Good morning!

Graham here.

It's been suggested that we insert a standard disclaimer/information notice for new readers, so here goes:

Please note that these reports are just our opinions, and do not constitute investment advice.

We are particularly open to suggestions to cover stocks with market cap of less than £500 million. We cover a range of industries but tend not to cover oil, mining or other natural resources, REITs, investment vehicles, and the like.

Best wishes,

Graham

Record (LON:REC)

- Share price: 45p (-5%)

- No. of shares: 199.1 million

- Market cap: £90 million

This is a currency asset manager which I last covered in April.

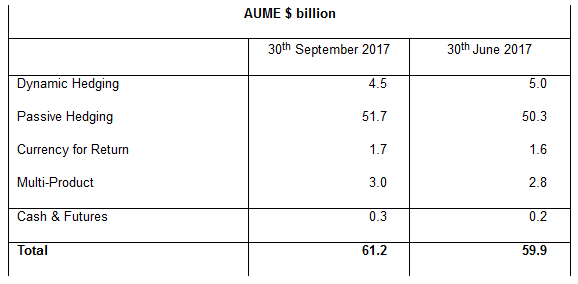

AUME (assets under management equivalent) started the year at $56.6 billion, and are now at $61.2 billion, after another quarterly increase.

As you can see, the vast majority of the AUM is in hedging products. This is either a cheap passive hedge or in a momentum-oriented "dynamic" hedge which tries to maximise the client's exposure to currencies which are strengthening.

Despite the increased size of the business, the flows were disappointing. There was a net withdrawal by clients of $1 billion, offset by market/exchange rate gains of $2.2 billion.

This is noteworthy:

For UK-based clients, Dynamic Hedging achieved cost-effective protection of currency gains from sterling's depreciation in the six months following the EU referendum. However, persistent weakness in sterling meant negative returns and cash flows were unavoidable. As a result Record's remaining UK-based Dynamic Hedging clients converted their mandates to Passive Hedging or terminated during the period.

If I understand that correctly, it sounds like Sterling holders eventually capitulated in terms of trying to use the more sophisticated Dynamic Hedging product, and instead simply sold out the rest of their Sterling holdings - either with Record's Passive Hedging, or with somebody else.

Taking a glance at the chart against the Euro, August was a particularly difficult month for Sterling, and Sterling sellers finally capitulated around then:

It's a bit disappointing that Record's Dynamic Hedging didn't prove its worth to clients over this period. But I suppose we are talking about a timeframe when there was no benefit to be gained by waiting to hedge, so there wasn't much of an opportunity to be clever and try to time things.

Summing up the weak performance, for both UK and US clients, no performance fees were earned.

So it's a really mixed bag of an announcement. AUM reaches its highest ever level but performance was poor, clients withdrew funds, and there is an additional threat posed by increased regulation.

Outlook is summarised as follows, not giving too much away:

"The theme of volatility in currency markets linked to political and economic uncertainty continues, and the consequent uncertainty provides opportunities for engagement with both existing and potential clients. We remain confident of making further progress in the second half of the financial year."

My opinion

I still think this share is worth a look.

It's undeniably niche, providing a specialist service which banks are lazy about.

It is extremely well-capitalised, as it needs to be.

It treats shareholders well, paying out dividends as it can reasonably afford to (and the yield is currently about 6%).

The main negative is that it has fewer than 60 clients, and predicting mandate wins and losses is difficult.

And conditions have been difficult for it to generate good performance lately.

Overall, though, I might buy a few shares in this.

Eservglobal (LON:ESG)

- Share price: 11.625p (+12%)

- No. of shares: 640 million

- Market cap: £74 million

This mobile transactions company announces details of a £24 million fundraising from an institutional offer, a firm placing and a retail offer, all at 9p per share.

It has a cross-border payments joint venture with Mastercard and BICS, called HomeSend, in which it has a 35% share. This joint venture needs additional capital, and Eservglobal (LON:ESG) is raising this money today partly on its behalf:

The net proceeds from the Fundraising will be used in part to fund an expected capital raise by the HomeSend JV to fund its short-term cash requirements and provide further capital for future cash calls, therefore enabling the Company to maintain its 35 per cent. ownership in the HomeSend JV.

And there are internal purposes too:

The proceeds will also be used to further support the rationalisation exercise within the core business, pay down all the Company's debt to strengthen the balance sheet and for general working capital purposes.

