Good morning!

Thanks for your suggestions - they are a key element in my decision-making.

Today on the radar we have:

- Northern Bear (LON:NTBR) - trading update.

- Maintel Holdings (LON:MAI) - trading update.

- Fulcrum Utility Services (LON:FCRM) - acquisition.

- Mobile Streams (LON:MOS) - trading update.

- Purplebricks (LON:PURP) - trading update.

- Keywords Studios (LON:KWS) - trading statement (from yesterday).

Cheers!

Share tips - I thought I'd add a few comments on my thought process when shares in my portfolio are tipped in the mainstream press, as happened this morning.

Two of my shares, Record (LON:REC) and PCF (LON:PCF), were tipped for the first time by the Investors Chronicle, as "Bargain Shares" for 2018.

For the avoidance of any doubt, this was bad news as far as I was concerned. I didn't want their share prices to go up, because I had absolutely no plans to sell them and in fact I had been hoping to buy more shares in PCF (LON:PCF) very soon.

One attitude to take is that it doesn't matter, because anyone who buys shares on a magazine tip probably doesn't know very much about the company, and will be a seller in due course. Some investors even sell into these tips, because they are so confident that the share price will retreat over the coming weeks and months, enabling them to buy back in at a profit.

For me, though, having researched a company, I don't want to take the risk that the share price doesn't come back down, with the result that I never get to buy as many shares as I originally planned.

So I went ahead and bought my last slice of PCF (LON:PCF), getting the full quantity of shares that I was originally going for.

I had to pay a bit more than I intended, but it would be much worse if the price continued rising, and I never got them.

My particular concern with PCF is that there are only about 50 million shares in the free float (depending on how you count it), i.e. the free float has a market value of less than £15 million. That's not much value for a small number of investors to scramble for simultaneously.

The full list of shares tipped was as follows: MPAC (LON:MPAC), Crystal Amber Fund (LON:CRS), Shore Capital (LON:SGR), Conygar Investment Co (LON:CIC), PCF (LON:PCF), Titon Holdings (LON:TON), Parkmead (LON:PMG), Sylvania Platinum (LON:SLP), U and I (LON:UAI) and Record (LON:REC).

Northern Bear (LON:NTBR)

- Share price: 81p (+24%)

- No. of shares: 18.5 million

- Market cap: £15 million

This is a tiny company even by our standards, but it's one we've commented on twice over the past year.

Based in Newcastle, It provides specialist building services, predominantly to the public sector - local authorities, housing associations, NHS trusts, etc.

These services include roofing, solar panels, fire protection, health & safety, etc.

Today, it reports that the good times continue, with a positive trading update for quarter ending in December 2017. Turnover and "adjusted profit before income tax from continuing operations" are ahead of management expectations.

The outlook remains strong, "subject to there being no exceptional adverse weather conditions over the remainder of the winter period".

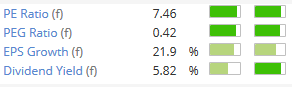

As noted previously, this stock is a favourite of the StockRanks:

Examining the share price performance, there has been surprisingly little progress over the past six months (today has gone a long way toward rectifying that, naturally):

Recent share price weakness maybe have been related to the Carillion (LON:CLLN) fallout. Today, we also get reassurance that there has been no "material direct impact" from this, and the company doesn't know if there will be a material indirect impact.

If I was to try to guess, I would have thought that contractors will at least in the medium-term be marginally less willing to bid too cheaply for public contracts, having witnessed the disaster suffered by Carillion and its suppliers. Perhaps contractors will have a little bit more pricing power, going forward?

Northern Bear's interim results, published in November, showed PBT from continuing operations of £1.3 million, flat against the prior year (incidentally, the company remarked at the time that it was being "careful" in terms of contract selection).

There are no broker forecasts available to me, but today's update strongly suggests that the full-year result this year which will prove better than FY 2017, i.e. that PBT from continuing operations will excelled £2.4 million.

Conclusion - the shares are obviously in "bargain" territory, although this is what you'd probably expect for a small building services contractor.

Management appear to be highly competent and executing well, and investing here is probably a bet on the management more than any other factor. That's the factor which I'd be most curious in, if I was investigating this further.

Edit - A holder of Northern Bear has posted their thoughts in Comment #20, in the comment thread below. As they appear to be very familiar with the management style and the company's divisions, I'd recommend taking a look at this comment for more insight.

Maintel Holdings (LON:MAI)

- Share price: 775p (+11%)

- No. of shares: 14 million

- Market cap: £110 million

This is not a company I've covered before. Checking the archives, I see that Paul has occasionally written on it.

It provides "managed services", i.e. it manages communications/IT systems for businesses:

Our core business is about enabling people to work together more effectively.

Checking the archives, I see that there was a profit warning in December. Paul is not a fan of the sector, reckoning that smaller telecoms & cloud companies such as this do not have a sustainable earnings stream, as technology changes and as prices for their services deflate over time.

This update on its face is fine. After downgrading expectations on 6 December, today it says that trading for the full-year ending 31 December is in line with those expectations. I should hope so!

