Good morning from Paul, and unusually for a Friday, Graham offered to join me today, to look at some backlog items of interest.

I did a few backlog items last night, whilst watching The Apprentice, so we're off to another flying start! And hopefully nobody here is going to get fired!!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda

I've got to finish early today, so not sure we'll get through that much of today's list, but here it is anyway -

Paul's Section

Luceco (LON:LUCE) - rose 20% yesterday to 128p - FY 12/2022 TU - guidance: operating profit (adj) at upper end of £20-22m previous range, on £206m revenues. Good, but does that justify a 20% rise in share price? Slow Q4 (as expected), revenues down 22% on Q4 2021, due to accelerated customer de-stocking. Demand from housebuilders slowed 10%. Gross margin improved in H2 to 37.5% (H1: 34%) after raising selling prices. “Exceptionally strong free cashflow” from reducing inventories & good collection of receivables. This has slashed net bank debt from £54m (June 2022) to £24m (Dec 2022) - that’s really good news, as I was worried about high debt, when reporting on its Oct 2022 profit warning here.

Liberum forecast 10.0p EPS for 2022, and only 8.3p for 2023. So price probably about right for now. If it keeps rising, then 150p might be a nice point to top-slice possibly? Or if you think it’s likely to beat forecasts, then it would be one to hold. It mentions cost inflation factors (freight cost, forex) now “moved in our favour” - which could drive margins up once hedging arrangements have expired. Interesting.

My opinion - this looks quite good, but I’d be careful not to anchor to the pandemic share price, which was an artificial high from a boom in DIY. Profits have since dropped a lot.

Overall, I don’t have a strong view either way, but the overall tone of today’s update seems encouraging - it’s over the worst by the looks of it, so maybe the share price should re-rate upwards?

CFO is stepping down after 5 years. Looks civilised, as a NED becomes new CFO (unusual, but why not?!). Handover in March 2023.

Hotel Chocolat (LON:HOTC) - rose 12% yesterday (taking mkt cap to £286m) on an in line H1 update (6m to Dec 2022), year end is June 2023. The tone of the update makes it sound as if they’ve knocked the ball out of the park, but it’s only trading in line with expectations - footnote says £213m revenues and £8m underlying PBT for FY 6/2023 - very modest profits for a company valued at close to £300m. Presumably bulls think it’s going to beat these numbers?

Net cash of £31m at 18 Jan 2023 is healthy.

Inventories down 17% vs LY, good as excessive inventories were an issue.

My opinion - the valuation seems to hinge on hopes that it can achieve aggressive profit growth, with Liberum assuming FY 6/2023 profit of £8.3m grows to £20.5m next year, and £32.7m in FY 6/2025. That doesn’t look realistic or prudent to me, given subdued consumer sentiment, and rising costs (although HOTC reckons it can cut costs), but we’ll see. The market’s running with the bull story, with a nice looking chart. Quite often when a share seems inexplicably expensive, it’s because the buyers know something good is going on. Although they were wrong in the past with HOTC, as it was over-valued for years, and then crashed when the international expansion all went wrong.

Finsbury Food (LON:FIF) - Finsbury Food - TS £118m - says its on track to meet market expectations for FY 6/2023. Decent revenue growth in H1, and I’ve been really impressed with how this business has managed to successfully navigate higher inflation, passing on extra costs - the sign of an efficient, well-run business, I reckon.

I don’t understand why the market is so stingy with its valuation of FIF, with a PER of only about 8. This seems a bargain to me, but it’s always been cheap, nothing ever seems to change, investors just don’t seem interested in it. Still, I’d rather have it that way around, and get a nice surprise (e.g. a takeover bid), than overpaying for something that’s always too expensive!

Dr Martens (LON:DOCS) - nasty profit warning, down 31% to 145p (a new all-time low). Softer demand and logistics problems, with its US warehouse in LA going badly wrong by the sounds of it.

Revised guidance: we now estimate FY23 EBITDA will be between £250m and £260m

Some knock-on problems into FY 3/2024.

My opinion - I can’t take it any further, as there’s no broker research available. But that 250-260m EBITDA figure is still impressive. H1 showed £89m EBITDA, which became £58m PBT. The market cap has just come down from £2bn to £1.4bn in a day, so this might be worth looking into.

