Good morning from just Paul today, with it being Friday.

Not much news today, so it'll be a catch-up day. I've got a list as long as my arm of companies to review (SAGA first), so no more requests please, there's masses to do, so I should have a big report done by lunchtime. It's overcast & windy here in Gozo, so there's nothing else for me to do!

Overnight news suggests that Israel may have launched a retaliatory missile strike against Iran, which is unsettling the futures. This is not the right place for discussing geopolitical issues, but it's likely to have some impact on markets, as the situation seemingly escalates. Two powerful nations directly firing missiles into each other's territory (rather than via proxies) is certainly an escalation. Let's try to stick to the impact on markets & economics here, rather than going down the rabbit hole of the politics of it all, which is definitely best left to all the vocal, self-appointed experts on social media!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news)

Man (LON:EMG) - down 5% to 255p (£3.06bn) - Q1 Trading Update - Paul - AMBER/GREEN

It's been many years since I last looked at this fund manager, which is known for its clever, systematic strategies. Shares crashed in the years after the 2008 crisis, and have only partially recovered since. Both Graham and I think the fund manager's space is a good bargain hunting ground at present. The StockReport shows attractive valuation metrics for many, including MAN - fwd PER of 8.3x and 5.5% yield, with decent asset backing too.

Q1 update today gives the key AuM (assets under management) stats, which show growth of 4.9% to $175.7bn - entirely driven by impressive investment gains in some funds. Client flows showed small net outflows.

Paul’s view - I don’t know why the share price has fallen 5% on this news, the market must have been expecting something better, or people just wanted to bank profits, who knows? Anyway, on the quickest of skims, I think this looks worth a closer look.

Zotefoams (LON:ZTF) - up 3% to 380p (£186m) - Partnership Agreement - Paul - GREEN

The market gives a cautiously positive reaction to this news -

Zotefoams, a world leader in cellular materials, is pleased to announce that it has entered into an exclusivity agreement with design and technology company, Design Blue Limited ('DBL') in relation to a newly launched foam material, developed in partnership with DBL, for high-performance impact protection solutions for the defence and law enforcement sectors…

I’ve looked up Design Blue at Companies House (co no. 03792408) it looks pretty good - FY 12/2022 revenues of £24, PBT £5m, with a nice strong balance sheet. So I’m guessing this deal with ZTF isn’t likely to be huge, in terms of revenues/profit for ZTF, but who knows?

Novacyt SA (LON:NCYT) - up 5% to 67.4p (£47m) - Pre-Trial Review - Paul - no view.

This was a covid wonder stock, that crashed & burned. It’s ended up with lots of cash, but a big legal case against the UK Dept Health, with trial imminent. It says today that the case against it is weak, and expects it to be thrown out (but they would say that). So it’s a special situation for punters who like gambling on court cases! Good luck.

Ethernity Networks (LON:ENET) - up 6% to 0.93p (£3.5m) - FY 12/2023 - Paul - no view.

Disastrous 2017 float, based in Israel, multi year losses & heavy cash burn. So it looks a disaster by all usual measures. However, 2023 results offer a glimmer of hope - revenues growing (up 26%), and a strong improvement in performance for H2 - EBITDA loss reduced 74% from H1, to $(0.8)m. Also has $2.0m cash left. Very much in the last chance saloon I would say, but the rapidly reducing losses, and maybe enough cash to get through 2024, mean there’s a possibility it might survive. Material uncertainty in going concern is an obvious worry. Paul’s view - this is not an investment, it’s a punt. I just wanted to get a quick comment into our archive for future reference, if any significant news were to come out. De-listing risk probably high. So yes it’s high risk, for sure.

