Good morning, it's Paul here on my own today. Fridays are usually quiet, so Graham's here Mon-Thu, just so you know what to expect. Today's report is now finished.

Agenda - hopefully not too many bombshells today, as I'm hoping to catch up on a couple of things from earlier this week.

Deepverge (LON:DVRG) - readers were yesterday discussing apparently encouraging FY 12/2021 results. I had a dig under the bonnet last night, and discovered a Citroen 2CV with worn big ends, needing an overhaul, not a Rolls-Royce! I would steer well clear of this. In particular the £10m placing monies have gone in less than a year, and it's now using desperate-looking short term loans.

Trackwise Designs (LON:TWD) - readers asked me to look at a trading update today (revenues down, but profits in line with expectations). I was expecting to conclude it's another jam tomorrow share, but from an initial review have come away intrigued. This looks worthy of further research, and do please post a comment if you know the company well. Speculative, but looks potentially very interesting I think.

RPS (LON:RPS) - a positive update, and broker raises FY 12/2022 forecasts, for this international consulting group. Valuation maybe about right? I wouldn't be inclined to chase this one, given the macro situation. Although RPS does seem to operate in sectors that could be resilient. Gross debt is a bit higher than I would like, and there's negligible NTAV backing.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Deepverge (LON:DVRG)

10.5p

Market cap £23m

Final Results

This was mentioned in yesterday’s SCVR comments section, by Chris1011, and chrisgb, asking me to check it out.

The headlines look good - revenues up 107% to £9.3m, and almost reached EBITDA breakeven, after years of heavier losses.

It raised £10m at 30p per share in June 2021, so the shares at 10.5p could be a bargain.

However on closer inspection, I’m not at all happy with the numbers, and think people should be cautious, and research this share very carefully before plunging in.

Where’s the cash gone?

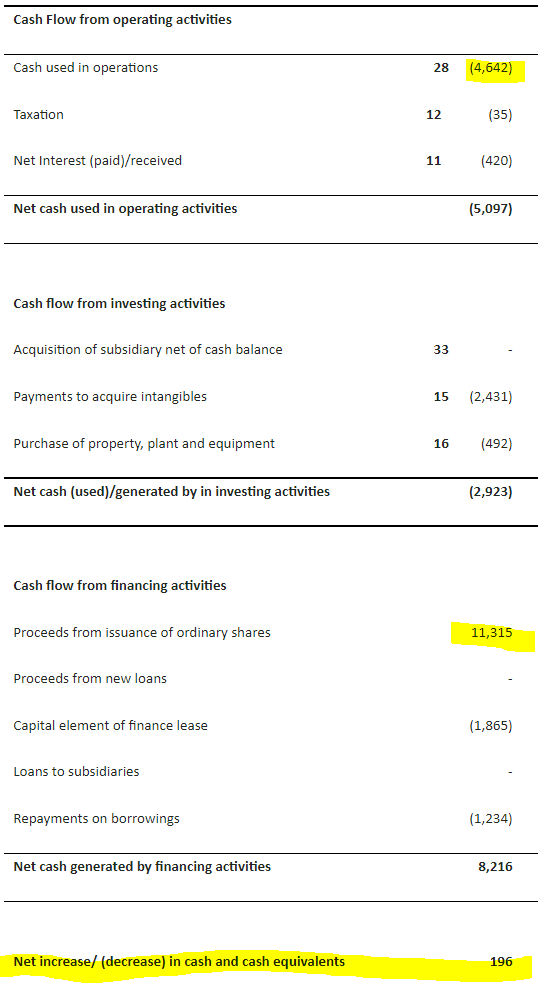

It raised £10m in June 2021, but by Dec 2021 year end, there was only £1.85m left. Where’s it gone? Take a look at the cashflow statement, which shows that DVRG burned £4.6m in operations, and capitalised £2.4m of costs into intangible assets. A further £3.1m cash outflow relates to leases & repayment of borrowings, plus a few other bits & bobs, and that’s the whole £10m fundraise money gone.

Here's the cashflow statement - as you can see, it raised £11.3m in fresh equity during the year, and burned through the whole lot, leaving just a £196k increase in cash for the year as a whole -

.

Excessive receivables

Note 28 shows that there’s a hefty £3.2m depreciation and (mainly) amortisation charge. Hence EBITDA is meaningless. The company isn’t anywhere near breakeven, as EBITDA suggested, it’s still heavily loss-making in both P&L and cashflow terms.

Note 28 also shows that receivables grew by £5.07m to end the year at a huge £6.8m (relative to annual revenues of £9.0m). Put simply, what that means is that most of the revenue booked for FY 12/2021 has not actually been paid for by the customers. It’s instead sitting in receivables, unpaid.

The auditors have signed off the accounts though, so presumably would have checked that the receivables have actually been paid? Maybe, I don’t know.

