Good morning from Paul! It's an early start today, as I have to stop early for an investor lunch.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

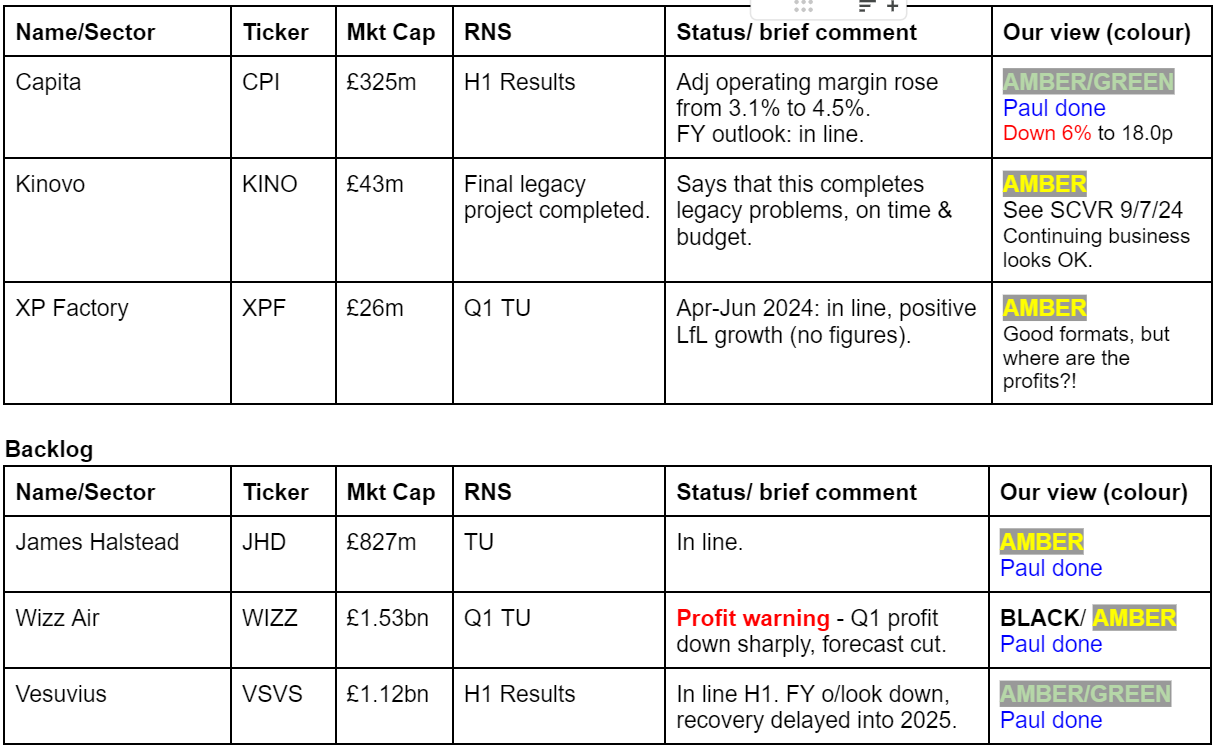

Companies Reporting

Summaries

Wizz Air Holdings (LON:WIZZ) - down 23% to 1,480p y’day (£1.53bn) - Q1 Update - Paul - AMBER

Took a 23% tumble yesterday on a disappointing Q1 update. With Ryanair, Wizz and Easyjet all coming under selling pressure lately, it's looking as if there might be an issue building with over-capacity with budget airlines. Especially with so many new planes on order. I'm avoiding WIZZ as unlike the other listed budget airlines, it doesn't have any balance sheet support, with negligible NTAV, so it's the riskiest pick in this increasingly difficult sector.

James Halstead (LON:JHD) - 191p (£827m) - Trading Update - Paul - AMBER

Reassured investors earlier this week with an in line trading update. It's a good quality business, making big profit margins, and with a strong (net cash) balance sheet. However, shares look pricey given the stagnant growth. To justify a 19x PER, I need to see growth accelerating. Decent divis, as it pays out almost all earnings to shareholders.

Vesuvius (LON:VSVS) - down 12% to 427p y’day (£1.12bn) - H1 Results - Paul - AMBER/GREEN

A sell-off yesterday was caused by wobbly outlook comments saying recovery is deferred into 2025. That said, the business is still highly profitable, and seems modestly valued. So this might be an interesting share for value investors to research further.

Capita (LON:CPI) - down 5% to 18.0p (£309m) - Half Year Results - Paul - AMBER/GREEN

Just a quick skim of these numbers, leaves me with the impression there's a reasonable turnaround underway here. Balance sheet is still weak, but the previously announced disposal should clear all bank debt. However it still relies on substantial up-front cash from the main public sector customers. Could be interesting, if further improvements are made to operating margins.

