Good morning from Paul!

Today's report is now finished. Have a lovely weekend, and see you next week!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Aquis Exchange (LON:AQX) - 374p (£103m) - Interim Results - Paul - AMBER

It's difficult to ascertain if this sub-AIM stock market will work or not. It's modestly profitable, and has a decent enough balance sheet with net cash. I'll keep an open mind.

Next (LON:NXT) - up 3% to 7350p (£9.3bn) - Interim Results (July 2023) - Paul - AMBER

Not a small cap but... a long-winded but fascinating interim report from this clothing giant contained lots of interesting nuggets. Profit guidance is raised again. Consumers more buoyant than it expected, thanks to low unemployment and strong nominal wages growth. Encouraging noises about inflation easing.

Kooth (LON:KOO) - down 3% to 305p (£112m) - Interim Results - Paul - AMBER

A small interim loss, and an OK balance sheet (post period end placing done) at this mental health app. All eyes are now on how its impressive California contract rolls out.

DFS Furniture (LON:DFS) - up 6% to 114p (£266m) - Preliminary Results (FY 6/2023) - Paul - AMBER/RED

Profit halved, but as expected. Similar numbers expected for the new financial year. Reckless strategy to pay out divis and buybacks from increased bank borrowings. Awful balance sheet with negative £(300)m NTAV. Pity, as the business itself looks good, with big market share, and recovery potential.

CT Automotive (LON:CTA) - up 13% to 45p (£34m) - Interim Results - Paul - GREEN

Automotive supplier looked close to going bust last year, but has posted an impressive turnaround back into profit. I think shares look cheap, could be a nice trade here for a rebound.

Digitalbox (LON:DBOX) - 3.75p (£4m) - Trading Update - Paul - AMBER/RED

Worrying comments from this nanocap digital advertising business, about damaging actions taken by Google/Facebook. I think this serves as a good warning to steer well clear of all the digital advertising businesses, such as XLMedia (LON:XLM) , Tremor International (LON:TRMR) , LBG Media (LON:LBG) and others. They're not in control of their own business models in my view, and look like accidents waiting to happen.

Braemar (LON:BMS) - shares still suspended - Update - Paul - AMBER

Reassuring update re trading, all sounds fine. We're still in the dark about the investigation into historic transactions, but it's nearing completion apparently. Shares are set to come back from suspension once late accounts for FY 2/2023 published in October.

Mothercare (LON:MTC) - 4.3p (ish) £24m - Results FY 3/2023 - Paul - RED

Just awful, I don't think the equity is worth anything. Details below.

Aquis Exchange (LON:AQX)

374p (£103m) - Interim Results - Paul - AMBER

Alternative stock market, with 4 divisions.

H1 revenue up 17% to £9.7m

PBT up 64% to £1.1m

“Positive on long-term potential of Aquis” .. doesn’t sound great to me - what about the short and medium term?

In line with expectations for FY 12/2023.

Balance sheet seems OK, at £22m NTAV, including £14m net cash.

Paul’s view - neutral. I can’t see anything exciting going on here, but it doesn’t look a basket case either, with cash in the bank, and modest profits, it’s got a lot further than previous incarnations of sub-AIM market. Let’s see how things develop, and keep an open mind.

Not a small cap but…

Next (LON:NXT)

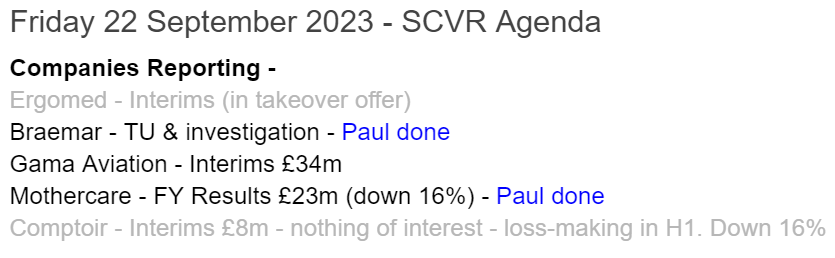

Up 3% to 7350p (£9.3bn) - Interim Results (July 2023) - Paul - AMBER

I just love this business, it’s extraordinary - serenely delivering for its shareholder, year after year, whilst all around it seem to flounder. Hence I’m always drawn to its detailed, clever reporting, which also explains macro factors very well. Key points I jotted down from an 82-page announcement! -

FY 1/2023 profit guidance raised again (third time) from £845m to £875m.

