Good morning from Paul only today, with it being Friday. Today's report is now finished.

Have a great weekend, and be sure to tune in to the next thrilling instalment (episode 28) of my small caps podcast tomorrow!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda - it's a quiet news day. Here's my agenda - hoping to have reviewed these 3 before the usual 13:00 finish time -

Essentra (LON:ESNT) - this is my first look at this share, as previously it's been too big. Shares have been in a downtrend for 7 years now, but a big restructuring looks set to eliminate net debt, allowing an imminent £150m return of capital to shareholders, about 23% of the current market cap. Lower margin divisions have been disposed of, leaving a high margin components maker/distributor, that looks worthy of further research. Trading for FY 12/2022 is in line, but conditions weakened in Q4 - offset by price rises and cost control. Overall, a thumbs up from me, as looking potentially interesting.

Nanoco (LON:NANO) (up 41% to 60p) [quick comment] - we’ve been keeping an eye on this share, where there’s only really one big issue - its litigation with Samsung, which could potentially be highly lucrative if NANO wins. Today’s announcement trumpets “Litigation Outcome - Settlement Agreed”, which sounds very exciting (depending on the terms of course, which are not disclosed). It seems an outline, no fault agreement, with detailed terms to be agreed in the next 30 days. Both parties have agreed a hold on the trial, due to start today. Without knowing much more detail about the case, and the likely financial outcome, it’s still impossible for me to form a view, or value the shares. But it’s certainly an interesting situation. No section below.

Clarkson (LON:CKN) - a surprisingly muted (+4%) share price reaction to an ahead of expectations FY 12/2022 update, which blows the existing broker forecasts out of the water (haha!) - Liberum raises forecast EPS by a whopping +19% today. The only question is how much of the earnings boom is sustainable, given that supply chain problems caused a temporary and huge spike up in shipping rates? I like the company, which has a great long-term track record, but am worried about the cyclicality & high risk of profit warnings possibly? So I'll steer clear for that reason.

One Media IP (LON:OMIP) Amazingly, I last looked at this tiddler here in Nov 2013 (not a typo!) It buys up digital music rights, and earns repeat income streams from them. It also has a software business focused on anti-piracy for music, which sounds quite interesting, but is cash-burning (expected loss of £(1.4)m this year to 10/2023).

Overall, OMIP historically seems to make about £1m pa profit, but looks way too small to be of much interest - the management and listing costs must be disproportionately large. There’s been a fair bit of dilution over the years too.

Today’s update reports revenue of £5.1m (up 16% Y-on-Y) and EBITDA £1.8m for FY 10/2022 - which means H2 must be £0.8m against £1.0m reported in H1.

My view - it’s clearly sub-scale, and obscure, but if the software business takes off, things could get more interesting. This looks a much more sensible investment idea than most micro caps, and it doesn’t seem to have any cash raising requirement to keep operating (but would need to dilute for any significant expansion - which is the main problem), so probably a lot safer than most micro caps. Might be worth a look for special situations micro cap investors.

