Good morning from Graham & Paul.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

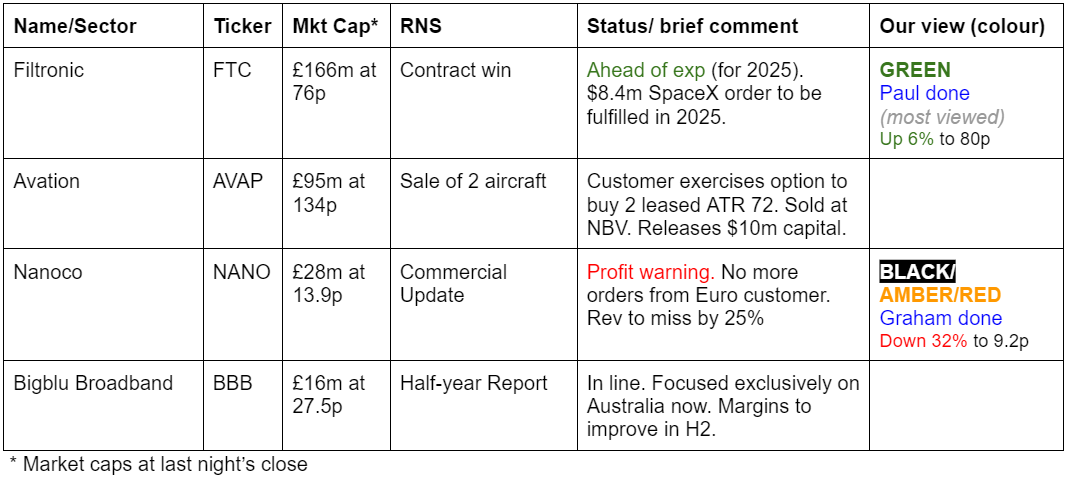

Companies Reporting

Summaries

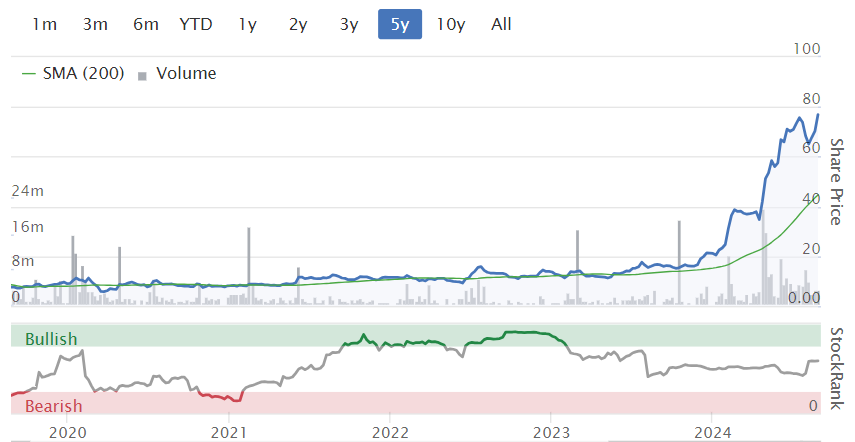

Filtronic (LON:FTC) - up 6% to 80p [08:21] £176m - Contract Win - Paul - GREEN

More good news with another order from SpaceX. Cavendish raises FY 12/2025 profit forecast by 20%. Shares still look reasonably priced, and it looks as if there's further upside. We've been very slow on this one, and I belatedly move us up from amber to GREEN. Well done to bulls, this looks an excellent situation, with more fuel in the tank for further rises, it seems. Although the bull case was already based on more orders being expected.

Nanoco (LON:NANO) - down 32% to 9.4p (£19m) - Commercial Update - Graham - AMBER/RED

I’m downgrading to AMBER/RED here as this is not one where I’d have any interest to invest, even if the current cash balance is slightly above the market cap. The company’s stated strategy to invest in its current commercial activities will see the cash balance decline and I don’t have faith that it will see profitability in the foreseeable future.

