Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

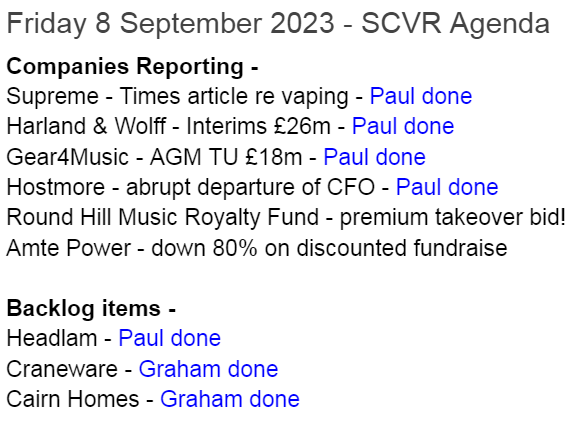

Summaries

Gear4music (HOLDINGS) (LON:G4M) - 87.5p (pre market) £18m - AGM Trading Update - Paul - AMBER

A reassuring update, reiterates full year expectations. Focusing on profit over growth now. £10.0m forecast EBITDA is a nonsense number, due to large capitalised development spending (although this is being reduced). So only £1.4m adj PBT is forecast for FY 3/2024, which isn’t enough to get me excited.

Supreme (LON:SUP) - 114p (pre market) £134m - Times article - Paul - AMBER

An interesting article in today’s Times newspaper flags that Supreme a company connected with Supreme's CEO has donated £350k to the Conservative Party. Supreme’s vaping products are criticised for being colourful and with scents which may appeal to children. Personally I’m worried about vaping, as it seems to be a new way of creating the scourge of nicotine addiction. Other views are available. Shares look good value, and the big political donation might help deter any action to curtail vaping! [no section below]

Harland & Wolff group (LON:HARL) - down 13% to 13.25p (£23m) - H1 Results - Paul - RED

Absolutely horrendous H1 figures - revenue of £25.5m, loss before tax of £(31.5)m, which includes a huge £13.8m in finance costs. Losses blamed on increased headcount in advance of big contracts. Huge order book of £1bn over 7 years. Balance sheet is one of the worst I’ve ever seen, with NTAV negative at £(92)m. Current assets £25m, current liabilities £142m! This is a crazy capital structure, where the business is funded entirely with large loans. It’s doubling down too, with “advanced negotiations” for a new £200m facility. Paul’s opinion - this share could easily go to zero, with big dilution or insolvency. Super high risk, but with equity valued at only £23m, there is leverage here for a speculative spike up - purely for gamblers. On fundamentals, I would deploy my bargepole for this share. [no section below].

Hostmore (LON:MORE) - unch 15.75p (£19m) - Resignation of CFO - Paul - RED

We’ve reviewed this TGI Fridays restaurant chain 3 times in 2023, concluding RED every time, flagging in particular the high risk of a profit warning, excessive debt, high risk of a discounted fundraise (or insolvency). See SCVRs on 10/1/2023, 10/3/2023, and 7/6/2023 for more details.

The company put out a bullish-sounding presentation earlier this year, which caused a spike in share price from 14p to 24p, when they said it could generate £10m pa in cashflow and pay off bank debt in 2 years. In retrospect, I think that’s probably pie-in-the-sky.

Put all that together with the abrupt resignation today of the CFO, and my hunch is that things could be going badly wrong here. A further downturn in sales would probably be terminal, because of the operational gearing in the restaurant sector. Hence I want to reiterate my worries about insolvency or a highly dilutive placing here. Very high risk, and I’m not touching this one again unless it’s properly refinanced with fresh equity. What price would that be at? 1p? 2p? It could be anything. I imagine existing equity could get all but wiped out here, if the downside scenario plays out. Why take that risk? We can get out, but the institutions can’t.

Craneware (LON:CRW) - 1530p (£543m/$678m) - Final Results (Tuesday) - Graham - AMBER

I provide the notes from my call with management of this software group selling into the US healthcare market. It helped me understand their views on a range of issues and hopefully it will help you, too! I have a positive impression of the business; stock might be fairly valued.

