Good morning!

Obviously the political situation is taking centre stage at the moment. This has been such a long-running saga, that the stock market seems to have priced-in political uncertainty.

How do I see politics affecting the stock market? The chance of a Corbyn Government (a far bigger risk to company earnings than Brexit, in my opinion) still seems very remote, thanks to the fixed term rules. So a Government apparently no longer has to call a general election, even if it loses a no confidence vote.

Nobody seems to like Mrs May's deal. So what happens next? She seems to have an extraordinary ability to stagger on, regardless of anything that's thrown at her. That would be a great plus, if she were actually competent. Having an incompetent, but extraordinarily stubborn & tenacious PM, is surely the worst of both worlds.

Conspiracy theories, suggesting that we're being manipulated into abandoning Brexit, are looking more credible by the day.

The way I look at it, is that chaos is the new normal. We just have to live with it, and share prices have already discounted the uncertainty.

Trakm8 Holdings (LON:TRAK)

Share price: 22.5p (down 65% today, at 13:45)

No. shares: 36.0m

Market cap: £8.1m

Half year results & trading update

Trakm8 is a UK based technology leader in fleet management, insurance telematics, connected car, and optimisation.

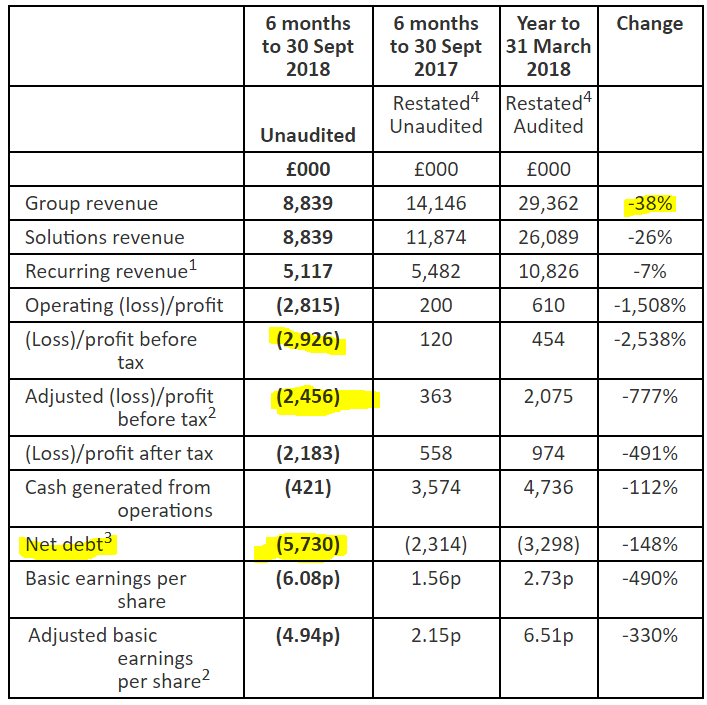

Awful results today, have clobbered the share price. Bad luck to shareholders here.

H1 was heavily loss-making, and I think the big issue is now whether the company can survive, given that debt has risen sharply?

I've highlighted the items below which concern me the most;

Various reasons are given for the poor performance - see RNS if you're interested.

Outlook - the dreaded H2 weighting strikes again;

Since the Group's trading update announced in September 2018 it has become clear that the improved H2 financial performance, driven by continued growth in the telematics business, will not materialise as the Group anticipated.

Continuing delays in decisions by customers is preventing the return to the usual levels of success in Fleet and Optimisation, a move to a rental model in the automotive space, and the loss, due to sanctions, of a multi-million-pound contract for the supply of Insurance solutions into Iran, has meant that revenue for the current financial year is now expected to be 20-25% below the FY2018 outcome, and 10-15% below on a like-for-like basis.

The directors expect that while the current year will be loss making, the market for Trakm8's solutions will be robust in the longer term and that the Group's strategy will drive Trakm8's future operational and financial performance; evidenced by contract wins from LexisNexis and an initial two year agreement to supply EE, part of the BT Group, with telematics based services, using its Connectedcare product.

The trouble is, given that the company has previously been over-optimistic in its commentary, that I doubt whether these current assurances will be given much weight by potential investors. It does however give some hope for existing investors to cling onto, should they wish to.