PPHE Hotel (LON:PPH) - £13.43 (£567m) - Graham - GREEN - see below for my notes from the company's IMC webinar and my Q&A with the company's CFO yesterday.

Paul’s Section:

Filtronic (LON:FTC)

Up 6% to 80p [08:21] £176m - Contract Win - Paul - GREEN

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, space and telecoms infrastructure markets…

More good news for the bulls today! -

“...is pleased to announce the receipt of a further follow-on production order from our partner SpaceX.

The order is irrevocable, valued at $8.4m (£6.4m), and represents a continuation of demand for the E-band solid state power amplifier ("SSPA") modules to support the ongoing deployment of SpaceX's Starlink constellation which provides high-speed, low-latency internet to users all around the world. It is anticipated the order will be fulfilled in calendar year 2025. Consequently, we now expect to trade ahead of current market expectation for FY2025.”

Broker update - Cavendish helps by quantifying the increase - raising its FY 12/2025 adj PBT forecast by a considerable +20% (old: £6.4m adj PBT, new: £7.7m).

In diluted EPS terms this is new: 3.2p, old: 2.7p. The 2025 PER is now 23.4x, which doesn’t sound a lot for a company that’s clearly hit the jackpot with a blockbuster product, and has the kudos of being involved with Elon Musk’s SpaceX (which has also been granted up to 21.7m warrants in FTC, vesting in tranches [10.86m vested to date] , potentially convertible into 10% of FTC’s equity, once it has bought $60m-worth of products). Full details in RNS dated 24/4/2024.

Paul’s view - this continues to look an exciting share. Speculation is rife that SpaceX might bid for it.

I don’t know why we’ve only been amber before, we should clearly be GREEN - very late to the party, but some subscribers here were ahead of the curve, with this share being discussed positively some time ago - well done to those of you who spotted the opportunity.

Graham’s Section:

Nanoco (LON:NANO)

Down 32% to 9.4p (£19m) - Commercial Update - Graham - AMBER/RED

Nanoco is “a world leader in the development and manufacture of cadmium-free quantum dots and other specific nanomaterials emanating from our technology platform.”

Here’s a Wikipedia article that might help shed some light on what these “quantum dots” are.

Paul covered Nanoco in March, explaining that after litigation with Samsung, it now had a large cash pile supporting its market cap.

But today we have bad news from the company: a large European customer (STMicroelectronics perhaps?) is walking away both from any further orders and from joint development projects with Nanoco.

The European customer has said “it’s not you, it’s us”:

Nanoco had achieved all of the required development milestones to date and had received positive feedback on the performance of the new material. Nanoco understands that the European customer's decision has been based on its own strategic priorities and not as a result of concerns with the performance of Nanoco's materials.

With this customer walking away, Nanoco will seek the “direct pursuit of already identified small scale market opportunities”, arising from the development work done to date.

Outlook

Revenue for FY July 2025 will be approx. 25% below consensus, that consensus being £9.5m. Development work with an Asian customer continues.

Chairman comment

"This is obviously disappointing news and reflects the nature of high technology supply chains for consumer electronics… Smaller scale opportunities are available for this technology in the short to medium term and we aim to address those niche markets directly and in partnership with other companies.

We also continue to work with our Asian customer in developing our second generation sensing materials, with commercial potential over the medium term. The Group's strong balance sheet provides us with the financial stability to continue this development work and our new business development activities."

Net cash balance

At the interim results (March 2024), the company said that after payments to shareholders and lenders, it would have a cash balance of £23m and was “fully funded through to cash breakeven, expected during CY25”.

At the year-end trading update (July 2024), the company said that it expected to have cash reserves of c. £20m at the end of that month. It admitted that the cash break even target for 2025 was now doubtful.

Today we have helpful new estimates from Cavendish: they reduce their net cash forecast for July 2025 from £15.8m to £12.9m.