Paul’s Section:

Capita (LON:CPI) - down 5% to 18.0p (£309m) - Half Year Results - Paul - AMBER/GREEN

Time constraints this morning mean that I can’t properly get into the details today.

We already know the story here - extensive restructuring has been going on for years, to reduce debt and (hopefully) return the remaining businesses to healthier profit margins. That could produce impressive results, given that revenues are large, at c.£2.5bn pa.

The H1 results table shows things moving in the right direction I think, with an improved operating margin, and adj PBT (if you accept the adjustments) up nicely, but still only a modest amount -

Note that net financial debt (excludes leases, which are large at CPI, it must have lots of expensive offices), unchanged at £166m has since been entirely cleared from a recent software company disposal. So it now effectively has no financial debt - although I imagine would continue dipping in & out of overdraft facilities depending on daily cash movements (payroll, payment runs, customer receipts, etc).

Graham and I seem to differ on this one, unusually. I’ve been amber/green since last autumn, going up to a full GREEN on recent news of the £200m software company disposal. Whereas Graham couldn’t be coaxed above amber when he last looked.

The newswire today says that shares are down 5% due to a lacklustre outlook. Or it could just be that today’s is a general down day, and it’s taken CPI down with it? Who knows!

I find these outlook points a bit too granular, and would have preferred a simple statement saying how they expect to perform vs market expectations -

Although the third bullet point above sounds like the outlook is in line with expectations.

Balance sheet - is pretty horrible still. Taking off £520m intangible assets, takes it to negative NTAV of £(350)m. It’s not bust though, because the Govt pays up-front (see the whacking great £515m deferred income creditor. That’s the other side of the double entry for cash in the bank. So without generous up-front payment terms from the Govt, Capita would either be bust, or would need an additional £500m in bank debt.

Still, it gets money up-front, which is very nice. Investors need to hope and pray that doesn’t change!

Paul’s opinion - I’m leaning towards AMBER/GREEN today, as looking at the full numbers has reminded me that the balance sheet is still weak, and that its turnaround is still a work-in-progress.

Although, providing nothing significant goes wrong, there could be an opportunity here for investors.

Vesuvius (LON:VSVS)

Down 12% to 427p y’day (£1.12bn) - H1 Results - Paul - AMBER/GREEN

Vesuvius plc, a global leader in molten metal flow engineering and technology, announces its unaudited results for the six months ended 30 June 2024.

The company reckons H1 was in line with expectations -

Resilient results in line with expectations, despite subdued market conditions

Surprising to see the shares down 12% then, clearly something has displeased the market.

H1 profit down a bit on last year, depending on which measure you use. Adjustments are not huge, and an operating margin just over 10% is pretty decent -

Outlook - I’ve just found the wobbly bit -

“We no longer expect a significant improvement in our end markets in the second half, with most external forecasts predicting end market recovery being postponed to 2025. Accordingly, we now expect our full year headline trading profit for the year to be only slightly ahead of last year on a constant currency basis(*).

(*) FY23 trading profit was £200m reported and is £192m retranslated at H1 2024 FX rates.

Balance sheet - quite capital-intensive, as I would expect from a steel/foundry-type business. NAV is £1,267m, which includes £693m intangible assets. So NTAV of £574m. That’s mostly made up of £464m fixed assets. Working capital is hefty, requiring some debt to finance it, doesn’t look excessive. Pensions are shown, so that would need scrutiny. Also note the minority interests line, so not all operations are 100% owned by VSVS.

Overall it looks OK, nothing to worry about.

Cashflow - I’m not so keen on this. Post tax cash generation in H1 was £69m, but this was mostly spent on £51m capex.

Then it spent £73m on divis & buybacks, fuelled by increasing debt by £100m. This raises the question over whether its generous 5.8% yield is sustainable?

There’s also a hefty £17.1m spent buying shares for the ESOP.

Paul’s opinion - the StockReport shows attractive value metrics, so this might be one for value investors to follow up on with your own more detailed research. It’s quite a lot of business for the money, but not a sector I know anything about, so am not sure I can add any value here really. After peaking in 2018, shares look to be in a long-term downtrend now. I wonder if it might attract a takeover bid given the modest PER?

Wizz Air Holdings (LON:WIZZ)

Down 23% to 1,480p y’day (£1.53bn) - Q1 Update - Paul - AMBER

This budget airline has halved in share price since the recent May 2023 high, and is now back down to a similar range when it first floated in 2015-17. Threat or opportunity? I’ve got to have a quick look.

