Good morning, it's Paul here with the SCVR for Monday.

Timing - I've covered quite a lot this morning, and am taking a break for lunch now. More later. Update at 18:23 - today's report is now finished.

Agenda -

Fonix Mobile (LON:FNX) - I looked at this one over the weekend, an interesting-looking recent float (Oct 2020)

Brief thoughts on vaccinations progress

5 new companies intending to, or actually listing, reviewed in brief

Bidstack (LON:BIDS) - 2020 trading update (needs a placing)

Porvair (LON:PRV) - quick review of its FY 11/2020 numbers

Zytronic (LON:ZYT) - Tender Offer, and (previous) trading update

.

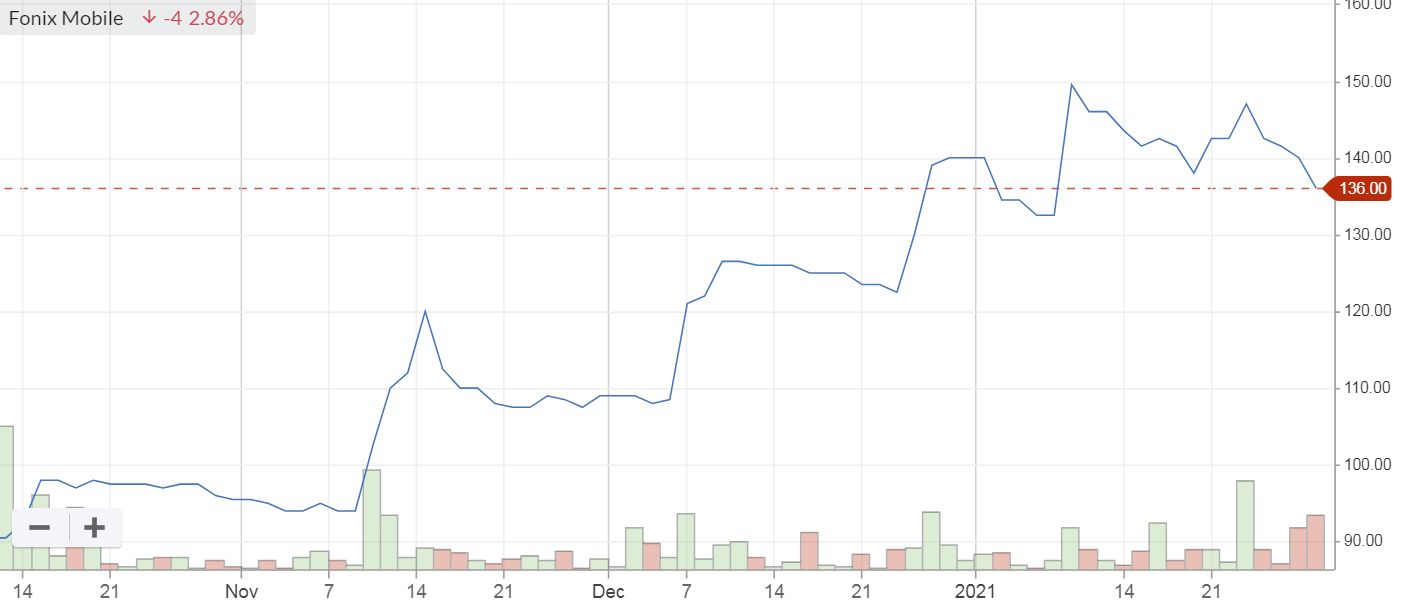

Fonix Mobile (LON:FNX)

Share price: 136p

No. shares: 100.0m

Market cap: £136m

Several readers mentioned Fonix last week, which jogged my memory to look at it over the weekend.

Fonix listed on AIM recently, the first day of dealings was 12 Oct 2020.

I must have been rather bored around that time, because I recall spending a Sunday evening reading its Admission Document, but never got round to typing up my notes, so belatedly here they are;

Floated at 90p

Placing of 50m shares, half the total, to raise £45m for selling shareholders - i.e. no fresh money raised for the company itself. Therefore the IPO should be seen as a half-exit for existing shareholders, which I’m generally not terribly keen on in an IPO

Directors sold 36m of the 50m placing shares, being about half their personal shareholdings

Paid big divis prior to the float, £6m in FY20, and £5m in FY19, so it’s a proper business, generating real cashflows, which is what aroused my interest in the company

Rapidly rising profit before tax:

FY 06/2018: £2.8m

FY 06/2019: £4.7m

FY 06/2020: £7.3m

Recent trading (at time of IPO) in line with expectations

Dividend policy to be 75% payout ratio (of earnings, I presume?)

Balance sheet - weak at only £2.4m NAV

Cashflow unusually high in FY 06/2020 - not sure why

Development spending - only low level of capitalisation into intangibles, which is good

High trade payables

Deferred payment to a charity of £3.9m - this was explained later as being for some technical reason at the request of the charity concerned, so not a problem

Notable institutions buying, mentioned in prospectus: Slater Funds 10.2m shares, Kestrel 4.0m

Questions arising from my review;

- Client risk? Top 10 clients are 83% of revenues. Impact of losing biggest?

- Why sell half the company if the future is so bright?

- How are they going to create any market liquidity in the shares, by placing them in large lumps?

- Barriers to entry? Competitive landscape & threats?

Overall - I like the look of this business, and want to investigate further. It’s a decent, cash generative business, in a profitable niche. Management have an impressive track record & still hold a large stake in the business (over a third) after the shares sold in the float.