Forecast EPS down 3.6% on LY to 553p = PER 13.3x - maybe about right, for a core business that is arguably ex-growth (although it is positive about international growth potential).

Inflationary pressures continue to ease.

Says it was over-cautious previously about consumer demand, and under-estimated boost from nominal wage rises c.April 2023, although wearing off somewhat. Also full employment has maintained consumer confidence, although that could slip in future.

Hot weather in May & June boosted summer sales at crucial time.

Cost savings good, and now sees only 2% cost price inflation in coming autumn/winter - more evidence that inflationary pressures are easing, and being mitigated.

Factory gate inflation has almost gone, as reduced consumer purchasing volumes mean suppliers are now struggling, so prices are easing. This is very encouraging I think, for the overall inflation outlook, which is looking much more benign than some people seem to think.

Only needs 1% growth in revenues, to “pay for” next year’s cost inflation.

Paul’s view - this is more evidence that the inflation & cost-of-living squeeze is coming to an end. But bear in mind Next is the best in class operator, by a mile, so I imagine its weaker competitors could still be seriously struggling, and end up as brands to be bought out of administration by Next, to add to its growing pile. Interesting introspective comments in its lengthy spiel, about whether it can be a sprawling conglomerate, or will be consumed by its own success, as so many other conglomerates have been - remember Sears, and of course Arcadia.

Kooth (LON:KOO)

Down 3% to 305p (£112m) - Interim Results - Paul - AMBER

Quite an interesting little company, which has an app designed to help people, especially children, improve their mental health - a very current and necessary topic.

We’ve been all over the place on Kooth this year in the SCVRs, Graham being sceptical with RED, me saying AMBER, then I even went GREEN on 4 July in a fit of excitement over the large California contract win. I think we’ll settle at AMBER for now, and just see how things develop. After all, £112m is a big market cap for an essentially unproven company.

Yesterday's interim numbers don’t really contain any surprises. H1 revenues of £11.7m, and about breakeven at EBITDA level. Loss before tax of £1.7m. Enough cash of £5.9m, plus a post period end £10m placing to fund the setup losses for its big California contract.

Paul’s view - the investment case rests almost entirely on Kooth making a success of the big (very impressive sounding) California contract win. If that subsequently led to more US states signing up, and those contracts actually being profitable, then I can see why bulls might see this share as very exciting.

Although Chris Boxall of Fundamental Asset Management made a great point on a recent podcast - that it’s all very well small caps winning big contracts, but having to actually execute on those contracts is often a giant challenge for a small team, and lots of things can go wrong. This wasn’t referring specifically to Kooth, but it was an important general reminder.

In my c.25 years of experience in the UK small caps space, I’ve seen hundreds of promising growth companies come and go, and it’s fair to say that investors nearly always wildly exaggerate the upside potential in the early stages, and are often ultimately disappointed.

I’ve got no idea how Kooth is likely to pan out, but it’s certainly an interesting story, and with already some revenues underway (guidance of £34m for FY 12/2023), it’s not a blue sky thing. Quite interesting!

It's had a great run on the back of the big contract win - can it continue?

DFS Furniture (LON:DFS)

Up 6% to 114p (£266m) - Preliminary Results (FY 6/2023) - Paul - AMBER/RED

DFS Furniture plc (the "Group"), the market leading retailer of living room and upholstered furniture in the United Kingdom, today announces its preliminary results for the 52 weeks ended 25 June 2023

Record market share c38% and FY23 PBT within previously guided range

Solid start to FY24, in line with expectations

Key points -

Revenue £1,089m (down 5% on LY)

aPBT halved to £30.6m

Underlying EPS 9.6p (LY: 17.5p), slightly below Stocko’s consensus forecast of 9.75p

Net bank debt is the big issue - it’s up 56% to £140m as management pursued a bizarre, reckless policy to borrow money from the bank to make shareholder returns, in a consumer downturn, when profits have halved. What on earth are they thinking?!

Debt refinanced in Sept 2023, so lenders seem happy for management to pursue a reckless capital structure, but of course lenders have security, so it doesn’t matter to debt providers if equity holders were to get wiped out in a severe economic downturn -

I am pleased to announce that since the year end the Group has successfully completed a £250m refinancing. The facility is a combination of a £200m Revolving Credit Facility, provided by members of the previous banking syndicate and £50m of US private placement notes.

