Good morning from Paul & Graham!

All done for today, and the week! Have a lovely weekend :-)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

A deluge of new reports today, but mostly uninspiring companies I have to say (EDIT: actually, some of them are OK!) -

Summaries

Saga (LON:SAGA) - 121p (£171m) - Interim Results - Paul - AMBER/GREEN

Signs of life at this insurance/holidays group for the over 50's. Interim results are flat vs LY, but the outlook is more interesting, saying ahead of expectations for FY 1/2024. Also it confirms there is plenty of cash & a facility available to repay the May 2024 bond in full. Useful amount of de-gearing has already happened. I think risk:reward here has improved, so it might be worth a fresh look.

XLMedia (LON:XLM) - down 5% to 8.75p (£23m) - Interim Results - Paul - AMBER/RED

Online marketing company that looks cheap superficially, but the investment case doesn't stand up to my scrutiny. In particular, the weak balance sheet, with some nasty liabilities falling due, makes any shareholder returns unlikely I think. Horrible sector, where profits are often not sustainable.

Eenergy (LON:EAAS) - 5.8p (£20m) - 12-month Interim Results - Paul - RED

This energy consultant achieves a breakthrough into profit. However, the balance sheet raises big concerns, due to a ballooning receivables book, and mounting bank debt. Looks quite precarious to me, so I'll be avoiding this one.

Ebiquity (LON:EBQ) - down 6.5% to 43p (£59m) - Interim Results (“broadly in line”) - Graham - AMBER

This media investment analysis group says that it is only trading “broadly in line”. The global advertising market remains “cautious and risk averse”, although EBQ hopes to help clients spend more efficiently in these conditions. This is not a bad consultancy in my view.

Future (LON:FUTR) - up 16% to 827p (£986m) - Full year trading update - Paul - AMBER/GREEN

Shares in this publishing/marketing group have shot up 16% today, despite its trading update only being in line. I think that's because the valuation arguably overshot on the downside, and it now looks cheap. Although the weak, heavily indebted balance sheet is far from ideal. Overall, I quite like it!

Supply@Me Capital (LON:SYME) - down 5% to 0.1p (£61m) - Half-Year Report (“broadly in line”) - Graham - RED

This fintech platform has generated a tiny sliver of revenue in H1 (£0.1m) and so it remains loss-making. The balance sheet doesn’t offer much comfort with no cash, loans from an Italian bank and a working facility offered by its own CEO. I doubt this will end well.

Cavendish Financial (LON:CAV) - 7.9p (unchanged) (£29m) - AGM Trading Statement - Graham - GREEN

finnCap and Cenkos are no more; they've been replaced by a company called "Cavendish". Cenkos staff have had to move office and the Cenkos listing has been cancelled. Market conditions remain very quiet but I think this combined group should do well if conditions ever improve.

Victoria (LON:VCP) - up 2% to 537p (£618m) - AGM Statement - Paul - AMBER/RED

Victoria PLC (LSE: VCP), the international designers, manufacturers and distributors of innovative flooring…

We briefly mentioned this controversial share in Monday’s SCVR, when a condemnatory article in the FT highlighted an audit report qualified over uncertainty in a small subsidiary’s accounts, and a rather worrying comment from the auditor that VCP’s management had limited its scope. This caused a sharp spike down in share price as low as c.400p, but it closed the day almost fully recovered, so a nifty trade there for anyone who moved fast.

As I expected, VCP has issued a firm rebuttal of the allegations, emphasising it’s only a tiny subsidiary, and very small amount of money, and proper financial controls are now in place.

It also says some fairly upbeat stuff about trading being in line, £20m of efficiency savings being in the pipeline, and an H2 weighting expected for this year. Demand generally stable. Margins improving due to lower input costs and efficiency gains.

