Good morning from Paul!

That's it for the day, and the week. Have a lovely long weekend!

Breaking news! No not another takeover bid, this is just to flag that my weekly roundup podcast has gone up early, as I'll be busy returning to the UK tomorrow. (EDIT: multiple background sound effects, I realise on listening back. Typical Gozo - there's a bird's nest just above my head, building site next door, under the flightpath for Luqa Airport, and swimming pool constantly refreshing. Maybe some cannons or guns going off too, that's usual?)

I hear that Mello was very enjoyable, and sorry I couldn't make it this time (I extended my trip to Gozo due to a lingering chest infection, which is now almost sorted).

Troll

I see we had a trolling outbreak again yesterday. Just when you think it's all sorted, another one pops up! Ignore them, is my advice, because they feed on and enjoy the disruption they cause. I look forward to the developers adding an "ignore user" facility, which I think we need. I've added an extra bit to the explanatory notes below, to emphasise that with the resources available (me, and 3 hours of Graham 4 days pw), we obviously can't cover everything! Although we're getting close to having reviewed c.500 unique companies so far in 2024, so there's no hope if you can't find anything of interest amongst that lot! We're not machines, we're human, so we have the occasional off day, offset by plenty of out-performing days. If people moan at me, then it stops being fun, and if that happens I'll hang up my keyboard and do something else with my time, to be blunt.

Market thoughts

Dismissing UK small-mid caps is now going out of fashion, I'm pleased to see.