Graham’s view

This is a cash-burning situation where personally I would not have much faith in the company making it through to profitability. That might be unfair, but I haven’t seen many advanced materials micro-caps achieve success, and Nanoco’s own track record doesn’t inspire confidence:

Therefore, even if the current cash balance is around £20m, above the current market cap, this is still one that I’d want to avoid. So I’m going AMBER/RED on this one.

PPHE Hotel (LON:PPH)

£13.43 (£567m) - Graham - GREEN

Yesterday was a great day for me when it came to studying PPHE. It started off with reading the company’s interim results (covered here), then attending their InvestorMeetCompany webinar with top management, and then finally having a 15 minute call with the CFO.

Many thanks to Andrew in the comments section here who submitted an excellent list of questions for me - as I only had 15 minutes, I didn’t get to cover them all, but I’ll keep them as ammo for the future! Many thanks Andrew.

Context: I am positive on PPHE due to the steep discount its shares trade at, compared to its net asset value.

According to its balance sheet, NAV is £300m (the two major items are £1.4 billion of PPE, minus £900m of bank borrowings, plus various other items).

However, if you put the hotels at their most recently appraised fair values, under various different methodologies, the balance sheet gets an uplift of £800m for a “fair value” NAV of £1.1 billion. And yet the market cap is only about half of this.

Without further ado, here are the notes I took yesterday, both from the IMC webinar and from my own Q&A.

Typical debt profile: net debt for the group is about 30% of value currently. New debt taken on for new build hotels is about 60% loan-to-cost, but when a hotel matures its value is higher than cost and LTV should fall below 50%.

With interest rates currently at higher levels, PPHE is unlikely to borrow more or significantly increase its debt profile.

An important feature of the loans is that they are amortising (i.e. repaid gradually). 15-30% of the principal gets paid off over 5-10 years.

Debt is all fixed rate. Zero variable rate risk, zero interest rate risk until refinancings.

New York Project: a site was bought in 2018, then Covid hit. Building costs are up substantially now. Union legislation has changed, and the project is paused. PPHE is not currently looking to build a hotel on this site and would be happy just to recoup its value.

Discount to NAV (net asset value) (more on this later): it’s “weird”. PPHE has a strong pipeline with results coming. But it’s a complex company to understand. Refinancing of loans will help to prove the value of hotels. The share price discount was substantially less pre-Covid.

The value given to new hotels does reflect the risk of opening delays but it’s not the biggest factor. Their asset value does grow over the stabilisation phase (i.e. as the hotels mature), as profitable cash flows get nearer.

2nd £4m buyback: the company acknowledges that this doesn’t substantially move the needle. But they need to take liquidity into account. Shareholders should view the buyback as part of their total return, including dividends.

Hotel opening delays in Rome/London: the delivery of furniture and fixed goods from Europe was delayed. Additionally, Rome has been a complex market to develop in. Litigation around permits, licences and the demolition process. They do have good advisors but it’s a learning process. Rome to open in Q4.

Paris plans: it’s a target market and they’ve been looking at it for many years. But it’s incredibly expensive to penetrate. PPHE are disciplined investors, and more cautious than some. They want a high incremental return on investments, and so they have a high threshold to invest in Paris.

London: it’s becoming more challenging to develop in London. The planning process is particularly protracted now. PPHE has recently won a planning appeal after a development was voted down at committee level for invalid reasons. They are now second guessing new plans in London due to planning problems. It is easier to develop in Eastern Europe.

Maximising Revenue (RevPar, revenue per available room): the company tries to get the right balance between higher prices (average room rate) and filling more rooms (occupancy rate). A higher room rate is more valuable because the additional revenue goes straight through to profitability, whereas higher occupancy doesn’t boost profitability so much, as there are additional costs of serving more customers. PPHE could fill 100% of its rooms every night but it is not trying to. 2024 was more difficult than 2023, and the company had to work harder to fill rooms. But it still has another four percentage points to go, to get back to the occupancy rate of 2019.

