Good morning from Paul!

Very quiet for news today. I'll leave it there for today, and the week. Have a smashing weekend, and see you back here on Monday hopefully!

Weekly macro/markets summary -

Usually included in my podcast, I thought we could trial having a written version here, as it’s very quiet for company news today. If people like it, I can make this a regular feature.

These are the significant markets & macro points which I jotted down on my pad this week (necessarily not exhaustive) -

Escalation of Arab/Israeli conflict, after Iran fired c.200 missiles into Israel. Minimal casualties, but Israel/US reportedly considering retaliation on Iran’s oil and/or nuclear facilities. Said to be the cause for 5% rise (Thu alone) in spot crude oil price from recent low of $65, to c.$73 (as at Thursday evening). Bank of England Governor also mentioned the risk of oil prices soaring due to M.Eastern conflict. This again questions the wisdom of the UK pursuing net zero priorities, instead of national energy security (particularly gas).

Also this week Israel invaded Lebanon with ground forces, another major escalation, so we should be increasingly worried about geopolitical crises, including of course the continuing Russia:Ukraine war. What (if anything) should we do with our portfolios?

Key comments from Bank of England Governor in a Guardian interview indicated that UK interest rate cuts could be more aggressive, as inflation is easing better than they expected. This put a stop to the rising pound, now fallen from a peak of c.$1.34, to $1.314 at the time of writing. Lower interest rates obviously good for equities, and earnings (at leveraged companies).

Rachel Reeves speech at Labour Conference reiterated that Corporation Tax would not be changed for the duration of this parliament - reassuring for businesses and company earnings forecasts.

UK services PMI data (a key forward-looking indicator of business confidence for the bulk of the UK economy) - softened to 52.4 in September, down from 53.7 in August.

Profit warnings (covered in SCVR) - 7 this week: ECO Animal Health (LON:EAH), Inspiration Healthcare (LON:IHC) , Wynnstay (LON:WYN), Aston Martin Lagonda Global Holdings (LON:AML) , Brighton Pier (LON:PIER) , Surface Transforms (LON:SCE) , and Likewise (LON:LIKE)

Ahead of expectations (covered in SCVR) - modest beats or raised forecasts for James Halstead (LON:JHD) and Renew Holdings (LON:RNWH) . Note large cap Tesco (LON:TSCO) also raised guidance.

Takeovers - Australians withdraw approaches for Rightmove (LON:RMV) after being rebuffed. Hopeless Musicmagpie (LON:MMAG) receives a rescue bid at 9p (it floated at 193p!) from AO World (LON:AO.). Learning Technologies (LON:LTG) possible bid at an opportunistic 100p (too low I think).

Good institutional support (at only a 4% discount) for MPAC placing & acquisition - an encouraging sign that the market is still working, and will fund companies, if the right deals are put together. Strong share price reaction afterwards too.

Private equity bids - why are management teams often supportive of deals that don’t seem to offer much shareholder value? Self-interest perhaps, but also that private ownership can make it easier to expand rapidly, avoiding the slowness, cost and bureaucracy of raising money from public markets. Stock market listings less attractive than ever, maybe?

Mortgage approvals up again in August (source: Bank of England) after a strong July, more evidence that residential housing market is improving gradually.

Nationwide house prices index confirms this, with average house prices up 3.2% over the year to Sept 2024.

AIM feels wobbly, and with erratic price movements. Increasing speculation that this could be due to budget-related actions by some investors, in particular worries that AIM IHT relief could be curtailed or scrapped (Peel Hunt note warned that this could hit some AIM shares by c.20-30% if IHT funds become immediate sellers from redemptions). Also some scuttlebutt that some SIPP holders are liquidating positions in order to take their 25% tax-free lump sum. All worrying, but we could also be laying the groundwork for a strong autumn rally, if the disaster scenarios don’t happen. Your guess is as a good as mine!

