Good morning from Paul!

Practically nothing on the newswire today. So today's

Labour landslide

Is now fact rather than forecast. This is not the place for discussions on politics itself. So please can we stick to how the election might affect the economy, markets, and companies/sectors.

Futures on IG are currently showing (at 06:23) little to no change (FTSE 100 up 17 points, sterling flat at £1 = $1.276), because markets already price in high likelihood events in advance. It's only big surprises that send markets haywire - who can forget the Brexit vote, when equities and forex markets went absolutely haywire - I can vividly remember that - even some FTSE 100 stocks collapsing, and (briefly) there were no buy orders on the books at all for some mid and large caps (so technically a bid price of zero!) - that's the danger of stop losses when something big and unexpected happens - fortunes were made and lost that day by geared traders.

FWIW I won't be making any adjustments to my portfolio, because I don't see that much is likely to change any time soon. The general drift is likely to be similar to 1997 I reckon - lots of new stealth taxes, but probably no big changes to the main taxes (if Labour stick to their pledges). I know a lot of affluent/rich friends are worried about potential tax raids on CGT, Inheritance Tax, etc. One has even emigrated to a tax haven! Will AIM IHT relief survive? Will pensions be raided? I was very worried about the Lifetime Allowance being re-introduced, so I wrote to Rachel Reeves explaining why that would be a mistake, and that proposal was dropped. Maybe not cause & effect there with my letter, but hopefully my voice added to others saying the same thing? It's always worth writing to people in positions of power, because apparently for every 200 people who agree on an issue, only 1 actually writes a letter. Also I like sending a physical letter because they probably receive very few (with people preferring emails, which are more easily ignored). The same is true of writing to company Directors - a physical letter will stand out, and will probably be read by the Chairman/CEO, whereas an email is less likely to reach them directly.

What comes next on Govt spending? Well, more public spending, but within tight constraints. Labour won't be able to increase planned borrowings - look what the forex and gilt markets did to Truss/Kwarteng when they tried to do something seen as radical. That lesson won't be lost on Rachel Reeves I'm sure, and she seems a sensible person with a relevant background in economics & finance.

So all in all, I'm pretty relaxed about this in the short term. That calmness might not survive Ms Reeves first budget! Since we don't know, there's little point in speculating about it.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Hardly any company news today -

Other mid-morning movers (with news)

Pipehawk (LON:PIP) - down 72% to 2.35p (£1m) - Trading Update - Paul - NO COLOUR

Says its subsidiary QM Systems has seen worsening of previously reported problems. Two material orders are not proceeding. QM’s finances “now under severe financial pressure”. Looking at putting it into insolvency process. Says remainder of the group will continue trading, and is in line with exps. QM delivered 65% of group revenue in 2023, and made a £1m loss.

I won’t give it a colour, as it would need more detailed work to see if there’s any value in the other parts of this group. Market cap so tiny, surely de-listing now seems likely? Not for me.

Summaries

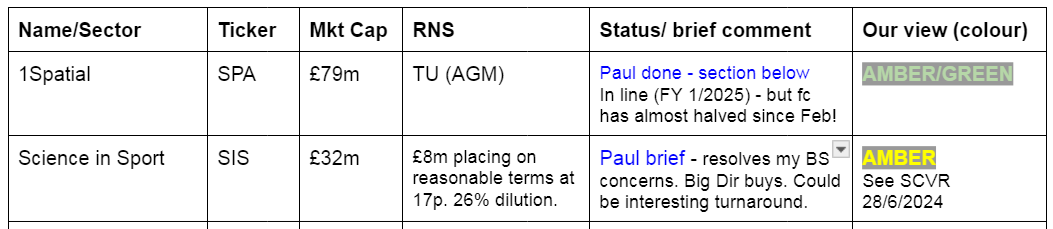

1Spatial (LON:SPA) - up 1% to 71.7p (£79m) - Trading Update (AGM) - Paul - AMBER/GREEN

Today's update is in line with expectations. The outlook sounds positive. Shares aren't cheap, but I think there might be something interesting here. So I've flagged it AMBER/GREEN more to say that I like the potential, rather than the figures as they stand (it looks expensive, and is still cashflow negative due to heavy R&D spending). Over to you, for more detailed research - let me know what you think!