Summaries of main sections

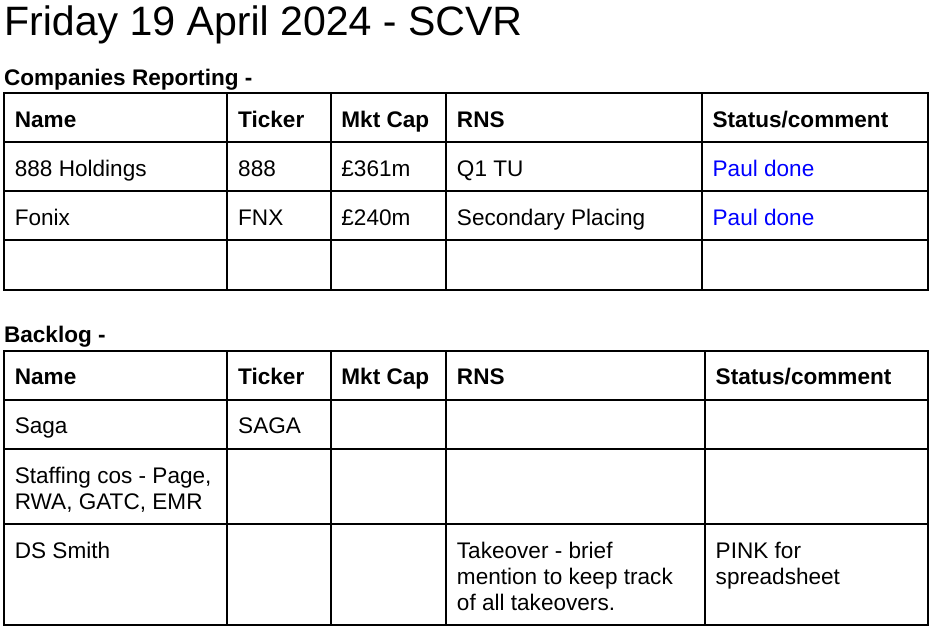

888 Holdings (LON:888) - up 2% to 81.3p (£366m) - Q1 Trading Update - Paul - AMBER/RED

Q1 update is reassuring, and FY 12/2024 expectations unchanged. I recap on the scale of the debt problem here, which is mind-boggling. This is a high risk: high reward special situation. It's likely to be a big mover in the next two years, but I don't know in which direction. Downside risk is too great for me to want to get involved.

Fonix Mobile (LON:FNX) - down 3% to 232p (£232m) - Director Selling - Paul - GREEN

Secondary placing by Directors. I run through the reasons why this has not spooked me. Hence I remain positive on this impressive share.

Saga (LON:SAGA) - 111p (£158m) - FY 1/2024 Results - Paul - AMBER/GREEN

Cruise & travel are doing very well, but insurance is still a problem area. Overall underlying profit improved, but is now expected to be flat for this year FY 1/2025. Debt needs restructuring, but I'm not worried about solvency or liquidity. To me the glass looks potentially half full here, but I'm not totally convinced, it depends how future trading goes.

Paul’s Section:

888 Holdings (LON:888)

- up 2% to 81.3p (£366m) - Q1 Trading Update - Paul - AMBER/RED

888 (LSE: 888), one of the world's leading betting and gaming companies with internationally renowned brands including William Hill, 888 and Mr Green, today announces a trading update for the three months ended 31 March 2024 ("Q1-24" or the "Period"). Further detail on the financial results by division is included as an appendix to this announcement.

Graham normally reports on this highly indebted gambling group.

Checking his previous notes for background -

28/9/2023 - Profit warning - Graham is amber, Paul is red, in a rare disagreement

5/12/2023 - Sunday Times rumour that 888 turned down a takeover offer from Playtech of 156p in July 2023.

17/1/2024 - Mild profit warning, low end of forecast range. Graham is amber/red at 74p.

26/3/2024 - FY 12/2023 Results. Main issue is huge debt, but has time to refinance. Graham: AMBER/RED.

Clearly it’s best to see this as a special situation, with higher risk:reward.

Today’s news - its Q1 update is reassuring, but not price sensitive particularly. At least it’s broken the chain of previous profit warnings, so forecasts seem more reasonable now, having come down a lot (more than halved over time from original hopes) -

Q1 2024 revenues slightly ahead of guidance; no change to full year expectations

Revenue appears to be on a gently improving trend -

Revenue up 2% relative to Q4 2023, reflecting a continuation of positive sequential quarter-on-quarter trends. The Group continues to expect revenues to return to year-on-year growth from Q2 2024 onwards, with full year 2024 revenue growth expected to be consistent with the mid-term target of 5-9% annual growth.

Strategy is reiterated -

On 26 March 2024 the Group announced its new strategy, Value Creation Plan (VCP) and clear medium-term financial targets, namely to grow revenue by 5-9% per year, improve adjusted EBITDA margin by approximately 100bps per year and focus on deleveraging to reach net leverage of 3.5x or below by the end of 2026. Strategic focus on embedding new ways of working across the business…

Reset of operating model well progressed, with £30m 2024 operating cost savings being reinvested into more profitable marketing to drive growth, in-line with the VCP.