Reader comment of the week, “I like the muppets, leave them out of this…!” (Peter T)

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Summaries

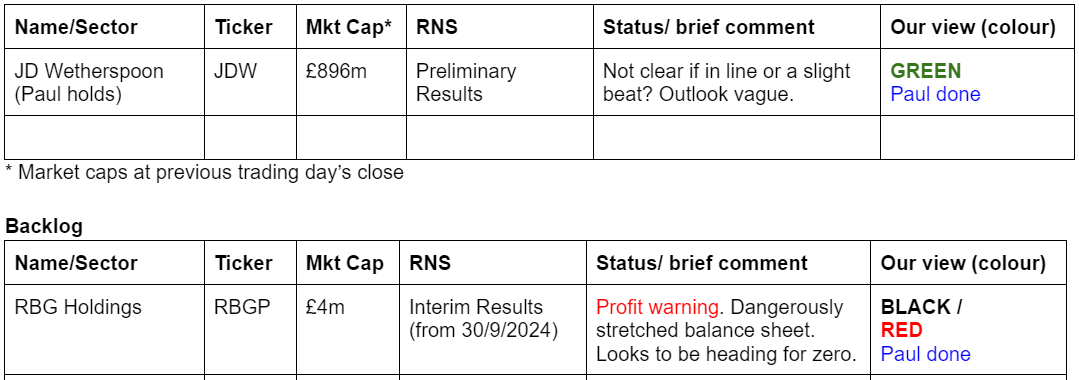

J D Wetherspoon (LON:JDW) (Paul holds) - up 1% to 729p (£904m) - Preliminary Results (52 wks to 28/7/2024) - Paul (I hold) - GREEN

Results look in line or slightly above. Outlook vague, but no different to usual. Balance sheet has plenty of freehold assets which comfortably exceeds debt, so no issues there. Most pubs are now freeholds. I remain of the view this looks a decent, differentiated business, that has further upside to earnings as it continues to rebuilt profits. Looks reasonably priced. So I see quite good risk:reward here.

RBG Holdings (LON:RBGP) - down 21% to 2.38p (£3m) - Interim Results (RNS 30/9/2024) - Paul - RED

Rather belatedly, I look at H1 results out on Monday, and as the share price has been clearly signalling, the news is really grim. The plc looks essentially bust to me, so the only question is what form a refinancing will take, and will there be any value remaining for plc shareholders? Sorry I didn't update sooner on this one, which back in the spring looked as if it might be a risky, but possible turnaround. Not any more unfortunately, based on the worsened balance sheet weakness, excessive bank debt, and another profit warning.

Paul’s Section:

J D Wetherspoon (LON:JDW) (Paul holds)

Up 1% to 729p (£904m) - Preliminary Results (52 wks to 28/7/2024) - Paul (I hold) - GREEN

The value for money pubs chain (also small hotels operation too) puts out decent results to July 2024 today.

Highlights table -

I’m not sure why it has a capital Y with an umlaut for each bullet point above? Maybe it’s supposed to be a picture of a cocktail?

JDW is showing strong profit growth, as it continues recovery from the pandemic lockdowns, and of course more recent headwinds from consumer squeezed incomes, and cost inflation. As a holder myself, I’m happy with these numbers.

Dividends have now resumed, only a 1.65% yield at 12p, but it’s a start.

Is this an earnings beat? I’m not sure as there aren’t any broker updates available. Stockopedia has 43.1p adj EPS as the forecast average from 9 brokers. Actual (not necessarily on exactly the same basis though) is above, at 46.8p (PER 15.6x). So this seems to be in line, or slightly above, which is what the fairly static share price is telling us today too.

Adjustments - or as JDW calls them, separately disclosed items. Are they reasonable? Note 4 gives the detail, which shows quite hefty losses of £32m this year, and £48m last year, relating to property - eg impairments on closure of sites, and various other adjustments. I would like some reassurance that these are not likely to keep happening every year. These have been mitigated (2024) or more than offset (2023) from gains on finance income, which I think relates to the inspired decision to cash in a massive profit on interest rate hedges taken out during the zero-interest rate era. So I’m flagging note 4 for you to have a closer look at, as it does seem that heavy property losses have been obscured somewhat.

