Happy Friday!

Purplebricks (LON:PURP)

- Share price: 377.625p (+1.4%)

- No. of shares: 272 million

- Market cap: £1,027 million

This unusual estate agency issues a bullish headline for its AGM statement:

Strong progress across three continents, on course to meet expectations

UK revenues are still guided to £80 million for the full year (ending in April) and H1 revenues should have more than doubled.

The US launch is underway, having begun on 15 September.

Quick excerpt from the CEO comment:

We are relentless at working to ensure we understand our customers' needs and meet their expectations and are proud of our 27,000 Trustpilot reviews and our NPS score of +80. Considerable progress has been made across the Group in the financial year to date and we are confident in our future and in meeting the Board's full year expectations."

Indeed, I too have referred to the online customer reviews when weighing up the pros and cons of potentially buying shares in Purplebricks.

However, it turns out that Purplebricks has been unhappy with what has been written about it online, when it's less than favourable.

The independent review website AllAgents suspended its coverage of Purplebricks following threats:

Due to repeated threats of legal action forcing the removal of content and negative reviews from our website, we have regrettably taken the unprecedented step in suspending the PurpleBricks profile page until further notice (as of the 18th September 2017).

It has even taken down the original notice of suspension, following more threats:

Not only, it appears, does Purplebricks not like what our reviewers say about them on allAgents, but they're also rather miffed about what we wrote about the suspension of the Purplebricks profile on our site. So, due to the further threat of litigation from Purplebricks, we've decided to remove it, despite it being entirely factually correct.

And how's this for a rhetorical blow:

In our humble opinion the thousands they're paying their lawyers to write to us might have been better spent responding in a positive way to the criticisms raised by our reviewers.

Ouch!

I already felt that Purplebricks was overvalued, but my conviction is growing. Companies should be able to take criticism, and allow customers to discuss their experiences without trying to shut down debate.

Shutting down debate is impossible in the current year, anyway, due to the nature of how the internet works.

To be fair to Purplebricks, their CEO claims that the AllAgents reviews which the company disputed were fake, could not be justified, or were by people who hadn't used the agency.

But have any other agencies had the same issue with AllAgents? Have any other agencies had their coverage suspended? If not, then the problem would seem to lie mostly with Purplebricks.

Applegreen (LON:APGN)

- Share price: 530p (-1%)

- No. of shares: 80.8m (+8.1 million Placing Shares)

- Market cap: £471 million (including Placing Shares)

Completion of placing raising EUR46.9m (£41.1m)

This is an Irish petrol retailer which has been expanding through the UK and USA.

I won't go into it in detail here but I'm flagging it as worthy of further research, because I think it does have a lot of growth potential, and the execution of the growth strategy so far has been excellent. The number of sites has grown from 152 to 283 since December 2014, and it's now in the process of acquiring US and UK businesses with almost 50 sites between them.

This placing is going to assist in funding those acquisitions and also help growing the rest of the pipeline too. It's a prudent move, as net debt had ticked up to €33 million by June 2017.

Today's placing was fully subscribed and sets the company up for the next stage of growth in an industry which might be set for a lot more consolidation in the years ahead.

Brighton Pier (LON:PIER)

- Share price: 114p (+4.6%)

- No. of shares: 31.8 million

- Market cap: £36 million

This group owns Brighton Pier and Eclectic Bars, and is run by the well-known investor and entrepreneur, Luke Johnson. He has a 24% stake.

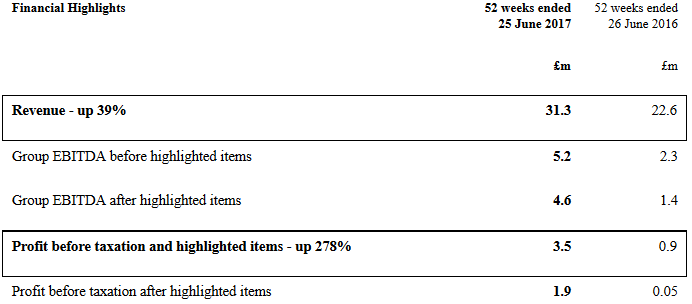

The Pier was added in April 2016, so last year's results (i.e. results for the year ended June 2016) mostly don't include it. So there is no point in making a simple year-on-year comparison of results.