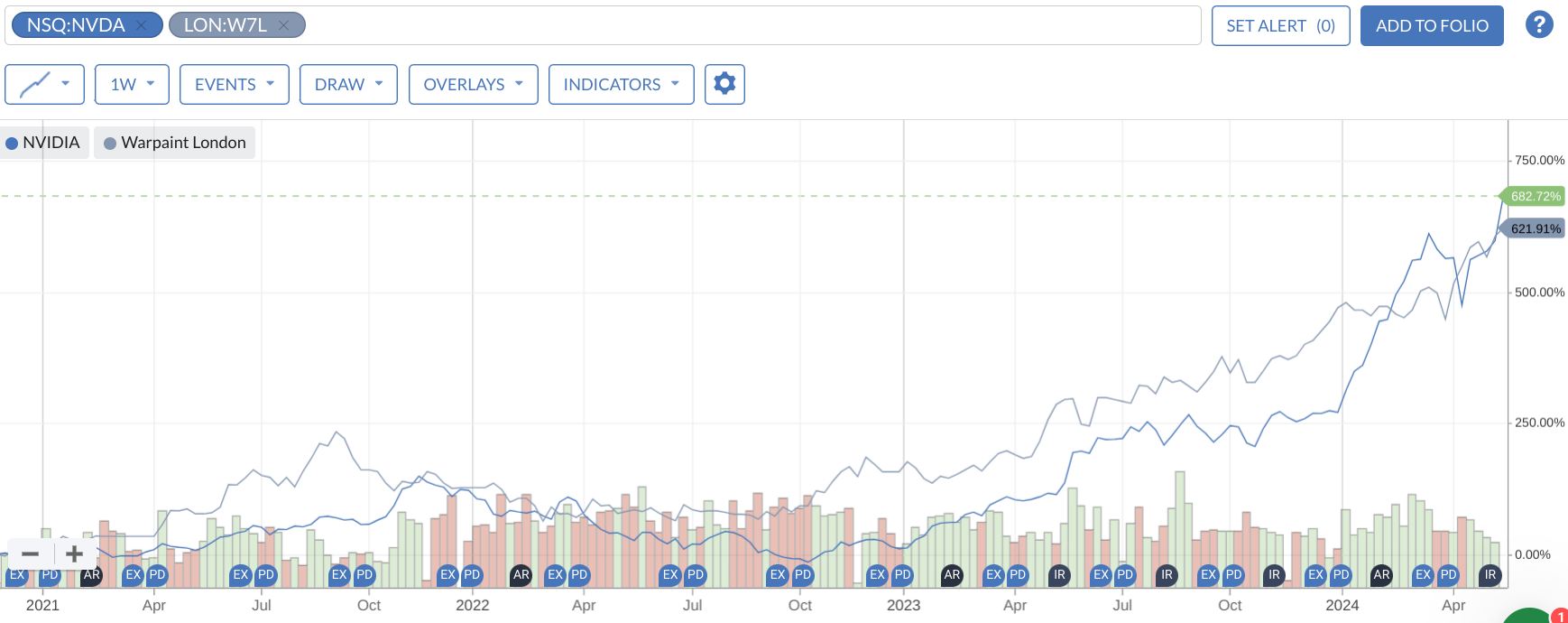

NVIDIA (NSQ:NVDA) has 5-bagged in the last 3 years, which is truly remarkable, what an extraordinary company and share. But so has Warpaint London (LON:W7L), also 5-bagging (well, almost) over the same period (which we flagged early on here in the SCVRs, and all the way up with GREENs). So we've got plenty of opportunities over here, and much less competition for the shares, as people have drifted away from the UK market., on shares that are quick & easy to analyse. I can almost hear all that cash starting to flow back into UK small caps!

EDIT: I did play around with the starting point on the chart below, to show the most favourable outcome that supports my case here, just to prove you can show almost anything with statistics by selecting a supportive starting date, lol! -

Although the almost vertical moves on lots of shares recently is starting to look a bit frenzied - is it time to take some profits on things that have bounced excessively? I'd say so, yes. Then we have the pot of cash to redeploy on new ideas. As my mentor says, "If you're going to sell, make sure you're the first to sell" - ie don't wait for the price to go into freefall because others got there first. Good advice that I keep front of mind.

Or, if you're a long-term holder, then the short term price gyrations don't matter, especially if there's a nice income from divis flowing in. Everyone has their own way of doing things, and "Do more of what works best for you" is what my mentor told me, and I pass that on to investors I talk to.

I find at the start of a new bull market, there's a lot of money to be made by being quite nimble, and rotating big winners into similarly good companies whose shares have not yet moved upwards (maybe due to a lingering institutional seller that's nearly finished). They tend to join the party soon afterwards, giving a double benefit. I saw that in both 2003 and 2009, both very good years for me. People start to take on more (perceived) risk in early bull markets too, so it's important to be flexible I think, and consider taking positions in companies with perhaps more debt than I would like, but no signs of actual distress. Those shares are often the biggest % gainers.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech). Although if something is newsworthy and interesting, we'll comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

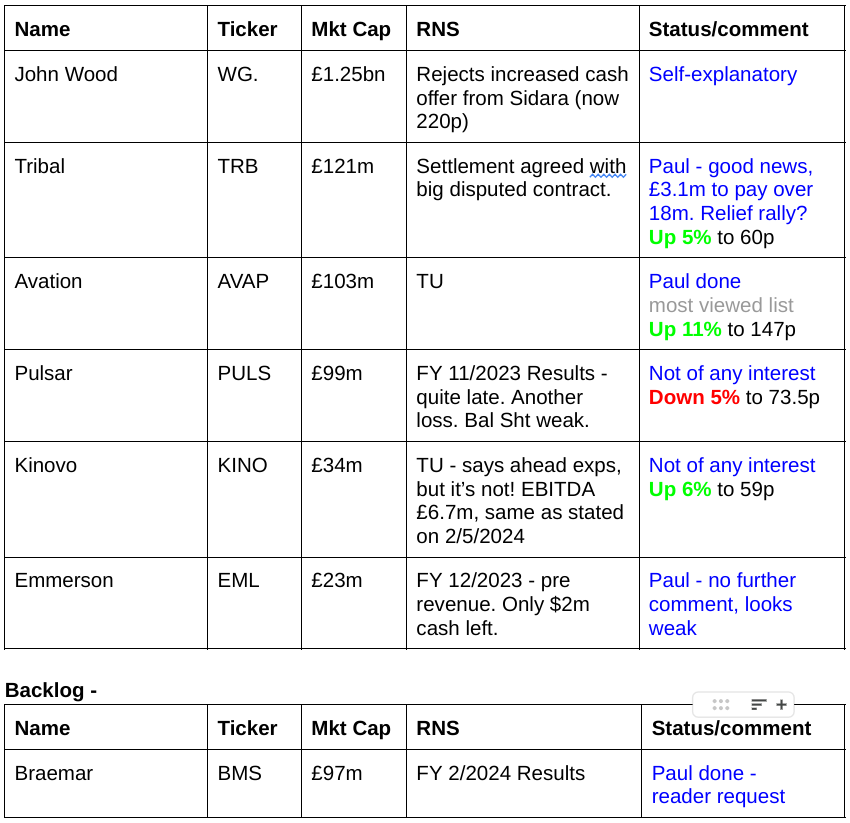

List of Companies Reporting Today

Very quiet today, so I'll have a look back to see if we missed anything noteworthy Mon-Thu this week.

