Good morning from Paul!

We're off to a flying start today! I had a rare burst of energy yesterday afternoon/evening, and reviewed most of the backlog items that had built up this week, with brief comments below. There's also a full section on Luceco (LON:LUCE) which several readers had requested, and I find quite interesting too.

Today's report is now finished. Have a lovely weekend, and do tune into my weekend podcast (on main podcast platforms, called "Small Caps podcast with Paul Scott". I'll aim to record that late morning tomorrow.

EDIT: Saturday at 13:30 - Two podcasts are up now - one for companies, and one macro. The mystery share for this week is Spectra Systems (LON:SPSY) (see Monday's report).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda

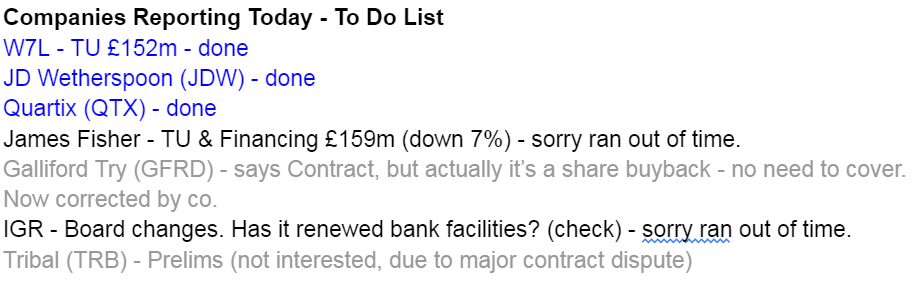

Lots of catch up items today, further down. Here's today's to do list of fresh announcements, in the usual format -

Main Sections

Summaries here, main sections further down -

Luceco (LON:LUCE)

FY 12/2022 Results - 110p (£176m) - Paul - GREEN

Owner-managed electrical equipment group. Did very well in the pandemic, now dealing with the hangover. Share price down a lot from recent rally - is this a negative market reaction to LUCE's in line results (and outlook) this week, or just a general market downdraught? A gentle thumbs up from me, I review results & financial position in more detail below. It looks OK overall, I might consider opening a small starter position on any further sell-off/market panic, when funds permit. Full section below.

Warpaint London (LON:W7L)

Q1 Trading Update - up 5% to 207p (£159m) - Paul - GREEN

Another owner-managed business. Good news, with strong trading continuing, and Shore Capital raises FY 12/2023 forecast by 11% to 11.0p. This comes on top of a very strong prior year comparative, when Q1 2022 revenues were +60% vs Q1 2021. Margins same as last year. Cash has grown since year end (and no debt). I go through all the detail below, and continue to view this share positively - probably more earnings upgrades likely for 2023, I reckon - the business is on a roll. It's a thumbs up from me. Full section below.

J D Wetherspoon (LON:JDW)

Half Year Results - up 9% to 635p (£815m) - Paul - AMBER

Underlying trading in H1 is just above breakeven, but it booked a huge profit (previously announced in Oct 2022) from interest rate swaps, used to reduce debt. Outlook seems to be improving. Complicated balance sheet, and £1.1bn freeholds haven't been revalued since 1999. Looks interesting, but needs a lot more research. It's had a great run since last autumn, priced at 21x forecast earnings, so would need upgrades to justify holding on to that price. So I'm neutral.

Quick Comments -

Pittards (LON:PTD)

Breaking news - 27p (down 27%) - a very worrying announcement has come out mid-afternoon. The company is doing an emergency 25p placing for just £255k, plus Director loans of £85k, at 25p per share. It also needs to call an EGM to authorise a reduction in the nominal value of shares from 50p, to a lower figure, which is just a formality. It will have to cease trading if this is not agreed. Lloyds Bank is jittery, and is only agreeing short term banking arrangements. Anyone holding this share here - I would hit the sell button & get out, as soon as you can. This looks very bad to me, I think existing equity could end up being wiped out, or massively diluted. Look at this -

"The Directors estimate that the proceeds of the Placing, Directors' Loans and the increase in borrowing facility should enable the Company to continue to manage its working capital until at least the end of May 2023 during which time it expects to have agreed new bank facilities with either Lloyds or an alternative provider. Depending on the size and structure of the new facilities further equity and/or debt may also be required to provide some funding for growth and fully return the Company's creditors to a normal profile. The Directors' estimate that this additional requirement is likely to be up to £3 million."