US Dollar/Macro: the leisure months were rainy in London, leading to a decline in the average room rate as leisure travel tends to pay the highest rates. Leisure also has short visibility (2-4 weeks). Big currency movements can impact demand if they are substantial (e.g. 10-15% move in GBP). PPHE does enjoy a diverse geographical exposure which helps. Finally, a US Presidential Election does tend to cause a slowdown in travellers, a short-term reduction in demand, but it rebounds quickly afterwards.

My questions to the CFO:

1. PPHE seems complex to prospective investors. For example, the company publishes NRV (net reinstatement value), NTA (net tangible assets) and NDV (net disposal value). Which one of these should investors focus on and why does it give a meaningful description of the company’s value?

A. Yes, the company is misunderstood. And it is put into the “fear basket” of hotels and hospitality. There are many different business models in this industry: there are big players like Intercontinental Hotels (LON:IHG). There are those that own brands. There are those that lease hotels and pay rent. There are real estate investors that buy hotel real estate and don’t operate it, but instead pay a fee of 10% of revenues and get meaningful income that way.

PPHE does everything: it builds hotels, owns land, operates and rents. They do not pay fees out to someone else to operate. The value for PPHE is in the real estate itself. When it comes to valuations, PPHE can provide comparable transactions for similar properties using cap rates of 5-6% (i.e. an earnings multiple of 20x). But some people instead put PPHE in the purely “operating” basket where it would only get an EBITDA multiple of 10-12x.

There is complexity. PPHE has a level of debt and is involved in construction. £3 per share of value is tied up in new hotels in London/Rome. These construction projects don’t help P/E ratios, but their cost goes away after openings and they will have normal trading.

On the valuations provided, PPHE is obliged to publish all of the “EPRA” KPIs. NRV is an external value based on operating value. NDV is the value if sold. The share price discount is substantial and we don’t understand it. We were able to sell 49% of an asset (i.e. a non-controlling interest) to get through Covid. And our loans are refinanced by banks based on the banks’ own valuations.

When it comes to reported profits, the depreciation charge is based on the historical cost. The buildings are thought to be depreciating. But we think that 4% of revenues is sufficient to maintain buildings, and that’s the “real” depreciation. The buildings will not need to be rebuilt! So our adjusted earnings add back depreciation, then deduct 4% of revenues.

2. How are PPHE’s distribution costs evolving, especially with booking.com? Is there anything investors need to be aware of in relation to this?

A. We have a love/hate relationship with booking.com. We love their service, but we hate their bills! However, before booking.com, you would be trying to fill a hotel with cheaper “key business”, and only a minute element was the leisure business who would walk in or call you (and pay higher rates). After the arrival of booking.com, the cheap business has been displaced, the leisure market has expanded and this boosts revenues substantially. Not £1 of revenue is free, no matter where it comes from. But PPHE enjoys a strategic relationship with Radisson, part of JinJiang, one of the largest travel companies in the world. This means that PPHE can negotiate competitively for distribution. 13% is the average cost of acquisition.

3. PPHE has just published a negative PBT, but positive normalised PBT after adjustments. Will we see cleaner accounts next year?

A. PPHE is always transparent with its adjustments and investors are free to treat the adjustments as they wish, e.g. something like the fair value of derivative movements. PPHE adjusts it out, but investors can add it back in if they wish. PPHE takes out pre-opening costs, such as the cost of hiring staff before a hotel has opened, because they don’t think it’s a fair reflection of their profitability. In general, hotels need about 3 years before they deliver. The current pipeline should deliver an additional £25m of annual EBITDA when the new hotels stabilise.

Graham’s view: it’s a great privilege to be able to speak with top management at companies such as this - many thanks to Daniel Kos, CFO of PPHE for answering my questions! My view is that the company does need to follow through with cleaner and more profitable accounts next year, but I believe that it will do this and I think it does deserve to trade much closer to its fair-value NAV.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.