The last balance sheet only had NTAV of £82m, but debt doesn’t look excessive, given the large EBITDA number supporting it. Overall, this might be getting interesting, now the excessive IPO valuation has dissolved.

Seraphine (LON:BUMP) (I hold) - this is actually my largest personal portfolio position, so when news came through last night (as always, from Sky News) that Mayfair Capital had agreed to buy it back for a 200% premium, at 30p, I had to pinch myself, and also woke up this morning wondering if it had been one of my frequent share-specific dreams?

The good news (depending on when you bought the shares) is confirmed in an RNS today -

Recommended Cash Offer - from Mayfair Capital (holds 43%, and originally floated BUMP at a bonkers valuation as it turned out).

The offer is 30p cash, a 206% premium, but just 10% of the IPO price of 295p in July 2021. It was one of many opportunistic floats, where private equity sold a business that was doing well in the pandemic, to gullible fund managers, who thought the growth was structural. To be fair though, the ecommerce sector was then hit with a big rise in digital marketing costs, and supply chain/forex chaos, combined with a consumer downturn, and re-opening of physical stores. So a lot has gone wrong since the IPO, including a series of profit warnings, and a net debt position that was looking distinctly uneasy, and a balance sheet that obviously contained stretched creditors & inadequate capital.

Anyway, I don’t care about the history, as I’m a Johnny-come-lately, buying at an average of 21p, after big Director buying and a bombed out valuation. It didn’t work very well though, with the price then more than halving after yet another profit warning, and I was getting really worried about this share, as indicated in these reports and comments, where I flagged it as very high risk (and I didn't really want readers to follow me in, in case it went wrong).

Today’s announcement makes some interesting points of wider read-across, that we need to avoid any small cap which needs to raise fresh capital, as the stock market isn’t interested, and demands deep discounts right now -

Seeking this capital on-market would likely be highly dilutive, and the restoration of value would take time.

"The Seraphine Board, therefore, believes that this transaction would remove the substantial costs associated with being listed and afford management the time and space to give their full attention to a return to profitable growth. The Seraphine Board also welcomes the further capital which has been committed by Mayfair, to accelerate growth and reinforce the Company's balance sheet, as well as Mayfair's stated support of the management team and employees.

"The Seraphine Independent Directors believe the offer from Mayfair, which follows a period of intensive negotiation and which represents a premium of approximately 200 per cent. to the current share price is a fair and reasonable offer that we recommend to our shareholders."

My opinion - clearly I didn’t follow my own rules here, and taking a large position in a company that obviously needed more equity, was a stupid mistake. That’s the trouble isn’t it? When you’ve got an excitable personality like mine, the decisions I make are sometimes irrational, and undisciplined. I find it impossible to follow a logical, sensible strategy, particularly after heavy losses, when my judgement is impaired even further, as it has been in the last year. As mentioned before, I enjoy doing the company analysis, but am pretty hopeless at managing my own money.

So this outcome, of a generous bid for a financially distressed company, is a lucky escape, and no skill or congratulations should be celebrated by me (although obviously I'm over the moon at a very good outcome).

Still, I live to fight another day, and should shortly have a nice cash pile to deploy on my bulging watch list, at last some good news, even if it was created more by luck than judgement.

Headlam (LON:HEAD) - 330p (mkt cap £267m) - trading update yesterday for FY 12/2022. UK’s largest floorcoverings distributor. I’ve got a call booked for today with former CEO, Tony Brewer, who now runs growing competitor Likewise (LON:LIKE)

HEAD seems to be performing as expected -

Revenue and underlying profit before tax for the Period are both expected to be marginally ahead of market expectations¹.

