Good morning!

Paul is writing again this morning, with additions to yesterday's article. He will be adding:

- DFS Furniture (LON:DFS)

- Dillistone (LON:DSG)

- Elektron Technology (LON:EKT)

- Creightons (LON:CRL)

So if you're interested in reading about them, his article is here.

Over here, I'm planning to start with:

- IQE (LON:IQE)

- Trinity Mirror (LON:TNI)

- Hogg Robinson (LON:HRG)

- 7digital

- S&U (LON:SUS)

And then I'll see if there are any other interesting stories to cover.

Cheers!

Market movements: a quick follow-up on the general market level. The FTSE is in the red today, at 7140 as I write this. This compares with 7780 on January 12. So we have a lot more potential bargains lying around than we did a few weeks ago.

Last year's low was around the 7100 level, so I'll reiterate that this is a key "level" - I think the mood would start to get a lot more bearish if we retraced back into 2016 territory.

I am still 25% in cash and have placed a few bids under some stocks I'm interested in. If somebody hits my bids, I'll be pleased. Or if the market doesn't drop low enough to hit them, then the rest of my portfolio will probably be doing ok.

Don't forget to bear in mind the potential impact of a stronger GBP on your stocks. One of the big-caps I own is British American Tobacco (LON:BATS) and I need to remember that its earnings in dollars aren't worth quite so much as they were before, when converted to GBP.

I'm also still playing with the idea of shorting the NASDAQ or some component of it, to hedge my exposure to market sentiment. However, the logical side of my brain is telling me that the hedge has a negative expected outcome and that it's a fine strategy to remain unhedged while also holding plenty of spare cash in the event of a major market crash.

IQE (LON:IQE)

- Share price: 98.7p (-2%)

- No. of shares: 756 million

- Market cap: £746 million

Response to Share Price Movement

Another prominent bear has had a go at IQE, the manufacturer of semiconductor wafers.

This time it's the US-based Muddy Waters. You can find its IQE research on its website.

It calls IQE an "egregious accounting manipulator".

I've had a chance to read the document and I am much less convinced by this document than I am by the typical short thesis published by these folks.

The argument is that IQE's transactions with its joint venture, the Compound Semiconductors Centre (CSC), are "not substantive". But I think everybody already knows that this is the case.

MW says that IQE might have "taken advantage" of its joint venture partner, the University of Cardiff. It is indeed something of a mystery how IQE's PPE contribution to the joint venture, in lieu of cash, was valued in the deal at nearly 5x its previous carrying value.

But in the worst case scenario, and if the PPE was overvalued, then what? It means IQE got a good deal, and therefore we should short IQE? How does that follow? Unless relations with Cardiff University were to break down, is there a problem?

- Accounting Issue 1 (IP Licensing).

I agree with MW's take on this. CSC bought intangible assets from IQE and started amortising them (writing them down) over seven years.

IQE recognised the payments from CSC as revenue. However, if these are purchases of IP, as described in CSC's reports, then IQE should have recognised the payments as representing a gain on sale of intangible assets, rather than as ordinary revenue. So IQE's revenues and gross margin would be overstated.

- Accounting Issue 2 (cash-cost purchases from CSC)

MW says that IQE is disadvantaging CSC by buying things from it at cash cost, instead of allowing CSC to make a profit margin.

I'm not entirely convinced by this. IQE's argument, paraphrasing it, has been that it is effectively doing its joint ventures a favour by sending them business, so as to help build them up to eventually win independent customers. These arrangements were temporary while they worked to become standalone entities.

That seems fair enough to me, so long as the unusual arrangements only last for a few years. On the other hand, it does make the 2015/2016 numbers less meaningful. And it's MW's job to find questionable accounts, so I can understand why it would want to look at this.

- Accounting Issues 3 & 4 (IQE carrying CSC at zero carrying value, and not recognising CSC losses)

The next issue highlighted by MW is that IQE arbitrarily changed its accounting policies and may have done so in a manner designed to deceive investors. It wrote down the value of its CSC investment to zero, after which point it did not have to recognise its share of CSC losses.

Again, there is no "smoking gun". There is no proof any wrongdoing whatsoever by IQE. As MW concedes, it may just be a somewhat arbitrary accounting policy.

This isn't to suggest that IQE bulls should be complacent. Losses have piled up at CSC which does suggest that the value of its preferred shares (£8 million) which are owned by IQE is speculative.

- Accounting Issue 5 (CSC is "non-substantive and an alter-ego of IQE)

For me, this is the least convincing line of argument. MW made a bunch of phony calls to IQE/CSC, and viewed lots of LinkedIn profiles, to determine that IQE and CSC are very closely related. Isn't that sort of obvious?

