Good morning from Paul, and happy half-year's eve! The card manufacturers are missing a trick not making cards for today, and half-year's day tomorrow!

Today's report is now finished. Podcasts tomorrow!

Half-year comments

This weekend I'm hoping to do a half year review of my 2023 watchlist ideas, which have done quite well in a lousy small caps market. Here's an overview -

Top 20 main value/GARP ideas - as of last night, 14 were up YTD, 6 down, average +6%, vs AIM All Share down 10% YTD, which is a creditable 16% out-performance. One takeover bid out of 20 shares, Best Of The Best (LON:BOTB), a 32% gain. I forgot to put Warpaint London (LON:W7L) on the list too, which is up 48% YTD, so if I'd remembered, the overall gain would have been higher.

Hence it does seem that value/GARP small caps have been a relatively safe haven in a difficult market so far this year. Although we could see it as more bumping along slightly above the bottom, given that 2022 was really bad for UK small caps. The recovery will happen, it always does, we just don't know when! Plus no doubt we'll see more upside from takeover bids, which help demonstrate that the market is cheap right now. This spreadsheet tracks performance with live prices.

"Runners up" - 12 more value/GARP ideas for 2023 - 7 up (not the drink!) and 5 down. Average is also +6%, also 16% out-performance against the AIM All Share index. Boosted nicely by the car dealers, with a + 56% gain on Lookers (LON:LOOK) (which I've banked in the market, due to deal risk worry), and also a nice +28% from VTU.

Cyclicals (Reach, Eurocell, and Headlam) are the 3 worst performers so far (Reach also got embroiled in renewed phone hacking legal action from Prince Harry). Here's the spreadsheet for this selection of 12 shares (same spreadsheet as above, but a different tab).

A lot of the above shares also pay divis, so the total return is higher than +6%.

How has my own, real world portfolio done? I got lucky with the 200% premium takeover bid for Seraphine in January, which was by far my largest position at the start of the year. So that's heavily skewed things into a large % gain YTD. However, I'm 23% down from my peak at the end of February 2023, which already takes into account the big imminent loss in WANdisco (LON:WAND) when it returns to trading shortly (a stupid decision to buy something highly speculative, where the trading updates turned out to be fraudulently mis-stated - not really something you can anticipate). Also, I'm still about 30% down from my all-time-high in mid to late 2021. So plenty of work to do, to get things back on track in the next bull market, but I'm confident it will happen, in time.

NB. I'm only referring to continuing activities, which is my ungeared portfolio. I've excluded the highly volatile performance from my geared portfolio, because I've closed it down, so in accounting parlance that is a discontinued activity! And life is much simpler and less stressful as a result, so there's an intangible benefit there [which I promise not to capitalise!]

Just thought you might find the above interesting.

Rather boring companies reporting today, so I'll probably try to pick off a few of the backlog items that are more interesting -

Quick Comments

Best Of The Best (LON:BOTB) (I hold)

530p (£44m) - Update on Mandatory Recommended Cash Offer of 535p - Paul

Globe Invest (Tedi Sagi) announced yesterday that it won’t be increasing the cash bid any higher than 535p. It’s been buying in the market, increasing from 29.9% to 38.7%. EDIT: RNS just out today saying Globe has increased further to 42.25%. Together with management irrevocable undertaking shares, the total was 58.75% yesterday, now up to 62.3%, so it's a done deal I'd say.

The “Mandatory” wording relates to Takeover Panel rules, where if anyone goes over 30% they usually have to make (ie. mandatory) a takeover bid, unless they’ve previously received a whitewash agreement allowing them to go over 30% (which first requires a 50% vote of independent shareholders).

An example of this has coincidentally been announced this morning at another company - shareholders at tinyBuild (LON:TBLD) (I hold - just a punt yesterday) have voted against a whitewash arrangement to allow its founder to increase his stake.