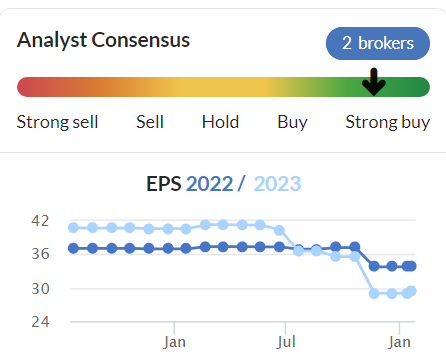

The footnote gives a link to its website, as usual here is the more specific link you need. This shows consensus 2022 forecast of £660m revenues, and £37.0m underlying PBT. That looks consistent with Stockopedia’s PAT of £30.5m, and EPS of c.34p. I make that a PER of 9.7 - a modest valuation I think, especially as HEAD has a particularly good balance sheet (loads of freeholds), and is a proven cash generative business (paying lovely divis), even in tough macro times. No outlook comments, but given tough macro, I'd assume it's likely to tread water, at best, in 2023. Forecasts for 2023 have already come down a fair bit, which gives us some margin of safety hopefully, lessening the likelihood of a profit warning -

It also has some good self-help and growth initiatives underway, including expansion of trade counters, passing through price rises (hence revenue solid, even if volumes fall), and chasing larger customers (it’s previously said there are gaps in its market, which it needs to target). Also efficiency measures being done - it’s previously said the patchwork quilt of depots, and overlapping logistics, is being rationalised, which saves money & improves service.

Share buybacks are sizeable - accelerated since Nov 2022, this £15m programme should be complete by end March 2023. That’s almost 6% of the market cap, so will nicely enhance future EPS & DPS.

High StockRank of 94.

I remain positive about this share, thumbs up. It’s still really good value I think, and now we also have the reassurance that it’s trading in line. Although rapidly growing LIKE is snapping at its heels, and already has c.6% market share, vs HEAD's 30%.

There was an IMC presentation yesterday, so I’ll watch the recording over the weekend.

Thumbs up from me.

.

Works co uk (LON:WRKS) - very quick comment on today’s interims & current trading update. Stores did well over Xmas (against soft comps re omicron). Online weak, down 14%. More price markdowns this year in Jan sale. H1 figures look poor to me, a loss of £(10.7)m, much worse than last year’s £(1.0)m loss, although H1 is seasonally weaker half year.

As mentioned here before, WRKS last year benefited from a big subsidy from Govt re business rates, that’s now ceased, a £3.9m additional cost. Net cash of £7.0m, down a lot, but should improve in H2 (seasonally stronger). Says it’s not changing outlook for FY 4/2023, which Stockoepedia shows as a PAT of £1.4m. But comments sound cautionary, so risk of an H2 profit warning possibly?

Balance sheet is OK-ish, if you take out the IFRS 16 lease entries.

My opinion - remains cautious - this looks a marginal business, operating just above breakeven. So it’s vulnerable to any further downturn. That said, it could see margins improve as freight & supply chains ease? Mgt will have to work hard to keep it going. I’d stick with CARD and SHOE, they look tons better than WRKS.

Graham’s Section:

PayPoint (LON:PAY)

Share price: 530p (+5% yesterday)

Market cap: £365m

Good morning! There’s quite a lot of newsflow around this one currently, and it was mentioned in the comments section yesterday, so I thought I’d drop in today and help to keep everybody updated on it.

Let’s start with the trading update for Paypoint’s Q3 (October to December, since year-end is in March). The company remains confident of delivering expectations for the year.

Key points:

Total net revenue +9.8% year-on-year to £32.5m

“Shopping” division net revenue +4.8% to £15.4m

There’s a lot of detail provided for this “Shopping” division. The main point is that their flagship product for UK stores - the PayPoint One terminal - continues to sell strongly and trade well. Within the Shopping Division, UK retail services net revenue increased 9.2%.

The other major part of the Shopping division is Card Payments, through which Paypoint provides card payment machines under a couple of different brand names. It also enables the purchase by customers of loyalty cards, gift cards, etc. (this includes gift cards from Appreciate). Net revenue here was flat.

Other divisions:

E-commerce (Collect+) division net revenue +50.9% to £2.3m

Payments & Banking division net revenue +10.6% to £14.7m

Strategic Update

PayPoint has neatly presented its progress on its four strategic priorities - one priority for each of the three divisions, and one for the group as a whole.

I haven’t got much to add here except that I think PayPoint has already achieved its first strategic priority - to be embedded “at the heart of SME and convenience retail business”.

It also has an ambitious goal to be “the definitive technology-based e-commerce delivery platform for first and last mile customer journeys”. I’m not sure if that is realistic - surely the competition in that niche must be formidable? But it does have partnerships with Amazon and FedEx, and Royal Mail strike action is another boost for it, so who knows?