IQE's response includes the following statement:

CSC staff are employed under their own contracts. IQE provides support services including recruitment, to avoid the duplication of costs. The costs incurred by IQE are recharged at cost to CSC, as disclosed in IQE's annual reports and financial statements.

Sounds ok to me.

Conclusion: I think I can see both sides' point of view. I continue to think that IQE shares are probably overvalued. £150 million of revenue from a such a capital-intensive business doesn't justify the current market cap, in my opinion.

Also, the 2015/2016 numbers are hard to make sense of, given the transactions with the JVs. It's been helpful of Shadowfall and Muddy Waters to shine a light on them.

But, does that really matter? Most IQE shareholders are focused on the opportunity for revenue growth from Apple and other customers in 2018 and beyond. I'm sceptical of such growth materialising or at least translating to cash flow in a manner which would justify the current market cap, but isn't that what counts? Nobody investing in IQE today is doing it because of its profitability in 2015/2016.

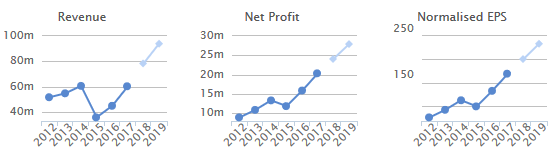

Trinity Mirror (LON:TNI)

- Share price: 72p (+3%)

- No. of shares: 275 million

- Market cap: £198 million

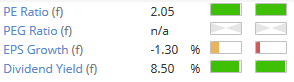

If you ever wanted to buy a stock on a PE ratio of 2x, the newspaper group Trinity Mirror is your chance.

In the trading update, Trinity helpfully tells us that market expectations for adjusted operating profit and EPS for 2017 are £121 million and 34.6p, respectively, and that it will "marginally" beat these forecasts.

Summary:

- Like-for-like revenue will reduce by 9%.

- Net debt c. £10 million

- Pension deficit £378 million, a reduction of £88 million versus the prior year.

- Outlook for 2018 in line with expectations.

Overall, it's a nice trading update with the key number for me being the pension deficit reduction.

We then have the announcement of the proposed £127 million acquisition of the Daily Star, Daily Express and related titles from Richard Desmond. His company, Northern & Shell, also owns Ok! magazine.

Northern & Shell's adjusted EBITDA for 2017 is estimated at £34 million, and Trinity reckons there are £20 million of cost savings to be achieved.

I've pulled out Northern & Shell's Annual Report for 2016 from Companies House.

In 2016, Northern & Shell performed as follows:

- Turnover from continuing operations down 11% to £208 million

- Operating loss from continuing operations of £17 million, versus a loss of £10 million in 2015

- Strong financial position with net assets (after deducting its pension liability) of £360 million, or £290 million if you exclude the value of all non-current assets. Most of the value is in cash and short-term investments.

- Pension deficit £64 million

These are 2016 numbers, so maybe things improved materially in 2017.

If its balance sheet is still strong, maybe this deal allows Trinity to solve some of its own balance sheet issues? According to the rationale:

Following the Acquisition, the Enlarged Group will have a robust balance sheet and leverage not increasing beyond one times EBITDA.

Later in the announcement, it says that the enlarged group will have "pro forma net assets of £635 million".

My opinion

My interest is piqued by this deal. The total consideration is £184 million, or 5.4x the adjusted 2017 EBITDA performance. We should be very sceptical about how much of that adjusted EBITDA was converted into net income. But if £20 million of cost synergies are achieved through 2019, this would be enough to send Northern & Shell back into profitability, on the basis of its 2016 figures.

There is no denying that the whole thing is very complicated. There are transaction costs of £7 million to be paid by Trinity and it will be a big job to separate the publishing assets at Northern & Shell from the other activities which Trinity is not buying. Trinity needs a new £75 million loan facility to pay for everything.

Further down the announcement, we learn more about Trinity's own pension scheme. The triennial valuation by actuaries (not by accountants) says that the deficit is c. £600 million (£1.5 billion of assets and £2.1 billion of liabilities). Trinity is supposed to pay about £50 million per year until 2027 into these schemes.

The whole thing is very ugly and complicated. It could be a value investing opportunity, but there is a lot to unpack to try to understand how performance might look in a few years. I've done some of that initial research this afternoon, but I think there is a lot more work required to try to understand what is happening.

The ValueRank is a perfect 99, if you are greedy for cheap earnings and dividends:

Another newspaper group which caught my eye recently is Independent News & Media (LON:INM). It looks a much more straightforward proposition than Trinity Mirror (LON:TNI).

