Good morning, it's Paul here with the SCVR for Friday.

Timing - I've got a conference call with management of a company at 14:00, so there might be a gap before I look at the next company here later, Fulham Shore (LON:FUL)

Please note that I did a detailed section on Revolution Bars (LON:RBG) (I hold) late last night, as it took hours to plough through a complicated & very detailed results statement. If you're interested, here is the link to yesterday's full report, including RBG. I might do a shorter summary here later. Or just skip to the "My opinion" part in yesterday's report if you don't want all the detail.

.

Furlough Scheme

It's been announced that this has been extended again, from end Mar 2021, to end Apr 2021. That's helpful for companies/sectors under pressure. Although we saw yesterday, highly critical comments from bosses of Wetherspoons & Rev Bars (I hold) about Govt policy.

Telit Communications (LON:TCM)

Swiss tech company u-blox announces that it's got an extension to the Takeover Panel's put up or shut up [rule 2.6(a)] deadline today. It now has until 18 Jan 2021. Talks are continuing. Sounds like u-blox wants to strike a deal with Telit.

United Carpets (LON:UCG)

(I hold, a very small position)

De-listing & tender offer.

There's no point in tiny companies maintaining a stock market listing, if there's no realistic chance of growing into something more substantial, and nobody is interested in supporting fundraisings. UCG agrees, and announces today that it's de-listing. Usually a disaster, as that can trigger a c.50% instant share price fall. Not in this case, I'm pleased to say. The controlling shareholders are offering to buy out minority shareholders at 6.25p, a c.19% premium.

I'm happy with that, and will take the money rather than holding shares in an unlisted company.

Although on second thoughts, I note that the tender offer is being funded from the company's own cash! Therefore it might make more sense to keep my shares, and hold a bigger proportion of the company, for free, holding out for a better future price, and/or receiving divis in future from when it's a private company. I think management seem ethical, and hopefully would not run the business in a way which is detrimental to minority shareholders. So maybe it's not clear cut after all?

Although very small, UCG is a nice little company, profitable & paying good divis before covid.

Edit: I forgot to say, this is a good tender offer, in that it's big enough to buy out everyone who wants to sell, in full, since there's a concert party which owns most of the company already.

.

Mulberry (LON:MUL)

208p - mkt cap £125m

I last looked at this fashion brand in 2015, but haven’t covered it since, because it looked too expensive. It’s firmly back in small cap territory now, so overdue me running my slide rule over the figures.

Mulberry has been in an offer period, with Mike Ashley’s Frasers (LON:FRAS) being in the running to bid for it. Yesterday, 17 Dec 2020, Frasers pulled out, saying -

Further to the announcement made on 19 November 2020 in relation to a possible offer for Mulberry Group plc ("Mulberry") by Frasers Group, Frasers Group confirms that it does not intend to make an offer under Rule 2.7 of the Code.

Mulberry itself has put out a statement this morning -

… Mulberry is no longer in an offer period in accordance with the Code.

Godfrey Davis, Chairman of Mulberry, commented:

"We continue to make significant progress in building Mulberry as a sustainable global luxury brand, creating value for all our stakeholders. This is focused around our omni-channel network and market leading digital platform; increasing our Asian footprint; and a relentless focus on innovation and sustainability, offering our customers beautiful products, made to last in our Somerset factories."

Let’s have a look at the most recent results, which were issued on 26 Nov 2020

Mulberry Group plc ("the Group" or "Mulberry"), the British luxury brand, announces unaudited results for the twenty-six weeks ended 26 September 2020 (the "period").

Growth in Asian markets and robust digital performance despite challenging international conditions

The financial highlights look sufficiently interesting for me to want to dig deeper. Remember these are half year numbers, so we should roughly double them to annualise (ignoring seasonality) -

· Group revenue down 29% to £48.9m (2019: £68.9m) primarily reflecting impact of COVID-19 and closure of majority of stores from start of period

· Digital sales up 68% to £23.4m (2019: £13.9m)

· Asia Pacific retail sales increased 28%, driven by ongoing investment in region

· Adjusted loss before tax of £1.9m (2019: £10.1m) before adjusting items of £0.5m (2019: £nil) reflecting actions taken in response to COVID-19, strong growth in Asian markets and strength of digital business [Paul: note that Mulberry benefited from £4.5m in Govt support, e.g. furlough scheme, shown within “Other income”]

· Period end Group net cash increased to £8.6m (2019: £6.4m), maintained through rigorous cost and cash control