Actually, I'm finding these results quite frustrating. I want to see how the Eclectic Bars performance has changed year-on-year, but there is no proper segmental breakdown of the figures.

We are only told that the Bars division made an operating profit of £2 million before losses on disposals, but the corresponding number for last year isn't given! In my opinion, it's unsatisfying to have the analysis of performance broken down at great length into "Pier" versus "Bars", but then for each division not to have its respective contribution to group financial performance made explicit.

Making do with what's given, these are the aggregate results:

The Pier traded in line with expectations during the period, but the latest trends aren't so positive:

Since the end of the financial year, trading on the pier during August and September has been mixed and did not match the strong trading performance of financial year 2016, owing to rain and strong winds. The management team at the pier has shown itself adept at generating revenue when the sun shines and saving costs when possible.

Meanwhile, Bars improved its gross margin by 200 bps and tightly controlled its costs, disposing of six underperforming venues and closing its doors on unprofitable nights.

The group has an ambitious strategy to "create a growth company operating across a diverse portfolio of leisure and entertainment assets in the UK", hoping to become a sector consolidator.

Regular readers will know that I'm a sceptic when it comes to bars and restaurants. To me, they resemble airlines: there are very large fixed costs (rents, wages) and yet most players in the sector end up competing with each other on price. There is no long-term competitive advantage.

This particular company has net debt of £7.2 million (gross debt £11.3 million), doesn't pay a dividend, and has a strategy to seek out more acquisitions. If you have confidence in management and/or in the Eclectic formula, then fair enough. Personally, I would need a really cheap valuation multiple and preferably a strong dividend yield to get me interested. And that's not currently the case.

ITM Power (LON:ITM)

- Share price: 47.5p (+12%)

- No. of shares: 250.6m (before issuance of 73 million new shares)

- Market cap: £119 million

Proposed Placing and Open Offer

This is a hydrogen energy company which had a material uncertainty over its going concern assumption the last time I covered it.

It is in the process of sorting this out now, with a proposed placing and open offer to raise a gross aggregate amount of £29.4 million (£25 million in the placing, £4.4 million in the open offer).

The 40p issuance price is a discount to yesterday's close, but the news has been greeted positively so the shares are currently trading at 47.5p.

I took a look at some company literature and interviews a while ago, and was impressed with the technology. If hydrogen becomes more widely used, particularly by vehicles, then ITM could be exceptionally well-placed to serve this growing industry.

Revenues have remained very small so far, however, so there is no doubt at all in my mind that this is in the "speculative" category, and Stockopedia algorithms agree ("highly speculative"!).

But the work pipeline reported at the final results recently was some £35.5 million. Today, it upgrades that to £36.7 million of projects under contract or in the later stages of negotiation. How much of that will translate into profitable cash income is open to question.

We are also told that there are 50 additional projects worth up to £180 million in sales, where ITM has been "engaged to provide a written proposal, the client is understood to remain actively interested", and there is a belief that that the client "has the financial means and the ambition to implement the project in the medium term".

So it sounds as if ITM could potentially spring into life over the next few years.

This is how the fresh money will be used:

The net proceeds of the Firm Placing and the Open Offer (expected to be up to approximately £28.4 million) will be utilised by the Company to provide working capital to support the delivery of the contract backlog and opportunity pipeline, to move to new larger facilities to increase annual production capacity, to strengthen the Group's balance sheet, and to move toward achieving positive cash flow and profitability within the medium term.

My opinion

I'm impressed by the size of the placing, and would expect that ITM is financially secure for at least the next couple of years. The best case scenario, which can't be ruled out, is that no further funding will be required. Although if significant numbers of those 50 other projects turn into contracts, they could create a short-term shortfall.

As far as risky shares go, this looks like one of the more interesting ones!

That's all for this week, thanks for dropping by and have a great weekend!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.