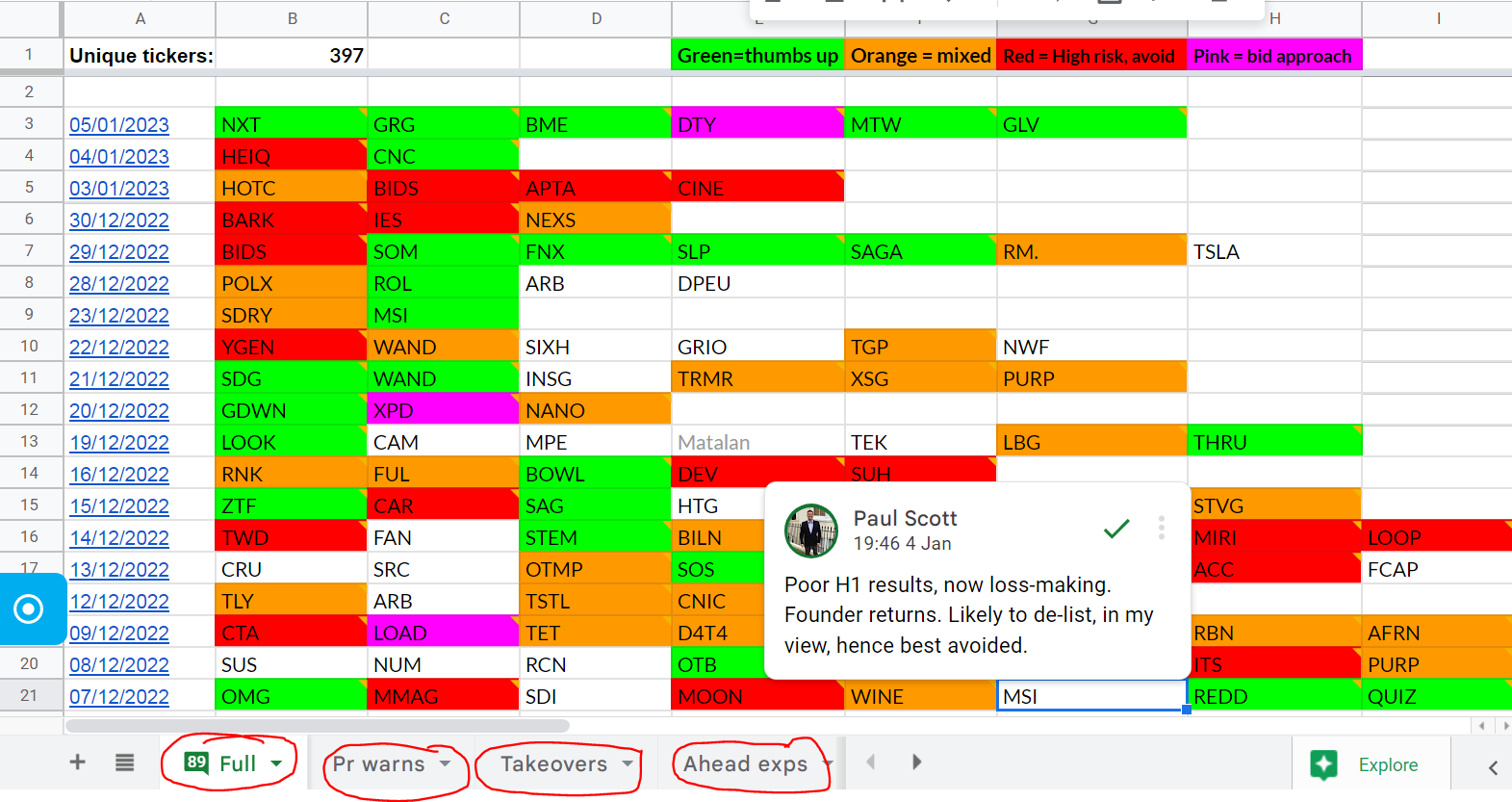

Launching my spreadsheet - this is a project I've been working on for the last few weeks. It's an idea I came up with, to do a summary spreadsheet of the SCVRs, listing all the companies we cover. I've now extended it, to colour code all the companies we look at, with a simple traffic light system (apologies to people with colour recognition challenges, but there is a key at the top, which I hope helps). Green is thumbs up, orange is mixed, and red is avoid/high risk. Pink is takeover bid approach. Then you can hover over each ticker, to see a pop-up box with a quick summary of our SCVR view. I've not done Graham's yet, as I thought he might like to do them himself. Here's a screen shot (I'm hovering over ITS on 8/12/2022) -

There are 4 tabs (ringed in red at the bottom) - the main tab gives you a quick reference listing all companies we cover. Then I've also started 3 other tabs to record - profit warnings, ahead of expectations updates, and takeover bids.

To look up any company, just use CTRL+F

The idea is that this is just for Stockopedia subscribers, as an added value service. So please don't share the link, which is here.

I'm looking for feedback - is this a useful spreadsheet? Should I keep updating it every day? Or is it a waste of time? I'll respond to your feedback accordingly. So please take a look if you wish, and then leave a comment below, so I can gauge whether enough people find it useful to make it worth putting in the extra time updating it every weekday. Thanks!

EDIT: feedback points so far seem to be -

- Yes people like the concept, so I'm pleased to continue with it.

- Colour-coding - request to change orange to yellow - yes, I'm happy to do that, leave it with me! (EDIT: done)

- Pop-up comments - doesn't seem to work with Apple, or some browsers. Leave that with me, I'm not much use on IT, so might need to get some help on that, which could take a little while to sort out. Maybe try downloading Google Drive onto your computer first, and open it within that maybe? The pop-up comments are a key feature of the spreadsheet, so it's important we try to get this working for everyone. We might need to move it onto Excel or something else, with a password? One step at a time anyway, this is just a new idea that I'll gradually develop.

