Good morning!

I have a flight this afternoon, so I apologise in advance for comments which will be more brief than usual.

Some announcements which have caught my eye:

- Record (LON:REC) - Q4 trading update. Reduction in AUM-equivalent (I hold).

- Bonmarche Holdings (LON:BON) - trading update. FY 2018 (ending in March) is in line with expectations.

- Distil (LON:DIS) - trading update. FY 2018 (also ending in March) in line with expectations.

There's not much else to report in small-cap land, apart from a tiny subscription for new shares at the struggling tiddler Mobile Streams (LON:MOS), and a start date set in stone for the new CEO of Revolution Bars (LON:RBG).

In big-cap land, I'm scratching my head a bit over the tobaccos. I have accumulated a position in British American Tobacco (LON:BATS), whose share price suffered yesterday after weaker-than-anticipated results from Philip Morris (US:PM). I need to do more work monitoring developments there, when I get some time.

Record (LON:REC)

- Share price: 44p (-10%)

- No. of shares: 199 million

- Market cap: £88 million

Please note that I own shares in REC.

There is no doubt that this is a disappointing update. Reading through, there are only one or two snippets of positivity.

Record is a specialist asset manager which focuses on currency management - helping clients to hedge their currency exposure, using simple or active strategies to boost returns.

Unfortunately, the high-margin product, Dynamic Hedging, isn't growing. Assets under management (using the method to calculate this for FX) for this category has fallen from $4.5 billion to $4.3 billion during the latest quarter.

A year ago, this product had $6.3 billion in AUM-equivalent.

This is the service it provided to clients during the quarter:

The Dynamic Hedging programmes performed as expected, and low hedge ratios in line with US dollar weakness allowed US investors to keep currency gains in the underlying assets.

Leaving the Dynamic Hedging product aside for a moment, returns in the Multi Strategy product were negative during the quarter. Over the long-term, it has produced a small positive return whose main attraction I understand to be its lack of correlation with mainstream assets.

Client flows were negative in each category, with nearly all of the outflows arising in the Passive Hedging bucket. But we do have net inflows penciled in for the current quarter, based on notifications from clients so far.

Passive Hedging flat fees are being reduced for some clients by 10%, with the addition of a performance fee - this is a significant change. We will have to see how it pans out. Combined with hiring and internal investment needs, the immediate outlook looks to have deteriorated. The CEO comments as follows:

We expect that these performance fees will more than offset the reduction in management fees over the longer-term, although the timing of performance fees alongside the additional investment in resources may reduce the operating margin of the business over the short to medium term. Over time we are confident that the continued enhancement of all our products including Passive Hedging will lead to further growth opportunities.

The shares were down by about 20% at one point this morning in early trading. They have recovered somewhat and are now down by 10%.

I have a holding which I bought around the current share price level in January. While I am obviously not thrilled by today's announcement, I'm not planning to sell my position yet.

I knew when I bought the shares that the company could be ex-growth in the short-term. The main reasons I bought in are still intact: it has a niche offering, is very professionally managed, earns excellent returns on capital, has a rock-solid balance sheet and generates plenty of cash, enabling a dividend yield approaching 6%. Even in the absence of performance fees or AUME growth, I think it's a nice hold. I can even accept a modest reduction in margins.

If it had growth on top of all of the above, I would make it one of my top holdings.

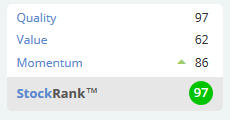

The StockRanks agree that it looks good:

Bonmarche Holdings (LON:BON)

- Share price: 90.5p (unch.)

- No. of shares: 50 million

- Market cap: £45 million

There are some great comments in the thread below, so do have a scroll below to see what others are saying about this women's fashion retailer.

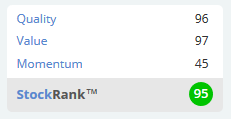

The StockRank for this is almost as good as Record's:

Checking my previous notes on Bonmarche, I've re-iterated many times that I like this stock, but am full up in terms of High Street exposure in my stock portfolio.

The transformation to online remains the major theme and we see this again in today's update:

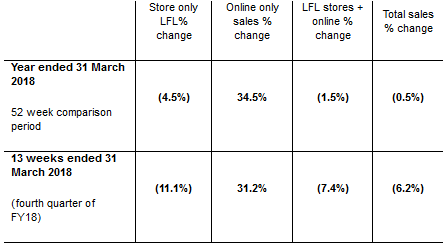

That's a very gloomy result for LFL stores in Q4, of minus 11.1%. It's falling too quickly for online to replace.

Partly thanks to cost and efficiency savings, the profit result for the full year will be in line with expectations.

Profit growth through cost savings is never ideal. It is a creditable management performance in the conditions, though.

Bonmarche claims to have flexible lease terms and I expect that this flexibility will be called upon in the months and years ahead, as the stated LFL growth can hardly be sustained across the entire store portfolio.

Overall, I still think this is an interesting one. It passes not one, not two, but three Stockopedia screens: Neglected Firms, Bill Miller Contrarian Value and Greenblatt's Magic Formula. You might want to consider adjusting these for Bonmarche's lease liabilities, if they haven't already done so.

Distil (LON:DIS)

- Share price: 2.4p (+9%)

- No. of shares: 502 million

- Market cap: £12 million

Redleg listed in major UK pubchain; trading update

I've managed to find something resembling a desk in the airport terminal, complete with power supplies. So let's take a quick look at Distil.

Distil owns RedLeg Spiced Rum, Blackwood's Vintage Gin, Blackwood's Vodka and a range of other alcoholic brands.

I've covered it a few times before in this report, arguing that it has some potential. It's still a very small company, so do tread carefully!

Sales are in a healthy uptrend, with RedLeg Rum being the key contributor.

RedLeg has already gained traction with a couple of major supermarket chains, and today we discover "another leading pub chain with national coverage has listed RedLeg Spiced Rum for its outlets". This suggests that we can look forward to more revenue gains ahead of the drinks market as a whole.

Good growth was already forecast and priced in to some extent - today's update is in line with expectations.

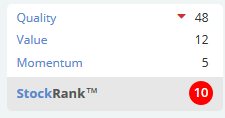

The algorithms identify this as a Sucker Stock, probably due to the very thin track record of profitability:

I reckon that this is a bit harsh. If you check results for the most recent H1 period, which tends to be quieter than H2, they show the company was very, very close to breakeven for the period up to September 2017. For the 12 months to March 2017, it did achieve breakeven. In other words, the company appears to be washing its face in terms of covering its expenses.

Cash in the bank was last seen at £690k. This is enough to carry on if we assume that marketing spend remains under control. So the risk of dilution looks modest for now.

Overall, therefore, I think this is worthy of further investigation, if you are happy to buy companies in this very early stage of development.

That's probably it from me today.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.