Good morning, it's just Paul here today. It's usually quiet for news on Fridays, so I'm planning on looking back at the carnage in the retailing sector yesterday.

Today's report is now finished. Lots of terrific reader comments this week, which is great to see, many thanks to all contributors.

Agenda -

Paul's thoughts on the current macro/markets.

Retailers that reported yesterday -

Boohoo (LON:BOO) (I hold) - an in line trading update was punished as if it had been a profit warning. Obviously ignore me, as I've been wrong on this share to date. However, there are lots of things being done behind the scenes to improve future performance. Now the last pandemic lockdown boosted prior year comparatives have washed through, we'll begin to see comparable performance on a like-for-like basis (i.e. against softer comps). This could result in a return to structural growth. Or it might not, we'll have to wait and see. I think the share price has overshot on the downside, whilst accepting fully that fundamentals have deteriorated considerably due to a variety of sector headwinds.

Halfords (LON:HFD) - strong results for FY 3/2022, but as I would expect, it's more cautious for FY 3/2023. The 27% share price fall yesterday seems excessive to me, given that we all know that consumer sentiment is softening. Could be a buying opportunity, for longer term investors. Balance sheet looks OK, but I'd prefer to see the company conserving cash going into a possible recession, rather than paying out generous divis & doing heavy capex.

ASOS (LON:ASC) - Profit guidance for FY 8/2022 is now only £20-60m. On £4bn revenues, that's effectively breakeven. Gross margin only 44% in Q3. Not good at all, but that's reflected in a dramatically lower market cap than when it was a growth darling. Some hefty Director buying today though.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

General thoughts

As always, this is just me thinking out loud, and starting a discussion. I certainly don't think that I'm some great source of wisdom, as one particularly barbed reader comment claimed a while back!

The macro bad news is getting considerably worse, seemingly every day, as we all know. I must apologise for not realising how serious the market falls would be. It’s certainly caught me out, at least the severity of market falls anyway.

We knew all these negative factors were coming, and they were in full view - central banks tightening, QE ending (even partially reversing possibly), higher inflation, continuing supply chain disruption, etc. It’s just that markets have previously taken all this stuff in their stride, so investors generally (including me) seemed to assume it would be the same this time. Maybe we were overconfident from all the profits made in late 2020 to mid-2021?

Anyway, speaking personally, I was far too complacent, in deciding to ride out any temporary downturn, which with hindsight was clearly a terrible decision. However, I can’t change what’s in the past, and have to deal with reality as it is now - i.e. a considerably smaller portfolio, and the anguish that comes with it, which I'm sure most readers will also be suffering from. It's horrible, but losses are part of this process unfortunately.

My view is that it’s probably too late to sell, and I’ll miss a recovery - shares often bottom out and start recovering before the bad news has ended.

Also, shares are the longest term investments - with no expiry date - so we’re meant to be long-term owners of businesses, not speculators on short term prices. Markets are more like a giant casino these days though, which does tend to exaggerate moves both up and down.

I’ve made a few adjustments to my long-term portfolio (SIPP) - I got cold feet about Joules (LON:JOUL) (I hold) because on a daily basis I get emails from them, offering 30-50% off. Also the last trading update made it clear the company is over-stocked, and is being run for cash, to (hopefully) avoid having to do another placing. It’s proven hopeless at managing supply chain problems, and the CEO is leaving. It's the lack of pricing power that worries me most - if it can't get full price for existing stock, then it won't be able to raise prices to cope with higher cost inflation. On the plus side, the freehold HQ could be refinanced, which might enable it to avoid a placing. Anyway, adding in a much tougher consumer backdrop, and I decided it was too early to have a big position in JOUL, so have reduced it to a small position. My intention being to buy back in greater size once there’s some evidence of a turnaround - difficult to imagine in the current environment.

Apart from that, B2B shares are holding up better than B2C, so I’m happy with big positions in Beeks Financial Cloud (LON:BKS) and Cambridge Cognition Holdings (LON:COG) . Anything like that, which has a strong tailwind, due to offering a service that’s in high demand from companies which are not affected by consumers reining in household spending, looks solid in these difficult times.

Apart from that, the market is also throwing up some amazing bargains right now, for value investors. In a couple of years’ time, it’s easy to imagine plenty of shares in our universe here being double or triple the current price.

We went through a similar thing in 2020, when the markets crashed because of covid. Panic selling & buying back later only works if you sell early, and buy back early. How many people can get the timing right, repeatedly? Not many, I reckon.