- Replacing tickers with company names? I'll start putting the company name in the pop up comment box, so the name comes up when you hover over the ticker (appreciating that this doesn't work for everyone at the moment, but we'll find a workaround).

Essentra (LON:ESNT)

216p (down 8% at 09:28)

Market cap £650m

We’ve never before looked at this company here, because the market cap was previously too large.

ESNT has been in a downward trend for the last 7 years, and is now paying us a visit within our SCVR universe of stocks, so let’s give it a test drive!

Background points I’ve picked up from a quick review of the StockReport -

Dividends previously generous, but were slashed by about two thirds from 2019 onwards. Forecast divi for 2023 is to rise significantly - how realistic is that? (update - it does look realistic actually, due to a major disposal about to complete, which will eliminate net debt)

Stockopedia screens - only qualifies for one, a shorting screen! (Altman Z-score), suggesting I need to look closely at solvency. (update - ignore this, as the big disposal will wipe out net debt & leave a strong balance sheet). It's important to check, when a poor Z-score appears for any share.

Broker forecasts - repeatedly reduced since last summer -

Graphical History - big fall in revenues below (graph 1 below) suggests a disposal might have happened, possibly? Update - yes, the business appears to be downsizing, and focusing on its high margin components division, which is why forecast revenue is set to decline further. Not a problem, I like that it is becoming more focused on high margin activities.

Poor long-term trend in EPS (graph 3) - can this be reversed?

.

Who owns it? No noteworthy major shareholders, just a regular bunch of institutions. Quite fragmented -

.

Recent change of CEO - Scott Fawcett has just taken over, from 1 Jan 2023. Other Board changes too. I wonder what the circumstances are behind these changes?

Disposal of cigarette filters business completed on 5 Dec 2022 - good, as I never invest in anything cigarette-related, nicotine is a curse on humanity, and blighted my health/life for 20 years, so I detest it with great passion.

Another pending disposal (of its packaging business) looks highly material, to raise £312m. A shareholder vote approved it on 9 Nov 2022, and it’s expected to complete by 31 Jan 2023. The group intends returning some of this to shareholders, and it should wipe out existing net debt.

The remaining business is focused on components -

Essentra Components is a global market leading manufacturer and distributor of plastic injection moulded, vinyl dip moulded and metal items. Operating in 25 countries worldwide, 12 manufacturing facilities and 23 sales & distribution centres serving c.80,000 customers with a rapid supply of low cost but essential products for a variety of applications in industries such as equipment manufacturing, automotive, fabrication, electronics, medical and renewable energy.

Acquisition of Wixroyd (supplier of industrial parts) for £29.5m(plus up to £7.0m deferred earn-out) announced on 1 Dec. Acquisition multiple was c.9x EBITDA -

This is the first acquisition to be announced since Essentra outlined its new strategy as a pure-play components business and continues a successful track record of acquisitions in the components business over the last ten years…

The acquisition fully supports the Company's strategy, as set out at the recent Capital Markets Event, to accelerate and supplement organic growth through value enhancing bolt-on acquisitions that expand its product, market and geographic breadth. The acquisition is expected to be accretive to adjusted1 EPS in the first full year of ownership, with ROIC2 expected to exceed 15% within three years, and delivers profit margins significantly ahead of the current Group level.

Interim results to 6/2022 - I’ve had a quick look, and the components division (the ongoing business, after disposals complete) looks good - with +13% LFL revenue growth to £176m in H1, and a 20.4% operating profit margin. It made £35.9m adj operating profit in H1 - this looks a good quality business.

Net debt of £249m should be wiped out shortly by the packaging division disposal proceeds, if it completes as planned at end Jan 2023. Interim divi raised 15% to 2.3p.

In line with expectations full year outlook (on 17 Aug 2022 publication date of interim results).

Pension schemes are on the balance sheet, so would need careful scrutiny before buying this share.

Balance sheet should look really good once the big disposal completes shortly.

Good, that’s a quick run through the basics, so let’s see what it says today -

Key points -

FY 12/2022 operating profit (adj) in line with expectations. However, bear in mind that 2022 profit expectations have been slashed by about two-thirds in the last 6 months, so this is not really a positive. It just means things haven't got any worse!