Action taken to improve EBITDA from 2025 looks good - but was previously announced, so nothing new -

Conclusion of strategic review of US B2C business announced on 28 March 2024, with the sale of selected assets and closure of remaining operations expected during 2024 subject to regulatory approvals. This is expected to deliver an ongoing EBITDA improvement of £25 million per year from 2025.

Outlook -

"I am pleased to report that Q1 2024 revenue was slightly ahead of our guidance, with strong player volumes converting into improved revenue run rates. Having lapped various regulatory and compliance changes during the quarter, and with increased marketing investment supported by an exciting product pipeline, we remain confident in a return to growth from Q2 2024.

Paul’s opinion - this update generally seems mildly positive. At least they’re doing something to dig themselves out of trouble. We don’t know whether it will work or not at this stage.

I’ve had a quick look back at the FY 12/2023 results, and the scale of the debt problem really is mind-boggling. NTAV was negative c.£(2)bn. Remember the market cap is only £366m, so equity is a small stub really, it’s debt that is of paramount importance (and of course debt ranks ahead of equity in law), with net debt of £1.7bn at Dec 2023. This was 5.6x EBITDA, unchanged from end 2022. The problem is that higher interest rates mean this debt is now expensive, with finance costs of £195m consuming all the operating profit (and that’s using the more flattering adjusted numbers). Note that the c.£40m finance income is nearly all forex gains, which are one-off, so I've ignored that.

Therefore this means there is practically zero chance of 888 being able to repay any meaningful amount of its debts from cashflow. So some alternative solution needs to be found in the next couple of years, as debt maturities are 2026-28. Covenants would need careful scrutiny.

Takeover approaches may not work, because the huge debt has change of control clauses, making it immediately repayable. So a would-be acquirer would first have to negotiate with the debt providers, before even considering what they might offer for the equity - why would they be generous? A bidder might just wait a couple of years for the debt providers to get more jumpy, and do a deal that wipes out equity perhaps? Other scenarios might be a debt for equity swap, which again would be incentivised to drive a hard bargain to the detriment of existing equity. Debt is so large that I regard it already as quasi-equity. These numbers remind me a bit of Cineworld, whose equity eventually collapsed under the weight of massive debts.

All in all, it’s a can of worms, and the only hope is that trading improves significantly, and allows management more flexibility to do a placing and/or debt for equity swap with a higher future share price.

The upside scenario would be if trading really takes off, then the benefit would all flow to equity and give a potential multibagger. I’ll keep an eye on it, but for the moment it’s not at all clear which direction this is headed. It’s going to be a big mover in the next couple of years, but I don’t know in which direction unfortunately! As risk is high, I’ll stick with AMBER/RED.

EDIT: I checked one of the bonds, and the 2028 9.4% bond is trading in Germany at 98, almost par. That seems to suggest the bond market isn't worrying about getting their money back - the price has been on an improving trend in the last year too.

Fonix Mobile (LON:FNX)

Down 3% to 232p (£232m) - Director Selling - Paul - GREEN

A managed sale of Director shares has been done through a “secondary placing” - remember for anyone not aware, this has no effect on the company itself, secondary placings are when large lumps of existing shares are bought & sold off-market, matching buyers & sellers.

…the Selling Shareholders have successfully sold a total of 6,666,667 Placing Shares at a price of 225 pence per Placing Share due to significant overdemand. The Placing Shares in aggregate represent approximately 6.7 per cent. of the Company's issued share capital.

It’s a fairly modest price discount, so price is not a worry.

Selling shareholders are mostly Directors, which to me is always a negative (Directors selling hefty amounts). However, I’m reassured that they still have very significant holdings, so it’s probably not a cause for alarm, or major concern -

Lock-in? I prefer it when this type of announcement comes with a commitment not to sell any more shares within say 6 or 12 months, but nothing is said here.

Paul’s opinion - hefty Director selling is never welcome, and can often be the canary in the mine, that it’s time for small investors to sell too. However, each case is different. In this case, I think the numbers look fine: the table above goes from 38.9m shares before, to 32.3m after. At 225p/share, their remaining holdings total £73m - a huge amount of money remaining invested in FNX, and 32.6% of the company.

To me, that’s absolutely fine. I’m told the Directors are serial entrepreneurs, who invest in many startups, etc, so it seems entirely reasonable that they might want to lighten the load a bit in FNX, to use funds for other investments.

Overall then I don’t feel knocked off course by this news, and happily remain at GREEN. I think Fonix is an excellent company (loads of detail in our archive here). Message to brokers - find more companies like this to list on AIM, and the market will blossom over time.