Also, people only like to brag about the successes on social media, and go silent when things are going badly. Silent, or lashing out at others, through frustration at losses. That’s unsurprising, because it’s painful seeing our portfolios shrinking. My SIPP is now down 35% year to date, and down about 43% from its all-time high. That hurts for sure, but I don’t have any plans to withdraw any money for the foreseeable future, so it doesn’t actually matter that much. It’ll come back up again, providing I’m invested in fundamentally sound companies, which is what I keep reminding myself.

If you’re a trader (which lots of people are, without even realising it), then good luck with ducking in & out of things. That’s not who these reports are aimed at, we’re just trying to assess company fundamentals here, and then it’s up to readers to decide what & when to buy or sell, as it’s your money - hence your choice.

FWIW, my current view has obviously become more bearish in the short term, because the macro stuff has got a lot worse. What looked like a short blip with higher inflation (similar to what we had after sterling plunged in 2016, which the market shook off), now looks like much more entrenched inflation. The Bank of England are now saying inflation is likely to peak at 11%. If energy costs fall back again (which they often do after big spikes), then inflation could gradually reduce. Although the evidence is that further big price rises for food in particular are in the pipeline, due to higher fertiliser costs, and other disruption as a result of Russia’s invasion of Ukraine. Lots of unknown factors.

The problem with inflation is that, once it’s embedded in the minds of workers & companies, it becomes a self-reinforcing cycle. We’re already seeing ominous echoes of the 1970s, with higher energy costs, and industrial action resuming. It’s difficult to blame people for wanting a 9% pay rise, since that only allows them to stand still in disposable income. The trouble is, few employers can absorb a 9% pay rise for staff, which means profits fall, a lot once operational gearing is taken into account. It's lovely on the way up, but brutal on the way down.

As we’ve discussed here before (writers & reader comments), pricing power is key for company profits. So I’m scrutinising trading updates to see what is said about this. Most companies are using the word “mitigating”, which obviously only means partial recovery of higher costs.

Also, as we’ve been discussing, many broker forecasts now look far too high, so we’re likely to see a deluge of profit warnings, as expectations are reset to factor in what looks like a much higher probability of a recession. With operational gearing, many companies profits could be badly hit, by even a relatively small drop in revenues. That’s why share prices have fallen so much in cyclical sectors. It frustrates me that they then fall again, when entirely predictable bad news comes out, but that’s what is happening.

On the upside, we’ve seen some spectacular rebounds from shares which oversold to irrationally low levels. Although often these big spikes up don’t seem to hold, and people sell into the rallies - not a good sign. Hence maybe it’s best to lighten the load on big rallies, rather than buying for breakouts which probably won’t last?

Takeover bids is another area where I think we could see a lot of activity. US investors in particular seem to be keen on buying up cheap UK companies. Also, founders who have deep pockets are probably wondering why they bother with a stock market listing - I can’t see Boohoo (LON:BOO) (I hold) remaining listed, if the share price stays this low. It’s a lot of hassle & cost being listed, and if there’s no benefit, then companies might decide to go private instead.

Summarising then, my current view is that we’re in a phase where earnings expectations need to come down a lot. The market has already priced-in this point for many small caps, but we then see further lurches down when companies warn on profits against estimates that pre-date the current batch of much worse macro figures. So please, come on brokers, slash those forecasts, and let’s have realistic numbers for companies to report against. It’s much better to dial the forecasts down, and then put out an in line with expectations update, than cling on to overly optimistic forecasts and then issue a profit warning - which often do lasting damage to investor sentiment.

What to do next? Well, personally I don’t see the point in selling now. I think everything I’m invested in are fundamentally good companies, and my focus on strong balance sheets mean that there shouldn’t be any solvency issues with my larger positions. That’s absolutely vital now that economic clouds are overhead, and interest rates set to rise considerably from the still ludicrously low current level. Banks turn tougher when interest rates rise, because problem accounts are accruing more interest charges, so the problems get bigger with each passing day. Hence giving a delinquent borrower plenty of time to trade their way out of trouble may not work any more. That means banks are now far more likely to pull the plug, than be relaxed. That’s a key point if you punt on companies that have highly indebted balance sheets. Such companies might need a big, highly dilutive placing, and we’ll be the last to know about it. Or worst case, could be placed into administration. I’ll keep my eyes peeled for that kind of situation, and warn you when I see danger - a key point of these reports. We can’t predict which shares will rise or fall, but we can warn you about company risks, and avoiding potential insolvencies - there are nearly always obvious telltale signs. Although Patisserie Valerie is one example of where a seemingly good business turned out to be publishing false accounts. That one was almost impossible to spot.