Quartix Technologies (LON:QTX)

AGM Trading Statement - up 2% to 275p (£133m) - Paul - AMBER

Vehicle telematics supplier. Nice clear update - trading in Jan & Feb consistent with meeting FY 12/2023 market expectations, helpful footnote saying: £30.8m revenue, £6.2m adj EBITDA (equivalent to £5.8m adj PBT per Finncap note, and 10.4p adj EPS). Challenging 2024 forecast of 14.4p - if achieved, the valuation would make sense then (it’s too high for historic & current performance). New units up 9%, but it doesn’t mention ongoing price erosion, and customer churn. France growing best - encouraging. My view - still too pricey, but I’ll keep monitoring it. If European growth continues, it could grow into the valuation.

Manx Financial (LON:MFX)

FY 12/2022 Finals - 27p (£32m) - Paul - RED

Jim Mellon owns 19% - it’s a small bank, on Isle of Man. Shares have tripled in last 6 months. Rose 27% on results day. Reported £5.2m PBT for FY 12/2022. Who would buy shares in a small bank in the middle of a banking crisis for weaker banks? Crazy! Very vulnerable to a run by depositors, high risk.

Staffline (LON:STAF)

FY 12/2022 Results - 37p (£61m) Paul - RED

Accident-prone & low margin staffing group. I’m not keen. Most of the profit comes from adjusting out £7-8m pa costs by calling them "non-underlying" in both 2021 & 2022. Outlook comments sound weak too. Weak balance sheet, with negligible NTAV. Why get involved? Could be a takeover target from big shareholders maybe? A big failure as a listed company, with too much dilution to recover anywhere near previous highs.

Science (LON:SAG)

FY 12/2022 Results - 387p (£176m) - Paul - GREEN

An interesting, acquisitive group, owner-managed. Outstanding long-term track record (25-bagger since 2008). Unchanged share price on results issued 2 days ago. Figures look good, this is a good quality business I think, reasonably priced (fwd PER 12.3). Outlook cautious due to macro uncertainty. Very good balance sheet, with lots of cash, so could make more acquisitions from internal cash. Thumbs up from me.

Audioboom (LON:BOOM)

FY 12/2022 Results - 435p (£71m) - Paul - RED

Podcasting company, mainly in USA. Intending to pay 8p divi in 2024. Outrageous share based payment charge of $4.4m is greater than adj operating profit of $3.6m, so this share is not of any interest - company is clearly being run for the benefit of staff/Directors, so no point in it being listed. Lots of Director buys typically £10-20k, have proven a poor indicator, so they don't know what it's worth either!

Inchcape (LON:INCH)

FY 12/2022 results - down 13% to 758p (£3.1bn) - Paul - AMBER

Amazingly NTAV is in small cap territory, at only £393m. Strong 2022 results, and in line outlook, so not sure what spooked the market? Risk:reward seems worse than for the small caps, which have much better asset backing (as a % of market cap). But INCH makes a higher profit margin than the tiddlers. I was just curious to see what the figures looked like for a mid-cap car dealer.

Crest Nicholson Holdings (LON:CRST)

AGM Statement - 207p (£533m) - GREEN

Housebuilder. No market reaction to TU. Says new house prices “remained robust” due to “enduring lack of supply”. “Steady recovery” in consumer sentiment & housing market activity, although softer than last 2 years, obviously. Mortgage interest rates reducing, as more competition from lenders for limited business volumes. First time buyers finding it harder to secure finance, compared with those with more equity. Build cost inflation expected to recede in 2023. Overall, sounds more perky than I would have expected. Worth a look after recent retrace? Big discount to NTAV now.