Hogg Robinson (LON:HRG)

- Share price: 116p (+49%)

- No. of shares: 328 million

- Market cap: £380 million

Sale of Fraedom and Offer for Hogg Robinson Group

Congratulations to all shareholders after some excellent news this morning.

It is another case of a company which had a very large pension deficit, which dragged on the stock market valuation.

Maybe we worry too much about pensions sometimes?

Background: Hogg Robinson Plc has two divisions. These are HRG (travel management), and Fraedom (software to help companies manage card payments and their expenses as a whole).

It is proposed that Fraedom be sold sold to Visa for £142 million in cash (at a multiple of 17x operating profit in FY 2017), while HRG be sold to American Express Global Business Travel for between 110p and 120p, depending on how much Visa eventually pays for Fraedom.

It's an unusual deal structure. If the Fraedom deal falls through, AmEx will happily buy Fraedom and HRG for £361 million. If the Fraedom deal goes ahead, AmEx will instead effectively buy the sale proceeds (£142 million) plus HRG for £394 million.

According to my maths, therefore, AmEx thinks that HRG is worth £252 million and Fraedom is worth £110 million, while Visa thinks Fraedom is worth £142 million.

What a great result by Fraedom - two heavyweights willing to pay up for it!

My opinion:

I've not studied Fraedom before, so I can't comment on the merits of the price offered for it.

The price offered for HRG, however, looks to me like a great outcome for shareholders. Travel management is not a high-tech service and so I think 8x annualised operating profit (using H1 2017 figures) is a good result, particularly given the £250 million accounting pension deficit.

What to do? A circular will be posted tomorrow. Then we will have some idea about the timeline involved.

I've done a dummy trade for a couple of thousand pounds. With shares offered c. 116.4p, the effective price is c. 117.3p after commission and stamp duty.

So assuming that the Fraedom deal goes ahead (it has nearly 50% irrevocable undertakings already) and then the AmEx deal does too, there is a gross return of up 2.3% available to buyers at the current offer.

That's assuming they subsequently receive 120p from AmEx, which is the best-case scenario. There is a downward adjustment mechanism which could reduce the amount paid by a penny or so.

Might be worth a look.

7digital

- Share price: 4.8p (-1.5%)

- No. of shares: 399 million

- Market cap: £19 million

Everything I've covered so far today has been very complicated, so I'm hoping for a nice simple trading update here.

7digital provides music/radio services to businesses. Browsing its website, it offers a wide array of services - developer tools, a music catalogue, radio production, etc.

Revenues for 2017 are up £6 million to £17.3 million, the improvement being more than fully accounted for by £6.5 million from a single new client.

The revenue result is lower than analysts were forecasting, but the company reassures than adjusted EBITDA losses will be reduced versus 2016 and better than market expectations.

I can see forecasts for a pre-tax loss of £3.5 million in 2017. The company is supposed to break into pre-tax profit of £0.5 million in the current year.

It recently raised £8.5 million, massively increasing the share count and leaving it with a war chest of over £7 million.

Outlook: on the back of a profitable H2, the CEO says the company has "the right foundation for full year profitability in 2018".

My opinion: there are grounds for optimism, now that fresh funds have been raised and the company is probably in the black.

That said, there is no getting away from its speculative nature, and the Stockopedia computers identify it as a highly speculative Sucker Stock.

If you can figure out what the company's unique selling proposition is, and you have room in your portfolio for some early-stage companies, then it could be worth investigating. It's not really my style to invest in something like this, so I'll move along.

S&U (LON:SUS)

- Share price: 2205p (unch.)

- No. of shares: 12 million

- Market cap: £264 million

This is a financial stock which I started covering last year and which I've had a positive impression of so far.

Trading as Advantage Finance (external link), this is a motor finance company in the subprime sector with a small property bridging arm attached.

I own shares in one of £SUS's peers, PCF (LON:PCF).

Today's update says that trading is "strong and in line with expectations", and the share price hasn't budged. The outlook statement from the Chairman is confident.

My opinion: I remain interested in and impressed by S&U. The growth in customer numbers is excellent (54k versus 43k a year ago) and revenues are set to have grown 33% in the most recent financial year ending January 2018.

A word on risk. Impairments are significant, at 23% of revenue. It's very much catering to those with weak credit scores. So it could be vulnerable in the event of a deterioration in conditions for the weaker consumer.

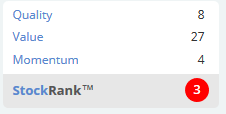

Stockopedia algorithms give it just an average rating.

On balance, I like it. It's clear about the segment of the market it's serving, and its formula is working:

Have a good weekend!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.