Cairn Homes (LON:CRN) - 94.4p (£636m/€742m) - H1 Results to June 2023 - Graham - GREEN

Excellent news from this Irish housebuilder as full-year guidance is upgraded. A very large H2 weighting is expected which should unwind the inventory position and reduce net debt. The large buyback programme expands to €75m at what I believe is an attractive valuation.

Headlam (LON:HEAD) - 227p (£183m) - Interim Results - Paul - AMBER/GREEN

I have a good rummage through the H1 results below, following a profit warning in July. H1 profit came in 65% below last year, due to gross margins weakening, and higher costs. An immensely strong balance sheet with c.£100m of freeholds, and modest net debt, makes this very securely financed. Current trading still sounds a bit soft, but medium term there are good reasons to expect a nice recovery in earnings. I'm tempted!

Paul’s Section:

Gear4music (HOLDINGS) (LON:G4M)

87.5p (£18m) - AGM Trading Update - Paul - AMBER

Gear4music (Holdings) plc, ('Gear4music' or 'the Group') (LSE: G4M), the UK's largest retailer of musical instruments and music equipment…

Trading is in line -

"We are pleased to report that trading during the financial year to date has been in line with the Board's expectations.

* Gear4music believes that consensus market expectations for the year ending 31 March 2024 prior to release of this announcement were revenues of £161.2 million and EBITDA of £10.0 million.

Prioritising profitability ahead of growth, so cost control and gross margin.

“Significant cost efficiencies” in software development unit - note that G4M capitalises a lot of development expenditure (£5.3m in FY 3/2023), which is why EBITDA is meaningless here, as it completely ignores these substantial costs. I’m glad savings have been made here, as the costs previously seemed excessive.

Secondhand system has launched well, in the UK and more recently in Europe too.

“Well prepared” for seasonal trading peak upcoming.

Paul’s opinion - the problem here is that £10.0m EBITDA only becomes £1.4m adj PBT (see Progressive note, 20 June 2023). Lots of revenues, of £161m, but hardly anything in profit. What’s going to change to improve that? I’m struggling to think of anything big.

The last accounts (which I reviewed in detail here) showed a very welcome and large fall in bank borrowings, so I think this share is relatively safe. It’s also got freehold property assets.

The original bull case with G4M, which caused 2 huge bull runs, since dissipated, was that rapid growth and improving margins (as it scaled up) would result in the profit margin rising from miniscule, to something more like c.5% - which on large revenues, would make it highly profitable. At this stage, I just don’t see that as being a likely outcome any time soon.

Therefore I don’t think I can get above AMBER (down from amber/green last time) for the time being, but I’ll keep an eye on developments.

Two fantastic bull runs (the trick is clearly to sell, when it stops rising) -

Headlam (LON:HEAD)

227p (£183m) - Interim Results - Paul - AMBER/GREEN

Headlam Group plc (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its results in respect of the first six months of the year to 30 June 2023…

Slightly ambiguous wording there, it’s H1 of FY 12/2023.

It’s nice to see a headline below that is realistic about profits being down, instead of trying to cover it up (e.g. Beeks Financial Cloud (LON:BKS) this week [I hold]) -

Revenue growth and good cash generation; profits lower due to macro and industry headwinds

If you recall, HEAD issued a profit warning on 27 July 2023 - see my notes here. This said that H1 would see revenues of £332m (up 2.5%), and a sharp fall in underlying PBT from £17m in H1 LY, to only £6m in H1 2023.

Interestingly, and encouragingly I think, the share price spiked down, but almost immediately recovered, and has been edging up a little since. Is this a sign that the bad news is now priced-in, I wonder? That could be bullish, not just for this share, but for other cyclical shares too perhaps?

Note that the share price of HEAD is actually lower than the low at the worst point in the pandemic. The share count has actually fallen too, due to buybacks. So this is looking very cheap compared with historic norms. Which does of course raise the question as to whether something fundamental might be going wrong at HEAD - the obvious one being increased competition from Likewise (LON:LIKE) (led by HEAD’s former CEO)?

Right, on to the actual numbers for H1, which I would expect to be the same as the TU in July.

Revenue up 2.5% to £331.8m - yes that’s as expected.