Amigo Holdings (LON:AMGO)

Update - down 86% to 0.25p (£1.2m) yesterday - Paul - RED

Subprime personal loans company. Wrote its own obituary yesterday, saying winding down the business, for creditors, so shares worthless it seems. We dropped coverage here on 11 April 2022 (5.0p) when I commented that “existing equity is probably worth little to nothing, so best to steer clear”. So the writing has been on the wall for almost a year. Sorry for anyone punting on it, but you would have been aware of the risks.

Idox (LON:IDOX)

AGM TU - 63p (£284m) - Paul - RED

Software group with a focus on public sector clients. In line with exps TU. Key bit sounds good - “High levels of recurring revenue, contract renewals, orderbook and pipeline provide good visibility, and leave Idox well placed to grow by double digits in FY23.”

Weak balance sheet, with negative NTAV. Software companies are still highly valued - are investors still overpaying for recurring revenues? IDOX looks too expensive for me.

Safestyle UK (LON:SFE)

FY 12/2022 Finals - down 15% to 25p (£34m) - Paul - RED

Double-glazing company. I remember when this floated, for several years it looked a really solid, value share, paying nice divis. The wheels came off in 2017-18, and have never been found! Poor results for 2022, loss-making now - blames a cyber attack in Q1 (£4m impact) & cost of TV ads. Small divi re-introduced. Guides profit of at least £2m for 2023. Weak order intake in Feb-Mar 2023. Balance sheet isn’t strong enough to absorb a serious cyclical downturn in my view. Why get involved in this share, especially now interest rates have risen and consumers retrenching? Should be a private company, not listed - 4 big shareholders, so high risk of delisting I reckon, best avoided in my opinion.

Carr's (LON:CARR)

FY 8/2022 delayed accounts - still suspended - Paul - AMBER

Restructured, to focus on engineering division. Results look quite good, but benefit from hefty profit adjustments in both 2022 and 2021, so statutory profit lower. Large disposal post year end, so too complicated to assess, treat it as a special situation needing deeper research. Hence no opinion from me. Reason for suspension was technical, over problem audit of a disposal, so nothing to worry about, but still badly handled. Company has applied to restore trading in its shares, so that should be imminent - will be interesting to see whether they gap up or down (down would be my guess!)

Main Sections:

J D Wetherspoon (LON:JDW)

635p (up 9% at 11:56)

Market cap £815m

I’ve just been having a rummage through the sector (hotels & entertainment) here, and of the larger small cap, or almost mid-cap pub cos, the recent winners (up about 50% from the autumn lows) are;

J D Wetherspoon (LON:JDW) and

Mitchells & Butlers (LON:MAB)

Laggards have been -

Fuller Smith & Turner (LON:FSTA)

Marston's (LON:MARS)

Young & Co's Brewery (LON:YNGA)

JDW is up 9% today, on a big down day for the market overall, so this must be a decent update. Let’s have a look.

Preliminary Results - seems to be the wrong heading, because these numbers are actually Interim Results for the 26 weeks ended 29 Jan 2023. The year end is FY 7/2023.

Key numbers for H1 -

Revenue £916m

Statutory PBT £57.0m (29.4p basic EPS)

Adjusted PBT £4.6m (1.0p basic EPS) - this is underlying trading.

Adjustments primarily relate to a large profit made from closing interest rate hedges (finance income gain of £65m). The cash received was £169.4m (see note 9). Very nice, but previously disclosed, this happened in Oct 2022. So underlying trading is a whisker above breakeven - hardly worth celebrating, as the market has done today.

Current trading sounds positive, although bear in mind that sector costs have gone up considerably since 2019, so the LFLs need to be strongly positive against 2019 just to stand still on profits, let alone grow profit -

"Trade for the last seven weeks was 9.1% above the equivalent period in FY19 and 14.9% above the equivalent period in our last financial year (FY22).

"Having experienced a substantial improvement in sales and profits, compared to our most recent financial year, and with a strengthened balance sheet, compared both to last year and to the pre-pandemic period, the company is cautiously optimistic about further progress in the current financial year and in the years ahead."