Paul’s opinion - I remain troubled by the negative NTAV balance sheet, and excessive debt, so it’s not for me. [no section below]

Paul's Section:

Saga (LON:SAGA)

121p (£171m) - Interim Results - Paul - AMBER/GREEN

Insurance & travel group targeting the over-50’s. I got a bit obsessed with this share previously, spending far too much time on its potential for a post-covid recovery, which seemed to repeatedly be deferred, and has been lacklustre so far.

So we switched from GREEN to AMBER in April 2023, and AMBER again in June 2023 (when it annoyed us by putting out an ambiguous TU that turned out to be a disguised mild profit warning).

The headline P&L numbers don’t look very exciting, with modest underlying profit, and huge adjustments again between underlying and statutory profit -

Outlook comments are a lot more interesting though -

"Overall, I am pleased with the progress made in the year to date. Looking ahead to the full year, we are keeping tight control of our costs and are confident that we will deliver significant double-digit growth in revenue and underlying profit that is ahead of market estimates, and repay the May 2024 bond when it falls due. This, alongside our continued focus on debt reduction, leaves us well placed as we position Saga for long-term sustainable growth."

I cannot find any broker notes, so don’t know how much it expects to exceed market estimates by, for FY 1/2024.

Last year SAGA reported £21.5m in underlying PBT, and is now saying it can achieve a double digit increase, implying something upwards of £24m u/l PBT this year - rather vague.

As you can see below, the Stockopedia graphs show that consensus forecasts have come down a lot from original expectations, but have pretty much stabilised this year. Are we now over the worst? It’s starting to look a little more encouraging.

Bond repayment in 2024 doesn’t look a problem, with Sir Roger helping out -

The Group expects to meet the £150m bond repayment due in May 2024 through a combination of Available Cash4 resources and drawdown of the loan facility with Roger De Haan. To provide additional financial flexibility following repayment of the bond, the Group has agreed a £35m increase to the facility, taking the total to £85m, and an extension to the expiry date, to 31 December 2025.

As I’ve always said, bear in mind that most of SAGA’s heavy debt burden is the ship loans. Total net debt is £657m, but £438m of that relates to the two owned nearly-new cruise ships, which have a book value of £597m - so the ship debt is more than fully asset backed.

Remaining “adjusted net debt” is £222m, which is too high I think, but not dangerously so.

Therefore I think these numbers are starting to vindicate my view on SAGA’s debt position as not being a crisis, more something that can be managed down over time. Sir Roger’s financial support (not cheap, at 10% pa, or 18% in an unlikely event it’s used for anything other than bond repayment) has proven key, although given that SAGA already has £181m cash on hand, that’s more than enough to cover the £150m May 2024 bond repayment. So I think his £85m loan facility is providing ample headroom, rather than being essential.

Balance sheet - is large, and complicated, and has negative NTAV. So the finances are weak, but improving I think.

The benefit all flows to equity remember, so the high level of gearing here could create nice upside for equity holders, as debt & perceived risk recede.

In the meantime, the 2026 bond is still seen as risky by the bond market, with a price of about 76. That gives a very nice return to maturity actually, so could be worth a fresh look for bond investors, as it seems as if risk is receding somewhat.

Paul’s opinion - I’ve only focused on the key points here, there’s loads more detail in the interim results.

Overall, it seems to me that things are at long last moving in the right direction. I see risk having reduced a lot, with travel now performing better, and some deleveraging now in evidence. The insurance division has been problematic, but in a way it’s encouraging that it says the sale of the underwriting division was pulled (after terms agreed) because they think they can get a better price at some point in the future.

Downside risk would obviously be, as with all travel-related shares, another pandemic erupting.

I can’t say I’m massively keen on SAGA, but that could just be emotional, as it disappointed so often from 2021 to earlier in 2023, that I just lost interest in it. Many other investors probably have the same emotions, which could possibly be providing an opportunity now that it does actually seem to be turning the corner - cheap due to investor apathy maybe?