The usual table is shown (below) of the remarkable long-term growth of JDW. The recent years excerpt below is there to demonstrate how its profits peaked at just over £100m in 2017, 2018, and 2019 (pre-pandemic), then were obviously clobbered by the lockdowns in 2020,2021 & 2022 (also start of energy crisis), before recovering nicely in 2023 and 2024. It stands to reason that there should be scope for profitability to recover further back to c.£100m.

The columns are, left to right, year, number of sites (notice it’s fallen, as under-performing sites closed), revenue in £k, and adj PBT in £k.

Rather repetitive commentary from eccentric Chairman/founder/25% shareholder Tim Martin covers the usual themes -(in a section headed “You cannot be serious”!)

Worries about more lockdowns, and lack of analysis as to whether they were effective in saving lives or not,

Price disparity & unfair taxation for pubs vs supermarkets.

Scottish business rates being unfair.

VAT inequality.

Pubs collect in a huge amount of tax for the Govt.

The usual points about corporate governance rules forcing out experienced, sector knowledgeable Directors.

High staff retention, staff bonuses, and profit shares.

Awards won.

Press lies about JDW, which constantly have to be corrected, but still get repeated.

He doesn’t like proposals to curtail pub opening hours, and points out pubs market share has fallen vs supermarkets, despite longer opening hours introduced in 1988 & extended in 2005.

Pubs are regulated, and drinking supervised (and recorded on CCTV), much better than drinking in parks, homes, etc -

“This does not mean that pubs are invariably oases of tranquillity but, in general, pub behaviour is good and pubs are valued by communities.”

He also rebuts the “slightly daft” proposal from Cambridge University, that beer should be sold in “schooners” (⅔ of a pint) not traditional pints -

“For example, our Aussie cousins, notorious guzzlers, already use schooners without any noticeable reduction in consumption.”

‘Spoons top selling draught drink is Pepsi, with coffee outselling Pepsi. Although it’s cleverly worded, and I bet you 50p that all the beers added together sell a helluva lot more than Pepsi! So I think we can take this with a pinch of salt. But it is a fair point that many people in ‘Spoons are eating & having soft drinks. I mystery shopped the Mary Shelley in Bou’mth again yesterday, and was delighted with the table service via app, my Stella arrived in literally about 1 minute, and a nice enough microwaved curry (I accidentally over-ordered and it came with 4 poppadum, plus a nan) followed about 5 minutes later, all for £12.47 - not much more than you’d pay for some supermarket beer and a ready meal. And no washing up to do. I also had the dubious pleasure of listening to some nearby “old gits” (think a cross between Alf Garnet and one of Paul Whitehouse’s characters) loudly putting the world to rights, and accusing various celebrities of being terrible people. Plus some incomprehensible story about a builder being paid to stay away from a building site in the 1970s or something. I shouldn’t have been earwigging, but they were so loud, they drowned out my headphone podcast.

Outlook -

"The company currently anticipates a reasonable outcome for the current financial year, subject to our future sales performance."

As indicated above, sales continue to improve. In the last nine weeks, to 29 September 2024, like-for-like sales increased by 4.9%.

I suspect some investors may be missing a trick on LFL revenue growth. Last year, inflation was much higher than it is now. So although LfL sales have slowed from +7.6% FY 7/2024, to +4.9% in the new financial year, inflation has fallen from c.5.9% a year ago, to c.2.2% now. So the “real” revenue growth by my simple calculations has actually gone up from +1.7% a year ago, to +2.7% now.

Hence sales growth in real terms, has not slowed down this new financial year, it’s actually grown slightly.

Freeholds - note JDW has been steadily buying more freeholds (excellent, in my opinion) and 72% of its sites are now freehold, up from 41% in 2010.

Expansion - there are currently 800 ‘spoons, it says there’s scope for c.1,000 in the UK. So not particularly exciting growth potential. Although there could be more growth from hotels, which is an interesting sideline, and it talks about expanding existing successful pubs into adjacent buildings, adding beer gardens, etc.