Adjusted EBITDA for 2017 will be c. £12.5 million, at the bottom of the £12.5 million - £13 million range which had been presented.

This is the important bit:

The Board remains confident in delivering substantial growth in revenue and EBITDA in the full year to 31 December 2018.

Adjusted EBITDA was £12.6 million in 2016, and then £12.5 million in 2017, as announced today. Brokers are targeting adjusted EBITDA of £16.9 million in 2018.

I think my concern is that the organic growth rates, excluding the effect of acquisitions, might not be very big. In 2016, the organic growth rate was just 1%. There was another acquisition in 2017, though on a smaller scale (£5 million deal size).

Unfortunately, I don't feel qualified to judge the prospects here at this point. It's certainly cheap, but what is its sustainable competitive advantage? I don't know yet.

Fulcrum Utility Services (LON:FCRM)

- Share price: 61p (+3%)

- No. of shares: 175 million

- Market cap: £107 million

Acquisition of The Dunamis Group Limited

This a multi-utility/duel fuel installation company.

Profitability has taken off over the last couple of years, leading to a "multi-bag" outcome for shareholders:

Today's announcement is material relative to the market cap: a £22 million acquisition, partly funded by a £10 million placing at 60p. £11 million of new shares will also be issued to the vendors.

The target company designs, constructs, installs and maintains electrical connections.

In the previous two financial years, it generated EBITDA of £4.1 million (2016) and £2.6 million (2017). 2017 revenues were only about half of 2016 revenues, which explains the drop-off in profitability.

Revenues might have recovered in the current financial, thanks to a single customer:

In the current financial year, Dunamis' focus on battery storage facilities has given rise to a key customer (across a number of separate projects) representing approximately 40 per cent of Dunamis' annualised revenues.

If this was a completely new customer (admittedly, this is somewhat unlikely), then it would have needed to boost revenues by c. 65%, in order to reach 40% of the total amount.

Further detail is missing, but there are grounds for optimism that the EBITDA figure for 2018 might be more like the 2016 figure, rather than the 2017 amount.

The rationale is sensible:

The Directors believe that the acquisition of Dunamis represents a compelling strategic opportunity for Fulcrum, allowing the Company to extend and expand its services to create one of the UK's leading multi-utility services groups. The Acquisition will significantly strengthen Fulcrum's position in the approximately £500 million UK electrical connections market, and substantially expand and extend the Company's electrical utility services offering. The electrical connections market is of strategic importance to the Company as it seeks to provide the most trusted end-to-end multi-utility service in the industry and continues to drive growth in multi-utility contract wins.

There is a lot more said about planned cross-selling activities and Dunamis' expertise in battery storage units at renewable energy sites. All in all, it sounds like the two companies are a good fit.

Trading update - over the last few months, trading is in line with expectations.

My opinion - I have a positive impression both of Fulcrum and of this deal, which is surprising since I rarely invest in utilities and generally stay away from them.

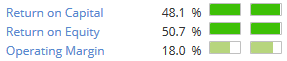

But Fulcrum has been producing superb performance levels and I haven't spotted any red flags surrounding it just yet:

Mobile Streams (LON:MOS)

- Share price: 1.9p (-35%)

- No. of shares: 92 million

- Market cap: sub-£2 million (EXTREMELY SMALL)

I always agree to writing about this without checking its latest market cap - oh dear!

As I said last month, I think this company's business model is to buy up cheap copies of popular gaming apps, and other cheap software titles, and distribute them to individuals who can't afford smartphones in Argentina and India.

Sales in Argentina collapsed last year as its customers moved on to smartphones, so the company has been rolling out in India.

Today's update is for the six months ending 31 December.

- Trading in Argentina was stable (misspelled in the announcement)

- 180,000 active paying customers in India.

The company continues referring to its "addressable audience" in India of 750 million possible users.

That is obviously a pie-in-the-sky kind of number, especially when you consider that the number of active paying customers has fallen from 230,000 reported at the previous final results, to 180,000 reported today.

Has the user base been deliberately reduced due to unprofitable customer acquisitions - was this the "customer churn optimisation"?

"Our primary focus during the period was to reduce losses with our key accounts in India through a process of marketing and customer churn optimisation..."

The company also talks about "certain challenges" with several of its telecom operator partners - it needs them to be able to bill customers conveniently, so that sounds serious.

It also refers to "increased regulation for value added services". Increased regulation was what wiped out Zamano (LON:ZMNO), so that's another potentially serious issue.

The EBITDA loss for the six-month period was about £700k, leaving net cash in December of £1.4 million. Revenues for the period are £1.9 million, just over half the amount recorded in the equivalent period in the prior year.

Marketing spend has been reduced by a whopping 80%, so as to conserve cash.

My opinion - having collapsed its marketing spend, the company is now in survival mode, trying to conserve cash to avoid going bust unnecessarily quickly. It very likely needs to be refinanced, so anyone who doesn't like being diluted should be avoiding these shares in the open market.