I’ll give it some more thought, but (Roland and Graham may disagree with me here!) I’m going to tentatively go up from AMBER, to AMBER/GREEN. It has just put out an ahead of expectations update, after all, so this isn’t just wishful thinking.

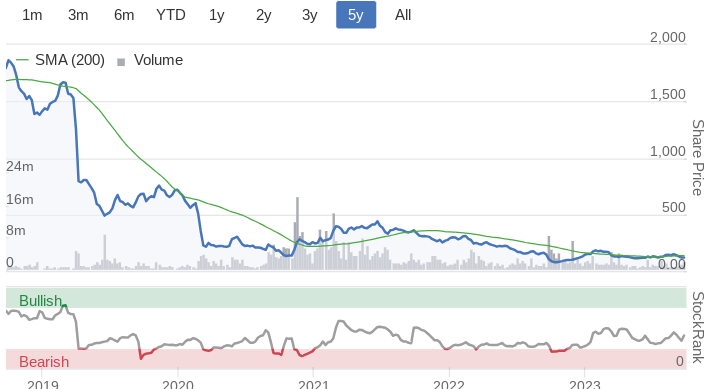

Terrible long-term share price performance -

But is it now forming a base, since the bad news has stopped, and a more positive update this week? -

XLMedia (LON:XLM)

Down 5% to 8.75p (£23m) - Interim Results - Paul - AMBER/RED

Both Candish (new name for Finncap + Cenkos merger) and several readers, seemed to think this online marketing company looks cheap. It has retrenched, and now mainly runs websites to find punters for gambling & sports websites.

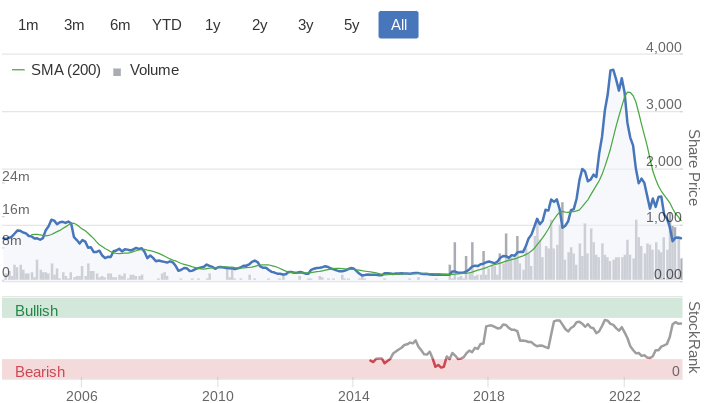

XLM shares peaked at just over 200p in 2018, and it’s been downhill ever since, now over 95% down from the peak. It paid decent divis between 2014-19, but nothing since.

Companies in this sector nearly always seem to go wrong, whilst looking cheap all the way down. That’s because they find a lucrative way of exploiting online ads, which is not sustainable, and after a while the cash machine is switched off by e.g. Google or Facebook etc, changing the rules in some way. Hence I think shares in smaller online marketing companies fail the first, and simplest test for investments - are profits sustainable? Often they’re not.

Key numbers for H1 -

Revenue down 33% to $28.8m

Operating profit of $6.0m benefits from a $4.0m impairment reversal, which obviously has to come off, reducing real operating profit to $2.0m (down 58%).

Balance sheet - looks weak. NAV of $105m includes $113m intangible assets, so NTAV is negative by about $8m. Creditors includes nearly $8m in deferred consideration, so that would use up all the $7.3m cash pile.

Since the half-year end it has raised $4.0m from the sale of some domains, so that helps. So there could be other hidden value within intangible assets, possibly?

Cash generation - EBITDA looks meaningless, because it capitalises a lot of costs into intangibles. In prior periods cash generation was quite good, but that seems to have dried up in H1 2023, and the previous tax credits have turned into a $2.77m cash outflow for income tax, which absorbs nearly all the cash generated in H1. Seems odd. The commentary says this relates to previously underpaid taxes from 2016-20, which doesn’t inspire confidence.