Supply chain & inflation comments sound reassuring -

Supply or delivery issues have largely disappeared, for now, and were probably a phenomenon of the stresses induced by the worldwide reopening after the pandemic, rather than a consequence of Brexit, as many commentators have argued.

Inflationary pressures in the pub industry, as many companies have said, have been ferocious, particularly in respect of energy, food and labour. The Bank of England, and other authorities, believe that inflation is on the wane, which will certainly be of great benefit, if correct.

Cashflow statement - shows how the massive cash inflow from closing the interest rate hedges £169.4m, enabled a £140m reduction in bank loans. So for 2022 anyway, we can see this company as a smart swaps trader, with a breakeven pubs company attached!

Balance sheet - is dominated by £1.42bn in fixed assets, which includes a lot of freeholds I believe. Under “property” in the commentary, it says the split of freehold/leasehold (what, by value, number of sites, sq ft? Doesn’t specify) has risen to 69%/31%.

There are hardly any intangible assets, so I don’t need to adjust for that. NAV is quite thin for the size of business, at £384m.

Working capital shows the business relies on trade creditors of £259m, which dwarfs current assets (including cash in hand of £46.5m) totalling £101m. That’s a favourable setup, as with other pubs companies, the beer has been sold for cash to customers, before the supplier has been paid for it. That’s only ever a problem if the business has to shut down (e.g. for lockdowns).

There’s about a £52m deficit on the leasehold entries, indicating some loss-making sites (I know JDW has been trying to dispose of some pubs, the nearest one to me here in Bournemouth has just closed, but there are at least 2 more within a 15 minute walk).

There’s a lot of long term debt, which partly funds all the fixed assets. Presumably it will now be paying higher finance charges in future, now the swaps have been closed? That would need checking.

Note 13 to the 2022 Annual Report shows that freehold and long leasehold property had a net book value (NBV) of £1.1bn. The properties have not been revalued since 1999, so maybe there could be some upside on the balance sheet freehold values? Although I imagine more recent valuations would probably be downwards. That would be an interesting question to ask management - prudently, what is the open market value of its freeholds vs NBV?

Broker updates - nothing available to me, although presumably some bullish commentary must have been sent by analysts to the select few, judging from the steadily rising share price this morning (now up 11.5% on the day at 648p.

My opinion - it’s a pity I didn’t do more work on JDW when the shares were so much cheaper, but I kept putting it off because it’s a lot of work to dig into the accounts of a company this size.

Based on what is said today though, I can’t get particularly excited about it. This is only a breakeven underlying trading result for H1. Almost all the statutory profit came from cashing in a canny hedging transaction.

We’ve also commented here before, that as the price leader in the sector (i.e. by far the cheapest), it could probably raise prices quite easily, without repelling customers, and as inflation eases, and consumers get used to higher prices, pub cos might see their margins begin to recover, possibly?

Overall, I instinctively like this company, but it’s a horrible sector right now, and I haven’t done anywhere near enough work on this to form a proper opinion. Whereas the small caps bars groups are really quick & easy to analyse. Hence I’ll say I’m AMBER.

Note that the share count has risen from 105m to 129m during the period covered by the 3-year chart below.

There's a nice-looking chart here, and the StockRank has clambered out of the red, into the lower middle level (currently 40) -

Luceco (LON:LUCE)

110p

Market cap £176m

I last looked at this here on 20 Jan 2023, thinking it looked priced about right at 128p, and suggesting top-slicing if it hit 150p, which turned out to be eerily accurate, for once!

The recently published results, and a webinar today, seem to have gone down badly with most of the recent rally now having conked out as you can see below, but this is in a market that was generally strong in Jan & Feb, and has now gone bearish again - so we don’t know how much share prices are reacting to fundamentals, or general market sentiment over tough macro, and the banking sector problems.

.

Is it a bargain now it’s back down to 110p? Let’s find out!

Luceco plc ("Luceco", or the "Group" or the "Company"), the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, today announces its audited results for the year ended 31 December 2022 ("2022" or "the year").

