Good morning, it's Paul here.

Mello London

David Stredder's team have been working hard to put together 2 events, back to back, in May 2019. The location is in Chiswick again, which was an excellent venue last time.

Mello Investment Trust & Funds - this should be an excellent one-day event on Wed 15 May.

The line-up of speakers & exhibitors looks superb - lots of very interesting insights, I imagine.

Mello 2019 - the main, 2-day Mello event is back (also in Chiswick) on Thu 16 & Fri 17th May. Previous attendees will know how well-organised, friendly, and interesting these events are. As usual, Graham and I will be in attendance, chatting to all & sundry about shares! Hope to see you there.

Debenhams (LON:DEB)

Share price: 3.06p

No. shares: 1,227.8m

Market cap: £37.6m

Series of announcements

Let's recap on the situation with this struggling department store chain.

Trading update (profit warning) - earlier this week, on Tuesday, the company issued a profit warning. To summarise it;

- LFL sales still negative, at -5.3% in H1

- Discussions ongoing to restructure balance sheet (i.e. equity/debt fundraising)

- Statement from 10 Jan 2019 that trading in line with expectations is no longer valid (it didn't seem credible to me at the time)

- Still expecting to close c.50 stores in the medium term

- Needs support of landlords & local authorities, to reduce rent & rates liabilities - this is the crux of the situation, and I don't see any alternative to a CVA or administration - hence it's very difficult to see any value in the existing equity.

Sports Direct statement - major shareholder, headed by Mike Ashley, has put in a requisition to sack almost the entire board. Bizarrely, Ashley has offered to take over as CEO of Debenhams, on a full-time basis - i.e. relinquishing his role at Sports Direct.

It's difficult to take this seriously, since Ashley seems to be doing so many deals at the moment, buying up various struggling retailers, that you wonder how he could possibly take on a role as big as running Debenhams on top of everything else.

It also brings into question the massive conflict of interest. Presumably he wants to buy Debenhams and merge it with House of Fraser. The only realistic way to do that, would be through some kind of insolvency procedure (most likely CVA or administration). If, as is likely, DEB shareholders would be largely or completely wiped out, then how can that be presented as acting in the interests of all shareholders?

Debenhams response - this morning. A brief response, which says;

The board has been engaging with Sports Direct and our other stakeholders regarding options to restructure our balance sheet and is disappointed that Sports Direct has taken this action. In the meantime, discussions to address our future funding requirements are well advanced.

My opinion - it remains uninvestable as far as I'm concerned. The reason being that the long, over-rented leases, are a millstone that has to be removed, in order for the chain to have any realistic chance of future survival. Lots of stores need to be closed. There's probably also a backlog of capex in the stores. All of this would need considerable new funding, but at what price?

The risk of insolvency at a 0p outcome for existing shareholders is way too high, for me to want to gamble on a favourable outcome here.

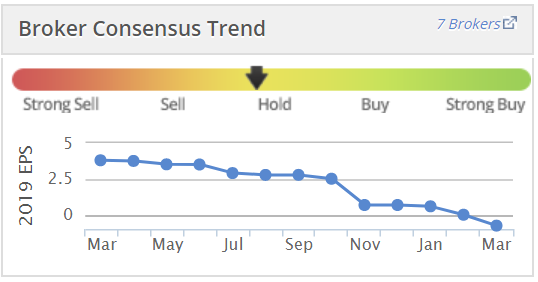

Note the trading performance seems to be declining badly - see broker consensus forecast downward progression, below. Once it becomes loss-making, then the clock really is ticking. DEB needs to clinch a refinancing deal quickly, or I fear events could spiral out of control.

Goals Soccer Centres (LON:GOAL)

Share price: 34p (down 39% at 08:09 today)

No. shares: 75.2m

Market cap: £25.6m

Trading update (profit warning) & change of reporting date

Goals Soccer Centres PLC (AIM: GOAL) a leading operator of outdoor small-sided soccer centres with 50 sites including four in California, North America...