The business model of catering to people using low-tech phones is also rather limiting - sooner or later, won't the same thing happen in India as just happened in Argentina?

Purplebricks (LON:PURP)

- Share price: 426p (-6%)

- No. of shares: 273 million

- Market cap: £1,163 million

Statement Re Share Price Movement & Trading Update

This online estate agent is well above our market cap limit, but I feel the need to comment on this highly unusual announcement.

The Purplebricks (LON:PURP) share price fell about 7.5% yesterday, on the back of a critical research note published by Jefferies.

According to the FT (external link), the research note claimed that only half of Purplebricks' customers in November 2016 had sold their home within 10 months. It also claimed that revenue may be overstated, unless Purplebricks has no contractual obligations to its customers after listing their homes on major property portals.

Purplebricks responds today as follows:

Jefferies estimated Purplebricks' completion rate is based on a single month's data and does not include properties that have completed but have yet to be uploaded to the Land Registry, which can take several months.

That could be worth some additional percentage points to the conversion rate, indeed. But Jefferies have been doing the analysis now, in early 2018, so that all of the November 2016 properties would be uploaded already.

Equally the research does not take into account properties which have exchanged, have reached sold subject to contract (SSTC), or are on marketing breaks.

Isn't ten months still quite a long time for a house to reached sale agreed (STC) status? And don't marketing breaks imply that the original marketing effort was a failure?

Purplebricks reiterates its most recently published sales conversion rate from instruction to sale agreed of 78 per cent, which it believes more accurately reflects its sales performance, although this figure itself does not include those properties in the sales pipeline at the end of the period which will in due course sell.

I think the share price is down today because this "refutation" doesn't really "refute". Instead, it strikes me that Purplebricks is merely quibbling with the Jefferies analysis.

The revenue recognition problem arises from the following two facts:

1. From 2013-2016, Purplebricks revenue was recognised as follows:

Fees earned on instructions of residential property are accounted for at the point of publication of the advert to property portals. Where property particulars have not yet been published to property portals, the fees are recognised as deferred income and presented within liabilities.

2. Customers are entitled to take "marketing breaks", referred to above. When they come back, they are supposedly entitled to continue receiving Purplebricks services to sell their home.

This means that Purplebricks hasn't done all of the work it will necessarily have to do for its customers by the time it puts their advert on the property portals. And as accounting principles testify, that would imply that they shouldn't recognise all of the cash received as revenue at that date.

Today's announcement doesn't clarify on this question, but merely states that Purplebricks stands behind its accounting policies and its results.

Trading update - There is also a trading update, stating that trading is in line with expectations for the year ending April 2018.

My opinion - I've remarked before that this company appears overly sensitive to negative customer reviews. It is also clearly sensitive to negative reviews by equity analysts, which is a bit more understandable given the claims that were made yesterday.

However, the 7.5% share price decline is frankly irrelevant when you look at the bigger picture:

What really matters is the risk of reputational damage from the suggestion that only 50% of properties from a particular month had sold within 10 months, and that revenues might be overstated.

As stated in my previous commentaries, I continue to suspect that the Purplebricks service is nothing to shout about. I also believe that the shares are overvalued, and have checked whether it is possible to short them today.

Keywords Studios (LON:KWS)

- Share price: 1628p (+0.5%)

- No. of shares: 62 million

- Market cap: £1,004 million

This is an acquisitive group providing services to the video game industry, e.g. art creation and translation/dubbing ("localisation").

The share price has just about doubled compared to when I covered it last May - congratulations are in order.

As a consequence, it is now above our typical market cap limit.

I do maintain a positive impression of it: it has executed its growth strategy very well (so far), and it has excellent exposure to the long-term secular growth of the gaming industry. At the same time, as a service provider, it doesn't face the same level of risk or volatility as do those companies which actually publish the games.

Yesterday's update was ahead of expectations:

The Board is pleased to announce that it expects revenues to be not less than €150m (FY16: €96.6m) and adjusted PBT* of at least €22.5m (FY16: €14.9m), both of which are comfortably ahead of consensus market expectations.

It's a truly international business, with 42 studios in 20 countries. The last time I studied the company, I noted that only 3% of revenues were denominated in GBP - the majority is in USD and EUR. Operational headquarters are in Dublin.

The outlook statement by the CEO is appropriately bullish.

Despite the positivity, it's probably reasonable to start having concerns about the valuation at these levels.

Against an EUR €1,140 million market cap, analysts are forecasting adjusted PBT of €39.5 million in 2019, pre-acquisitions. They reckon that like-for-like revenue growth is in the mid-teens.

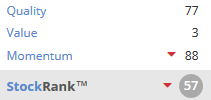

The StockRanks are fairly clear:

My opinion - As confirmed by analyst forecasts, the current valuation doesn't make sense unless you expect Keywords to make more and more acquisitions, and for these deals to be at least as successful as the previous deals.

It has performed brilliantly so far, but the risk of a mishap must surely be increasing, with the share price not leaving much margin for error.

I'm all done, thanks very much for your requests and have a fantastic weekend!

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.