Checking the H1 report, I see that overall group revenues in the first-half were just €4.1 million, down on the previous year. The company talked about earning €15-19 million over the 14 months to December 2017, an awkward choice of period. "Timing challenges" in relation to two contracts were blamed for the fall-off in revenue.

The company describes its achievements as follows:

eServGlobal has been a source of innovative solutions for mobile and financial service providers for over 30 years.

Despite this, the core business doesn't seem to have achieved lasting success, judging by its declining sales and losses. EBITDA breakeven is the target for this part of the business in Q4.

HomeSend is the exciting part, where Eservglobal (LON:ESG) has been able to participate along with Mastercard because of the role played by its technology.

In June, it said it was "on the point of significant sales expansion within HomeSend".

The addressable market is considered to be huge, covering a vast array of international remittances by individuals. It looks like HomeSend wants to go head to head with Western Union.

For now, this is still early-stage. It sounds a lot more promising than the typical early-stage opportunity which comes in front of me, so perhaps it's worth a look.

But for me personally, I don't have any interest in investing here.

Fintech strikes me as an investment bubble which has been inflated by the very strong bull market of recent years. I don't want to buy into anything which is associated with that sector, where I might be investing alongside some of that really speculative money.

So for that reason, and perhaps unfairly, I'm not motivated to research this particular stock in any further detail. I'd rather spend time analysing stocks in sectors where there is no bubble and no speculative money, because I think my probability of getting a decent result is automatically improved by that decision.

Henry Boot (LON:BOOT)

- Share price: 330p (+7%)

- No. of shares:

- Market cap:

This is an old name in property development, based in Sheffield.

Results are set to be materially ahead:

...trading has continued to be very strong across all our business segments, in particular, within property development and land promotion. Therefore, given the accelerated completion of transactions in September and October 2017, and the successful delivery of major development schemes through the second half of the year, we anticipate that the Group's performance for the year ending 31 December 2017 will be materially ahead of the Board's existing expectations.

"Almost every deal" the company was hoping to complete, has indeed completed.

And a whole range of deals completed faster than anticipated.

We normally see the opposite problem, that customers are slow and that sales get delayed (see the "timing challenges" for the previous stock).

Since companies who suffer delays often expect some kind of catch-up in the subsequent period, I guess the opposite might be true in this case - there will be fewer deals available to complete in 2018, since they have already completed in 2017.

But the company explicitly tells us that this is not the case:

We continue to backfill the opportunity pipeline and work on deals for 2018, thereby replacing the deals that have been executed earlier than expected, and there remains a possibility that some of these may conclude before the current financial year end. With this in mind, together with the wider UK economic backdrop, the Group's expectations for 2018 remain unchanged.

Wow! An unanticipated increase in deal speed, combined with the maintenance of the work pipeline. Doesn't get much better than that.

The NAV was 184p at June and so we can look forward to this getting a healthy uplift, perhaps in the region of 194p-196p by year-end? And that's after the payment of dividends (the yield is c. 2.6%).

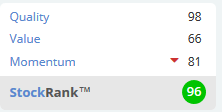

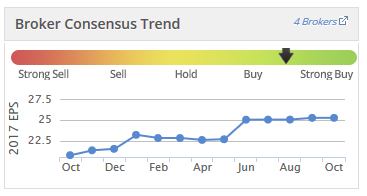

The earnings momentum is illustrated by Stockopedia as follows:

As I said last time I covered this, my main question is around the valuation. I think this is trading at around a 65%-70% premium to NAV.

While it's fairly clear that the company has executed its plans extremely well, that premium seems more than generous, especially given how the property markets work.

As I've said before - property companies often look the cheapest when they are most expensive, and the most expensive when they are cheapest (relative to earnings and investor sentiment).

When I've bought property developers and REITs in the past, I've done so on the basis of the NAV discount, when it looked bigger than average, and methodically sold them when the discount disappeared or the premium was bigger than appeared to be justified.

For example, Henry Boot (LON:BOOT) had a NAV of 129p - 138p from 2009 to 2012, when the share price was in a range of 60p - 130p.

As you can see, the discount/premium to NAV is a lot more volatile than the NAV itself!

I'll keep this on the watchlist, but won't be buying it at these levels.

That's all for now. Of the three companies mentioned, I don't have any positions, although I like Record (LON:REC) the best at current valuations!

Thank you for the comments and suggestions.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.