Good morning from just Paul today!

Today's report is now finished, at 13:20

Tune in for tomorrow's next thrilling podcast instalment!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

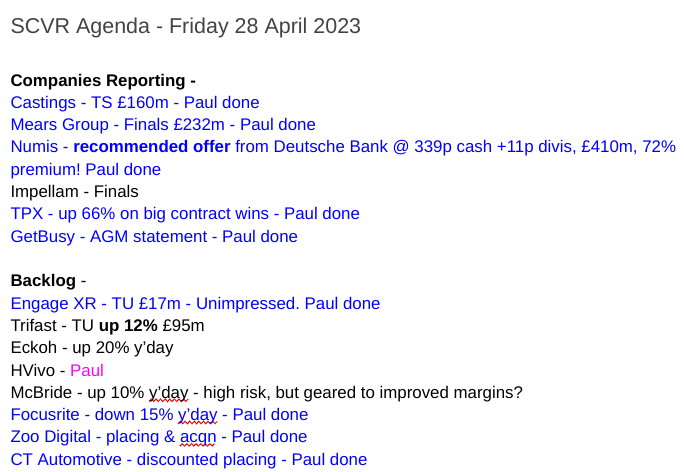

A crazily long to do list today, but I've already done 2, just need to type up my notes - I'll focus on quick comments, to get through as many as I can -

Update at 11:38 - good progress so far, lots has turned blue, on the to do! I'll have to leave some of the smaller things, and hope to get up 2 or 3 more sections on the larger market caps below.

Good, most of today's list got done, please remember we can rarely cover everything. I've deleted a couple of micro caps from the list that don't look very interesting.

Quick comments:

Numis (LON:NUM) - recommended cash bid at 350p (incl 11p divis) - Paul - GREEN

Checking our archive here, Graham has reported positively on this investment bank/broker, marking it GREEN on 3 April, 7 Feb, and 8 Dec. Graham pointed out the short term headwinds from the weak IPO market, but good recovery potential, strong asset backing, and decent yield from Numis shares.

It’s surprising to me that Deutsche Bank is doing this £410m cash bid, given it has widely publicised problems of its own.

This is a recommended cash bid, at 339p + 11p in divis, total 350p. That’s a very nice premium of 72%, so nobody can complain about that. Investors can use the proceeds to buy another cheap broker, and get more of it, which itself might then be bid for.

The takeover bids are rolling in at the moment, which does reinforce the point that private markets & acquirers are valuing some UK shares more highly than the public market does. I think this augurs well for UK markets, and a wider recovery as more people realise that the UK small caps space is (selectively) full of bargains - but also plenty of junk too though! - which is my view.

ENGAGE XR Holdings (LON:EXR) - up 18% y’day to 3.85p (£20m) - Paul - RED

I took a look at this software company focused on the metaverse (creating visual software for headsets). Q1 2023 TU says in line with expectations, and revenue up 40% on LY. Big name clients. VR concert with Fatboy Slim. Lenovo headsets coming. E10.8m cash end March 2023, after surprisingly well-supported placing in Feb 2023 (it was getting close to running out of cash, so this saved the company I would say). No 2022 accounts published yet, but FY 12/2022 TU looked grim: E3.9m revenues, E(5.8)m EBITDA loss!

Paul’s opinion - looks grim to me. There must be any number of companies in this space, selling a product for less than the cost of developing it, so what’s the point?! The product demo I watched online looked really weak & gimmicky in my view. The heavy cash burn suggests it might be back for more cash in 2024. Hence the risk is investors will see it as a jaded concept, and the share price melts away to dust. Why get involved, when the chances of commercial success seem to distant, if at all? I've been in the UK small caps market for over 25 years, and have noticed that this type of share hardly ever succeeds. Even if they do, it's years, and numerous fundraisings later. They're best avoided, apart from where a commercial tipping point has been reached, where profitability and self-sustaining cashflows have been reached. EXR is nowhere near that point.

Castings (LON:CGS) - up 3% to 379p (£165m) - Paul - GREEN

Ahead of market expectations TU for FY 3/2023.