· Inventory reduced by 13% to £33.6m reflecting the benefit of our agile supply chain and actions taken to manage inventory levels in line with anticipated demand as a result of COVID-19

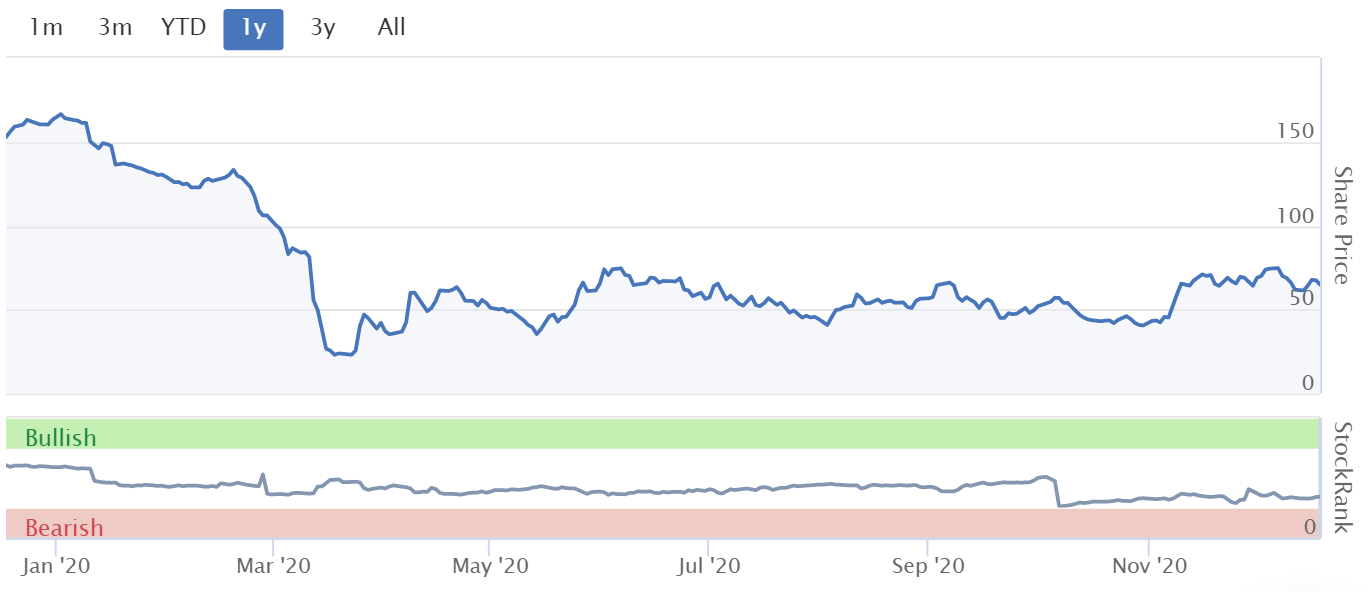

How was it trading before covid? Looking at the Stockopedia graphs below, the answer is: badly. Something was obviously going wrong before covid struck.

.

.

Current trading sounds reasonable - I like the strong digital sales, which is key for most retailers/fashion companies these days.

Also, liquidity looks OK, with a small net cash position & undrawn £15m bank facility (available until Mar 2022)-

.

.

Outlook - none of the following should surprise anyone. As mentioned in the section on Rev Bars (I hold) yesterday, Jan-Mar 2021 seems likely to be a continuing difficult period, with unpredictable lockdowns coming & going, to limit covid cases until enough people have been vaccinated.

Despite the recent positive news about vaccine progress, COVID-19 is likely to continue to impact our trading for at least the remainder of the current financial year.

As previously stated in the Company's announcement of preliminary results for the 52 weeks ended 28 March 2020, released on 5 October 2020, sales are expected to be lower than the period ended 28 March 2020, but the Group expects losses to be reduced[1]. Our expectations will undoubtedly be negatively affected by any further countrywide lock downs or a "second wave" of COVID-19.

We remain confident in the strength of the Mulberry brand and our strategy over the longer term.

Going concern note sounds OK - but they're dependent on the bank facility to provide headroom. It would be essential to check out the bank covenants before buying any Mulberry shares.

The Group has continued to trade significantly ahead of our original base case with a cash position materially ahead of assumptions. As a result, the Directors remain confident that despite the current uncertainties, the Group has the financial resources to take opportunities as they arise and is in a strong financial position.