The debt is expensive. Note that bank debt finance costs soared from £2.5m last year, to £10.4m this year, which is consuming about a quarter of operating profit, just paying the interest bill, before any debt has actually been repaid.

Outlook - it sounds like management is on top of the issues, and it gives useful, detailed guidance -

As mentioned above, upholstery market volumes are down 15% relative to pre-pandemic levels. We expect a further decline in the upholstery market order volumes in FY24 before they start to recover given the ongoing pressures on the consumer.

Based on all the data points we can see, our baseline assumption is that the market will decline by a further 5% in volume terms in FY24 with the Group continuing to outperform the market leveraging the strength of our brands, operating platforms and scale. Despite the continued pressure on revenues, we are targeting a modest year-on-year increase in underlying profit before tax and brand amortisation1 supported by the continued delivery of our gross margin improvement plan and operating cost savings.

Following a mid-single digit year on year decline in the final quarter of FY23 in part linked to the hot weather, across the FY24 period to date order intake has strengthened back into positive growth in line with our expectations and helped by the expected opportunity from weaker prior year comparatives

It also talks about an aspiration longer-term to raise PBT margin to 5-8%. That would certainly be very bullish for the shares, if it’s able to achieve that, and repay some of the debt.

Balance sheet - regular SCVR readers can guess what my view on this is!

Some sobering numbers here - NAV is £237m, which includes £537m of intangible assets. So NTAV is negative a gigantic £(300)m.

Furniture retailers enjoy negative working capital, but instead of sitting on a big cash pile, like smaller SCS (LON:SCS) (I hold) does, DFS has spent the lot, and racked up £140m net bank debt on top. It’s crazy, and leaves no room whatsoever for any unexpected economic shocks.

Note that the lease entries net off to a £100m deficit - indicating that DFS must have a significant problem with loss-making individual stores where it’s locked into paying too much rent.

Paul’s opinion - investors are being asked to gamble here, that management aspirations to improve margins will work, and allow it to pay back the debt which has been drawn down to pay unaffordable divis & buybacks.

There should be margin opportunities, from much cheaper sea freight, and maybe factory gate prices could now be moderating? That could enable DFS to remain profitable, even if consumer demand remains subdued, as they expect. I like that DFS is planning for a further drop in the volume of demand.

With big market share, a very good brand name, in a fragmented market, I can see that DFS is a decent business. The only thing that puts me off its shares, is the absolutely terrible financing structure. It’s reckless to the point of being bizarre, to have chosen the last year or two as a time to max out the borrowings, to pay divis, whilst profits are tumbling.

Holders of the share might well be sticking 2 fingers up at me, and celebrating a multibagger in a few years’ time, which would be lovely for them. But why take the risk, of betting on such a fragile financial structure, which could so easily come unstuck?

There again, with household incomes now starting to grow more quickly than reduced inflation, maybe bigger ticket items like furniture could see a resurgence beginning? Who knows! Lots to weigh up here.

It's not just me that's sceptical -

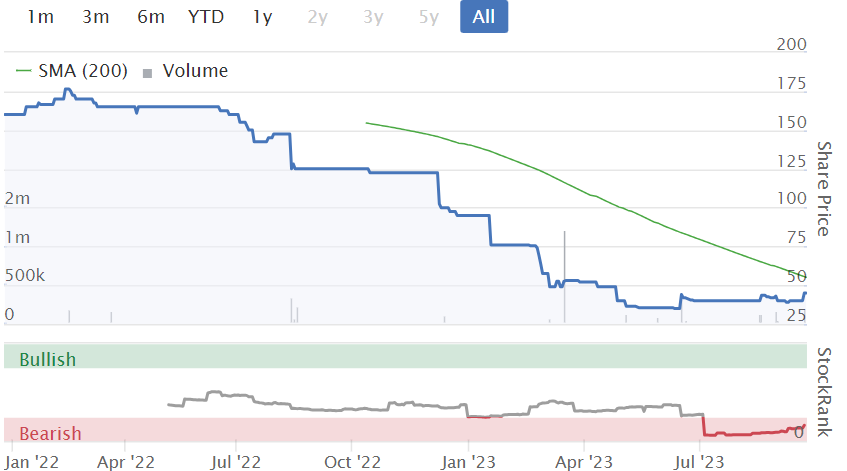

CT Automotive (LON:CTA)