Would it ever consider overseas expansion I wonder? Probably best not to risk it, is my view.

JDW has also started doing some franchised sites, including at two universities, and is considering other franchise opportunities. Interesting!

Overall then, growth does seem to be on the agenda, despite the reduced number of sites. I recall in an interview earlier this year, Tim Martin said they made a mistake in duplicating sites in the same location, where they had a quiet pub, and a noisy pub (with music), but that idea didn’t work, hence why some sites have been closed, he even laughed about making a mistake that cost the company £100m.

Multi-site operators in retail and leisure are constantly assessing and tweaking their estates, so I don’t see any issue with any of this, in fact it’s good to see an estate being actively managed to weed out the under-performers, or let sites go where landlords demand excessive rental increases, etc.

Balance sheet - the massive item is £1.37bn in fixed assets (property, plant and equipment), of which most is freehold (and long leasehold) NBV £1.07bn.

Working capital is heavily negative, or favourable I should say (as cash comes in before trade & other creditors have to be paid), with current assets of £122m, and current liabilities of £351m.

Long-term borrowings (excl leases) is substantial at £719m, but of course this is comfortably exceeded by freehold property assets, so it’s not a concern.

NAV is £402m, with only £6m intangible assets, so £396m NTAV or 320p/share, so some asset backing of the 729p share price.

I can’t find any mention of what the current market value is for its freehold estate. Freeholds seem to be in the books at cost, and don’t seem to have been revalued upwards. So possibly there might be upside on freehold valuations, although town centre properties may also have fallen in value. A property surveyor once told me that pub freeholds are based on the profitability of the individual site, which makes sense, or alternative use if loss-making.

Bank facilities were renewed and improved, and fresh interest rate hedges are now in place, to protect against an unexpected spike up in interest rates, which may be unlikely, but that’s what people thought in 2022 and 2023 too! JDW’s hedges then proved a stroke of genius/luck.

Paul’s opinion - I’m happy with this, there don’t seem to be any issues.

I remain of the view that ‘Spoons is a differentiated business (much cheaper selling prices than the competition), hence has a loyal customer base. It’s the pile it high, and sell it cheap operator in the pubs space, with decent enough product at good value prices. I've never had any problems at many 'Spoons sites I've visited, nobody's ever bothered me.

I think profits could have further scope to rise further, and maybe return to historic margins, which would mean a higher share price I think.

Stockopedia shows a fwd PER of 13.9x, and that’s on what seem conservative forecast assumptions. I’m hoping it might continue to see forecasts edging up, with a positive trend well established already -

Summary - I think JDW is a decent, differentiated business, with a strong market position. Shares look good value to me, so I’m personally happy to continue holding. I think there’s a possible opportunity here for earnings to rise more, and the PER to expand a bit further too. This share probably won’t shoot the lights out, but I can see more upside than downside on it at the current price.

RBG Holdings (LON:RBGP)

Down 21% to 2.38p (£3m) - Interim Results (RNS 30/9/2024) - Paul - RED

I meant to review this earlier this week when H1 results came out, as there was a lot of reader interest in it, at/near the top of the “most viewed” home page widget. Shares are in freefall now, so obviously the damage has been done for any bulls still left holding it. However, I thought it might be useful to review the situation anyway, in case people are tempted to bottom fish for a possible recovery (the short version is, I wouldn't personally).

I’m embarrassed to see that when I last reviewed this problematic holding company for 2 legal practices, I was amber/green back in March and April. Obviously that looks really bad now, six months later. However my view back then was moderately optimistic because RBGP had taken seemingly good turnaround actions - disposal of the last problem division Convex, small placing to improve balance sheet, renewed bank facilities, and turnaround actions (eg cost cutting). Hence to me, at the time, it looked an interesting potential turnaround, albeit peppered with high risk warnings in the SCVRs at the time.

Unfortunately, the last six months have not gone well, despite the perky tone of the H1 results commentary out on Monday.

“RBG Holdings plc (AIM: RBGP), the legal services group, today announces its unaudited results for the six months ended 30 June 2024 ("H1 2024").”