Balance sheet - as at 26 Sept 2020 - remember this is likely to deteriorate until about April 2021 from continuing trading losses, which erode balance sheets by the equivalent amount of after tax losses -

NAV: £12.2m, less £15.0m intangible asset, and less £1.5m deferred tax asset, gives negative NTAV slightly, of £(4.3)m.

The problem is very similar to RBG (I hold), in that it’s the IFRS 16 lease entries which really screw up the NAV. In this case;

Lease assets: £42.9m

Lease liabilities: £(88.2)m

Net lease liabilities: £(45.3)m

If we delete all the IFRS 16 entries, which I do once I’ve noted them down, then NTAV recovers to a reasonable level, of £41.0m.

Basically, the balance sheet is OK, but the company has a big problem with onerous leases - which is likely to cause multi-year losses, paying rents on uneconomic sites.

On the upside, the company should be able to renegotiate leases, threatening a CVA if landlords don’t play ball, as many others are doing currently.

The commentary suggests not much progress has been made with persuading landlords to reduce rents;

During the period, the Group has agreed one COVID-19 related rent concession which meets the above criteria in the form of a legally binding agreement which provides a temporary change from base to turnover related rent. The reduction in rent has been accounted for as a negative variable lease payment within net operating expenses.

Two other rent concessions were also agreed during the period which do not meet the above criteria, and which have therefore been accounted for as lease modifications under IFRS 16.

Tax-free shopping - the Govt’s plan to scrap this scheme would hit high end London retailers hard, selling luxury goods tax free to wealthy holidaymakers. This is a risk for MUL investors to consider.

My opinion - I think I’ve gone far enough to work out that this share doesn’t interest me on fundamentals. The leases mean that it’s probably going to struggle to become profitable again. Although looking forward to 2021, personally I am bullish on consumer spending once covid is in retreat.

Why is MUL worth £125m then? I suppose the bull case is the value of the brand, and potential upside if it can recapture the glory days of a few years ago, when the share price rocketed on its products suddenly becoming highly fashionable, and selling for very high prices & profit margins.

Therefore, the thing to focus on, is product & fashion trends. That’s what is likely to drive the share price. Big upside if they can become a super cool brand again. Or languishing, struggling to exit problem store leases, and maybe a fundraising, if not.

Clearly Mike Ashley would have snapped it up, if it was a bargain, but he’s walked away, which doesn’t fill me with confidence.

The focus on Asia, and strong online sales, do however make it potentially interesting. I'll put this one on my watchlist as possibly of future interest , if the brand becomes hot again. They love a lot of UK brands in the Far East, so it's not inconceivable that an overseas bidder could crop up at some point.

This chart nicely encapsulates "fashion risk"!

.

.

Restaurant (LON:RTN)

64.7p (down 4%) - mkt cap £381m

I last looked at this restaurant chain (mainly Wagamama, and Frankie & Benny’s) about 6 months ago, when it did a CVA to ditch problem sites.

This is a big plus - generally I only really want to entertain buying shares in multi-site retail/hospitality where a CVA or pre-pack administration has already happened, or is about to happen. That way, you’re buying something clean, with usually all the problem leases either disposed of, or renegotiated, giving a big competitive advantage.

This matters more than ever before, because we’re currently seeing the first ever major, probably permanent, shift in commercial retail leases - rents coming down a lot, monthly (not quarterly) rents now the norm, turnover rent leases becoming mainstream. The likelihood is that a lot of sites become empty as 2021 grinds on. It’s a great time to be expanding, if you have the finance available, and an appealing format, because I hear that some wonderful deals on town/city centre sites are emerging.

Here’s the latest from RTN - I find this first paragraph very confusing;

Through a range of decisive management actions, cash-burn during the November national lockdown was minimised to c. £5.5m for the month. This is £2.0m higher than during the first lockdown due to rents payable under the terms of the Leisure CVA[1] as well as employer contributions towards furlough payments.

Additionally the working capital outflow and increased cash exceptional costs as a consequence of the November lockdown totalled £15m.

Are they saying the cash outflow was £5.5m, or £5.5m+£15m? The word “additionally” suggests the latter, so that means £20.5m cash outflow in November, I assume.

Tier restrictions - no surprises here;

...the Group anticipates further significant disruption on trading whilst these restrictions remain in place. ... if UK tiering allocations were to remain the same as currently in place throughout the first quarter of 2021, this will have a significant adverse impact on the Group, and indeed the wider hospitality sector.