Underlying PBT also in line at £6.0m (down 65%)

Operating profit (underlying) is £8.2m (H1 LY: £17.9m)

Why is profit down so much? -

…principally impacted by the macro and industry headwinds of lower residential trading volumes and high operating cost inflation

This is despite cost-cutting, profit still fell significantly -

Efficiency and mitigating actions contributed £5.0 million of benefit in the first half, expected to build in H2

It provides a profit bridge from H1 operating profit LY, to this year -

Actually, I’m going to challenge this bridge, as I don’t find it very convincing. A key reason for the drop in profits is that gross margin was lower, at 31.5% H1 TY, vs 33.7% H1 LY. That caused a £7.3m fall in gross profit, but it’s not mentioned at all in the table above.

So the way I see it, I’ll ignore the table above, and instead my conclusions are that profits fell due to -

Lower gross margin (£7.3m impact), and

Increased admin/distribution costs (£5.6m impact)

It doesn’t precisely reconcile to the £9.7m drop in operating profit, but it’s roughly in the right ballpark.

Finance costs more than doubled, up from £1.0m to £2.2m. Note 4 shows that there was no interest income in H1, suggesting it’s in a negative cash position throughout the period. That’s confirmed by bank interest payable in H1 being £1.0m, versus £0.2m in H1 LY. So definitely a deterioration in the cash/debt position. Maybe there's a credit interest offset against the bank borrowings?

The lower gross margin concerns me, because that is indicative of increased competitive pressure.

Having said all that, in a tough macro environment, I wouldn’t expect profits to be static. As long as it’s not loss-making, then a lean period now might just be a blip, who can say?

Interim dividend is reduced, but still worth having at 4.0p (LY H1: 6.2p). A key feature of HEAD shares is the generous divis historically, and importantly it is so financially strong that its dividend paying capacity remains good. So once this soft patch has passed, I think divis could resume an upward trajectory.

Balance sheet - this is fantastic! NAV of £219.9m, only £21.3m is intangible assets. So NTAV is £199m - about half of which is freehold property. The market cap is £183m, so this share is more than entirely backed by tangible net assets - a real sleep soundly share to hold - ideal when you’re anticipating, and waiting for a recovery in trading.

There’s a £3.3m pension deficit showing as a liability.

Cashflow statement - is actually improved, because of normalised working capital movements. H1 TY also saw £3.7m spent on an acquisition, quite hefty capex of £9.7m in H1 - is this is the roll-out of trade counters perhaps? £5.2m was spent on share buybacks, and £9.0m in dividends in H1 - hefty shareholder returns, but probably not sustainable at that level for now?

There was a large drawdown of bank borrowings of £60.0m, offset partly by repayment of £23.2m borrowings, so it looks like the company has adjusted its cash/debt position there to give it more headroom I’d say. Not a concern though, as the levels are comfortable - net bank debt of £19.6m at June 2023, albeit considerably worse than £1.8m net cash at Dec 2022. Hence why I think the big shareholder returns probably need to be reined in for now.

Current trading - “broadly in line with expectations” for July & August, but mitigated with cost savings, so -

...management's expectations for the full year are unchanged

That sounds OK. No sign of any green shoots at the moment, and with house building set to slow down markedly, I would say the macro factors are probably not going Headlam’s way any time soon.

Therefore I’m wary that it might deliver another profit warning. Is that a worry though, given the market reacted so stoically to the recent profit warning?

Outlook - I find this reassuring -

Looking ahead, the ongoing macroeconomic and industry headwinds are likely to prevail into 2024, with suppressed residential consumer spending continuing. However, the medium-term market outlook is strong; annual volumes are currently around 20% lower than in 2019 and we expect volumes to improve significantly over the coming years.

This, combined with the increasing benefits as the strategic initiatives mature, provides opportunities for material profit improvement over the medium term including as a consequence of high operational gearing. Furthermore, the cash requirement, albeit relatively modest, from the strategic initiatives is anticipated to reduce, providing a further boost to cash generation.

Strange that they think they have high operational gearing. It’s a low margin business, so surely operational gearing is quite modest? Maybe they mean that the bulk of the overheads are fixed costs, which makes sense.