So overall, not a cash generative business any more, it seems.

The commentary also says XLM is exploring the option of setting up a bank borrowing facility, which reinforces me worry that cash generation, and liabilities payable could now be problematic.

Outlook - key points are these -

Actions to reduce the Group's cost base during the period will provide further benefit in H2.

As a result, the Group expects full year adjusted EBITDA to be broadly in line with management expectations.

As noted previously, the Group's performance will continue to benefit from period revenue spikes resulting from new online sports betting state launches in the US, however the timing, number and scale of launches will vary significantly.

Paul’s opinion - as is often the case, once we start digging into the detail, an amazingly cheap PER (the StockReport shows this as only 3.6x) is cheap for good reasons.

I see XLM as a shrinking business, that’s now struggling to generate cash, and has more liabilities than current assets, with tax arrears liabilities and deferred consideration creditors looking potentially onerous. Hence divis seem very unlikely.

Maybe new management will be able to lick the company into shape, I don’t know.

For me though, this sector is a no-no, and I can’t see anything positive in these numbers, so on balance I think AMBER/RED best reflects my view of things at this point in time. Who knows what the future holds though? It could get better or worse, I have no view on that.

Eenergy (LON:EAAS)

5.8p (£20m) - 12-month Interim Results - Paul - RED

eEnergy (AIM: EAAS), the net zero energy services provider…

It’s reporting a 12-month interim period, because the year end has been changed from 30 June to 31 Dec 2023, thus creating a one-off 18-month period.

Readers discussed this share yesterday, and seemed to think it might look interesting, so I’ve had a look at the figures -

Impressive revenue growth up 50% to £33.2m

Adj PBT up 34% to £2.7m - this number looks inflated to me, as it ignores costs like £0.5m share options which it claims are exceptional, but happened in both years!

Statutory PBT of £1.1m looks a more realistic performance measure to me, and is much improved from a £(2.2)m loss last year..

Note finance costs have shot up, at £1,050k

There is no historic track record of profitability, it’s been growing fast, and this seems to be the breakthrough year into (modest) profit.

Balance sheet - this is the problem area. I very much dislike this sector, of energy consultants. The pattern is often that they report good profits, but ever-increasing receivables, bank debt, and eventually even insolvency when they fail to collect in the receivables. I can’t remain the company name, but that happened a few years ago for a share that we discussed here a lot. It always looked cheap, but profit never turned into cash, and it eventually went bust.

Unfortunately EAAS reminds me of those numbers. Its balance sheet is weak, with NAV of £24.1m containing £28.8m intangible assets, thus NTAV is negative at £(4.75)m.

There’s also a bloated receivables book of £22.9m, which looks huge compared with £33.2m annual revenues - that’s about 3-times what it would normally be. Hence the excess raises questions over whether it will be paid by customers, or disputed? Also it requires bank borrowings to finance this bloated receivables book. There’s £7.75m of borrowings, and only £1.3m of cash, so the financing position looks weak to me.

Cashflow - is negative, because all the profit is sucked into receivables, this year and last year.

Paul’s opinion - I think this might need an equity fundraise. Being cynical, maybe that’s why they’ve recently hired Equity Development, to drum up some interest in the shares before a placing? All too often private investors are the cannon fodder to pump up a share price, in advance of fundraisings (often at discounts).

The key thing is that I’ve dodged a lot of bullets over the years by bargepoling all shares which build up excessive receivables books, because they nearly always end in disaster. I learned this the hard way, by incurring a heavy loss on Accident Exchange (very similar business model and numbers to Anexo (LON:ANX) now).

For this key reason, I’m not prepared to give Eenergy the benefit of the doubt. It may operate in a fashionable area, but for me cash is king, and that ballooning receivables book tells me that it has a bad business model, and has significant financial risk.

Sorry about that. I expect the readers who asked me to look at this one are probably now wishing they hadn’t!

