Good morning! It's just Paul here today, as it's Friday (usually quieter). I'll sign off for today, and the week, so today's report is now finished.

Have a lovely weekend, and if you fancy it, do tune in for my next podcast summary of the week, on QualitySmallCaps - it should be up by Sat lunchtime.

Agenda -

Everything is written by Paul today, with it being Friday.

Main sections:

Alumasc (LON:ALU) - announces a disposal of its loss-making Levolux subsidiary, which gets its £2m loss off the books and into discontinued operations for FY 6/2022, which is handy! I have a ponder about cyclical businesses, and conclude that we don't know what happens next at this stage.

Tracsis (LON:TRCS) - I circle back to its positive year-end trading update issued this Weds. It's not cheap, but I think Tracsis looks on a roll, with positive forward-looking commentary. Thumbs up from me, although it's not cheap, but the premium rating looks justified.

Short sections (no further detail):

Micro Focus International (LON:MCRO) [no section below] - not a small cap but… a recommended cash takeover bid has been announced for Micro Focus, at 532p per share. The bidder is a large Canadian software group called OpenText. What is so noteworthy about this, is the bid premium - a whopping 98% above last night’s closing price for MCRO shares! This is the second big premium bid from Canada recently, following on from RPS (LON:RPS) which received a bid at a premium of 76% from Canada’s WSP - a larger consulting group.

I looked at MCRO here in June, concluding that it’s clearly financially distressed, with one of the worst balance sheets I’ve ever seen, including a $3.65bn net debt pile, that it was struggling to reduce. Although as noted in that report, software companies can often attract surprisingly high takeover bids, as we saw with EMIS, and smaller Proactis & Tungsten. Here’s another one, where a bidder obviously sees considerable value in the business, and seems happy to take on its gargantuan debt.

Software does seem to be an active sector right now, and it seems the worse the finances, the better chance of a takeover bid! On that basis, maybe WANdisco (LON:WAND) is the next one to be bid for?!

Holders Technology (LON:HDT) (89p - £4m) [no section below] - too small to cover here, but I’ve just read the interim accounts, so might as well jot down some quick notes. H1 revenues down 40% to £3.45m. H1 loss of £(226)k vs £104k profit H1 LY. Disposed of low margin business in 2021. Positive outlook comments for H2. Strong balance sheet, with £3.9m net current assets (including £2.5m cash). Pays divis, including a small special divi. De-listing risk must be high, as I cannot see any reason why something this small would waste money on listing costs, but it’s been listed for over 20 years! Dominant shareholder with 44%.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Alumasc (LON:ALU)

132p (down 3% at 08:53)

Market cap £48m

This announcement also includes a brief trading update, so why didn’t they include that in the title? Schoolboy error.

Trading update -

Alumasc expects to announce results in line with the Board's expectations for the year ended 30 June 2022 on 6 September 2022 and can confirm that trading in the core activities of the Group during the second half of the year was strong. The activities of Levolux will be shown as discontinued in the 2022 results.

Disposal - of Levolux. This looks a sensible disposal, as performance at this subsidiary company has deteriorated badly. Looking at companies house (co.no. 1834176), it made revenues of £12.7m in FY 6/2021, and £15.9m in FY 6/2020.

Today’s announcement says that Levolux fell to £7.8m revenues in FY 6/2022, incurring a £(2.0)m loss. Therefore it’s a significant problem now, with uncertainty over recovery (Alumasc was making upbeat sounds about Levolux being "well placed to recover", after making a £(1.0)m H1 loss, as reported in the group interim results to Dec 2021, published in Feb 2022, so things have clearly not improved for Levolux since, despite cost-cutting).

It’s being given away for £1 to an investor called Rcapital Partners. There’s another £1m receivable if Rcapital sells it on for a profit of over £1m. That’s unusual.

Alumasc will book a £14.9m impairment charge, mostly (£11.1m) intangible assets like goodwill. Tangible assets of £3.8m are being given away as part of the deal, including £1.4m cash - so really Rcapital is being paid to take Levolux away.

However, this neatly gets Levolux’s £2.0m loss for FY 6/2022 off Alumasc’s figures, as it will be separately disclosed as a discontinued activity, and investors tend to ignore that, valuing the business on continuing activities only. So I can see why they’ve done this, to clean up the numbers, and get rid of a problem subsidiary that’s losing money.

Levolux was acquired in May 2007.

My opinion - it’s not clear from Finncap’s note this morning if the elimination of Levolux’s £2m loss for FY 6/2022 was baked into the current forecasts or not? Although this bit below leads me to imagine that maybe the numbers have not yet been adjusted, so there could be upside on continuing operations forecasts perhaps?

We will adjust numbers for the disposal at the group’s forthcoming results on 6 September. [Paul: Finncap note today, many thanks for that]

Currently Finncap is saying £10.8m of adj PBT, on revenues of £97.0m for FY 6/2022. That’s 23.6p EPS, so the PER is only 5.6, which seems very cheap.