This suggests that large sales must have been booked in H2, and not paid for by the year end. That could just be a timing issue, or possibly something worse - e.g. large lumpy sales booked just before the year end.

Assuming that receivables turned into cash in 2022, then the company’s cash position should have improved from £1.85m at end 2021.

The commentary in the strategic report confirms that the company may require additional funding.

New loan facility

Was set up in March 2022, suggesting that the company hasn’t got enough cash. It’s surprisingly large, at up to £25m, and is a 3-year mezzanine loan from Riverfort Global Opportunities PCC Limited, and YA II PN, Ltd - never heard of them, but it might be worth googling them.

The terms of this large loan facility are provided in note 35 - Post balance sheet events.

DVRG drew down £4.0m initially in March 2022 - why did it need to do this, since the large receivables should have been paid by then?

The terms of this facility look expensive, and maybe a sign of desperation?

The loans are convertible, and have hefty quantities of warrants attached, priced at 20.0p for the initial drawdown. What this does is cap the upside for DVRG shareholders, since if the share price recovers to 20p+, then the lender will be motivated to convert, exercise warrants, and thereby limit the upside beyond 20p through selling into the market.

Alarmingly, the initial £4.0m drawdown has to be repaid quickly, in just a few months -

The initial drawdown is to be repaid by the payment of £500,000 on the 16th day of each month for five months commencing from 16th October 2022, with the balance of £1,500,000 being repaid on 16th March 2023.

My opinion - this looks a can of worms to me. The company clearly is using fairly desperate & expensive short-term funding, when it shouldn’t need to, if the receivables had turned into cash. This makes me suspect that the figures could turn nasty in future, with a big write-off of receivables maybe?

What I would expect to see next, is a PR splurge, to ramp up the share price to 20p+, so that fresh equity can be raised, and lenders persuaded to convert loans, and exercise warrants. What are the chances of that succeeding in this bear market? Very low, I suspect.

Overall, I’m staying well away from this share, it looks awful. In a nasty bear market like we currently have, investors might not be willing to keep putting in fresh cash for jam tomorrow shares, hence they're best avoided I reckon. It wouldn't surprise me if DVRG goes to zero by next year - even if it doesn't, why take the risk?

I appreciate this will be uncomfortable reading for holders, but I've got to tell it how I see it.

.

Trackwise Designs (LON:TWD)

53p (down 12% at 08:19)

Market cap £20m

We’ve only looked at this share twice since it listed in 2018, and came away underwhelmed both times, due to high valuation & jam tomorrow numbers/commentary in the past.

Wolfspirit has asked me to look at today’s trading update, and Quilleron has added some useful background information in the comments section below, thanks for that.

Trading Update

Trackwise Designs (AIM: TWD), a leading provider of specialist products using printed circuit technology, provides an update on current trading for the year ended 31 December 2022 ("FY22").

Reduced demand from electric vehicle maker(s) in the UK.

Revenues below previous expectations (no figures provided)

More positively, adj operating profit, and PBT are in line with market expectations (that’s unusual, but it says due to contractual terms, presumably for minimum order quantities?)

Order book is now £4.6m (for delivery in FY 12/2022), so together with revenues of £3.3m YTD (end May 2022), that implies FY 12/2022 revenues of at least £7.9m (assuming no slippage into 2023, and there could be new orders maybe?) - roughly flat vs £8.0m for FY 12/2021. Finncap is forecasting £22.1m revenues for FY 12/2022 though, which looks way too high, given what the company has just said.

Cash received of £3.2m re an asset funding loan, but no actual cash balance or net debt figure is provided, an annoying omission.

New factory at Stonehouse (freehold) sounds almost ready, which will significantly increase production capacity, initially prioritising electric vehicle parts.

Looking through previous RNSs for Trackwise, it announced net debt of £4.16m at end Dec 2021. However since then it raised fresh equity at 80p per share, raising about £5.5m (I’ve estimated expenses and deducted them from the reported £5.86m before expenses).

My opinion - you’re probably expecting me to say Trackwise is a jam tomorrow, over-priced speculative thing, as it has looked in the past.

But actually, this share is starting to look quite interesting, for more risk tolerant investors, due to -

- Market cap has now fallen to a much more reasonable £20m

- Production is already happening, with a potentially big contract, and £8m revenues in 2021 is not bad.

- New factory to increase production capacity, almost ready to start.

- Modest losses of £569k (PAT) in H1 2021, and FY 12/2021 looks to be in a similar ballpark, per trading update of 28 Jan 2022.

- The cash burn is mainly capex for the new factory, not so much trading losses, so that’s fine for a small growth company.

- Interesting pipeline for its innovative IHT product, of 95 customers.

On an initial review, I think this share is worth a closer look. The key point for readers to research, is what the products do, how appealing they are to customers (the big order from an EV maker suggests they’ve got something good here), and what the competitive landscape is. Also, is the product patented, which is probably key? If so, how long for?