Paul’s opinion - a desperately disappointing end for small shareholders in BOTB, with the company being sold at an undervaluation to Tedi Sagi, despite a strong trading update earlier this year, and broker forecasts revised upwards, and a lowish PER. Although management had already effectively cashed out a while ago, c.£70m banked mostly at a price of £24/share! So their remaining holdings were only worth barely more than 10% of what they’ve already banked, so perhaps it just wasn’t worth the hassle for them to carry on running the business (after over 20 years), when they’ve got £70m burning a hole in their back pockets? So I can see why this deal makes sense for management, but it’s a big disappointment for outside shareholders. Still, BOTB shares have delivered a 30% YTD rise, which is not to be sniffed at. Previously, BOTB shares did a 30-bagger move roughly, from £1 to a peak of £30, so the opportunity was there for investors to bank a big profit too. I certainly don't bear a grudge, this has been one of my best ever investments, banking profits well below the £30 peak on the way up, but still a substantial gain.

Since the 535p deal now is almost certainly going ahead, with very little chance of any further upside, it might make sense to sell in the market, if there’s something more interesting to invest in (that’s what I’ve done, selling most of mine). Or hold out for the last few pence, whichever you prefer. Deal risk looks low to me.

MJ GLEESON (LON:GLE)

358p (pre market) £209m - Sale of portfolio of homes - Paul - GREEN

Many thanks to Ben Hazzard for flagging in the reader comments the RNS from this low-price housebuilder, which I hadn’t spotted.

This is extremely interesting, and could be a trigger for housebuilder shares to recover possibly? I say that because selling big parcels of houses to institutional investors (build to rent) could enable housebuilders to up their production and sales, despite a slowdown in demand from individual households (due to macro, higher mortgages cost, etc) -

MJ Gleeson plc ("Gleeson" or the "Company") is pleased to announce that it has entered into a contract with global investment firm Carlyle (NASDAQ: CG) and Gatehouse Investment Management, a market leading single-family housing investment manager, for the sale of 288 homes across multiple developments, of which up to 66 homes are expected to be completed in the financial year ending 30 June 2023 ("FY2023") with the balance in FY2024.

Consideration for the sale totals £50.4m payable in cash upon completion of each home, save for a small retention. The proceeds will be reinvested into the business for working capital purposes. This transaction strengthens Gleeson Homes' forward order book and allows the business to expedite the opening of new sites.

The Company will issue its next scheduled trading update, in respect of the year ending 30 June 2023, on 7 July 2023 and expects to confirm that it will deliver results for FY2023 in line with expectations.

Paul’s opinion - this looks quite exciting to me. If I had any spare cash, I’d be a buyer of GLE after this news. It also sounds potentially good for the country, to see institutions buying up new houses, then if it happens at increased scale, this could improve the supply of good quality rental properties, which is badly needed.

Bear in mind also the imminent reforms to unlock infrastructure investment from insurance companies, pension funds, etc, is there the potential for a boom in housebuilding, not linked to mortgage rates? This type of thing could be a gamechanger, and a nice catalyst for renewed interest in housebuilder shares. So thumbs up from me, and for the sector, which is cheap right now I think. Although if house prices fall a lot, then all bets could be off. So some risk for sure.

EDIT: Many thanks to Liberum, with an update note available on Research Tree. This says that today's deal represents 4% of sales volumes for FY 6/2023 (ending today!), and a whopping 12% of forecast volumes for the new financial year, FY 6/2024. So this deal looks highly significant. The only query I have, is what volume discount the buyers have negotiated? There's a danger that margins might take a hit, chasing volume, who knows?

Liberum also says the average sale price of £175k is 4% below the average. Also there will be no selling costs (compared with selling houses individually - e.g. marketing, commissions, etc), which helps offset the price discount. Carlyle (the buyer) is a huge operation, with plenty of experience in buy to rent, so maybe there could be more similar deals for GLE, and other housebuilders?

Could this be the time to buy? Or are we going to see another leg down, if macro conditions worsen? Answers on a postcard please! Do remember though that this time, housebuilders have bulletproof balance sheets, with net cash. Very different to previous recessions, where they were loaded up with debt. That makes risk:reward a lot more favourable this time around, although as always, timing the exact low is pure guesswork.