The background is that LUCE got a boost in profits during the pandemic home improvement boom. It’s since had to contend with reduced demand, overstocking from customers, cost inflation, supply chain, you name it!

Key numbers for FY 12/2022 results -

Revenue £206m, down 10% on 2021’s pandemic bonanza year, but up 20% on 2019’s pre-pandemic year, mostly from acquisitions, but 5.6% is organic growth.

Gross margin of 36.0% similar to pre-pandemic 36.2%

Wiring accessories is the most profitable division, making 63% of group operating profit.

Profit before tax (PBT) - big difference between adj PBT £19.4m (which is bang on expectations as indicated in 20 Jan update), and statutory PBT of £11.7m - so I need to check what the adjustments are. See note 1, the big adjs are £3.0m amortisation of goodwill, which is customary to adjust out. Also a nasty £5.7m hit to statutory profit re currency/interest rate hedges, that is adjusted out. I’d like to know more about how this arose.

Basic EPS is 11.1p, down 45% on LY, but 44% up on 2019 pre-pandemic.

Liberum shows adj fully diluted EPS as 10.0p for FY 12/2022, and forecast to fall to 8.7p in FY 12/2023. So that seems a conservatively set forecast, that hopefully LUCE can beat.

Dividends - 1.6p interim (paid Oct 2022) and 3.0p final (to be paid May 2023) - that’s a yield of 4.2% - not bad. Although note divis are reduced from the previous 2 years.

Outlook comments look a bit mixed - but OK overall I think -

Trading in early 2023 has been in line with our expectations, with tailwinds from reduced customer destocking, improved gross margin and lower input costs balancing less residential RMI activity.

Whilst the macroeconomic outlook for 2023 remains difficult to judge, I am encouraged by the healthy underlying trading momentum we are carrying into the year which leaves us well positioned to progress as market conditions improve."...

I am also encouraged by the way in which our performance improved as the year [2022] progressed, providing healthy earnings momentum as we start a new financial year.

Liberum (many thanks) has tweaked its forecasts upwards, seeing FY 12/2023 as 8.7p adj diluted EPS (PER 12.6x)

Webinar recordings - we’re spoiled for choice! There’s an hour-long presentation from BRR Media, which I’ve just started to watch, and also another one with Q&A from private investors on InvestorMeetCompany.

I see the CEO pronounces the company name loo-see-co. I’ve been wrongly pronouncing it as loo-secco for years.

Over & under-stocking by customers - this was a considerable factor in the 2021 boom, and resultant hangover in 2022. So it sounds as if performance might normalise, but it’s not clear whether that’s going to be above or below 2022 numbers. Your view on that is going to determine whether you think LUCE shares are cheap, or not -

In 2021, the combination of strong end user demand and exceptionally constrained global supply chains caused our distributor customers to materially increase their stock of our products, adding to our sales. In 2022, they largely unwound the extra inventory added as both demand and supply chain constraints eased, reducing our sales.

This sharp transition from stocking up to stocking down had a significant impact on our year-on-year performance. Customer stock movements explain all of our revenue and profit reduction in 2022. The data we have from our major customers shows that they reduced their stock levels by c.£20m in 2022, with a further c.£5m reduction expected in 2023. We therefore believe that we are nearing the end of this temporary, post-pandemic destocking phase, which is encouraging for the future.

Cost inflation & pricing power - the company seems to have demonstrated a fairly good ability to pass on price rises, so that’s a sign of decent strength in the business model, I think.

Balance sheet - NAV is £86.7m. Note that, as an acquisitive group, intangibles (goodwill) are rising, and reached £41.7m at Dec 2022. Deducting that, gives us a still respectable £45m NTAV.

Working capital looks healthy to me, with £108m current assets, less £54m current liabilities.

Long-term debt is £28.4m, partly offset by £5.3m cash.

I think the financial position looks fine, providing management is not tempted to go on an ill-timed acquisition splurge with the large bank facility.

This is confirmed in a good going concern note (always read these, as they contain important information).

Cashflow statement - looks excellent. Last year’s working capital boost has unwound nicely this year, turning into cash, allowing it to pay good divis, pay down bank debt, make an acquisition, and fund capex, all from internally generated cashflow. So this looks a healthy business to me.