- up 13% to 45p (£34m) - Interim Results - Paul - GREEN

This is a low cost automotive parts manufacturer, with a global footprint. A disastrous float, it almost went bust in the pandemic, but I flagged up here in June 2023 that there was a nice turnaround story underway. It refinanced with a 34p placing in April 2023. I speculated that there could be good upside on the share price, but nobody was interested back in June. Maybe investors might take another look now we’ve got some improved results, rather than just a trading update making positive noises?

CT Automotive, a leading designer, developer and supplier of interior components to the global automotive industry, today announces its results for the half year ended 30 June 2023 ("H1 2023").

Positive trading, efficiency initiatives delivering margin improvement

Highlights - shows a very good recovery from almost ruinous losses in H1 LY, to a small profit this time, and a big reduction in net debt, thanks to the April 2023 placing at 34p, so financial risk now greatly reduced I think -

Outlook -

Whilst cognisant of the macroeconomic uncertainty, the Board remains confident of meeting full year expectations."

Broker update - many thanks to Liberum, for publishing an update note, giving forecasts. It’s reduced aPBT for FY 12/2023 from $9.1m to $8.7m (£7.1m), but that would still be a very pleasing outcome for a £34m market cap company.

This forecast implies a big H2 weighting to profits, but some comfort is provided in the results statement commentary -

Tooling revenue expected to be second-half weighted reflecting the timing of customer projects, with strong visibility on projects due to complete in H2 2023…

Efficiency initiatives in China and Türkiye progressing as planned and are expected to deliver additional savings in H2 2023, further improving operating margins…

Improvement in Group distribution and logistics recovered as supply chains and container rates normalised

Broker note - I can’t fathom Liberum’s EPS numbers, as they only use one decimal point, so it goes from forecast EPS of $0.1 to $0.2 from 2023 to 2024, not much use.

Also, the number of shares in Liberum’s P&L forecast table is stuck at 57m, but actually increased to 73.6m after the April 2023 placing, so I’m just flagging that I suspect the broker forecast numbers could contain errors.

If I manually work out from Liberum’s $8.7m aPBT, less 16% tax (not sure why they use that number), I get PAT of $7.3m, or £5.9m, divided by 73.6m total shares (I won’t adjust for a weighted average), that’s about 8.0p EPS for FY 12/2023.

At 45p/share, that gives us a 2023 PER of 5.6x - good value I’d say, although this type of business probably shouldn’t command a PER of any more than about 8-10. Which would give me a target share price of 64-80p. Usefully higher than the current price.

Why did performance crash in 2022? Due to lockdowns and semiconductor shortages causing big disruption to the whole automotive sector. Let’s hope that’s a one-off.

Balance sheet - not great, despite the equity fundraise in April 2023, which really just partially repaired the damage inflicted from disastrous trading losses in 2022.

NTAV is only about $9m, with quite large working capital balances (mainly large inventories and receivables), offset by hefty trade creditors and some bank debt.

Now that it’s profitable again, this shouldn’t matter too much, but I would certainly prefer to see the company retain profits for several years, rather than pay out unaffordable divis.

Broker forecast shows nil divis in 2023 and 2024, and the word “dividend” does not appear at all in the interim results statement.

Shareholdings - Executive Chairman Simon Phillips still owns 27% of the company. That’s well down from the 38% he held after it first floated, due to dilution from the April 2023 emergency placing. It’s surprising to see an owner-managed business go into a big industry downturn inadequately financed.

It floated at 147p in Dec 2021, and quite quickly ran into serious problems, so I’m sure questions have been asked about the whole IPO process. Still, that doesn’t matter to me now, as a potential buyer at a much lower price. But it could mean there might be an overhang in the shares, which are very illiquid. I wonder how many of the institutional holders would dearly like to sell and forget about it, but can’t due to lack of market liquidity? So the main risk here I think is that despite good news, the share price could remain permanently depressed from drip-selling by institutions that are high & dry on the shareholder register, but maybe need to raise cash to meet their own client redemptions?

Paul’s opinion - this looks a decent recovery situation, and it’s cheap I think.