Costain (LON:COST)

Up 2% to 46p (£128m) - Reduced pension contributions - Paul - AMBER/GREEN

Good news for shareholders - the minimum deficit recovery payments by Costain into its pension fund are to drop from £12m pa to only £3.3m pa.+ CPI inflation, from now, July 2023. There is a total funding deficit of £25m, so this payment plan looks very reasonable.

There is a potential sting in the tail though, in that if divis paid exceed pension contributions, a top-up is required. That does look an issue, based on the forecast divis. So if people want good divis, then the pension contributions would be a fair bit higher than £3.3m, so maybe keep the bunting tucked away for the time being!

The StockReport shows 1.63p divis forecast for FY 12/2023. With 277m shares in issue, that would cost £4.5m, which is well within the total expected pension contributions this year (a split year) of £7.4m.

However, looking at FY 12/2024, forecast divis are much higher, at 3.17p, costing £8.8m. That's way above the minimum of £3.3m, so if my numbers are correct, those divis in 2024 would trigger an additional £5.5m payment into the pension scheme, taking the total to £8.8m.

Contributions stop if funding reaches 101% (currently 97%).

Paul’s opinion - there are quite a few moving parts here, but it’s clearly a positive that the minimum level of pension deficit recovery payments has dropped such a lot. Management might decide to postpone dividend increases, and instead prioritise acquisitions, or internal investment, so as not to trigger larger pension payments. They’ve got a variety of options anyway.

Looking back at my previous notes, I’m not keen on this low margin contracting sector. Although COST has the best balance sheet in the sector that I’ve looked at. Ultra-low PER of 4.1x has obvious appeal, and we had in line updates on both 11 May, and 9 June. Something went wrong with a contract building the A66, which wasn’t very well explained on 9 June, so that worries me.

Overall, COST shares look superficially very cheap, now they’ve dropped a lot recently into value territory. Although bear in mind the negative points above. Let’s split the difference and call it AMBER/GREEN.

DP Poland (LON:DPP)

Up 2% to 7.85p (£56m) - FY 12/2022 Results - Paul - RED

Some quite good KPIs, but the bottom line is yet another hefty loss chalked up - DPP has been listed on AIM for 13 years, and it’s never made a profit! It operates the Dominos Pizza franchise in Poland - where they love pizza, so there’s masses of home-grown, much cheaper competition.

Look at how the share count at DPP has soared (712m now, 129m in 2016), as it’s diced with death numerous times, being bailed out with repeated placings. Why investors keep pouring money down the drain here, I cannot fathom.

It made an acquisition of another chain, not long ago.

Revenue £36m (up 20%)

Loss before tax is flat vs LY at £(4.3)m

Outlook - doesn’t say anything of note, other than that “some food costs dropping in Q2 2023” should help improve profitability (ie. reduce losses).

Balance sheet - is weak, with NTAV of around zero. Small net debt position.

Looks like another refinancing is only a matter of time, probably dressed up to say it’s for another small acquisition.

NB note 27 shows that loan notes of 7.5m Euros are payable by DPP on 31 Dec 2024. It doesn’t have the cash to pay those, so a refinancing will definitely be needed.

Paul's opinion - I wouldn’t go near this share. It’s a lousy business, and valued at a totally irrational £56m. Moreover, the clock is ticking for repayment of a 7.5m Euro loan note at end 2024, so it will need to raise more cash, or convert that loan into equity maybe, if the lender agrees? Either way, this share looks deeply unattractive. RED.

Hopefully this section is helpful to anyone, to put you off buying DPP shares if you read a puff piece about it somewhere else. This is why we cover rubbish companies as well as good companies - so you can look up our notes, and save time having to find all the things that are wrong with it!