Q4 slowdown in revenue (“toughening market headwinds”) , but cost control & raising selling prices has offset volume decline. Reasons? US distributor de-stocking, and China lockdowns (which should abate in H1 2023 it says). Those both sound temporary issues, which augurs well for a recovery at some point in future maybe?

Intention to return £150m to shareholders in Q1 2023 - this is 23% of the current mkt cap of £650m, so significant. Hence buying the shares now, you’re effectively paying £500m market cap.

Inflation - confident it can pass on cost increases to customers. That's important, as it means less risk of a collapse in profits if macro conditions worsen, as seems likely in the short-term.

Outlook -

Looking ahead, the Group continues to monitor the macro-economic outlook and is focused on maintaining profit margins. The Group's resilience is supported by its breadth of customers, market categories, geographies and acquisition momentum. The Company's strong balance sheet also provides flexibility to pursue organic and inorganic growth opportunities.

Broker forecasts - annoyingly, there aren’t any research notes available.

Consensus data on Stockopedia shows 5.9p EPS for FY 12/2022, and 12.8p EPS for FY 12/2023. I’m not keen on shares where a big increase in 2023 EPS is forecast, as depending on the circumstances, that could open up greater risk of profit warnings. Right now, with tough macro, I prefer to see 2023 forecasts set modestly, and below 2022, to reduce the risk of a profit warning.

My opinion - just my first look at this company, so consider this only a semi-informed view.

I think it looks interesting. Once the big disposal completes shortly, that opens the door to a substantial return of capital to shareholders of £150m, and enough left over to clear most of the net debt.

The remaining components business looks good - high margin, so it must be specialised, so the next step would be to find out specifically what it makes/distributes, and how sustainable are those high margins?

I like the comments about pricing power, and passing on higher inflation.

We can forget the Altman Z-score warning, as there’s over £300m about to come in from a disposal, which clears the debt, and leave a strong balance sheet.

A lot now hinges on how well management executes on the acquisition strategy. If that genuinely adds value, without diluting shareholders, then that could be a good catalyst. If they screw it up, we've all seen that happen at plenty of other companies, it could be problematic.

Overall, I’m going to give this share a thumbs up, as looking worthy of more detailed research by subscribers.

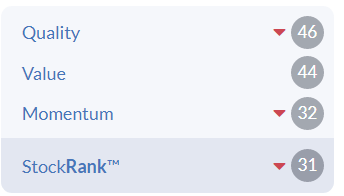

Stockopedia's computers are currently unconvinced of the bull case, so it might be best to watch from the sidelines if you're of a nervous disposition?

Clarkson (LON:CKN)

3265p (up 4% at 12:05)

Market cap £1,002m

Clarkson PLC, the world's leading provider of integrated shipping services…

That seems a bold claim, given that CKN has revenues of about £500m pa, which must be fairly trivial in the context of the global shipping industry.

Strong trading in Q4 (of FY 12/2022)

Broking division - particularly strong.

FY 12/2022 results - “ahead of current market expectations”.

Guidance - not less than £98m underlying PBT.

Diary date - 6 March 2023 for results.

A 4% rise in share price today seems surprisingly modest for an ahead of expectations update.

Broker update - many thanks to Liberum for an update.

It’s raised FY 12/2022 forecast EPS by 19%, to 233p! Next year's forecast goes up 22% to 237p (note that’s only slightly ahead of 2022).

PERs at 3265p per share are therefore 14.0x for 2022, and 13.8x for 2023.

The broker research discusses whether the boom in recent earnings is cyclical, or structural.

Balance sheet check - I’ve looked at the 6/2022 balance sheet, and it’s fine. I see little to no risk of insolvency, plenty of net cash, so no concerns here.

The Z-score agrees (it can be difficult to please!), with this share in the safe zone -

My opinion - I’ve not followed Clarkson for a while, and don’t have any industry expertise at all, so take my views with a pinch of salt.

The only thing I would say is that we know the pandemic obviously caused huge disruption to global shipping, and shipping container rates soared about 10x, making container shipping hugely profitable for a while. That’s now reversed. So the key question, is to what extent did Clarkson benefit from this? Its main profit comes from ship broking. To my non-expert mind, it seems reasonable to assume that lower demand for shipping, due to weaker economies, and de-stocking in the West, and much lower container rates, is likely to see brokers making less money compared with the last 2 boom years.