Similarly, Ryanair shares have taken a big drop recently, from 21E down to 14.6E, Easyjet has not been great of late. Thankfully my sector pick, JET2 seems resilient, after good results which we briefly reviewed here on 11/7/2024. I do feel JET2 is well differentiated, focusing on not just flights but also package holidays, excellent customer service, which was reflected in a recent survey. Whilst WIZZ and Ryanair in particular have recently scored poorly in customer surveys. Or are we just waiting to be hit with a profit warning from JET2, given that it declined to give detailed guidance for the key summer period? Only time will tell, my crystal ball is in for servicing I’m afraid.

Focusing on WIZZ, its problems began in mid-June -

Stockopedia is showing WIZZ on a forward PER of just 4.3x, which looks odd. Bargain, or a sitting duck for further downgrades?

The newswire says that yesterday WIZZ reported that Q1 profit slumped 44%, and forecast was cut.

Q1 Update - covering Apr-Jun 2024, within FY 3/2025.

Accounts are in Euros.

Problem with 47 aircraft being grounded over engine inspections.

Q1 trading was poor, with a statutory loss of E(4.5)m before tax, vs E67.1m last year, on E1.26bn revenues.

Balance sheet - has negligible net assets, and far too much debt, so that rules out this share for me.

Paul’s view - not of interest due to the weak balance sheet. Whereas JET2, EZJ & RYA all have much more balance sheet support, through decent tangible assets. WIZZ is by far the weakest of the 4 listed budget airlines in terms of its balance sheet. If I’m going to invest in a difficult, unpredictable sector like this, then I’d always go for the rock solid balance sheets first.

There seems to be a lot of new capacity in the pipeline, with large order books of new planes, combined with worries in some countries about over-tourism. Which makes me wonder if we might be heading into a glut of budget airlines & holidays, and increasing pushback from the countries being inundated with tourists? So on balance maybe this whole sector is best avoided?

EDIT: WIZZ issues another update today, giving July 2024 traffic stats, and CO2 emissions.

James Halstead (LON:JHD)

191p (£827m) - Trading Update - Paul - AMBER

Readers asked me to circle back to this update from Weds this week.

This specialist commercial flooring company was an impressive share performer until about 2015, but for the last 9 years it’s traded in a range roughly from 200-300p. Although shareholders have received a good flow of divis, so the total shareholder return has been better than the share price alone suggests.

I’ve never really understood why the stock market has generally applied a premium rating to this company, with it frequently trading with a PER of 20x or more. That doesn’t seem justified based on recent years’ performance, with little profit growth since 2021. So we need to see an acceleration of profit growth here, or this share could end up de-rating further (it’s hardly cheap now , on a fwd PER of 19.0x) -

“James Halstead plc, the commercial flooring manufacturer and international distributor, is providing the following trading update ahead of its results for the year ended 30 June 2024.”

Overall - it’s in line, so reassuring rather than spectacular -

“In summary, profit before tax will be at record levels and in line with (upwardly revised) market expectations. “

Expects to improve on last year’s results, for profit, cash, and dividends.

Regions mixed - M.East & Americas good, UK & Europe weaker.

Margins “bolstered” by product mix, cost control, and efficiency.

Costs - lower raw materials prices (but still 50% above 2020 levels), but electricity remains expensive.

Red Sea disruption has caused delays, costs, and increased inventories.

Broker consensus - only shows a very slight increase in FY 6/2024 forecasts back in April 2024 - so nothing to get excited about here either -

Balance sheet - nothing said in this update, but I’ve checked back and it’s smashing, very conservatively financed, with net cash - which we often find at family-run businesses. About £166m NTAV at 31/12/2023, including £62m net cash. Thumbs up here!

Paul’s opinion - this is undoubtedly a decent quality business, evidenced by strong profit margins. But where’s the growth? Brokers are forecasting very little, and with EPS seemingly stuck at around 10p, that means I’m being asked to pay 19x for what looks like an ex-growth business.

So I think to be bullish on this, there needs to be a clearer route towards better profit growth. I can only go on the existing broker forecasts, it’s your job to analyse whether you think these are likely to be beaten or not, through deeper research into products, competition, etc.

Overall, I think it’s a good business, but looks priced about right, based on the information available today.

So it has to be AMBER.

Obviously if business improves, and broker forecasts start rising, then we’d be happy to move up.

This is a nice quality business, for sure. Strong profit margins, strong balance sheet, good reliable divis, so I can see why some people like the company. I just don’t think the share price is attractive given the apparent lack of growth. Could that change as better macro conditions emerge? Quite possibly, we’ll have to wait and see. Big profit margins worry me in a way, as that attracts competition, so I’d be interested to know what other companies supply similar products around the world.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.