It doesn’t seem to have published FY 12/2021 results yet, which is terribly late, so they’re due out imminently. They were similarly late last year I note.

Finncap’s forecasts look too aggressive, but it says these will be amended when the FY 12/2021 results are published (probably next week I’m guessing, or the shares would need to be suspended I think?). So I'll keep my eyes peeled for the 2021 results, and review them next week.

I’m intrigued by this company. Am not really looking for jam tomorrow shares right now, but this is on the cusp of scaling up production, so the jam could actually be served up (on toast?!) imminently.

I’ve just found some interesting info on the company’s website, including patent info, here.

If this IHT product (large, flexible printed circuit boards) takes off, and assuming the IP is watertight, then this could get very interesting. I’m tempted to have a little punt here.

.

RPS (LON:RPS)

114p (up 4% at 10:42)

Market cap £317m

RPS is a diversified global professional services firm of circa 5,000 consultants, designers, planners, engineers, and technical specialists.

As an established technology enabled consultancy, RPS provides specialist services to government and private sector clients.

RPS, a leading multi-sector global professional services firm, is today issuing a pre-close trading update ahead of its H1-2022 results on Tuesday 9th August 2022.

PR headline -

Better than expected trading and positive outlook

Figures given today are for the management accounts to May 2022 (5 months of FY 12/2022).

Overall - “Strong trading”, “encouraging”, and “ahead of the Board’s expectations”

Revenue up 12% on LY (constant currency)

Profit margin - “c.100bps of margin improvement” - it depends what this means, gross margin, operating margin, net margin? Looking back at H1 last year, it refers to 5.6% adj operating margin in the highlights section. So it looks to me as if the company is saying that’s risen to c.6.6% this year in H1, which would give a useful profit uplift of about £2.6m by my calculations vs H1 LY.

Growing order books & increasing headcount.

North America is the only area not growing, due to slow private equity activity, and delays to Govt infrastructure projects (starting to improve now). Note that N.America seems only a small part of the group.

Outlook & valuation - sounds good, but note that it hasn’t said anything about full year market expectations, so I assume that stays the same, but is perhaps de-risked by strong H1 trading?

Actually no, Liberum has helpfully issued an update today, and has raised profit estimate by 7%, to 7.3p adj EPS (fully diluted for share options).

That gives a PER of 15.6 - not exactly a bargain, in these uncertain times.

Positive Outlook

The Group's contracted order book at 27 May 2022 was up 8% on December 2021 and 12% on May 2021 and continues to be supported by the very positive market trends in urbanisation, natural resources, and sustainability.

Following the strong performance in the Period and the growing contracted order book we expect this momentum to continue in the second half…

"There remains clear demand for our expertise in our areas of focus - including renewables, project management, transport infrastructure and sustainability - and we are well positioned to continue to benefit from the positive market trends in urbanisation, natural resources and sustainability well into the future."

Balance sheet - nothing is said about this today, but I’m checking everything, given the potential for a recession, and higher interest rates, which usually triggers banks drawing in their exposure.

The last balance sheet for RPS was as at 31 Dec 2021, and it’s adequate, but not great.

Writing off £340.8m intangible assets, takes NTAV down to only £7.8m.

The current ratio (working capital) is adequate at 1.19 - remember there are no inventories at a company like this (consulting business), so it can run a lean balance sheet much more easily than companies which sell physical goods.

Note there was also £53.6m in borrowings in non-current liabilities, although largely offset by cash of £40.1m on the year end date - probably a favourable snapshot.

Hence net debt of £13.5m would likely be considerably more at various times of the year & month, due to normal cashflow swings for a business of this size.

I wish companies had to report average daily cash/debt, which is crucial & much more meaningful information, that not many companies actually report because it’s not required. It should be, so there’s a suggestion for an improvement to accounting disclosure requirements.

Overall then, it’s not the best balance sheet, but not a concern either, providing business holds up in any possible imminent recession. If business were to dry up, then the bank facilities might become an issue, possibly? Although in that scenario, receivables would usually unwind, thus reducing bank debt. So it’s probably OK.

My opinion - if we’re entering an economic slowdown, as seems likely now, then I’m not sure I’d particularly want to own shares in a consulting group. That said, the company emphasises it covers lots of geographies, and sectors which sound like they would be resilient in a downturn, and the outlook comments seem strong.

It’s great to see a company reporting upbeat trading, but the question is, will that last? Hence personally I wouldn’t want to chase this one, at its current valuation.

Sector expert Simon Hedger @vodkaquickstep on Twitter, has pointed out the takeover potential here, and he’s got it right about that in the past with other companies, so that's something to consider.

The 3-year chart below has been a lot more resilient than most small caps recently. Also note the strong StockRank, hovering just below the green upper quintile.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.