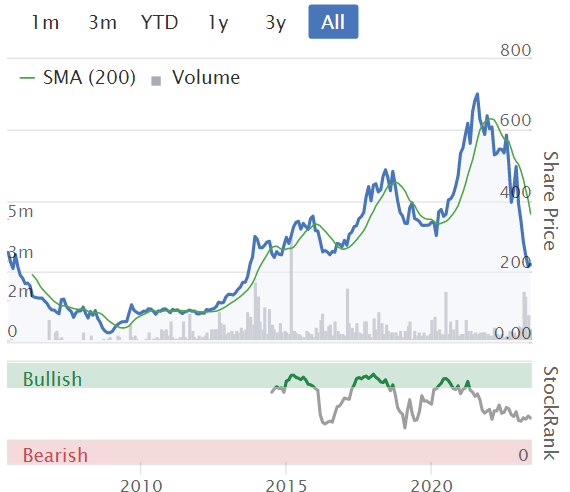

Anpario (LON:ANP)

200p (£48m) - AGM Statement (y’day) - Paul - AMBER

Anpario plc, the independent manufacturer of natural sustainable animal feed additives for health, nutrition and biosecurity…

Says that trading continues in line with expectations, but look how much they’ve reduced expectations in recent months - EPS forecasts more than halved! -

ANP says that farmers are cost-cutting, so demand for speciality feeds has reduced. It sees no immediate improvement, but is hoping for a better H2.

ANP itself has been cost-cutting too, to benefit H2 2023, and 2024.

Improved efficiency from automating production.

Gross margins are improving as lower raw material costs are coming through.

H1 results due out 13 Sept 2023.

Paul’s opinion - I’ve not been keen on this company before, as performance did not justify its premium rating. On the upside, shares have fallen a lot, and I previously mused on 22 March that at 214p the shares might be coming into buying range.

A 225p tender offer for 17% of the shares was announced on 8 June, putting the surplus cash to good use. That could mean future upside on EPS, if trading recovers.

The hope for an improved H2 mentioned today seems to be backed up with sensible reasons, although it sounds like interims are likely to look poor, so why get involved now, and probably take another hit when interims are published?

Overall, it all just seems a bit lacklustre. ANP seems to have a fairly high margin niche, and profit might recover back to previous £3-6m pa range in time. But what then? To engage my interest, I’d want to see its products generate sizeable compound growth, and become a mainstream proposition. It’s easy to see how that could make this share a multibagger. Trouble is, it just hasn’t happened, and doesn’t look likely to happen at this stage anyway.

So ANP can only really be seen as a value share at the moment, on a PER of maybe 10x.

If earnings recover back to previous levels of say 15-20p EPS (raise that by 17% due to the tender, so 17-23p forecast, hence 170-230p target share price.

By coincidence, it’s plumb in the middle currently at 200p. So ANP looks priced about right. Hence I’ll stay AMBER. I’ll keep an eye on it though, as any acceleration in growth, eg big new contracts, would be a potential buying opportunity in future.

A big de-rating here, as the growth trend conked out -

Record (LON:REC)

Unch 93.5p (£186m) - Final Results - Paul - AMBER/GREEN

Record plc, the specialist currency and asset manager, today announces its audited results for the year ended 31 March 2023 ("FY-23").

I’m not familiar with this share, but wanted to flag it to you for further research because the shares are close to a multi-year high, and results reported today look excellent.

Profit before tax (PBT) up 34% to £14.6m

Notional assets under management (read the footnote 1!) are huge at $88bn

Divis raised 25% to 4.5p total = 4.8% yield, pretty good. On top of this, it also seems to pay smallish special divis each year too, taking the 2023 yield up to 5.5%

Basic EPS up 32% to 5.95 = PER 15.7x - the StockReport shows consensus forecast of 6.01p, so it’s a whisker below.

Outlook comments from the outgoing Chairman (founder? It’s his name over the door!) are very interesting, looking at the macro picture, and implying maybe we’ll end up going back into a QE, low interest rate environment from political necessity? Maybe this is why US markets are showing apparently irrational strength? (although it’s narrow leadership) -

Outlook

In contrast with the optimistic tone with which I feel I can talk about Record, I see many serious and deep challenges ahead for the global economy in general, and for the developed West in particular.