Strong demand, due to high build rates by heavy truck manufacturers (70% of CGS’s revenues derived from this sector). Some production inefficiencies in H2, but now largely resolved. Input costs (raw materials & energy) successfully recovered from clients. Balance sheet here is superb, last reported as NTAV £125m. Neutral cashflow, after special divi payment, and increased working capital. Outlook sounds positive from buoyant customer demand.

Paul’s opinion - lovely figures: PER 12.5x, yield 4.7%, great balance sheet. Pricing power proven. V high StockRank. BUT - main products (turbocharger housings) likely to be phased out with electrification? So big question is what alternative products can Castings focus on longer-term, and will these be a lucrative niche too? Still, in the meantime, it’s a thumbs up from me.

WANdisco (LON:WAND) (I hold) - suspended - Paul - RED

Update today reiterates that the entire fraud was apparently just one rogue employee. Obviously that sounds ludicrous, but that’s what we’re being told.

Hoping to lift suspension of the shares. New CFO started on 11 April. New CEO being sought. No mention of solvency or cash position, which was flagged by the company as a concern when the fraud news first broke.

Paul’s view - is not printable. Any recovery from this share would be good, as I’ve already mentally written it down to zero. Likely outcome? If it comes back from suspension I would work on the basis that it might resume trading at maybe 90% down? Because the valuation rested entirely on the positive contract announcements, which were made up. The big lesson here remains - don’t believe the trading updates from jam tomorrow companies until the numbers are audited, and the cash is in the bank. Especially when management has a track record of being overly-promotional, with false dawns before. I see my losses here as the market charging me a fee to re-learn these lessons!

Getbusy (LON:GETB) - up 2% to 66p (£33m) - AGM Statement - Paul - AMBER

In line with exps for FY 12/2023, “high level of confidence” of achieving exps. Good visibility, as it’s a recurring revenues business. ARR now £20.5m, up 17% on a year earlier, at constant currency. Positive noises made about customer acquisition, average revenues per user, and reduced customer churn.

Liquidity looks OK, with £2.7m cash, plus unused borrowing facility of £2m.

Guidance FY 12/2023: revenue £21.1m, adj EBITDA £0.7m - unchanged EBITDA from FY 12/2022, and it turns into a £(0.7)m loss before tax.

Paul’s opinion - it looks OK, but still seems sub-scale, isn’t profitable, and growth isn’t rapid enough to get me excited. Hence shares look uninspiring, unless it can really turbocharge the growth, which isn’t happening yet. Also I find generally this type of business usually seem to find things to spend additional revenues on, usually increased sales & marketing (as is happening here), so the operational gearing often turns out to be an illusion. But it’s chicken & egg - they can’t get the growth, without first spending more on sales & marketing. That said, investors like recurring revenues businesses, and tend to value them quite highly. The fundamentals don't justify a higher valuation right now.

Zoo Digital (LON:ZOO) - down 9% to 166p (£148m) - Paul - AMBER

Has done a placing at a 13.5% discount (160p), issuing 7.8m new shares (89.8m existing, so 8.7% enlargement), to raise £12.5m before fees. There’s also a very small £0.5m retail offer to existing retail investors, through BookBuild.

Purpose - proposed acquisition of a Japanese company later this year.

Trading update - FY 3/2023: revenues $90m+ (up 28%, almost all organic), adj EBITDA $12m+ (up c.44%). Cash of $11.8m. Revenue is well short of expectations (of $99m), due to major customer delays. But as it’s a low gross margin business, that doesn’t seem to have done much damage to profits.

Paul’s view - it’s a mild profit warning, obscured by the fundraise news. Annoying that the fundraise is at a 13.5% discount. Also raising more equity reinforces that this has not historically been a profitable or cash generative business. FY 3/2023 seems to be its breakthrough year, where it is forecast to make c.£7.1m adj PBT.

We’ve commented positively on the great newsflow from ZOO during 2022, but I’m less keen on it after this profit miss, and dilution from the placing. Still, it’s a good story, although I think the current valuation (PER 30x FY 3/2023, and 21x FY 3/2024) looks fully priced for the time being. Gross margin of only 32% indicates this is a competitive area, lacking pricing power. Although that’s arguably offset by the structural growth opportunities from streaming TV services globally.

I’ll shift from green to amber, to reflect dilution & the mild profit miss.