A very poor share price performance, and low StockRank are further negatives -

Future (LON:FUTR)

Up 16% to 827p (£986m) - Full year trading update - Paul - AMBER/GREEN

Future plc (LSE: FUTR; "Future" or "the Group"), the global platform for specialist media, today provides an update on its performance for the year ending 30 September 2023.

It’s only in line with expectations, so why is the share price up 16%?

Adjusted operating profit is expected to be in line with the Board's expectations1, delivering a resilient performance despite continued macroeconomic volatility impacting our sector.

1 Company compiled consensus for adjusted operating profit is £254.1m

Wow, that’s a huge number, adj operating profit of £254.1m, for a market cap of £986m. What’s the catch I wonder?

The rest of the announcement is quite brief, so here it is (as usual I add the bolding) -

Audience numbers have stabilised in the second-half and the Group has had positive month-on-month momentum in the final quarter.

However, overall trading conditions remained mixed, with challenges in consumer spending and the digital advertising market. As a result, Advertising and Affiliates product trends are broadly in-line with the first-half, as expected, despite a robust Prime Day in July.

Go.Compare (price comparison) revenue has accelerated in the second half, reflecting favourable market volumes with consumers looking for value.

Magazine revenue has remained resilient.

Foreign exchange has been a headwind in the second half, given currency movements in the period.

Interim results - for H1 3/2023 - I’ve had a look through these (published on 18 May 2023) for context. Key numbers -

Revenue flat at £405m

H1 adj operating profit of £130.3m, down 3% on H1 LY. Hence today’s guidance for £254.1m implies a small step back to £123.8m H2 adj operating profit, hardly a disaster, and given tough macro, could be seen as quite resilient I’d say.

Adj diluted EPS of 71.2p in H1 (down 12%)

Lots of adjustments, but the main item is amortisation on acquisitions, which is fine to adjust out - that’s what almost everyone does, and is generally accepted by almost everyone!

Lots of debt - net bank debt was £391m at 3/2023, but huge facilities of £900m, so tons of headroom. Bear in mind that operating profit numbers above won’t include the considerable finance costs of the borrowings.

Outlook was cautious, guiding towards lower end of expectations (this is back in May 2023, remember).

Balance sheet - as I suspected, a really low PER often points towards a weak balance sheet. This is pretty grim from my value investor point of view. How does £1.66bn in intangible assets strike you?! Although to be fair, given the nature of the publishing businesses, a lot of its subsidiaries do have intangible value that could be realised in a sale.

NAV is £1,057m. If I write off intangibles completely, and the (I assume) associated £122m deferred tax, then my adjusted NTAV comes out at negative £(481)m. That’s obviously not ideal, but I think it can be justified, given that the acquisition goodwill is for decent, cash-generating but asset-light online businesses. For this reason, I’m not having a fit over the negative balance sheet.

Bank debt is rather too high for my comfort, at £391m net debt (about a third of the market cap). So the business is heavily reliant on its bank facilities. I’d prefer to see it hold fire on any more acquisitions, and pay down some debt.

Valuation - the StockReport shows consensus EPS for FY 9/2023 of 140p, which ties in with the 71.2p in H1. Today’s higher share price of 827p is a PER of 5.9x - that strikes me as an attractive price.

Even if we very crudely adjust for the debt, of about half the market cap, then the PER would rise to about 9x (a bit less actually, as finance costs should be stripped out, if we’re stripping out the debt, but I’m only working out a ballpark figure here).

Looking at the historic share price chart, this company has commanded a seriously big price premium in the past, but looks like it’s now maybe overshot on the downside, and is priced like a value share - probably because investors may be worried about macro, and the debt burden?

Paul’s opinion – I was expecting to be cautious or even negative about FUTR, but having worked through the numbers with an open mind, I’m actually quite positive on this. It seems to be trading resiliently, and arguably the share price might have overshot on the downside perhaps? Therefore I’ll go with AMBER/GREEN - it’s worth you taking a look, and doing your own more detailed research, please remember we only have time to do quick reviews here. Let me know what you think!