Accounting problems - Uh-oh, the dreaded accounting "errors" bogeyman has appeared again;

As part of the review of the results for the financial year ending 31 December 2018, the Board, together with the Auditors, are working to resolve certain accounting errors, and are reviewing some accounting practices and policies.

It is likely that the Board will take a more prudent approach both for 2018 full year results and going forward.

Profit warning - this is not quantified, which is unhelpful;

As a result, the Board now expects the 2018 full year results will be materially below expectations and that the reporting date (previously 12 March 2019) will be delayed.

Banking covenants - breached;

Whilst the majority of these accounting adjustments are of a non-cash nature, this does nevertheless mean that the Company will have exceeded one of its banking covenants at 31 December 2018. We are in discussions with the bank with a view to agreeing re-negotiated facilities.

Re-negotiated facilities usually do get agreed, when listed companies breach covenants, but at a price. Riskier lending gives banks the opportunity to hike up interest charges, and fees. Plus there's always the risk that the bank might not play ball, and could demand a discounted equity fundraising as the price of maintaining lending facilities.

Ultimately, banks can even pull the plug, and force a company into administration. So make no mistake, the risk here just got a lot higher.

Current trading - is strong;

The Board would also like to confirm that trading in the first two months of the year has been strong with an increase in like-for-like sales, in both the UK and US, over the comparable period in 2018.

My opinion - these latest problems make it uninvestable, as far as I'm concerned. The business model has looked questionable for a while, so the latest bombshell of imprudent accounting, must surely be the last straw for some investors?

This share is illiquid, so selling up & moving on is only an option for small shareholders. Larger holders are left high & dry, probably praying for a takeover approach.

Falling knife catching is too risky here, even for me! Heavily indebted companies, which have breached a banking covenant, can be very dangerous. That situation often ends with ruinous dilution from an emergency fundraising, or insolvency, or a lowball takeover offer (as we saw recently with FlyBe). Why take the risk?

Big Sofa Technologies (LON:BST)

Share price: 4.75p (up 5.6% today, at 12:10)

No. shares: 138.8m + 25m placing today = 163.8m

Market cap: £7.8m after placing

Placing - this raises £880k of fresh cash (before associated expenses), plus £120k (3m shares) in unpaid consultancy fees have been settled in shares. The price is 4p.

Current and former Directors have subscribed for 7m shares, with the balance of the 15m cash shares being bought by Novum Securities.

On current trading, it says;

The Company appointed a new Chief Executive Officer on 7 November 2018, who has undertaken a strategic review and initiated a programme of cost savings. As a result, the Directors expect the Company will be able to realise cost savings across the business in 2019 of approximately £1.0 million compared to 2018.

The Company has made a positive start to 2019 with revenues and commissions which are expected to be recognised in 2019 exceeding £400,000 (as at the date of this announcement), and a good pipeline of prospective commissions.

The Directors believe that the Company's strategic roadmap (outlined in the Company's financial results for the financial year ended 31 December 2018 represents a sound strategy for 2019.

£400k strikes me as a minuscule revenue figure, even allowing for the fact that it's only early March.

Final results - there's no sign yet of this being anywhere near a viable business.

A few key figures for 2018 results;

Revenue £1.7m - up 29% on 2017. In my view, that's nowhere near enough revenue growth to justify investing in a loss-making company. I don't mind buying into loss-making companies, if there is very strong revenue growth (in 3 -digit percentages), high gross margins, and a clear roadmap to profitability in the next year.

Gross profit is only up 16% to £1.0m - again, nowhere near good enough.

Operating expenses of £4.7m - clearly costs are wildly excessive, compared to gross margin. It would need to grow sales by almost 5-fold, in order to move into profit on this cost base. Hence why 16% gross profit growth is nowhere near enough.

Loss before tax was £3.7m - a level that will require funding, from shareholders.