However, as we all know, if we’re going into a recession, or economic depression, then profits in cyclical sectors can quickly disappear. So maybe PER isn’t a safe way to value companies at the moment?

It all depends on what Govts do. Look at the pandemic - it looked as if everything was going to collapse, then Govts introduced such huge stimulus and support measures, many companies saw profits soar, and stock markets quickly recovered the losses. Maybe the same sort of thing might happen again?

Hence how we’re valuing all shares, is fundamentally down to your opinion on what actions Govts take to prevent an economic meltdown this time.

All I can do, is look at the finances, and report whether it looks soundly financed or not, then leave it up to you to decide if you like the shares or not. I do think it’s a great idea to be doing the research, and making a list of potential bargains, then pull the trigger whenever you’re happy to do so. Rallies can happen very fast. Whether they stick or not though, who knows?

Alumasc’s last balance sheet looks adequate, with c.£16m NTAV. There was some net debt, of £4.1m at end Dec 2021. Also note the pension deficit is small in accounting terms, but is sucking in a fair bit of cash (£1.3m of deficit repair payments were paid just in H1). Who knows what the combination of much higher inflation, higher bond yields, and lower asset values might do to pension deficits? So there’s potential uncertainty there.

Overall, this share might turn out to be cheap, if economies bounce back once we’re through this energy crisis. My hunch is that it might be too early to anticipate recovery in building products, before the expected big downturn has even happened. But as always, nobody knows how the future will pan out.

I find it's quite useful to see what level shares bottomed at during the early part of the pandemic. That might give an idea of what level investors found the value irresistible. Although plenty has changed since then, so the individual share's circumstances would also need to be taken into account. It's not easy this shares stuff, is it?!

.

Tracsis (LON:TRCS)

1032p

Market cap £306m

This was published on Weds, but slipped through the net here, so let’s circle back to it, in the absence of anything more interesting today.

Tracsis, a leading provider of software, hardware, data analytics/GIS and services for the rail, traffic data and wider transport industries, is pleased to provide the following trading update for the year ended 31 July 2022.

Key points -

“The Group expects adjusted EBITDA to be ahead of market expectations.”

FY 7/2022 revenues £69.0m (up 37% on LY [last year]) - organic & from acquisitions (no breakdown provided).

Cash of £17.2m (but there is £8.2m of deferred consideration to pay, per Finncap's note today)

Rail division - trading well, high recurring revenues, “fast-growing user base”, “large pipeline of multi-year opportunities”, won US contracts - that all sounds excellent, I like this a lot.

Other division - also doing well, revenues ahead of expectations, driven by post-pandemic recovery in events/travel.

Diary date - 9 November, for FY 7/2022 results. PIWorld results webinar at 13:00 on 11 November - registration here.

Valuation - thanks to Finncap for an update note. It has 34.5p adj EPS for FY 7/2022, rising to 41.1p for FY 7/2023. Given how upbeat the commentary is, and I see Tracsis as a reliable company (that has a track record of being straightforward with its outlook comments), then I think we can probably rely on the 41.1p EPS forecast as being credible.

That would put it on a PER of 25 times - which looks fully priced I’d say.

Balance sheet - looks OK to me. Last reported end Jan 2022, NAV is mainly intangibles (from goodwill on acquisitions), but NTAV remains positive, at £5.8m. We could probably safely eliminate the £8.4m deferred tax creditor too, which would raise adj NTAV nicely to £14.2m. Overall, it's fine nothing to worry about here, given that this is a decently cash generative, recurring revenues type of business.

My opinion - I think Tracsis deserves a premium rating. It’s managing to do that lovely thing - making acquisitions without increasing the share count or getting into excessive debt.

The share count has remained roughly constant at c.29m for the last 6 years.

Probably the only drawback, is that historically valuation sometimes got ahead of reality a bit, and it then went sideways for long periods, testing the patience of shareholders.

As something to just tuck away and forget you own it, I suspect the outcome long-term would probably be pretty good. That’s based on its track record to date, and what seems to me a very good update this week. Sounds like there’s more growth to come. Thumbs up from me.

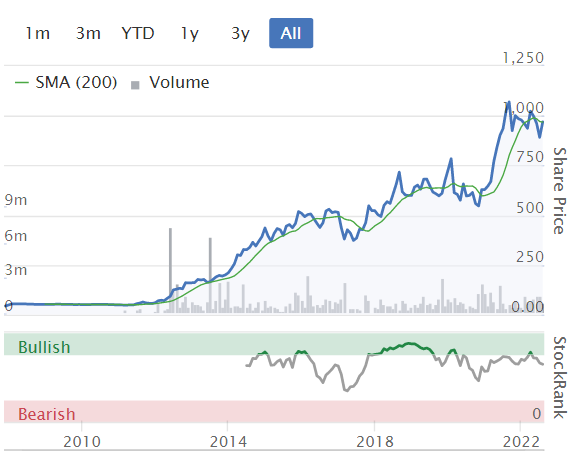

Terrific long-term track record of value creation. Also note TRCS has been a safe enclave during this vicious small caps bear market in the last year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.