Other mid-morning movers (with news)

Surface Transforms (LON:SCE) - up 6% to 1.32p (£17m) - Open Offer Result - Paul - AMBER/RED (speculative punt possibility?)

Good news today of the open offer being over-subscribed for new 1.0p shares. So they’ve upped it from 200m to 300m. By my calculations that will now increase the share count to 1,302m (allowing for the latest placing, plus the enlarged open offer). That gives my manually recalculated £17m market cap above. When there’s huge dilution, you have to be careful not to chase up the share price too high, by referencing previous share prices when much fewer shares were in issue. So for example with SCE a share price of only 3.0p would be a £40m market cap.

Management today confirm an order book of a huge £390m (although that’s spread over multi-years), and a pipeline of another £400m. That’s great, if they can actually figure out how to manufacture the brake discs in scale.

They also confirm that they’re confident they now have enough funding. I’m fairly sure they said that in the previous 18 fundraises too.

Paul’s view - my policy of steering clear of anything that obviously needs to raise fresh equity has dodged lots of speculative bullets, as 1p seems to now be the default price for last chance saloon placings & open offers. Once a fundraise is done, then that’s the time to have a speculative punt on it, in my view, but only with money we can afford to lose, and keeping a close eye on the exit. With this latest fundraise now in the bag, immediate financial risk has receded, so I’ll shift up from red to AMBER/RED. I imagine flippers from the 1.0p open offer are likely to keep a lid on the share price, as banking a say 40-50% gain will be tempting to the many private investors who will have taken part in the open offer. Good luck to holders, I hope this time it finally works! Tempted to have a little flutter myself actually, as mentioned last time!

EnSilica (LON:ENSI) - down 17% to 45.5p (£39m) - Equity Fundraise - Paul - AMBER

Announced after hours last night a placing. Today confirms it has raised £4.9m of new equity at 45p (a hefty 18% discount to last night’s closing price of 55p). Trivial amounts subscribed for by the Board, who also have trivial existing holdings, apart from the CEO who is not buying any shares in the placing, instead accepting dilution from 18.9% to 17.2%.

There’s also a tiny retail £0.3m offer through a platform I’ve not heard of before called WRAP. Googling it, this seems to be something set up by leading market maker Winterflood, called Winterflood Retail Access Platform, so I’d be interested to hear more about this. We’ve already got a couple of others, including REX (from Peel Hunt, I think?) and what’s that other one that’s been going a while (will edit this when I remember the name, it's two words). EDIT: Primary Bid, thanks to AstonGirl!

I flagged here 3 times (14/12/2023, 26/2/2024, and 28/2/2024) that ENSI would need to raise more equity. Hence why it’s so important to not be the cannon fodder that chase up the share price on the rampy news, but then get slammed with dilution when they use the good news to raise more funds, as has predictably happened here.

Now that it’s better funded, I can safely go up from amber/red to AMBER, as risk has now reduced, and the price is cheaper (but more shares in issue of course). There were some interesting elements in previous RNSs, so this might be something speculative to have a look at, for the more adventurous amongst us. It’s a chip designer of some kind. Let’s hope it doesn’t end up crashing like the disastrous Sondrel (shortly to de-list after being bailed out by a private equity firm).

I think our process here of steering clear, and flagging the risk of dilution/insolvency/de-listing at many under-funded micro caps is working very well - we’re getting nearly all of them right, and I hope that’s saved readers a bob or two in avoided losses.

Summaries of Main Sections

Braemar (LON:BMS) - 295p (£97m) - FY 2/2024 Results - Paul - AMBER/GREEN

Readers subject me to an hour's torture trying to unpick the FY 2/2024 results from this shipping broker. Problems are unchanged - excessive share option dilution, inadequate explanation of historical transactions that caused shares to be suspended for months last year, little balance sheet support, also some funnies in the accounts, and numerous EPS options to choose from! All that said, the valuation now looks so attractive, I'm pulled magnetically towards AMBER/GREEN, despite my unease over the various issues.

Avation (LON:AVAP) - up 11% to 146p (£103m) - Trading Update - Paul - AMBER/GREEN

Ahead of expectations trading update today, and interesting value in the aircraft order book. Thanks to readers who have been flagging up this interesting special situation previously. I do a brief review below, and conclude that the discount to NAV looks worthy of a closer look.

