intensive balance sheet.

Working capital: current assets of $59m, current liabilities of $67m (including borrowings of $17m).

Overall, NAV crashed from $27.3m at end 2021, to just $2.6m at end 2022. Note also there have been some accounting errors that have been corrected, which might be why the CFO was changed recently?

Intangible assets of $1.8m, once deducted, bring NTAV down to just under $1m, so negligible asset backing overall.

Although note the post year-end equity raise will have boosted NTAV by $9.1m (after fees), so NTAV should now be about $10m, and on a rising trend if indeed the company is now profitable, as it claims.

Overall then, if the bank renews facilities, the company should be fine.

Paul’s opinion - when previously commenting on this company, it looked a basket case. However, after a recent placing, and what seems to be dramatically improved, and now profitable trading in 2023, I think this is now looking a potentially interesting, and cheap turnaround story.

Still not without risk, but I’ll push the boat out, and go GREEN on this for a recovery, as my sums above suggest it could have c.100% upside from the current 40p share price.

But definitely not one for widows or orphans, and please be sure to DYOR, as this does still look higher (but probably receding) risk.

I also like the angle on the re-shoring trend, and its low cost production model, with the new Mexico facility reducing the reliance on China production.

Views from readers please!

Here's the chart since if floated in late Dec 2021. Note that the share count was 50.9m on floating, but has now gone up to 73.6m after the recent placing, Note that Directors own 32%, and its website shows main country of operation as China! It floated at 147p - admission document is here.

This presentation from management is 8 months old now, but it's still useful as it runs through what went wrong in 2022 -

Peel Hunt (LON:PEEL)

Down 2% to 100p (£123m) - FY 3/2023 Results - Paul - AMBER/GREEN

Graham normally looks at this big name broker/investment bank, with legendary quality research that we cannot get access to.

Checking the archive here -

1 Dec 2022 - poor results in a tough sector, breakeven H1. Bal sht good, Graham says could be approaching value (at 79p)? GREEN

3 Apr 2023 - Down 3% to 103p (£126m) - weak TU - will be a loss for FY 3/2023. Graham is neutral, after recent share price recovery. AMBER

Obviously the macro & markets position has worsened quite a lot over that period too. In particular IPOs in the UK look dead in the water for now, an important source of income for investment banks, and fundraisings generally are depressed at the moment. Small-mid cap fund managers might also be struggling with redemptions, so far from ideal conditions.

However, that’s arguably the time to buy highly cyclical shares like this - when they’re cheap, providing costs have been cut, and the balance sheet remains tough, and that things like lease liabilities are not too onerous.

Key numbers for FY 3/2023 -

Revenues down 37% to £82.3m

Swung to a small loss of £(1.5)m before tax, vs a £41.2m (not a typo!) profit LY (last year).

Outlook - green shoots of recovery? Maybe just a bud?!

Whilst the macro-economic backdrop may remain challenging for some time, we have seen a gradual improvement in our M&A pipeline since the start of FY24, with UK mid-cap valuations remaining attractive, and are seeing tentative signs of a pick-up in capital markets activity. We will continue to progress our strategic priorities whilst prudently managing the business through this period of downturn. As consolidation amongst UK-focused investment banking and financial advisory businesses accelerates, we remain confident that our consistent model of delivering a joined-up and agile service, providing our clients with trusted and impartial advice, will position us well to take advantage of opportunities that may arise.

Balance sheet - profitability doesn’t really matter too much at this stage, as it’s at a cyclical low probably, and should come back in a recovery, in due course. It’s the financial strength that matters most now, to determine how financially sound Peel Hunt is, whilst you wait for a trading recovery.

The good news is that the middle section of the balance sheet (working capital) looks really healthy, with a net current assets position of £101m. What does this number mean? If you imagine the business ceased trading, and just wound down all its working capital, then there would be £101m in cash at the end of that process, which would only take a few months, under a year anyway (simplified, obviously in reality there would be shut down costs).

This £101m net working capital supports most of the £123m market cap, so there’s strong asset backing here.

Also, very small losses on the P&L won’t make a significant dent in the asset backing. Whereas if it was say, losing £20m+ each year, then that would result in the same amount reducing working capital, as the debit (losses) on the P&L is has to be matched by a credit (reduced net assets) on the balance sheet, in order for the double-entry bookkeeping to balance.

I should add that there’s a £15m loan in long-term creditors, so arguably we should deduct that from the £101m net working capital, to give a truer net working capital position of £86m.

In other words, the business itself is really only being valued at £123m mkt cap, less £86m working capital, so about £37m - which seems cheap given the scale of profits that might be made in future, when markets are back to normal.

Paul’s opinion - I think this is cheap enough to be AMBER/GREEN - in other worse, not trading well at present, but with significant upside longer-term. The shareholder register looks very fragmented - so I imagine lots are probably owned by employees and/or ex-employees?

The sector needs consolidation, so maybe PEEL could pick up some also-rans if they get into financial trouble?

Another corked bottle from 2021's vintage IPOs -

Travis Perkins (LON:TPK)

Down 6% to 818p (£1.73bn) - Trading Update - Paul - AMBER

I’ve never looked at this building products distributor, other than to mention that it span off Wickes (LON:WIX) (in the news today!).

Today, TPK says -

In light of ongoing challenging market conditions, full year adjusted operating profit now expected to be around £240m. The Group delivered a resilient performance in the first quarter but has not seen the anticipated easing of market conditions in the second quarter to date.

New build & domestic RMI markets - impacted by higher interest rates, inflation, and weaker consumer confidence.

Other markets (commercial, industrial, infrastructure & public sector housing) - more resilient.

Paul’s opinion - unfortunately, TPK does not explain how its latest guidance of £240m compares with previous guidance. On doing some rummaging, I can see that its update on 25 April 2023 contained a footnote, saying guidance was for £272m adj operating profit. So today is a 12% downgrade in this performance measure.

Last year’s adj operating profit was £295m.

The trouble is, adj operating profit is not a good measure of profits, because finance costs came to £49m last year, which takes away quite a chunk of operating profit. Hence adj PBT would be down more than 12%.

Clearly this is a disappointment, and I’m surprised the share price is only down 6% today.

Long-term, this share has gone sideways for 20 years, so the only reason to hold it long-term has been for the divis, and also it might be a share for traders to buy the dips, and sell the rallies?

At some point, the building products sector could be a nice place to invest for a recovery.

I don’t have any strong view on TPK, on an initial, quick review, so I’ll be neutral. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.