Not the best business in the world, and the balance sheet could do with strengthening over time, hence little prospect of meaningful divis for a while.

I think there could be a nice trade here, to make perhaps a 50% capital gain over time, as the market digests its turnaround back into decent profitability. It could take a while to re-rate though, as I suspect there’s probably a lot of institutional overhang on the shareholder register.

A badly bungled float, but could be a recovery from now on I reckon -

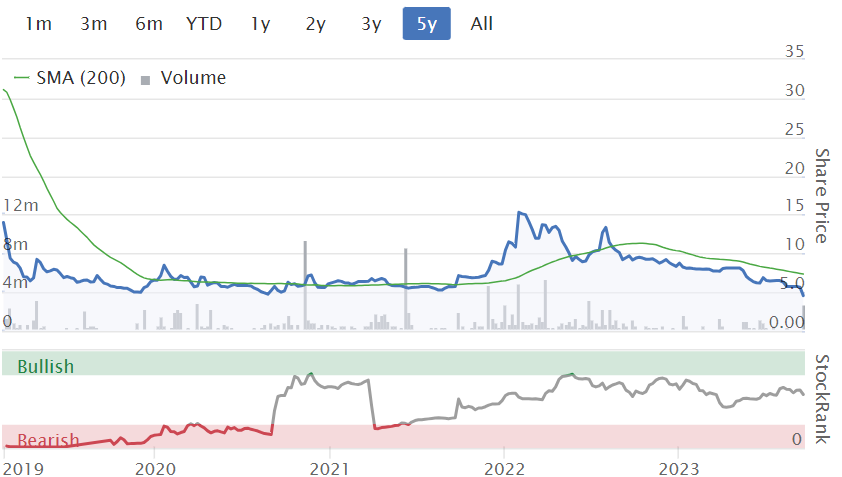

Digitalbox (LON:DBOX)

3.75p (£4m) - Trading Update - Paul - AMBER/RED

I wouldn’t normally mention this nanocap, which makes money from online ads on its websites such as The Daily Mash, Entertainment Daily, The Tab, and The Poke. However, something cropped up in its recent trading update which I think is quite alarming for the whole digital advertising sector - a sector I avoid, because profits are often flaky, and subject to the vagaries of the giant tech companies suddenly changing their way of doing things. That’s why so many sector companies have disappointed, e.g. XLMedia (LON:XLM) , Tremor International (LON:TRMR) and many others. They always seem to look dirt cheap, but that’s because there’s no robustness or longevity to profits, they’re just exploiting a short-term way of making money from advertising loopholes that subsequently get closed off, I reckon.

This is very much reinforced by what DigitalBox said earlier this week, which sounds like a general warning for the whole digital advertising sector -

Digitalbox plc, the mobile-first digital media business, which owns leading websites Entertainment Daily, The Daily Mash, The Tab and The Poke today announces a trading update ahead of the publication of its unaudited results for the six months to June 2023 ("H1 2023") which are due to be announced on 26 September 2023.

For H1 2023, the Group will report revenue of £1.2m (unaudited) and net cash of £2.3 million (as at 30 June 2023).

While the Company has traded ahead of the Board's expectations in H1 2023, it has seen traffic sourcing to its sites in the first months of H2 2023 continue to be impacted by a previously communicated and well-documented trend that many publishers are seeing.

This trend is for lower traffic volumes from the major platform sources Alphabet and Meta to third party sites. Macro-economic pressure on these key players means they have had to increase consumer engagement time on their own platforms to improve their results, which has reduced traffic sent to third-party publishers like Digitalbox.

Furthermore, Digitalbox has seen a block within Google Discover cutting traffic to the Group's leading brand Entertainment Daily, and an imposed reach reduction on a leading Facebook page for The Tab. While traffic volumes have been disappointing, session values have traded materially ahead of the market.

Paul’s opinion - a really good reason to completely avoid everything in this sector, that often make money opaquely from digital advertising. Facebook, Google, and the other giants can snuff out these businesses at a stroke, hence why buying shares in them is best avoided, I think.

Another one in this sector that I would 100% avoid for the same reasons, is LBG Media (LON:LBG) - that looks like an accident waiting to happen, I’d say.