Paul’s opinion - I’ve viewed HEAD as AMBER the last couple of times, as tougher trading became apparent. However, on being reminded of the tremendous balance sheet strength, and the upbeat medium-term outlook, and the share price resilience to the last profit warning, I’m seeing signs here we might be over the worst. So I’m warming again to HEAD as a recovery trade for the medium term. There’s probably more upside than downside, hence I’m tempted to dip my toe back in with a small position here, when funds permit. With the intention of buying more if it continues falling.

Recent comments from the Bank of England, that it sees inflation falling, and interest rates now being at or near the peak, suggests to me that buyers might be starting to nibble at cyclical companies like this again. When the bull market starts, it can surprise everyone at its speed, and often anticipates improved fundamentals - if we sit and wait for confirmation of an economic recovery, we’ll probably miss a good part of the next bull market. Hence I’m definitely warming to the idea of putting some money to work on shares like this, and Eurocell (LON:ECEL) (£100k Director buy there this week too), even though the figures look rather poor at the moment. They both have nice strong balance sheets, which means short term share price falls are not a concern.

Stockopedia likes the value and quality, but obviously not momentum -

Graham’s Section:

Craneware (LON:CRW)

Share price: 1530p

Market cap: £543m ($678m)

This software group (serving US-based healthcare providers) issued full-year results on Tuesday.

The share price reacted positively:

I had been up all night with a fever, causing me to miss the SCVR on Tuesday, but I had a conference call arranged with Craneware management shortly after 10am. So I did get the chance to speak with CEO Keith Neilson and CFO Craig Preston.

Before getting into the contents of the call, let me remind you of the headlines from Craneware’s full-year results.

Revenues +5% to $174m

Annual recurring revenue nearly equals total revenues.

Adj. EBITDA +6% to $54.9m

PBT $13.1m (unchanged on the prior year)

For a more detailed review, see Roland’s fine article earlier this week.

Cash - $78m of cash offset by $83m of total borrowings ($75m long-term, $8m short-term).

Interestingly, the Craneware balance sheet includes $51m of cash representing “amounts held on behalf of customers”. So it’s perhaps more reasonable to treat the company as having $27m of its own cash, offset by $83m of total borrowings. That leaves a net debt position of $56m.

Operational highlights - the company has migrated customers onto its new “Trisus” platform, where it can offer a wide range of services. Craneware is even generating some revenues from third parties who add their own applications to the Trisus platform. Customer retention has been maintained at over 90%.

Outlook statement:

COVID-19 public health emergency in the US formally declared over in May 2023, providing a more supportive market backdrop at the end of the year and into Q1 FY24

Continued post-period sales momentum and a growing pipeline of opportunities

Well positioned for FY24 and beyond with balance sheet strength, high levels of ARR and early signs of increasing customer confidence.

My call with management

It was just a brief 15-minute call but I got to ask a few questions which I thought would be helpful for myself and for readers. I have paraphrased the answers below based on my notes - these are not direct quotes from management!

Q1. I asked them to break down in plain English what their software achieves for their customers. Specifically the difference between “digitisation” (this is not what they do) and “digitalisation” (this IS what they do!).

A1. Keith Neilson explained that “digitisation” is simply the recording of individual transactions in a digital format, whereas what Craneware does - digitalisation - is taking all of the data from individual transactions and using it to look for improvements in business processes. Craneware’s solutions can look at the back end of a hospital and help find ways to do things better, with potentially billions of dollars of savings (healthcare spending is enormous!).

Q2. I asked if the demand for Craneware’s products was driven largely by regulations (such as 340B) or if it was largely optional for customers to sign up.

A2. It’s a mix of both. Firstly, there are reporting standards which hospitals have to comply with. You get large amounts of customer data which have to interact and comply with these standards. And then you have the money-saving insights and improvements that are made possible by the software.

Additionally, under the subscription model, the vast quantity of data is constantly being updated over time (i.e. it’s not just an instant piece of analysis - hospitals can see how their processes are changing over time). With high customer retention of 90%+, most customers get to see these long-term benefits.

Q3. With inflation so high over the past year, investors have a different perception of what is an attractive level of revenue growth. Has Craneware’s 5% revenue growth been driven by pricing increases or by additional customers and product sales? And how does the company intend to manage inflation in future?

A3. Craneware has been keeping its pricing flat, so the revenue growth it achieved over the past year is from additional customers and additional product sales.