Across the board, Western governments have arguably over-extended themselves both in the scope and scale of public expenditure, and in their method of financing this expenditure - namely through debt. Much of this debt is, in practice, monetary financing via "Quantitative Easing". Central banks, and their sponsoring governments, may find this financing becoming increasingly onerous as short rates rise. The same issue has already hit some regional banks in the US, and may hit more. This monetary dislocation is running concurrently with very low or zero productivity growth in much of the global economy. It remains to be seen whether Western democracies can find policies to re-establish low-inflation growth.

Record is not immune from these challenges, but structurally we are positioned to be nimble and adaptable to client demand as it develops and changes. While cost pressures (particularly labour costs) will undoubtedly impact the business, the current pace of growth and change should allow the revenue to grow sufficiently to more than compensate for the cost-base growth.

I leave the business in good health; vibrant, enthusiastic and looking for new opportunities. I couldn't have wished for more.

In addition, the CEO has his own outlook section (below), and seems to like analogies that don’t actually say very much -

Outlook

The next phase of our development of Record is to reap some of the rewards of our modernisation and diversification. The soil has been fertilised over the last few years, and the new plants well heeled in. For quite some time they have been putting down roots and like any young tree more has been going on under the surface than on the top.

As was clear at our Capital Markets day recently, the next phase should see some new revenue from our diversifying strands at RAM and Record Digital as well as continued work to scale our currency business. This continues our theme of diversification and modernisation, while our recent promotions carries on our theme of succession planning for the long-term future. We will continue to keep a close watch on costs but drive forward with our three‑year plan.

Balance sheet - looks OK with about £27m of NTAV.

Paul’s opinion - neutral, as I don’t know anything much about the company or its business model. However, the figures look impressive, both these latest results, and the historic track record. Could be worth you doing some research on it. So let’s go AMBER/GREEN to reflect that.

Forex related businesses seem to be having a bonanza at the moment, and Record is no exception. So the vital question is whether this is sustainable? Also risk management is critical at this type of business I would imagine.

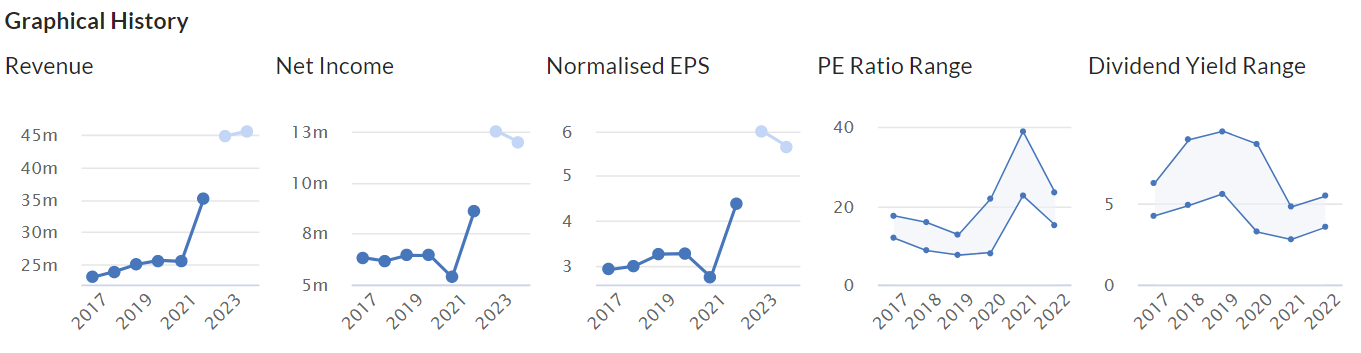

James Latham (LON:LTHM)

1,239p (£249m) - FY 3/2023 Results - Paul - AMBER/GREEN

Lathams distributes a wide range of timber products. It’s had an absolute bonanza during the pandemic, with profits soaring -

Pre-pandemic it made a fairly consistent operating profit margin of around 7%. That shot up to around 15% in FY 3/2022, combined with much higher revenues, from higher unit prices, and the pandemic DIY boom, saw PBT soar to £58m last year.

This year it’s come down a bit, but PBT still highly impressive at £44.5m, based on an operating margin achieved of 10.7%, about half way back to normal (7%) from the peak (15%).