Good luck, whatever you decide to do with your own money. I know lots of people in cash at the moment, at least partially, and they’ve been very much right. However, at some point that cash has to do something, because it’s currently losing about 1% per month in purchasing power. So a stock market rally could happen, and be quite rapid, when cash comes back into the market. That catalyst for that? I reckon central banks might stop tightening, once they realise they’ve pushed major economies into recession, and inflation peaked. No idea when that might be. Hopefully some resolution of the terrible war would help (hopefully a coup to consign the evil Putin to the history books - although with such a rotten regime, his replacement could be similar or even worse?)

Lots to ponder, and tough times likely to persist for some time, I imagine. However, as I saw in 2000-2, 2007-9, and again with covid in 2020-2021, these major sell-offs lay the groundwork for fabulous bull markets afterwards, where bombed out valuations turn into big multibaggers in some cases. It’s important to remember that during the downturns, so that we don’t make bad decisions fuelled by panic & fear, then miss out on the big subsequent gains.

.

Re-mortgaging

My mind keeps wandering back to this. I might have mentioned it before, but looking at last weekend’s papers, I was staggered at how low the 5-year fixed rate mortgages are still, at just 3% annual interest rate. This makes no sense to me at all, with inflation at something like 8-9%, and set to rise to 11%. To be able to refinance your mortgage at just 3%, and have that rate locked in for 5 years looks a stunning deal, for both low cost, and peace of mind.

Therefore, it seems to me that any readers with a mortgage and no redemption penalty, could bag a remarkable deal, if you move fast (such insanely good deals are rapidly being pulled). Obviously no advice intended, I'm just flagging up a potential opportunity.

A few years of higher inflation could effectively scrub off maybe 20% of your mortgage, in real terms. In the past, that would have meant punishing interest rates of something like 9-12%. So to be able to borrow now at 3%, fixed for 5 years, despite inflation about to hit double digits seems to me a stunning proposition - worth grabbing quickly before it’s gone, after taking professional advice.

.

Retailers reporting yesterday

Boohoo (LON:BOO) (I hold)

60p

Market cap £763m

I never imagined BOO would come back (roughly) into our market cap range for small caps again. Again, profuse apologies for getting this one wrong (so far anyway). Collectively we must have lost many millions on it, which is awful - it upsets me to think about it, as we're all here to try to help each other make money, not lose it.

Let’s recap on why this share has performed so badly? Firstly, it’s a sector move, not specific to BOO.

This chart below shows the 5-year performance of Boohoo, Asos, Gear4Music (not fashion, but an etailer), and US based FarFetch. As you can see, Boohoo and Farfetch out-performed in the middle to right side of the 5 year period, but more recently have plummeted, down to pretty much the same end point for all of them - Boohoo down 72%, Asos worse still at down 85%, G4M down 77%, and FarFetch down 77%.

BOO's fall from grace has happened for a variety of reasons -

- the entire sector (online fashion) facing headwinds - mainly supply chain-related cost inflation, and increased competition (esp. China’s Shein), plus now a more general consumer downturn)

- A consequent de-rating, and a collapse in investor sentiment, as sexy growth shares were reassessed as struggling to find further growth, and profit squeezed hard.

- The pandemic pulled forward a lot of demand, which created a boom in 2020 (and re-rating up of the shares), but created very tough comparatives, which companies in the sector are now struggling to match, let alone beat. Have they gone ex-growth, or are we about to see a more normal, structural level of growth return, now that the pandemic effect is disappearing from the prior year comps (from round about now actually, as the last lockdown finished c.May 2021)?

- Widely publicised (putting it mildly) ESG issues for the whole sector seemed to be focused by the press entirely on Boohoo, forcing it to make expensive changes. This had no impact on demand though, with sales booming at the height of the press outrage. Although this issue will have no doubt put off ESG-focused funds from buying or holding BOO shares.