Gone nowhere in 5 years -

Braemar (LON:BMS)

Shares still suspended - Update - Paul - AMBER

This shipping services company dropped 19% to 223p on 26 June 2023, on news that its shares would be suspended due to an ongoing investigation into some sort of historic accounting irregularities.

This is the latest update today -

Trading well, in line with mkt expectations for FY 2/2024.

Guidance is £18m underlying operating profit (before forex), with £7m of that achieved in H1.

Confident in H2 outlook, with forward order book 21% higher than last year.

No change to FY 2/2023 guidance of record revenue & profit (doubled to £20m), and net cash of £6.9m at 2/2023.

“Thorough and complex” investigation done by FRP, nearing completion. Focused on transactions between 2006-2013.

Expects to publish FY 2/2023 accounts in Oct 2023, then restore trading in its shares.

Final dividend of 8p to be proposed, on top of 4p interim.

Paul’s opinion - the good thing is that the business seems to be humming along fine, with no sign of any financial distress at all, which is what matters most.

As for the investigation, it remains totally unclear what the problems are, and how serious they are, and what (if any) consequences there will be. All highly unsatisfactory I’d say, shareholders must be annoyed and somewhat worried.

A long and detailed investigation by FRP won’t come cheap either.

Anyway, we can’t judge things until we have the full facts, but overall I’d say today’s update reassures.

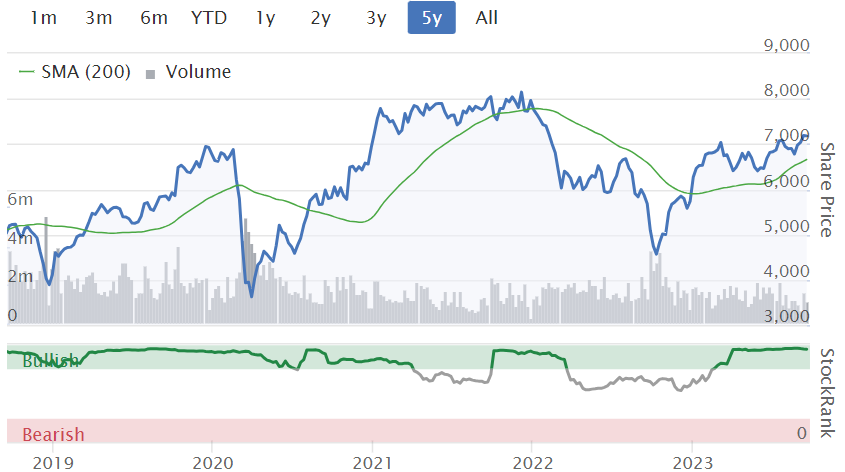

Mothercare (LON:MTC)

4.3p (ish) £24m - Results FY 3/2023 - Paul - RED

I’ve had a quick look, to see if there’s the potential for a multibagging turnaround at this famous brand name maternity retailer, which now operates through a capital-light overseas franchise model. The short version is - very unlikely, in my opinion!

It’’s dripping with red flags for extremely high risk. So please don’t risk any money on this, unless you’re prepared to take on the possibility of getting wiped out. Specifics -

Fully drawn down £19.5m loan is costing 19.2% pa interest!

Needs a waiver to covenants from the lender.

Expecting to complete a refinancing shortly, so I’m steering well clear until we have full information on this.

Mentions the word “stakeholders” - which often implies equity is slipping away in value and importance.

Pension scheme deficit has reduced, but still requires hefty cash injections of £35m over 10 years, but back-end loaded, which is helpful, based on March 2023 actuarial valuation.

Adj PBT of only £1.1m for FY 3/2023 (down from £9.0m in previous year).

Franchise partners struggling & shrinking.

Current trading sounds poor, with franchise partners’ sales down 15% in H1 2024.

Medium term target of £10m operating profit looks complete fantasy to me, so I’m ignoring that.

Going concern statement - material uncertainty.

Paul’s opinion - I think I can save you some money here, but just urging you not to get involved. This looks to me like a valiant attempt to save a failing business. I value its equity at zero, because I don’t see how it’s ever likely to generate enough cash to repay debt, and service the pension scheme’s cash hunger.

If you eliminate intangible assets, and the fictitious accounting surplus for the pension fund (and replace it with the actuarial deficit of £35m), then it’s an insolvent balance sheet.

Shareholders need to pray for a miracle, if you’re too stubborn to just sell out for anything you can get. RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.