“Executing a clear strategy to restore value and reduce risk profile”

Trading - was in line for Jan-Apr 2024, but saw “a marked decline” in May & June 2024.

Adj LOSS before tax of £(2.8)m in H1 - statutory LBT £(5.7)m - I think that’s so bad, it might not be a recoverable situation.

I cannot fathom this quote below, how is this possible? Maybe the banks relaxed the covenants? -

“The Group was during the period and remains in full compliance with its banking covenants.”

Outlook - is another profit warning, despite an attempt to polish the proverbial turd -

Balance sheet - is also really bad, and doesn’t look sustainable to me as currently structured.

It’s laid out wrong, in the American style with assets bunched together, then liabilities lower down.

I’ll edit & summarise the balance sheet below - with all intangible assets and lease entries removed.

Fixed assets £1.8m (office fitouts & computers, so probably very little resale value)

Receivables £19.4m (which tend to be high at solicitors, but often are not fully collectable)

Cash £1.5m

Tax assets £2.2m

Current assets total £23.1m

Trade & other payables £11.5m

Debt (excl leases) £4.1m

Current liabilities £15.6m

Net current assets £7.5m

So far that looks a survivable position, providing it can collect in the receivables at a sufficient pace to meet the payables due.

On to >12 months creditors, oh dear, this is the breaking point -

Debt £21.75m

Net tangible assets negative £(12.5)m

Hence this business is completely dependent on the bank debt remaining in place. I imagine the bank must be having kittens at how bad the H1 results are, and the uncertain outlook. In total the bank is owed £25.9m secured (on what? Receivables presumably?) so it’s really in a quasi-equity position now. Four times the commentary says it is and remains in compliance with its bank covenants. I don’t believe that’s likely to remain the case - how can it? A loss-making business that owes its bank about 10x its market cap!

Going concern - gives itself a clean bill of health, with no explanation. I have to invoke Victor Meldrew here - “I don’t belieeeeeve it!”

RBGP is clearly going to need a refinancing, probably at a guess I’d say it needs c.£13m to correct the negative NTAV position back to c.zero, and pay down half the bank debt. Given the market cap is now down to only about £2-3m, then dilution from any fundraise now looks likely to be ruinous, and could be at any price (1p? Less? Who knows).

Existing equity now looks probably worthless unfortunately. Maybe a restructuring could involve putting the plc holding company into administration, after selling off the operating companies to anyone who’s prepared to fund newco. I seem to recall there are difficult rules around legal firms and insolvency, as you would expect.

On Tuesday this week, 21% shareholder Ian Rosenblatt told Sky that he’s intending to requisition an EGM to remove the CEO. The company hasn’t issued any RNS, so possibly has not yet received any EGM requisition. We were told yesterday by RNS that the Senior Partner of Rosenblatt (the main operating business of RBGP) has resigned as a plc Director, but remains a Director of two companies below plc level. This suggests to me that Rosenblatt (the firm and the individual) are possibly trying to extricate themselves from the plc in some way.

Paul’s opinion - things have clearly deteriorated considerably, and the hoped-for turnaround which seemed possible six months ago just hasn’t happened. Hence this plc now looks essentially bust to me, with bank debt now being the main priority. It’s the type of situation when RNSs start to talk about “stakeholders” instead of “shareholders”. Could it be a multibagging turnaround? It’s possible, but looking increasingly remote in my opinion.

I don’t know what the outcome will be, but the facts have clearly worsened very considerably, from a high risk possible turnaround, to a very high risk likely wipeout for equity. For that reason, I think it’s very important not to risk money we can’t afford to lose on this share. Adding to existing positions in the hope of a miracle very rarely works in my experience. So rather belatedly, it has to be RED - best avoided.

I won’t be tempted to have a punt on this, as I think the risk of a total, or near-total loss has to be over 50% after these awful interim results. That’s what the share price is telling us too. If it was going to be rescued, then insiders would be filling their boots, which they’re not.

IPO to catastrophe in just over 6 years -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.