Time to jump on the rollercoaster again maybe, if you have the stomach for it!?

Graham’s Section:

Ebiquity (LON:EBQ)

Share price: 43p (-6.5%)

Market cap: £59 million

A “broadly in line” outlook statement has rattled confidence here:

Ebiquity plc ("Ebiquity" or the "Group"), a world leader in media investment analysis, announces interim results for the six months ended 30 June 2023 ("H1 2023").

The company’s H1 financial highlights do look encouraging to me: revenues up 11% and adjusted operating profit up 23%:

I last looked at this one in February, when financial momentum also seemed to be very positive.

However, it’s important to be aware that the numbers here are complicated by the adjustments. For example, Ebiquity’s full-year results for 2022 showed an adjusted operating profit of £9.3 million, but an actual operating loss of £5.9m.

Often this happens when a balance sheet is stuffed with intangibles (e.g. as a result of acquisitions), and the value of these intangibles needs to be written down over time.

At Ebiquity, the balance sheet is worth £45m but this includes £53m of goodwill and other intangibles; strip them out and tangible worth is negative.

For the latest H1 period, thankfully I see that Ebiquity’s unadjusted earnings are at least positive (operating profit £2.4m, PBT £1.4m).

Net debt has increased from £9m (December 2022) to £15m (June 2023). One of the major reasons for this is a negative cash flow from operations in H1; checking the footnotes, I see that Ebiquity made a very large (£16m) payment relating to a 2020 acquisition. Of this £6m was paid in cash and £10 in the form of new shares.

This neatly explains why net debt is up and also why the share count is now around 140m (up from 120 million in December 2022).

The company says that this large payment is twice the amount expected at the time of the acquisition - “reflecting its strong performance”. So not necessarily bad news! Future cash flow performance could be much better, unhindered by these acquisition payments.

Outlook

We get the phrase “broadly in line”, implying that trends are slightly below expectations. This explains today’s share price fall:

A small number of large clients have recently reduced budgets, however, the business continues to trade broadly in line with expectations for 2023.

Additionally there is “some uncertainty for 2024” due to macro conditions, although “our business has historically been significantly less sensitive to weak conditions in the advertising market as our clients often look to us to help even more with improving marketing efficiency in such an environment”.

The view that Ebiquity can help companies make their media investments more efficiently in challenging economic conditions is repeated again in the CEO’s statements.

Clients are blue-chip and include the likes of GM, J&J, Danone and Disney.

Graham’s view

I continue to have a positive impression of this company. As I said before, it’s not really my style to invest in “consultancy” type businesses. However, as far as consultancy businesses go, this one has some attractions:

International diversification (significant revenues from Continental Europe and further contributions from North America/APAC)

Blue-chip clients

Good momentum in revenues and earnings.

Against that, you have the empty balance sheet and the significant adjustments being made to the accounts - par for the course when dealing with an acquisitive consultancy.

I’ll keep my neutral stance, albeit with a slightly more favourable view than I have for most companies in this sector.

Quantitatively, there are signs of cheapness - but I would argue that cheapness is not hard to justify. Remember that earnings forecasts (and therefore forward P/E ratios) most often use the optimistic adjusted figures:

Supply@Me Capital (LON:SYME)

Share price: 0.1p (-5%)

Market cap: £61m

SYME, the fintech business which provides an innovative fintech platform (the "Platform") for use by manufacturing and trading companies to access Inventory Monetisation© ("IM") solutions enabling their businesses to generate cashflow, announces its unaudited results for the six months ended 30 June 2023 ("H1 2023")...

I don’t think I’ve studied this one before. Browsing its website, I see that the idea is to allow companies to put their inventory on a blockchain; they can sell the inventory in exchange for digital tokens, and then buy the inventory back when a customer in the real world wants to buy it.