Note that Fonix is also a reliable cash cow, and dividend payer, so the total shareholders return is better than the chart suggests. FNX shares have gone in the opposite direction to most small caps over this period since the 2021 market high - so relative out-performance is much better -

Saga (LON:SAGA)

111p (£158m) - FY 1/2024 Results - Paul - AMBER/GREEN

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, announces its preliminary results for the year ended 31 January 2024. These results are reported under International Reporting Standard (IFRS) 17 'Insurance Contracts' and any prior year comparisons have been restated accordingly.

SAGA’s main operations are insurance, and travel (particularly two owned cruise ships). The concept is that it’s a long-standing (and trusted?) brand for services directed at the over 50’s. Historically this was highly profitable & cash generation, but a period of private equity ownership (using it as a cash cow) seems to have done a lot of damage. Or maybe the whole concept of a brand for older people is now outdated, since an increasingly internet-savvy older generation can just shop around for whatever they want, from any company? Who can say, I’m just pondering. Personally, I think this brand is still of considerable value, just maybe not as much as before.

I can’t use the highlighter on my abroad chromebook, but the obvious points below are the large size of adjustments in both years - but if you accept the adjustments, then profit is moving in the right direction. Also note the huge (but reduced somewhat) net debt -

Debt - the key point, which many people just seem to ignore, is that most of the debt is financing the owned cruise ships. So the leverage ratio doesn’t make sense to me. I would strip out the cruise loans, which is asset financing, and then view the remaining net debt as structural, and it’s not actually particularly excessive. Sure it would be better if it came down, and profits need to rise further. Anyway we’ve covered this so many times before, I don’t want to get bogged down in analysing the same things again - different investors view it differently. The key point is that I don’t see insolvency risk here, because the founding family have propped it up with loan facilities which give plenty of headroom for the bond repayment.

A £75m reduction in net debt in FY 1/2024 is actually quite good. There probably won’t be any divis for a while, until these historic things have been sorted out.

If performance improves in future, then the leveraged upside to equity (from a market cap of only £158m) could be substantial, as one of our top regulars, davidjhill has explained in the reader comments earlier this week. Both bull and bear cases make sense to me, depending on how future trading goes.

Also management are looking at ways to make it a more capital-light business model, which it has been speculated might involve a sale & leaseback on the cruise ships. That would wipe out the bulk of the debt in one fell swoop, and could be a nice catalyst for a re-rating of the shares, if it’s done, and on sensible terms?

There’s also been repeated talk about disposing of the insurance underwriting division.

Cruise & travel - impressive words here -

"Ocean Cruise had an outstanding year and, as a result, we far exceeded our initial earnings targets, while River Cruise and Travel both returned to profit for the first time since the pandemic. Looking ahead, forward bookings are strong, with all three of these businesses significantly ahead of the same point in the prior year.

Insurance - not sure about this, it seems to be a problem area -

"While our Insurance business continued to be hindered by challenging conditions, with inflationary headwinds impacting policy volumes and margins, particularly for our three-year fixed-price policies, we are taking the necessary actions to reposition the business. We are investing in price to improve our competitive position and stabilise our policy volumes and early signs indicate that this is delivering the expected benefits.

Outlook - rather uninspiring -

The net result of these is that we expect the Group to generate an Underlying Profit Before Tax10 that is broadly consistent with that of 2023/24, reflecting growth across Cruise and Travel, offset by a transitional year in Insurance, before a planned return to growth thereafter.

Paul’s opinion - debt & liquidity bother me less than most other investors, I think.

Cruise & travel seem to be performing well, but the insurance businesses look to be the problem. So I think the upside case on SAGA shares mainly comes from them being able to sort out the insurance side, and return it to previously decent profits. If that can be done, then the shares would have big upside I think.

Alternative upside could come from a deal to clear the debt on the cruise ships, and that’s surely looking more likely now that we know they’re operating profitably & ahead of expectations?

I appreciate some readers will think I’m wrong, but I see more upside here than downside, so I’m going with AMBER/GREEN. I don’t have any position, or emotional attachment to this share, in fact I’m rather fed up with it after years of disappointments when I forlornly waited for a promised turnaround that didn’t happen (or rather, has only partially, and very slowly happened). So I’m definitely not looking through rose-tinted glasses, as with all shares, we’re trying to look at things dispassionately with fresh eyes.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.