Paul's Section:

A couple of quick comments on company webinars -

Intercede (LON:IGP) (I hold)

This niche software company, which specialises in online identity management (eg 2-factor logins), held a Capital Markets Day yesterday, which was also broadcast live on InvestorMeetCompany (the recording is now available here). So if you find yourself with several hours to kill over the weekend, this is worth checking out. I learned more about the company, and particularly enjoyed hearing talks from IT specialists, and a glowing report from one of IGP's main systems integrator partner. A cybersecurity (friendly hacker) explained how easy it is for hackers to break into IT systems, even for major corporations. I made that rookie error of buying more shares during the webinar, which I know shouldn't be done - having a cooling off period after presentations is my personal most frequently ignored golden rule!

Nexus Infrastructure (LON:NEXS)

I've previously mentioned how my two questions on this webinar were not answered. To be fair, they have now been answered. I've never looked at the Q&A tab on InvestorMeetsCompany presentations, but this is where they subsequently give written replies to questions that were not answered live for whatever reason. Here it is - if you click on the Q&A tab at the top of this page. I had queried why receivables are so high. The reply says that this is partly due to retentions on contracts, which can take c.2 years to be received. This has rather put me off this share, since as revenues expand again, then it seems likely that more cash will get sucked into receivables. It's only getting a c.13% gross margin, and then has to wait 2 years for the profit element to be paid, which seems the worst business model I can think of - very low margin, and very slow payments from customers. So I decided to let my shares go, which had only been a small starter sized position. My second question was about de-listing risk, where they replied something like there are no plans to delist, but I can't find that in the Q&A section.

Reader request -

Braemar (LON:BMS)

295p (£97m) - FY 2/2024 Results - Paul - AMBER/GREEN

A reader request that got over 20 thumbs ups, so I’ll take a look.

Braemar Plc (LSE: BMS), a leading provider of expert investment, chartering and risk management advice to the shipping and energy markets, announces its audited results for the year ended 29 February 2024 ("FY24"), which are in line with market expectations[1].

[1] Company compiled consensus as at the date of this announcement: FY24 revenue of £150.4m and FY24 underlying operating profit (before acquisition-related expenditure) of £18m.

Webinar forthcoming - 11am, 30 May, on IMC.

Checking my previous notes confirms a nice summary from TortoiseInvestor here, that there were significant problems previously at BMS in several ways - excessive share options (I also flagged this here on 22/3/2023), and BMS shares seem to have been suspended from June-Nov 2023 due to investigation into $3m of historical transactions - which seemed bizarre at the time, given $3m is not anywhere near enough to jeopardise the company’s solvency.

On to the FY 2/2024 results, which it says were in line with market expectations, but the adj EPS is 21% down on FY 2/2023. Also note the large different between statutory and underlying results, and that it shows basic, not diluted EPS below -

Further down we find out that underlying basic EPS of 36.62p becomes 29.96p adj diluted EPS (and 12.8p statutory diluted).

Adjustments - are they reasonable? They’re in note 2.2, with the main ones being £2.6m investigations costs of the $3m historical transactions, not expected to recur. So it cost more to investigate them, than the actual transactions, how does that make sense? It says these are not going to recur, so I can see why it is fair to adjust out as a one-off, but I would still like to better understand what actually happened.

The other main adjustment is the dreaded “consideration treated as employment costs”, which I struggle to understand wherever it crops up (eg at Begbies Traynor (LON:BEG) and S4 Capital (LON:SFOR) ) - it’s something to do with acquisitions, where accounting standards require deferred consideration to be classed as employment costs. The CFO at BEG tried to explain it to me on a Zoom, but I still didn’t properly understand it. Not many accounting concepts defeat me, but this one has I’m afraid! So I take the view you either just accept the adjustments, or you don’t. Sorry that’s not much help!

Dividend yield is 4.4%, and the payout of 13.0p is up 8%.

Outlook comments sound reassuring, especially the big increase in order book, although I wish companies would specifically confirm (and quantify in a footnote) market expectations instead of less precise (some might say) waffle -

(sorry I can’t highlight anything on this travel chromebook)

Balance sheet - a few items in there to note, but nothing particularly big (e.g. pension surplus £1.4m, convertible loan notes £3.0m [what are the terms?], long-term receivables explained in note 4.1 of £4.6m). Cash of £28m roughly offset by long-term borrowings of £27m (I’ve knocked off £3m in lease liabilities), see note 4.6.

NAV is £80m, but intangible assets are the bulk of this, at £74m, giving NTAV of c.£6m - so effectively there is hardly any asset-backing to this share underpinning it, which may not matter providing earnings and divis keep coming out.