EPS numbers are 180p FY 3/2023, and 229p FY 3/2022.

PER is 6.9x on the latest number - cheap? Not really, because earnings seem likely to fall further, as things normalise.

Valuation - I’ll have a stab at valuing this share, because I don’t want to value it on super-normal profits generated from one-off supply chain chaos caused by the lockdowns. Also I can't find any broker forecasts.

The big question is to what extent will revenues and higher margins be maintained? Who knows? These things tend to revert to the mean though, and often shortages are followed by gluts. So anything could happen.

We could work out a range of scenarios. I think my base case for valuing the shares would be to ignore current trading, and assume the operating margin returns to c.7% in time. Revenue might fall too, as supply and competition normalise, so say 20% off revenue gets us to £326m, at 7% is £23m operating profit. PBT would be higher than op profit, since it has a big cash pile, earning interest now, so I’ll say £2m net finance income, hence £25m PBT. Take off 25% tax, and I make that earnings of £19m, divided by 20.2m shares = 94p per share. Hence the 1,239p share price works out at a PER of 13.2x my forecast future normalised EPS. That seems reasonable, and is a similar rating I remember in the past for this share.

Balance sheet - is stunning! I always say that for this company, and every time it gets better still. NAV is now up to £196m, with only £2m intangible assets, so £194m NTAV! That’s incredible.

Net cash is £62m, which doesn’t look window-dressed (ie exaggerated) to me, because creditors are low. Net working capital is a remarkable £155m! So Lathams could easily pay a large special dividend if it wanted to, but owner/managers are super-conservative here, only paying small 8p special divis this year & last year.

Cashflow - is better than last year, as the previous working capital build-up has flattened off now.

Dividends are very well covered, so the company could easily afford to pay out far more, it doesn’t need to hoard all that cash to such an extent.

Note the pension scheme is a drain of £4.4m on cashflow this year, and £3.4m last year.

Outlook - sounds mixed. This bit worries me a little -

We have a concern that the market in Europe is quiet, and this could cause manufacturers to export cheaper product to the UK market, and negatively affect product values…

The board is therefore very aware that the results for the last two years have been exceptional, and far beyond the profits earned before the start of the COVID-19 pandemic. The board's challenge is to navigate the business towards what is a more normal and realistic profit achievement which takes into account the market conditions we are operating in and the inflationary overhead pressures that all companies are facing.

Straight talking there, which is commendable.

Paul’s opinion - I think it looks reasonably valued, even on my basis of making quite cautious assumptions. As management confirm, the last 2 years have been “exceptional”, and investors should keep that front of our minds, so don’t make the mistake of valuing this share on probably unrepeatable high profits.

There’s also the magnificent balance sheet to take into account.

The consensus forecast for FY 3/2024 of 148p looks much too high, so I would expect to see that come down. My 94p estimate is far more realistic, and valuation still stacks up at that level too.

Overall then, I’ll go AMBER/GREEN.

An amazing long-term chart (with divis on top), but I'd rather buy on a dip, not near the highs -

Various Eateries (LON:VARE)

32p (£28m) - Interim Results - Paul - RED

A small, but expanding chain of bars & restaurants, main brands being Coppa Club, and Noci.

Horrible H1 figures, this is really struggling now. Has spent most of its cash pile on expensive fit-outs of new sites.

Profit warning - EBITDA margins “significantly lower” than previously expected.

Paul’s view - I’m struggling to see any attraction to this share, almost at any price. Hospitality sector is really grim at the moment. Given that VARE spends big on swanky fit-outs, those sites should be highly profitable when they're new. But it still can't make a profit, so I think the concept is actually quite flawed.

It's probably going to need another fundraise, to keep funding the fit-outs for new sites, unless it can do deals for large reverse premiums from landlords.

2 main shareholders - Hugh Osmond (47%), who hasn't demonstrated yet that he can work his magic on this company. And Canaccord with 24%. They might decide to take it private, since there's little point in it being AIM listed with such a small free float, in terrible market conditions. so I'd say delisting risk could be high.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.