To someone like myself, who failed to get on board the crypto train and who still doesn’t get it, this sounds like it is probably a waste of time. But let’s see if it works out.

Note that businesses on the platform won’t sell their inventory directly to SYME; a separate entity will take care of that, which has been sold to former directors of SYME.

Speaking of which, there are significant related party transactions. Let me try to explain:

Regarding the sale of that subsidiary to former directors, the £2m amount due from that sale has not yet been paid to SYME. The CEO (through his own company) has assumed the obligation to repay it to SYME.

Separately, the CEO has also offered to lend £3.5m to the company in a working capital facility.

So if I’m reading it right, SYME could find itself in a position where it is both owed money by its CEO, and it has borrowed money from its CEO, at the same time.

It’s always important to be aware when these sorts of transactions are happening, as they can lead to complications (not always good ones for the minority shareholders!).

Financial performance: H1 highlights show revenues of £0.1m (last year: nil). It sounds like they are still very much in the preparatory stage, before a full launch.

Operating loss is £2.3m (last year: £2.1m operating loss).

Looking ahead:

With the completion of inaugural IMs, the Group now expects to start to build a demonstrable track record of revenue generation as it scales delivery of new IM transactions.

They have a “pipeline” (inventory to be monetised) of £404.5m.

CEO comments:

The past six months have been productive for SYME, with our team working tirelessly on several key development workstreams. I am delighted with the progress we have made. We've started to build our track record on IMs which have unlocked a significant increase in engagement and interest in the SYME Platform, both in our core markets and further afield. Our pipeline is strong and the experience we have gained continues to streamline the onboarding process.

Balance sheet: the company has almost zero cash in hand, and has borrowed €1m from an Italian bank. Net assets are negative (minus £2m).

Graham’s view

I don’t see how to avoid giving this stock the thumbs down. It is effectively pre-revenue, and therefore it is still at a very speculative stage of development. The balance sheet is in the red, and the web of related party transactions are another hurdle when it comes to having any confidence in the outlook for private investors here.

I also don’t believe in this technology; others do and that’s fine.

So this one is getting the thumbs down from me; I feel safe in my belief that the risk:reward here is very poor. Hopefully this one can be the exceptional early-stage company that succeeds, rather than the typical story of high hopes and subsequent failure.

Cavendish Financial (LON:CAV)

7.9p (unchanged) (£29m) - AGM Trading Statement - Graham - GREEN

The combination of investment banks finnCap and Cenkos now has the unfamiliar name “Cavendish Financial”. The merger completed earlier this month, creating a business with nearly 200 staff and 220 quoted clients - making it a heavy hitter in the markets we cover here.

Staff have moved offices, trading has moved to a single platform, and there is “substantial progress” with IT integration.

I share their belief that the synergies should be significant and that the combined group should be stronger than the sum of its parts. In difficult market conditions, I think it makes sense for companies in this sector to consolidate and create a stronger group that should hopefully be very profitable in the next bull market.

Speaking of market conditions:

Trading across the City has been quiet during the Summer, but since merger completion the Group has already announced a number of significant transactions which will close in the coming months including acting as sole adviser to Round Hill Royalty Fund Limited on its offer from Concord Cadence Limited, fundraisings for Haydale Graphene PLC and Shield Therapeutics plc and obtaining key regulatory clearances for the equity financing of Allergy Therapeutics by ZQ Capital and Southern Fox.

Graham’s view

As of March 2023, finnCap had tangible equity of £12.5m.

As of December 2022, Cenkos has equity of £22m.

The combination now has a market cap of £29m (there are 362 million shares outstanding, at about 8p each).

I am waiting to see a financial statement from Cavendish but I’ll tentatively give it the thumbs up on the basis that it will be in an excellent competitive position in the next bull market (if there is another bull market!) and there is a good chance that the market cap is offering a discount to tangible equity.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.