CT Automotive (LON:CTA) - 43p (£22m before fundraising) - Paul - RED

I’ve only mentioned this automotive parts supplier once here, on 9 Dec 2022, to warn people away from it, after a profit warning took it down 16% to 102p, and leaving it indicating an $11m loss for FY 12/2022. Bear in mind this company only listed in Feb 2022, so it’s been a disaster. Also net debt looked worryingly high when I reviewed it in Dec 2022.

Problems seem to have been caused by semiconductor shortages, supply chain bottlenecks, input cost inflation. However, I wonder if there might be recovery potential here? It operates in a variety of low-cost countries, including China, but might see more demand for reshoring in e.g. the USA market (I think it has a factory in Mexico). Volex recently noted this factor is helping demand from its Mexican factory. Also as we’re seeing from CGS today, production of vehicles is now recovering, so demand for components should also logically be recovering.

The fundraising CTA announced this week dilutes existing shares by 45% (including the Exec Chairman who will still own 27% after the fundraise), at a hefty discount - priced at 34p. This raises £7.7m before costs.

Paul’s opinion - obviously a nasty situation, now with dilution, but I’ll keep an eye on it, as there’s a possible recovery story here at some point. I need to see the full 2022 numbers, which haven’t been published yet. Maybe this fundraise was essential to persuade the auditors to sign off the going concern note in the 2022 figures?

Tpximpact Holdings (LON:TPX) - up 66% to 53p (£49m) - Paul - RED

An announcement today about big contract wins with UK central Govt has put a rocket under this troubled IT group, adding £20m to its market cap.

The deals are worth up to £77m over 4 years, with the Dept for Education, and Land Registry.

It certainly reinforces TPX’s credibility to win contracts of this size with Govt. But it also makes me wonder what the terms are? It won them in a competitive tender, and there’s always the risk that a financially troubled group like TPX, which has stretched its banking arrangements, might be tempted to bid for work at less than ideal terms. We don’t know.

I reported here on 31 March 2023 how its bank had waived the covenants that were breached on that day - a very close shave.

Paul’s opinion - I hope TPX uses this contract win euphoria to get an equity fundraise away, which it needs to become financially stable enough. The Sept 2022 balance sheet is very weak, with NTAV negative at £(16)m, with £20m of long-term bank borrowings sticking out like a sore thumb. I’d want to see that at least halved, with a £10m+ placing, before considering this share safe enough to invest in. In the meantime, it’s making progress, but still very high dilution/solvency risk.

Mears (LON:MER) - up 6% to 222p (£245m) - Paul - GREEN

I last looked at this provider of maintenance & repair services for housing here on 8 Dec 2022, concluding that the trading update and outlook both looked good, awarding it a coveted SCVR thumbs up!

Mears manages & maintains about 450k affordable houses in the UK - so it’s an outsourcing group for this sector.

What’s the latest? Today we get FY 12/2022 results, another positive trading outlook comment, and a £20m share buyback.

Adj PBT is £35.2m, up 37% on LY. Thin margins though, as this profit is generated from £960m revenues.

Delighted to see average daily net cash of £43m disclosed - this is far more useful than the period end day’s snapshot (which was £100m net cash at end Dec 2022).

Nice divis here, at 10.5p for 2022 in total (2021: 8.0p).

Adj EPS is 24.5p (2021: 18.2p), so the PER is 9.1x - still good value I’d say.

Order book healthy at £2.9bn, about 3-years revenues.

Balance sheet looks OK, neither strong nor weak, in my view.

Outlook - positive start to 2023, in line with expectations.

Paul’s opinion - positive, this gets a thumbs up. I wouldn’t expect this type of business to ever attract a massive PER, but 9.1x looks too stingy. So it’s not difficult to imagine say 20-50% upside on the share price, in a more healthy stock market, and you get paid decent divis whilst you wait.

Paul’s Section:

Focusrite (LON:TUNE)

451p

Market cap £267m

Shareholders have had a horrible time here. This share seems to have suffered that nightmare double whammy of seeing forecasts fall, combined with a growth company high PER rating turning into a value company lower PER. Combine those two, and they’re a powerful force on the way up, but unfortunately on the way down too. As you can see -

Here’s the share price since listing -

I never would have predicted such a big sell-off, although it was clearly overvalued at the peak.