But if that’s the case, why did Clarkson do so well in Q4 2022, when these factors would have already been underway? Maybe there’s a time lag, with bumper trading being on previously agreed, expensive contracts? I don’t know.

For me, I wouldn’t want to buy into any cyclical sector that’s just had a massive boom, when boom is already turning into bust. The risk of profit warnings in 2023 looks too high to interest me.

That said, Clarkson has an outstanding long-term track record of shareholder value creation.

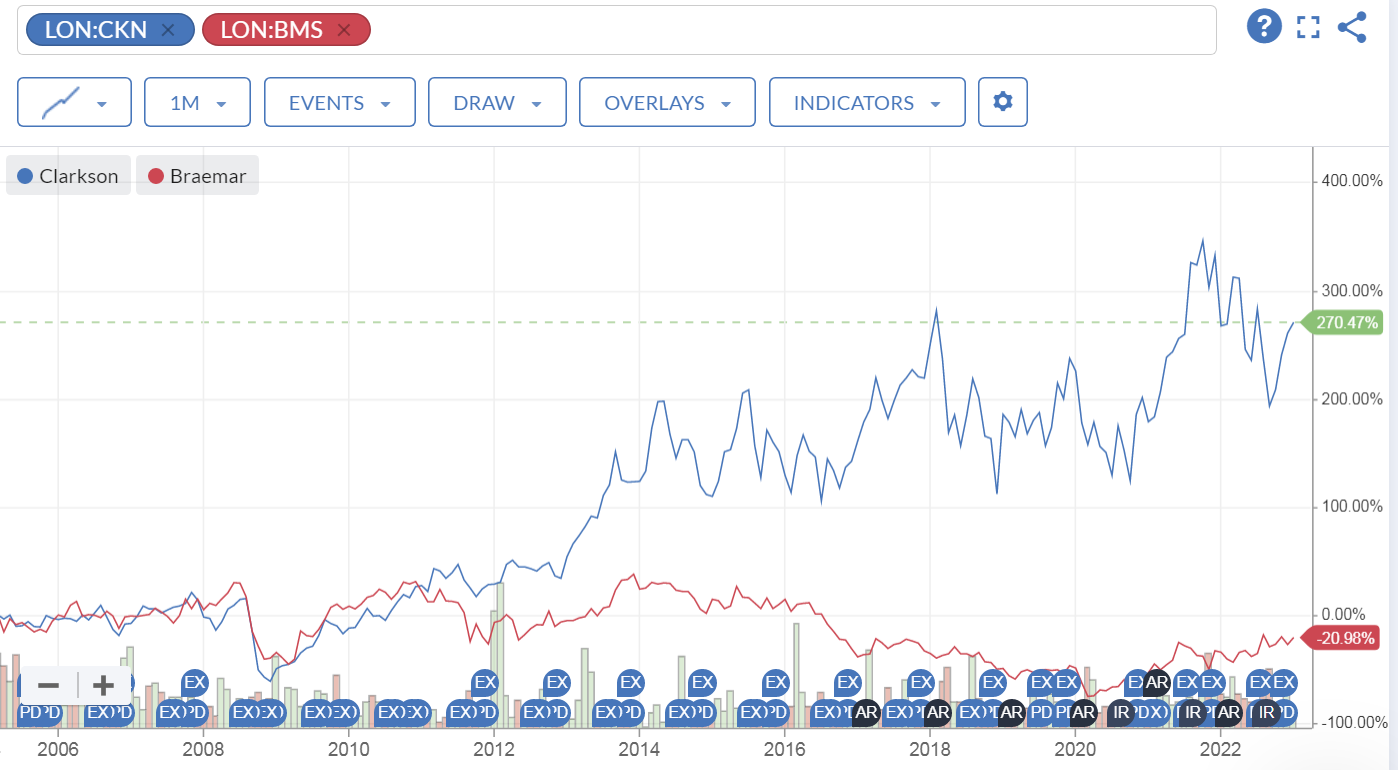

Smaller listed rival Braemar (LON:BMS) might be worth a look, and I see its headline valuation numbers are much cheaper than Clarkson.

See the chart below, which shows the striking long-term outperformance of Clarkson vs Braemar. Although also note that most of Clarkson's big gains happened quite a few years ago, and it went sideways from 2013 to 2021, and isn't that much higher even now, after a boom in its sector. So you could argue this either way, depending on what timescale you choose for the chart!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.