I dispute that we had group-think on BOO. We made perfectly rational decisions to buy a reasonably-priced growth stock, based on the facts at the time. The facts have since changed - an unbroken track record of strong profit growth went sharply into reverse. In hindsight, I think management were too slow to ‘fess up to the issues, which does undermine my confidence in their outlook comments somewhat - a discount needs to be applied to their bullishness! Also there’s no denying that I was slow to wake up to the extent of the problems - I wrongly thought that they wouldn’t suffer too much from supply chain issues. So definitely lessons to be learned there.

I take on board the point about the relentless share price decline too. With mid to larger caps, there are bound to be hedge funds analysing data that we can’t see, and opening short positions. So I’m wondering if it might be better to follow the chart more closely for online retailers?

Fundamentally, and looking long-term, is the business broken? Definitely not, in my opinion.

To save me re-typing everything, he’s what I wrote in the comments section below earlier this morning in reply to a reader request for my current view, sorry for some duplication of the above -

Hi Shrubby,

Boohoo (LON:BOO) has always been a long-term position for me. Obviously the fundamentals have deteriorated badly in the last year, but that's due to clearly identified problems - higher costs of inbound freight, which is impacting everyone in the sector, but should reduce in time. Also, BOO in particular relied on cheap air freight, for distributing all its product worldwide out of the UK. As air freight is now expensive, it's been a big hit to them, and delivery times in the US in particular are recognised to be unacceptably slow at 7-10 days, which is no good for fast fashion, people want something to wear for the weekend. That's why in the UK BOO is still trading alright.

They're fixing things, but it takes time. A new US distribution centre in Pennsylvania is opening soon, but they're saying mid-2023 to be fully up to speed, expect upside on the timings, they indicated in recent webinar that the timing guidance is deliberately cautious, as a big distribution centre takes time to build up. That should be transformative for the US side of the business, as it will allow next day delivery across most of the US - making BOO far more competitive than the key rival, Shein.

Interestingly, in a webinar, the CFO said that there would be no cost savings from using a US distribution centre, as higher import duties would offset reduced freight charges. However, the big benefits are handling returns more efficiently, and crucially restoring competitiveness with rapid delivery times - very much what customers want, it’s called fast fashion for a reason!

Other improvements being made include automating the 4 UK distribution centres, which is expected to reduce labour costs by £25m p.a., and will be another competitive advantage over smaller rivals.

The most recent update was in line, not a profit warning.

Investors are I think spooked by sales going into decline, but Q1 was expected to be soft (previous guidance mentioned this), since the comparative is very strong (the last lockdown, when physical stores competition were closed). The pandemic effect has now washed through, and comps are now softer, so we should see growth resume.

Remember that the 2-3 year growth on pre-pandemic, is huge. It's just that the growth was front-loaded into 2020, so the performance since then has looked lacklustre because 2020 was so strong. That's all through the system now, and hopefully we should see a return of more normal, structural growth. If so, then this could re-rate the share upwards very significantly, from such a low level.

The downside scenario is that there's more competition now, and Shein in particular, might be eating Boohoo's lunch. Only time will tell. Mgt sound confident, but they've been over-confident in the past.

Other positives include an increase in wholesaling, which is a nicer, lower risk, less hassle sales route (the buyer has to cope with customer returns, etc).

Customer returns have always been the bane of life for eCommerce fashion businesses, and that needs a tighter grip.

Note that the new brands absorb cash when they’re acquired, and heavy marketing spend is required. However, they then begin to contribute to profit after a while. Note that this caused marketing spend rose from 9.1% to 11.1% of revenues last year. This is expected to fall back again “in the medium term”, which provides a good tailwind for profitability.

I would suggest people watch the detailed webinars from BOO management, on BRR Media. These show a business & management that are on the front foot, and growing the business for the long-term. Whereas the stock market seems to view the group as a disaster area, which it’s not. As Mahmud Kamani, the joint founder says, "We're dealing with it" - i.e. they know what all the problems are, and they're being sorted out, but it takes time.

My opinion - well probably best to ignore me, as I've been a perma-bull on this share, whilst the share price has collapsed.

However, my stance has always been (as stated previously) on the long-term fundamentals of the business, and I think this remains very positive. At 50-60p range currently, I think this could be a historic buying opportunity. Sentiment could change very rapidly, once it returns to revenue growth, and the costs of lower in & outbound freight come through. Hence why I think it's possibly a future multibagger. But that obviously depends on future performance.

In the meantime, I hope mgt don't take it private, but that must be under discussion with the market cap now so low.