In fact, I called this one wrong when last looking at it here on 14 March, giving it a GREEN opinion at 665p, thinking it was reasonably priced on a fwd PER of 15x. Nobody knows what will happen with short-term market sentiment though, including me! We're really just looking at the company fundamentals here.

Turns out the market disagrees, with it now down another 32% in the last c.6 weeks to 451p.

So I looked at its recent interim results last night, asking myself, has it overshot on the downside now?

Here are my notes from the interims -

Broker forecasts have reduced to c.40p EPS (down, but hardly a disaster - but could they drop further, now the earnings trend seems to be downwards?). This is still double the pre-pandemic level of EPS, so this is not a broken business.

Founder, Philip Dudderidge, still owns 33% - the owners eye, but not too dominant, in my view.

The well-known Buffetology Fund (which has had a difficult time, like many of us), is a notable major shareholder with c.10-12% - could they be a potential seller, to meet redemptions, which might depress the share price?

StockRank is low, at only 27.

Last reported on 14 March 2023, with in line H1 TU, and FY 8/2023 also guided in line. Although broker forecasts have been falling, so it’s not really in line! -

Interim results to 2/2023 -

11 brands now (musical instruments, speakers, and the core products are boxes to digitise sound, used also by podcasters)

“Content creation” division hit by surplus inventories, and having to clear old stock to make way for new improved product launches - I think this could be the problem - we’ve covered this point before actually here - that TUNE’s core products have a limited lifespan, and have to be constantly updated to remain competitive. This involves considerably capitalised R&D, and means that I question whether the business is as high quality as we previously thought?

H1 revenue £86.2m, down from £92.9m a year earlier. This is flattered by acquisition & forex. The organic revenues from core products (Focusrite and Novation brands) are down a hefty 19%.

H1 adj diluted EPS is 18.0p (H1 LY: 26.2p) - so c.40p broker consensus looks realistic for the full year, given new product launches should give things a boost.

H1 divi very small at 2.1p

It’s moved from net cash of £18.0m, to net debt of £13.2m - due to funding acquisitions. This is not a problem level of debt, so not a concern at all to me.

Audio reproduction division did well, so there’s a portfolio effect here of strength in some areas mitigating weakness elsewhere, which I see as positive obviously.

Current trading - “remained solid”, with the outlook sounding quite positive, although it’s not that clearly explained, so somewhat ambiguous I’d say.

Capitalised development spend is high, at £4.3m in H1, so £8.6m annualised. This renders EBITDA meaningless of course.

China risk - this sounds quite alarming, in that the commentary reinforces just how dependent TUNE is on manufacturing and components from China, which of course could be calamitous as relations deteriorate between the West, and China. That said, who isn’t dependent on China? If war breaks out over Taiwan, then we’re all in a mess, regardless of what we’re invested in.

Balance sheet - dominated by £84m intangibles, from multiple acquisitions. However, there’s no need to panic, as the NTAV is still positive, at £26.6m - which is adequate, rather than strong. Working capital looks healthy. Overall, at the current level of profitability, the balance sheet is fine, not a worry.

Cashflow statement - again the capitalised R&D stands out as a big number, at £4.3m in H1. Also there was a big reduction in payables, which could do with querying if anyone talks to management. We can also see that it borrowed the money to make acquisitions.

Paul’s opinion - not a great deal has changed since I last looked at TUNE a few weeks ago. So I see the 32% fall in share price since then as overdone.

A much more appealing fwd PER of 11.1x per the StockReport is interesting value for what remains a decent quality business (see the high quality scores on the StockReport).

I think it’s come into buying range for value investors, and the newsflow hasn’t been particularly bad, hence I’m happy to give it a thumbs up. It’s the sort of thing where, if I had spare cash, I’d probably be nibbling at it for a small starter size position, and then wait to see how things develop. But as always, each to their own. I can see why some investors don’t like buying into a falling price, as things often overshoot on the downside. So watching and waiting is also a sensible strategy, although that can often mean we miss the bottom, and miss out on takeover bids too. A bid looks unlikely here, since it would need the approval of the founder, with a bid-blocking 32% stake.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.