I think it’s probably safe to assume that Jan-Mar 2021 could be very grim - with little revenues, if any, and certainly no profits. A lot of retail/hospitality sector companies are probably better off pulling down the shutters for 3 months, and putting the staff on furlough. That’s likely to be cheaper than operating on low revenues (in a seasonally quiet quarter anyway), and higher costs.

Outlook - similar comments as we've just read from Rev Bars (I hold) -

We therefore expect a strong recovery when there is a return to more normal levels of customer activity. The timing of that will depend primarily on government restrictions being eased.

My opinion - no surprises here. The information I need most is not given - i.e. what are the cash and liquidity headroom (under borrowing facilities)? So this should be seen as more of an operational, than financial update.

For me, the balance sheet is the deal-breaker - far too much debt, and negative NTAV of about £(377)m as at 28 June 2020. The lease liabilities are gigantic, which worries me a lot. Although it’s a similar situation to RBG and MUL, in that the net lease liabilities do the main damage to their balance sheets. That could sort itself out, at least partially, once sites are hopefully trading strongly again from mid 2021 onwards, we hope. That would enable the lease assets to be revalued upwards.

I can see how this share might be a rather risky, but potentially lucrative bet on the public going wild in 2021 once restrictions are lifted, and vulnerable people have been vaccinated. My hunch is that, after this awful experience in 2020, many households which have seen enforced saving in 2020, could well throw caution to the wind in 2021, by going on a spending spree - pent-up demand, live for today, that kind of thing.

After all, they reckon the “roaring twenties” was a reaction to the horrors of WWI, and Spanish Flu, in that people wanted to get out there and have some fun again.

RTN could be an interesting way to have a punt on that process happening again (which seems plausible to me). Investors need to look closely at the bonds though, to ensure that is safe financing, and of course that will need refinancing at some point, so the upside on the shares could be diluted with the fairly high risk of an equity fundraising being necessary at some stage to repair the balance sheet.

The chart does seem to be forming a base. Remember the share count has roughly doubled since 2018, so the share price might not regain former highs.

.

.

Saga (LON:SAGA)

246p - mkt cap £345m

(I hold)

Appointment of Joint Corporate Brokers

Several people have asked me what I make of this announcement from Saga, which is my 2nd largest personal holding (long-term, not a trade).

Saga plc, the UK's specialist in products and services for life after 50, today announces the appointment of Investec Bank plc as its Joint Corporate Broker with immediate effect. Investec Bank plc will work alongside the Group's existing Joint Corporate Broker, Numis Securities Limited.

There’s also a date for the diary;

The Group will also announce a Trading Update, covering the period 1 August 2020 to 25 January 2021, on Tuesday 26 January 2021.

My view - appointing a joint corporate broker can often be a precursor to a fundraising. I don’t think Saga needs a fundraising, because it’s just done one. I’ve never worked in the City, but have lots of friends who do. Therefore I’ve rung round a few mates in the City just now, and asked their opinions on this issue, generally, not specific to Saga, and thought you might find this interesting.

Question - why do companies typically appoint a joint broker?

Answers - from a small selection of my City friends (brokers, PRs, etc)

- Fundraising - especially for the smallest companies that burn cash, and do repeated placings. The main broker can’t keep going back to the same investors, who might tire of the fundraisings, hence a new pool of investors is needed from a new broker, to supplement the existing one.

- Existing broker not doing enough, taken eye off the ball, so companies might want to introduce some competition from a new broker.

- Management not happy with low share price, and want to generate some interest in the company, with more research notes & a fresh broker talking to new investors

- Moving up the broker food chain - as companies grow, they start with smaller brokers, then move up over the years to bigger name firms

- International exposure - e.g. Investec (just appointed by Saga) are a more international firm, so can bring in investors globally

- Brokers chase retainer fees (monthly), so often approach companies and offer to become a joint broker, so a company can try out their services, i.e. brokers pushing for more business

- Personal contacts - e.g. new CEO or Chairman might want to bring in a broker they have good existing relationship with, or people falling out, or an individual broker moving from one firm to another & client moves with them, or adds them as a joint broker

.

As you can see, there can be many reasons why a joint broker might be appointed, and it’s not necessarily connected with an immediate fundraising.

In the case of Saga, it’s sorted out its bank debt in the last placing, and the remaining debt looks fine to me, not a problem, since waivers have been given on the ship loans, and the Bond is not a problem for several years.

I can’t see that Sir Roger de Haan would want to dilute at such a low valuation, given that he paid the equivalent of 405p (post consolidation) for two thirds of his recently acquired stake.

My hunch is therefore that a fundraising at SAGA seems unlikely, but who knows?

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.