Good morning, it's Paul here.

I'm struggling to get to grips with the RNS, due to an amusing viral video having caught my attention. It's the Speaker of the House of Commons saying, "Mr Peter Bone", set to Beethoven's 5th. So if so-called Brexit is driving you around the bend as much as it is for me, then this might provide some light relief (it is very funny!)

As a further distraction, there's a tramp wandering around my neighbourhood this morning, looking like a dishevelled Father Christmas, repeatedly shouting at the top of his voice, "I've had enough!". I know exactly how he feels, small caps are really rubbish at the moment.

On to today's news.

Bioventix (LON:BVXP)

Share price: 3600p (pre-market open)

No. shares: 5.14m

Market cap: £185m

Bioventix plc (BVXP) (“Bioventix” or “the Company”), a UK company specialising in the development and commercial supply of high-affinity monoclonal antibodies for applications in clinical diagnostics, announces its unaudited interim financial results for the six-month period ended 31 December 2018.

This tiny company has extraordinarily high profit margins.

Headline figures look good;

Highlights

* Normalised* revenue up 24% to £4.4 million (2017: £3.5m)

* Normalised* profit before tax up 24% to £3.2 million (2017: £2.6m)

* Closing cash balances of £5.5 million (2017: £5.6m)

* First interim dividend up 20% to 30p per share (2017: 25p)

Outlook - sounds positive too;

We are delighted to be able to report such positive news for the current half-year. We are pleased with the continued success of our vitamin D antibody and the remainder of the core antibody business. We remain optimistic about our troponin revenues and the success of these high sensitivity troponin products around the world and we look forward to further progress in the second half of the year.

I don't see any mention of performance versus market expectations.

My opinion - none really. I know the bull case pretty well, having met the company several times over the last few years. To my mind, the £185m valuation is now so large, that you really have to understand the products & markets very well indeed, and be super-confident that amazingly high profit margins are sustainable.

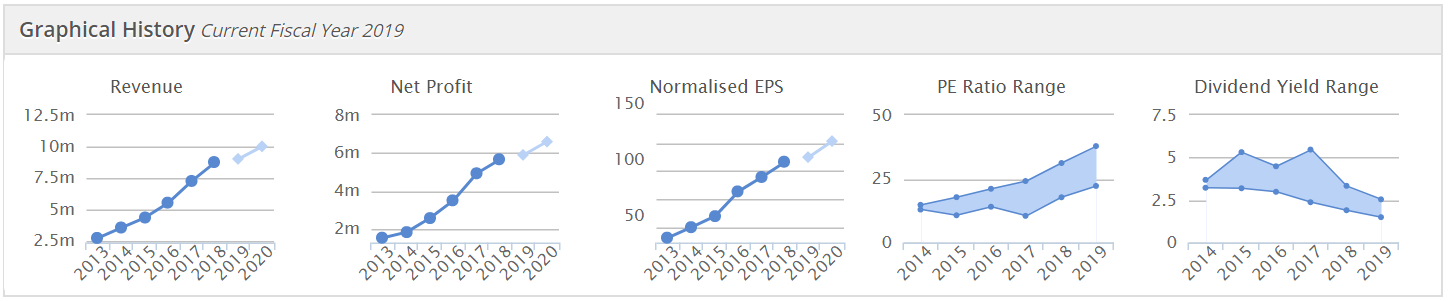

The company has a brilliant track record;

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.