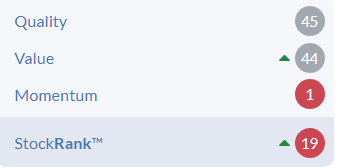

Stockopedia drenches me with a bucket of its unemotional iced water, the StockRank being a dismal 19.

.

.

Halfords (LON:HFD)

145p (down heavily yesterday)

Market cap £318m

Halfords Group plc (“Halfords” or the “Group”), the UK’s leading provider of Motoring and Cycling products and services, today announces its Preliminary results for the 52 weeks to 1 April 2022

HFD has had another barn-storming year -

Underlying Profit Before Tax of £89.8m, +£32.9m (+57.8%) vs. FY20 and -£9.7m (-9.7%) vs FY21.

(note: includes business rates relief of £11m (FY22), £39.1m (FY21) and nil (FY20)).

It’s good to see the benefit of business rates relief spelt out prominently.

Underlying basic EPS is 35.5p - giving a PER of just 4.1, the lowest I can remember seeing for this share. Which is clearly telling us that the market doesn’t currently believe HFD can repeat such high earnings in future years.

Given the share price plunged yesterday, I’m going to focus on the outlook comments and balance sheet mainly.

Outlook - this doesn’t sound too bad to me, given that we should already know that profits are likely to fall in a tougher consumer environment -

FY23 Outlook

Over the last three years, we have built a larger and stronger services business, focused more heavily on motoring. As a result, the Group has a much higher ‘needs-based’ revenue stream, improving our resilience in the current macro-economic climate. However, this transformation journey is not complete and therefore we are not immune to the external challenges, with reduced demand, particularly for more discretionary, higher ticket items, and significant cost inflation impacting our financial performance.

Forecasting FY23 with any degree of certainty this early in the year is particularly challenging. Based on what we see today, we expect FY23 underlying PBT to be within the range of £65m to £75m, but we acknowledge the uncertainty that this year is likely to bring.

Whilst the macro-environment presents a challenging short-term outlook for many businesses, it reaffirms our longer-term strategy. This year, we will continue to invest to improve our customer proposition, particularly in a year where overall value will be critical, whilst simultaneously remaining agile in our operations and carefully managing our cost base. We believe we are well-positioned, given our market leadership position in both motoring and cycling, and our strong balance sheet, to emerge from this challenging trading environment in a relatively stronger position.

I’m really puzzled why the share price fell 28% yesterday on this news, which looks perfectly reasonable to me, in more difficult current macro circumstances.

As usual, I can’t find any broker notes for HFD, so will work out the figures myself.

FY 3/2023 guidance is £65-75m u/l PBT. I’m going to take the low figure of £65m given macro uncertainty. Less 25% Corp Tax, becomes Profit After Tax (PAT) of £49m. Divide that by 218.9m shares in issue = 22.3p forecast EPS. That’s down 37% on FY 3/2022, which sounds sensible in the current gloomier climate.

If my numbers are right, then this gives a valuation of 145p share price, divided by forecast EPS of 22.3p = PER of 6.5, for the current year, which looks cheap.

Hence it looks as if the current share price is already pricing in another profit warning, and further reduced profit in FY 3/2023, which gives me some comfort. Especially if the downturn in consumer spending doesn’t turn out to be as bad as we currently fear.

Dividends - 3p interim already paid, with a further 6p coming, so 9p for the year, a yield of a very attractive 6.2%.

The intention is to increase divis, but that can quickly go out of the window in a downturn, so I wouldn’t hang my hat on the intention.

Personally, I would have preferred HFD to axe the final divi, to maximise cash, in case there’s a recession. Better to do that, than give the shareholders cash, only to ask for it back when the share price is lower, in a recession.

Balance sheet - planned capex for this year FY 3/2023 of £45-50m seems very high. Plus a further potential £15m for integrating a recent acquisition, which again seems very high. I’m wondering if mgt might regret that capex spending, if the economy nosedives?

NAV is £551m, but I need to adjust out intangible assets of £442.4m. This takes NTAV to £108.6m, which is mainly physical fixed assets (PPE) of £101.7m.

I usually also adjust out the IFRS 16 lease entries, which show a net deficit here of £41m.

That takes my adjusted NTAV figure to £142.7m - which seems adequate to me, given the substantial size of the business.

Cash is £46.3m, and there’s negligible bank debt of £0.2m, so net cash of £46.1m - pretty healthy. In a consumer downturn, I don’t want to see any bank debt on the balance sheets of retailers, preferably, so HFD looks OK.