Forecasts - thanks to Cavendish for an update today. Muddying the waters further, it reports FY 2/2024 adj diluted EPS at 34.1p, when I was just getting comfortable with the company’s 30p above!

It assumes a rise to 38.1p in FY 2/2025, so a PER on that basis of only 7.7x - that looks appealing cheap, and might be enough to help me shed some of my general sense of unease about this company and its accounts.

Paul’s opinion - the key issues remain the same - excessive share options (although taken into account in diluted EPS), the long & seemingly unexplained suspension of the shares last year. Also note 4.2 shows unusual receivables collection, so I hope on the webinar people ask management why some customers don’t seem keen to pay on time, or at all?

Overall, I can see why some investors will be attracted to the low PER here, and a pretty reasonable dividend yield. With the company also talking about favourable market conditions too (how much due to geopolitical crises?), the low valuation metrics definitely appeal.

I didn’t really want to go above amber, and am uneasy about giving a view here, but I think the valuation numbers are pulling me towards AMBER/GREEN, but with some reservations as noted above.

Avation (LON:AVAP)

Up 11% to 146p (£103m) - Trading Update - Paul - AMBER/GREEN

There have been some terrific reader comments lately on this aircraft leasing company, from davidjhill and others (sorry I haven’t name-checked everyone). So thought I’d give it a fresh look. We covered Avation a lot years ago, especially in 2015 & 2016 when affable Aussie, former CFO Richard Wolanski used to turn up for pretty much every private investor event that was held!

The pandemic obviously caused chaos in the airline industry. Graham did a quick review most recently here on 15/9/2022, concluding that the “value could be substantial” at Avation, and that it deserved a closer look.

I particularly like the point that readers here flagged up, that AVAP’s order book now contains hidden value apparently, due to the market value of aircraft it has on order being higher than its contracted cost. So this looks a special situation worth investigating further, if we haven’t missed the boat already, given the big recent upwards share price move? Although zooming out to 5-year view below, shows a move that’s within the normal range, and also bear in mind it got through the pandemic with only about 10% expansion of the share count, hence maybe pre-pandemic share price of c.300p might not be a pipe dream?

Latest news starts off very nicely -

Avation PLC (LSE: AVAP), the commercial passenger aircraft leasing company, provides the following trading update as of 24 May 2024:

The Company expects to report a profit for the year ending 30 June 2024, which is significantly ahead of current market expectations.

Avation's fleet comprises 34 aircraft leased to 16 airlines in 14 countries. The fleet includes 19 ATR turboprop, 13 narrowbody jet and 2 widebody jet aircraft. As of 30 April 2024 the average age of the fleet was 7.2 years and the average remaining lease term is 4.3 years

All aircraft are currently leased with the fleet currently generating total monthly lease rentals of US$7.9 million which has increased due to fact that the fleet is now fully utilized.

It quantifies what the purchase rights for aircraft on order might be worth -

Following the exercise of purchase rights for the ten aircraft, Avation was granted six additional purchase rights and the expiry date for all 24 remaining purchase rights has been extended to June 2034. Avation believes that these purchase rights have significant value. The Company uses the Black-Scholes pricing model to value aircraft purchase rights. The pricing model is volatile and sensitive to changes in underlying asset valuations, interest rates, time to expiry and other inputs. At current market conditions the estimated purchase rights value is US$115m (unaudited).

Bear in mind that the market cap of the whole company is £103m, so that US$115m hidden asset is highly material! Although I see from the 31/12/2023 H1 balance sheet that an $88m asset called “aircraft purchase rights” was already recognised within fixed assets. So maybe the “hidden value” isn’t actually hidden, most of it seems to already be on the balance sheet. That needs careful scrutiny.

NAV was 256p according to Avation at Dec 2023, which hardly includes any goodwill or similar intangibles.

Note that the $699m net debt caused $31m in H1 finance charges, which more than consumed $18m operating profit, resulting in a loss in H1.

Paul’s opinion - sounds interesting, but it would take me lots more time to dig fully into all the detail, but so far I quite like what I see. You’d need to do loads more work, inspecting the terms of the debt, competitor valuations, etc.

Thanks to Canaccord for a more detailed note out today, which highlights a big NAV discount to peers, although I’ve heard that a lot before with AVAP and it didn’t seem to make much difference in the past.

Anyway, I like discounts to NAV and special situations, so purely on my brief review, let’s give this the coveted “worth a closer look” SCVR conclusion, and AMBER/GREEN. Nice spot readers, and thanks for sharing your more detailed work with us.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.