My opinion - I think this is quite a good business. It’s owner-managed too, which we really like here at the SCVRs - with mgt having big shareholdings. Although note the multi-million pound Director selling, well timed, during the pandemic boom - another case of us needing to “follow the money!” Although they still have plenty of skin in the game.

It’s difficult to value, because we simply don’t know whether earnings are going to continue falling (slightly, as forecast), or bounce from here?

On balance, at 110p per share, I’d be inclined to lean towards buying rather than selling, but not a big position size, for my own watchlist, and thinking longer term. So I’ll mark my view as green, but not strenuously so. In the shorter term, I’ve got no idea what the share price is likely to do.

Warpaint London (LON:W7L)

198p (pre market)

Market cap £152m

Unusual share price action with this share recently - it’s been rising, when everything else has been falling. Does the buyer(s) know something? Unusual demand for a company’s shares in a falling market can sometimes be a signal that something interesting is going on behind the scenes. This is today’s news, and yes, it's good -

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to provide an update on current trading and confirm the date for release of the Group's results for the year ended 31 December 2022.

Strong trading continues in Q1 2023

Turning it into bullet points -

Last update on 11 Jan 2023 was good - Q4 2022 saw “particularly strong trading”, ahead of expectations.

Strong trading has continued in Q1 2023 - a record Q1 performance.

With 8 days still to go, Q1 sales are >£16m, so (my guess) maybe £17m for the full Q1? That would be almost 30% up on Q1 LY - impressive.

Margins continue to be robust, in line with LY.

Cash position is £7.6m, up from £5.8m at Dec year end. No interest-bearing debt.

FY 12/2022 results are due out on 26 April 2023 (rather slow reporting).

Overall - it’s an upgrade (not quantified) -

…given this strong start to the year, the outlook for FY 2023 is now expected to be ahead of the board's previous expectations.

Management comments suggest the business is doing well across the board, so clearly has the right products, at the right prices -

We are enjoying a strong trading performance across the Group, with sales growth in many territories and online. We also continue to enjoy healthy margins. We look forward to the remainder of 2023 with confidence and will update further at the time of the release of the Group's results in April."

Broker update - many thanks to Shore Capital, for giving us an update today. It’s upgraded profit forecast for FY 12/2023 by 11%, to 11.0p. Hence at 210p (up 6% in early trades at 08:06) the shares are in the full price aisle, not a clearance bin!

My opinion - congratulations mainly to management, but also to shareholders. I could have sworn that this was on my top watchlist ideas for 2023, but unfortunately it looks like I forgot to include it, as intended.

We’ve been commenting positively here on W7L for a while, it’s a really nice business, that seems to be in a sweet spot, expanding into more retailers, and with good international growth too.

I remember my interview here with the CEO on 18 Jan 2023, which was one of the most interesting & enjoyable interviews I’ve ever done. I'll invite him back to discuss progress, when the full year accounts are published.

I’d say that the share price is probably up with events for now (at 210p), but there are obviously favourable things going on, so what’s the betting strong trading continues, and further upgrades happen later in 2023? That seems likely to me, so I would be sitting tight on my shares, if I’d remembered to buy some, which unfortunately I didn’t!

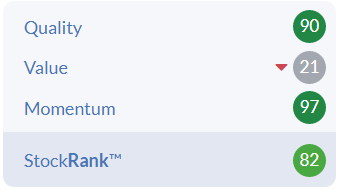

Stockopedia’s computers are on the same page - high quality company, but shares look pricey (although the latest upgrade hasn’t yet fed through, so the value score might improve) -

.

Note below that W7L qualifies for a momentum screen, so I’m going to click on this and have a look at other companies that are bucking the downward market trend - this could be a shortcut to finding the companies that are trading well, despite tough macro and markeets, and hence maybe could continue to out-perform possibly?

(clickable link on picture below)

It hasn't always been plain sailing for W7L in the past, but I think it's a much better business now (this was discussed in my CEO interview)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.