Cost-cutting has been done, of £1.0m. So on unchanged revenues, it would still burn through £2.7m in 2018.

Balance sheet - receivables jumps out as a too-big figure, at £1,069k. Given that revenues was only £1.68m for the year, then even putting VAT on to revenues, means that about 6 months revenues have not been paid for by customers.

It's possible that there might be other receivables in that £1,069k figure, not just trade receivables, but no further breakdown is given.

Cash position - the company is burning cash fast, so the £816k year-end cash, plus the £880k fundraising (less fees) would probably only give the company enough cash to last until early autumn. Expect another fundraising in the summer. If there's not decent growth evident by then, who would want to continue financing it? Therefore I think this company must be running out of options, and is close to taking up residence in the last chance saloon.

On the upside - the relationship with Ipsos looks interesting, and accounts for about a quarter of revenues. Ipsos invested £3.4m into BST in 2018, and has a nominated Director on the Board. It must see something of interest in BST, although there's not anything evident from the company's financial performance to date.

My opinion - I only invest in loss-making growth companies, when it is clear that the business model is beginning to work, and that breakeven is in sight. That's not the case here, so for me it remains uninvestable at this stage.

Redde (LON:REDD)

Share price: 111p (down 19% today, at 12:41 - price moving rapidly)

No. shares: 306.7m

Market cap: £340.4m

Contract loss - this looks to be the loss of a major customer;

Taking into account the loss of this contract, other contract wins and the effect of mitigating actions, the Board expects that the impact on existing consensus market expectations for the financial year ending 30 June 2020 would be a net reduction in sales of approximately £111.9m (representing 18.2 per cent. of consensus expectations) and a reduction in adjusted operating profits of approximately £4.7m (representing 8.7 per cent. of consensus expectations).

The effect on working capital in the financial year ending 30 June 2020 is anticipated to be positive.

This bombshell (which might be an exaggeration) comes on top of several disappointments in its recent interims. I've only skim-read the results, but key points which triggered a sharp fall in share price seem to be;

- Tougher prior year comparatives in early 2019, due to beast from the east causing more accidents last year

- Higher level of working capital & investment in infrastructure & IT (although today's contract loss should reduce working capital, so could be seen as helpful in that regard)

- Caution on divis - being maintained, rather than further increased. Pointed out that it has paid shareholders almost 50p per share since 2013. Today's announcement might trigger a reduction in divis, or it might not, we don't know yet.

Today's announcement mentions a good pipeline again;

After 10 years of partnership, the Board is obviously disappointed not to have secured the renewal of this contract. However, as announced in the interim results on 27 February 2019, the pipeline of new business is nevertheless encouraging with a number of live prospects.

My opinion - I don't like this sector. Having said that, REDD has (until recently) been a rare success, paying out huge divis. If you buy today, at around a quid, you could be locking in a yield of over 10% - IF divis can still be maintained. Often they're not sustainable, when the yield goes that high, only time will tell.

The big question is whether today's major contract loss is the thin end of the wedge - with competitors under-cutting REDD, or just a one-off? Perhaps it might need to cut its prices (and hence margins) to remain competitive? That would be bear case.

The bull case would point to a very good track record over the last 5 or 6 years. This could just be a glitch, in which case, today might be offering a good opportunity to buy at an attractive price, for a very attractive divi yield (if they are maintained, or even reduced a bit).

It looks very tempting to me at c.100p per share, but I'll need to do some more research. Do readers have a view on this one?

Loss of major contracts is something that nobody (outside the company) can really predict. It's just inherent risk when you own shares. My commiserations to shareholders here - I don't think people should beat themselves up too much about it, as this looks an unforeseeable problem. In the real world, companies win & lose contracts. Reality is rarely a smooth, straight line upwards - in fact, I think companies (such as CAKE) which demonstrate uncannily smooth growth, are questionable as to how real the numbers are?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.