My opinion - as we know, HFD had a big boost from cycling during the pandemic. That said, the motoring services part of the business is growing through acquisitions.

I reckon a lot of HFD customers' spending is actually discretionary spending, not needs based, to contradict the company’s commentary. So it could suffer a bigger downturn in demand than expected, possibly?

For that reason, we may not have seen the low yet.

That said, a share price which is now down 67% from its 52-week high does mean that a lot of downside risk is already priced in.

The other broader issue is, why are we valuing companies on this year’s earnings alone? It’s likely to be a bad year, but in the future, earnings should rise again. Hence getting shares now on a low multiple, of low earnings, could turn out to be a fantastic long-term buying opportunity, as both those elements increase. Also shares are probably the best long-term hedge against inflation, although it hits profits in the shorter term, as we're seeing.

On balance, I think this share looks quite attractive now, for maybe a small opening position, or to just go on the watch list for things to buy once the macro side of things is looking clearer, if you’re more risk averse.

.

.

ASOS (LON:ASC)

868p (up 11% today at 12:31)

Market cap £867m

Again, it’s astonishing to see this previous £5bn+ market cap giant now back almost into small cap territory.

As mentioned before, Asos has only ever scraped out a tiny profit margin, although that seemed to be improving more recently. For many years, investors valued it very highly due to the rapid sales growth, which inevitably slows after a while. The high valuation has gone out of the window for now anyway. Will it recover? That’s difficult to say, but if you view the long-term chart below, it’s twice recovered from big plunges, plus of course the astonishing initial bull run, which made it one of, or maybe the biggest multibagger ever on the UK market.

It’s still about 100x the price that I sold my 500k Asos shares, deciding they were overvalued… at 9 pence each, a long time ago! Little did I know that my £45k sale would be the worst financial decision of my life, with those same shares worth over £30m a few years later. Oh well! I just laugh about it, as it’s pointless crying over spilt milk - we can’t change anything in the past, so might as well get some mileage out of it in a blog.

.

Asos dropped about 23% on yesterday’s update, but has recovered about half of that fall so far today (at 13:36), which looks encouraging. Quite a few retailers are in today’s top % risers actually, rebounding from being yesterday’s top % fallers list. We don’t know yet if this is just a short-term rebound, or something more permanent?

I see there’s some decent buying today from Asos NEDs and the Chair. Total Dirs buying is 93.4k shares, that’s about £780k invested, a decent vote of support, more than just a PR stunt I’d suggest.

A major US shareholder has also today announced an increase from 7.16% to 8.71%.

It’s certainly helpful to see big Director buying, as I know lots of investor friends are looking for this, as a signal to give them the confidence to dive in too, given haywire market conditions.

Trading Update for Q2

This update is for the company’s Q3, so this is Mar, Apr, May 2022, for its Aug 2022 year end.

Higher returns rate (also mentioned by BOO)

Revised guidance is now barely above breakeven, given anticipated revenues of c.£4bn -

Guidance for the year updated to reflect uncertain consumer purchasing behaviour and the potential continuation of higher returns with revenue growth expected to be 4% to 7% and adjusted PBT now expected to be in the range of £20m to £60m

My opinion - it’s difficult to know what to make of this.

The whole sector is suffering from supply chain problems, and increased cost of in & outbound freight. That should all get sorted out in due course, so this year’s headwind should become a future tailwind. Hence I wouldn’t write off this sector.

However, another headwind is that customer acquisition costs are so much higher now, as Google, Facebook, etc, grab the profits for themselves. Maybe in a downturn, online marketing costs could become cheaper again?

There are so many moving parts, it’s really difficult to even guess what the future holds.

With BOO & Asos now at similar market caps, the choice is whether you want the bigger (double the revenues) company Asos, or the historically much more profitable one, Boohoo. Or neither of course, which seems to be the most popular choice right now!

What keeps me interested in the eCommerce space, is that we are right at the point where pandemic distortions drop out, and growth rates will be comparable to the prior year, for the first time since early 2020. This could go two ways -

Bullish - structural growth continues, with online continuing to take market share from physical stores.

Bearish - eCommerce has gone ex-growth completely.

On balance, the bullish case seems more likely to me. So many people have got used to shopping online, that it seems more of a permanent, structural change, not a flash in the pan. We’ll know quite soon, but with the added distortion of a general consumer downturn.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.