Paul’s Section:

1Spatial (LON:SPA) - up 1% to 71.7p (£79m) - Trading Update (AGM) - Paul - AMBER/GREEN

1Spatial, (AIM: SPA), a global leader in Location Master Data Management (LMDM) software and solutions…primarily to the Government, Utilities and Transport sectors via the 1Spatial platform. Our solutions ensure data governance, facilitating the efficient, effective and sustainable operation of customers around the world. Our global clients include national mapping and land management agencies, utility companies, transportation organisations, government and defence departments.

I haven’t yet managed to visualise what the company actually does. It seems to be specialist software. Here’s their website. I see there are recordings of management webinars on InvestorMeetCompany, so I must find time to have a look through these, to better understand the company and its markets.

I’ve started looking again at SPA this year, because the figures have improved dramatically from when we last looked about 4 years ago. So it’s a much more credible share now than before, having broken into profits, hence why I resumed coverage in Jan 2024, to recap -

11/1/2024 - 52p - Me - AMBER/GREEN - Contract wins. Worth a closer look. Much improved in last 4 years.

11/3/2024 - 56p - Me - AMBER/GREEN - Muddled TU, shares dropped 11%. Potentially interesting co.

24/4/2024 - 60p - Me - AMBER - Final results FY 1/2025 - small profit, negative cashflow. I’m not convinced yet.

It’s since had a more recent rise, and at 71.7p is up roughly 41% YTD 2024, not bad!

Today’s news - sounds reassuring, but not price sensitive either way, being in line -

“Trading for the full year is expected to be in line with expectations. We have secured several new contracts in Europe and the US (as previously announced) in recent months, and we continue to make progress with our innovative 1Streetworks SaaS offering.”

“Planned headcount increases” are underway. Hopefully these additional costs should be baked into the forecasts already.

Outlook -

“The Group has a strong order book, a growing recurring revenue stream and substantial sales pipeline underpinning the Board's confidence in the outturn for FY25. We believe the investments we continue to make in people and technology have positioned the business well to take advantage of the huge opportunity ahead."

I like “huge opportunity” situations! Let’s hope that’s realistic, and not over-excitement.

The graphs below are impressive, and tell me this looks to be quite an interesting opportunity, with a credible track record so far -

Note that the broker consensus numbers seem to have been reduced significantly in recent months - so delivering in line with expectations now, would effectively have been a profit warning if they hadn't walked down the forecasts in advance -

Paul’s opinion - This share is tricky to value at this stage, and the forward PER of 32.4x looks aggressive. However, I find PER isn’t a good measure for growth companies that are spending heavily on expansion. PER is more useful to measure more mature companies I think. Often the best growth companies look very expensive early on, and it’s a mistake to screen them out as overpriced, as all too often I’ve missed some multibaggers in the past by being blinkered on valuation.

Looking again at SPA’s FY 1/2024 results, R&D spending is heavy, and absorbs more than all the cash generation. That’s fine if the results are going to be booming sales, so generally I like big R&D spend, if it’s being used on something productive. I can’t really assess that though.

I’m going back up to AMBER/GREEN, because I suspect there could be something interesting here, that’s at least worthy of further research. I’m a bit worried that if we mark too many things as just plain amber, then readers who only follow up on our green or amber/green sections might miss something good.

What do readers think? I’d like to hear from anyone who’s done more research on SPA.

I see Marlborough funds hold 16.9% and increased in March 2024. They're no fools, and are very good stock pickers. I would like to see SPA strengthen its balance sheet with a placing of say £5-7m, which would only be c.7-10% dilution, and I think would be beneficial, since its current balance sheet looks a little stretched, with negative NTAV of c. £(2)m. Software companies don't need much capital, but NTAV should be positive in my view. Customers like to know that a key software supplier will definitely still be around in future.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.