Balance sheet - net debt of £35m as of December 2022.

Estimates - according to Stocko, full-year estimates are for revenues of £121m and net income of £37.1m, which puts the shares on a cheap valuation (ValueRank 94).

Appreciate takeover

Appreciate (LON:APP) also issued an announcement yesterday, noting the FCA’s approval of Paypoint’s proposal to acquire them.

Each Appreciate share is set to be bought for 33p plus 0.019 new PayPoint shares. This is worth about 43p-44p, depending on which value you use for PayPoint shares.

News here is imminent:

The Scheme remains conditional on the approval of Scheme Shareholders at the Court Meeting and Appreciate Group Shareholders at the General Meeting, such meetings to be held on 20 January 2023…

In a takeover situation, 75% of votes cast at the shareholder meeting need to be in favour of the deal. As noted originally by Boon and then Michael C, there are some hedge fund shenanigans with a group called Samson Rock building an 18% position in Appreciate and also shorting PayPoint. Could they perhaps be intent on forcing PayPoint to pay more?

(Note that if or when the deal goes ahead, the PayPoint shares they receive could be extremely useful when it comes to closing their short!)

My view

It’s a complicated story. My view is as follows (I don’t currently have a position in either share, but I have in the past owned both of them, personally or on behalf of others):

PayPoint is a good-quality business with a history of excellent cash generation and ROE, and I like its future prospects. It is part of the shopping infrastructure that convenience retailers need, and its products have remained modern and relevant. I also think the shares offer decent value at current levels.

That having been said, the Appreciate takeover doesn’t make great sense to me from the point of view of synergies. Yes, PayPoint sells Appreciate gift cards (alongside Amazon gift cards and video game vouchers). Yes, many PayPoint customers are also Appreciate customers. But is that enough to justify the combination of the two businesses, strategically?

The easiest rationale for the takeover, in my view, is that it’s an opportunistic one. The Appreciate share price got too cheap, by a wide margin. PayPoint, as a large, financially strong business that has a working relationship with Appreciate, was able to identify this and act on it.

At its current share price, which is near the takeover price, Appreciate gets the follow value metrics from Stocko computers:

It seems like quite a good deal for PayPoint, doesn’t it?

Secure Trust Bank (LON:STB)

Share price: 735p

Market cap: £136m

Thank you to GreyInvestor for mentioning this in the comments yesterday!

This specialist lender issued an “in-line” trading update yesterday, but the shares are superficially very cheap, so let’s take a closer look!

Highlights from the Q4 update:

“Significant” increase in adjusted PBT.

Core loan book up 19% year-on-year. Consumer finance was up strongly, but real estate finance was up only marginally (due to the interest rate rises).

New business lending down 5.4% year-on-year.

Customer deposits up 19.6% year-on-year.

It’s reasonable to wonder about the fall in new business lending. The explanation is that “given the current macroeconomic environment, the Group took a proactive approach to tighten credit criteria”.

CEO comment:

We will continue to manage our risk exposures appropriately during this period of uncertainty and remain confident in delivering our growth ambitions and medium-term targets.

Estimates: on Tuesday, the commissioned researcher Edison adjusted (i.e. lowered) its forecasts for STB, “to better reflect the deteriorating economic outlook in the UK”.

They revised their view of loan growth lower, reduced their operating income forecast for 2023 by 5% to £185m, and reduced the corresponding underlying PBT estimate by 18% to £41.6m.

My view

You don’t need me to tell you that’s a very significant reduction in the PBT estimate - but maybe it’s already priced in at this market cap? What are the risks?

The trading update says little about impairments, but Edison’s note says that “if economic conditions remain challenging, future impairment charges may be materially above forecasts”.

The £1.1 billion real estate book is said to have an LTV below 60%, so perhaps we can conclude that the £350m commercial finance book and £1.4 billion consumer finance book contain most of the risk?

Balance sheet equity as of June 2022 was just over £300m, supporting assets of £3.1 billion. That’s a high degree of leverage, and helps me to understand why the shares are priced so cheaply.

I would need to do more work on this to come up with more definitive conclusions but for now I wouldn’t automatically assume that it’s a bargain. Shareholders could be exposed to significant risk here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.