It's a common flaw in many investors, to disregard poor performance, and instead switch to blind faith that things will get better. I've learned the hard way, over the last 20 years, that this is not usually a good position to take. It's usually much better to just ditch any share, if the fundamentals are deteriorating, which is exactly what I did with my TRAK shares, selling in autumn 2016, when performance began to deteriorate.

EDIT: Checking our archive here, I seemed to have briefly bought back into TRAK in autumn 2017, although I can't remember doing that.

Balance sheet - I'm always wary of loss-making companies which have debt. The risk is that banks can withdraw debt facilities, which can result in either a discounted fundraising, or insolvency. The following caught my eye;

- TRAK has £6.5m in long-term borrowings, so investors would definitely need to check out the terms of that debt.

- Recievables of £6.7m looks high, given that H1 revenues were £8.8m.

- NAV is £19.4m, less £20.3m intangibles, gives NTAV of negative -£0.9m - not good, but not disastrous either.

- Development spend of £1.7m was capitalised in H1. Although note that the company receives substantial R&D tax credits. The cashflow notes show that £969k was received in tax, which is clearly good.

- I think there's a heightened risk that the company may need to do an equity fundraising, hence significant dilution could be on the cards for shareholders.

My opinion - based on performance to date, it's become clear that this really isn't a very good business. There seems little visibility, and management assurances are consistently over-optimistic.

In particular, revisiting the trading update here on 12 Sep 2018 , it strikes me as highly misleading in tone, compared with today's awful H1 results. For that reason, I consider this share uninvestable. It's not the first time that management at TRAK has tried to pull the wool over investor eyes - remember the misstated net cash figure in the commentary a couple of years ago? I gave them the benefit of the doubt at the time, but am more sceptical now.

If I wanted to invest in a telematics company, then Quartix Holdings (LON:QTX) (I have no position) is vastly superior to TRAK. It generates pots of cashflow, and pays a 4.8% dividend yield. Whereas TRAK looks financial precarious, and continually disappoints.

Personally I wouldn't touch TRAK unless it sorts out its balance sheet debt, and returns to profitability. Although, having seen the company disappoint so badly to date, it's probably not something I'd want to revisit at all. There just doesn't seem to be any proper visibility, the overheads are too high, management lack credibility now, and the insurance business is rubbish - young drivers want to rip out telematics devices after one years' forced use - nobody wants a spy in the car monitoring how you're driving - that completely removes the enjoyment from driving.

How about this for a 5-year chart;

Eagle Eye Solutions (LON:EYE)

Share price: 128.5p (up 3.6% today, at market close)

No. shares: 25.4m

Market cap: £32.6m

This is an IT company, providing digital vouchers for supermarkets & other retailers to communicate offers to customers.

It's vaguely on my radar, because I like the potential for the business model, and it already has some impressive, big brand clients. Customer churn is low - a key measure for any IT company.

Although I have a concern that EYE does not seem to have adequate cash resources, whilst still loss-making. There is a bank facility, but loss-making companies should not be funding themselves using bank debt.

Today's update sounds generally upbeat, but the conclusion is that it's in line with expectations;

The challenge we have set ourselves this year of running the business 'Better, Simpler, Cheaper' is now well under way and the initial impact of these initiatives, supported by the growth in revenue, have meant that the Group's adjusted EBITDA loss has materially reduced compared to Q1 FY2018.

We remain on track for our move to EBITDA profitability, in line with management expectations.

Expanded markets - it's moving into the fast food sector.

Outlook - upbeat;

The growth in revenues and volumes is expected to continue into Q2 FY2019, from the annualisation of Tier 1 contracts, the impact of new wins and the strong growth of the issuance network in the first quarter.

With our recurring revenue remaining high, at 72% of Group revenue, very low levels of customer churn and an expanding addressable market opportunity, the Board looks to the remainder of the year and beyond with confidence."

My opinion - this company looks potentially interesting.

Most small caps have reduced in price quite a lot in the last few months, and this is no exception. The market cap isn't low enough to tempt me in, but it's getting into more interesting territory, where I could be tempted if the price continues drifting down.

I have to leave it there for today.

Wishing all readers a pleasant weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.