Its customers have had to deal with very high wage inflation and would have been very unhappy to see rising software costs on top of that. However, US inflation has fallen to only 3% and so they are back to more normal conditions now. The prices of individual Craneware products can contractually be increased. But the company would prefer to grow by developing new software and increasing the value of existing software, rather than increasing its prices.

Q4. Given that the company’s balance sheet includes customer-owned cash (due to one of the company’s roles as an intermediary in the transfer of cash), there is a net debt position. How does the company see this position evolving in the future?

A4. Firstly, the customer-owned cash is a good thing for the company. It can be offset against customer invoices, so it reduces the risk of bad debt. It is also interest bearing, and the company is looking for ways to improve its cash management in order to reduce its net net finance expense (the amount of interest the company paid this year doubled from $3m to $6.5m).

The customer-owned cash is high-volume, staying for a short period of time but being constantly replenished.

As for the overall net debt position, the company is comfortable with the amount of debt it’s carrying but may seek to pay some of it down early. It has confidence thanks to its high levels of ARR/repeat revenues.

Graham’s view

Many thanks to Alma PR and to Craneware for the chat - it definitely improved my understanding of the company and hopefully the above notes have given you an extra insight into it, too!

Roland did a fine job reviewing the full-year results earlier this week, and I have little to add to my previous comments on this stock - if you treat it as a “SaaS” stock, you can argue that it’s cheap. If you look at it through conventional metrics, it seems fully priced. But it’s always nice to find a successful founder-led business.

Cairn Homes (LON:CRN)

Share price: 94.4p (-2%)

Market cap: £636m/€742m

Shout-out to JASVFS in the comments who requested this one. The Irish housebuilder issued half-year results yesterday. I previously covered their H1 trading update in July.

Please note that the stock is dual-listed both on LSE and on Euronext Dublin.

In addition to the results for the six months to June, we also get an update on the order book, with a current snapshot. Business is booming:

(Note: Cairn says that sales of multifamily units drove a higher ASP last year.)

And here’s an excerpt from the H1 results table.

Gross margin at 21% is as expected.

The year-on-year fall in H1 may not look too encouraging, but there’s a significant H2 weighting in store. Previous guidance suggested full-year revenues of €650 million and operating profit of €105-110m.

In fact, this guidance has been upgraded: they are now expecting revenues of over €675 million (at an unchanged gross margin) and operating profit of €110-115m.

The company’s construction work-in-progress (“WIP”, an important component of its inventories) has jumped by €80m over six months, and is expected to unwind fully in H2 as deals close. So WIP will fall back to around €340 million.

Because of the temporary increase in WIP, net debt increased to almost €230 million by the end of H1, but is expected to fall back to €130 million as the WIP converts back into cash.

Share buyback - one of the key reasons I gave this share a positive review was its buyback programme.

I don’t automatically give companies with buybacks the green light. But if their stock is rated at a modest valuation and they are able to devote substantial amounts of cash to buying back their own shares, then this can do wonders for EPS growth (of course profits cannot suddenly shrink, or it won’t work!).

Cairn has announced a €35m increase to the €40m buyback programme announced in March. So it’s now a €75m programme - 10% of the current market cap.

€25m has been spent so far, with another €50m to be done.

Shares outstanding have fallen from a high of 770 million a few years ago, to just 670 million now.

If they were able to keep buying at the current share price (€1.10), the remaining buyback programme would reduce the share count by another 45 million. So maybe there will only be about 625 - 630 million shares left?

Remember that this is the valuation at which they are buying:

The balance sheet shows equity of €733 million (around the same as the current market cap) and moderate leverage. Total assets are over €1.13 billion, financed by gross borrowings of over €300 million. The lenders are a banking syndicate with security over all of Cairn’s assets.

Graham’s view

No reason to change my view on this one: I was positive in July at 99p. The share price is now 94p even though they have upgraded their guidance!

The macro picture remains very supportive, due to the housing shortage conditions. Desperate conditions in rentals do, I think, have a spillover effect into the buying market.

Cairn has achieved a lot in a short period of time, and they say that they are making “progress towards a c. 15% return on equity target as we exit 2024”.

Existing ROE already looks OK and so based on the valuation and the buyback activity, I remain positive on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.