Some time later, I touched base with Fonix’s advisers, who kindly organised for me to talk to the company late last year. This was part briefing, part Q&A. Here are my notes from that conversation;

Rob Weiiz, CEO & co-founder

Background in telecoms startup 2005/6 - sold for $75m in 2011

Boku & Bango mentioned, good strategy (I can’t remember the context for this remark, sorry)

Fonix is focused on the UK

Launched in Jan 2014

Messaging/payments company for mobiles

No debt, and not much capitalisation of development spend

33 staff, of which 14 are developers

Lots of runway for growth

Goal was to achieve a return - ie. partial sale at some stage, hence the AIM listing

Richard/Rupert are AIM veterans, CEO not previously involved in a float

Fonix shares should provide income (divis) and growth

Continue to pay divis

Question - if the future’s so bright, why are you selling half your holding? Answer - that was always the strategy. Options pool for loyal staff, been with us many years. Additional credibility with clients & potential clients, becoming a plc listed company

Not regulated by FCA (?)

Children in Need - big client, £12.5m revenues last year to Fonix, who processed 73% of all donations

Very sticky clients - never lost one

Fonix is closely integrated with clients & their systems, so don’t want upheaval of changing suppliers

Profit margin is 4-5%, which looks high to me for payment processing, but reassured this has proven sustainable in the past

Focusing on reducing basket abandonment by customers, and mid-tier operators like ITV

Brilliant team, lots to go after

My overall impression of CEO - seems lucid & straightforward.

Good, that’s some background, now onto the first trading update since the float.

Fonix Mobile plc is pleased to provide a trading update for the 6 months period to 31 December 2020.

This update was issued last week, on 29 January. Fonix has a June 2021 year end, so this is an update for H1. The company’s financial structure did not change in the IPO, so apart from one-off listing costs, there shouldn’t be any other adjustments needed.

Impressive growth here, and I think this is all organic too (ie. not boosted artificially from acquisitions) -

Other points -

- All 3 business segments have grown, in line

- Operating costs unchanged (so should be nice operational gearing to profits)

- New customers, and robust pipeline for H2

- Children In Need raised £13.9m through Fonix (up on £12.5m last year)

- Diary date - 22 Feb 2021 for H1 results - good prompt reporting

Outlook - confident

Broker update - see Finncap’s note from 28 Jan 2021, many thanks for providing us with this. Unlike some other antiquated brokers, Finncap “gets it” - i.e. that small cap investors need information and forecasts to help us form a view on a share. That then improves liquidity, and increases the market cap, if there’s a good investing proposition.

Forecasts are adj EPS of -

6.8p FY 06/2021

7.6p FY 06/2022

The forecast for the current year looks too low, given that H1 has out-performed, and also Finncap’s figures don’t seem to build in any operational gearing from the costs being flat against last year. So I’m thinking that a fairly decent beat against forecasts could be on the cards here.

Therefore the PER of 136p/6.8p of 20.0, is probably over-stated. I reckon 8-10p EPS might be more possible, which would be a PER of c.14-17 - quite reasonable in an expensive market.

My opinion - this looks a very decent growth company, and sensibly priced.

Finncap points out that other payment processing companies are much more highly priced.

My main hesitation here, is that there could be risk from one or more big clients making alternative arrangements. This year in particular, there could be cancellations of big TV shows, possibly? Hence I’d rather sit on the sidelines, and see how 2021 plays out.

But overall, it’s one of the better small cap floats I’ve seen in a while, so it could be worth readers spending a bit of time to research it yourselves.

.

.

Vaccinations & re-opening

Stunning news over the weekend over the progress of the UK’s vaccinations, this is really heart-warming. Nearly 600k people vaccinated on Sunday alone, taking the total to c.9m now vaccinated.

Market confidence seems to be ebbing & flowing on a daily basis, re covid. However, the rapid fall in new cases, combined with most of the vulnerable now having been vaccinated, has reinforced my optimism that we’re probably soon going to be over the worst. Then gradual re-opening & relaxation of restrictions.

For that reason, I’ve been topping up my Saga (LON:SAGA) (I hold) position this morning. The recent drop from c.300p to c.250p looks like an opportunity to me, given the positive update last week. The only fly in the ointment is the current negotiations to relax banking covenants. However, how many companies are hitting a brick wall on that? None that I’ve seen. Lenders are being co-operative. Why wouldn’t they relax covenants, when interest rates are this low, and there’s light at the end of the covid tunnel? Hence I feel that SAGA could get a double benefit, from agreement on covenants, and then resumption of travel. It’s not without risk, but to my mind, if I’ve weighed things up correctly, then risk:reward seems highly favourable.

As always, it’s essential to always do your own research, as the future may not pan out how I think it will, there are always uncertainties, with everything.

.

New floats

There are an unusually large number of new companies announcing their floats today. I think the London market feels a bit stale right now, and definitely needs some new blood, so I welcome good quality new floats. Here are today’s newbies, I’ve put in links so you can click through to any which might float your boat;

NextEnergy Renewbls - Intention to Float - an IPO to raise up to £300m for investment into renewables infrastructure. It intends to pay divis, and achieve capital growth. Renewable energy is certainly a booming investment area. How to pick a winner in the field though?

Digital 9 Infrastructure - Intention to Float - is hoping to join the Main Market, priced at 100p, to raise up to £400m in an IPO. Prospectus due in March. This is a newly established investment trust. It will invest in internet infrastructure;

The portfolio will comprise future proofed, non-legacy, scalable platforms and technologies including (but not limited to) subsea fibre, data centres, terrestrial fibre, tower infrastructure and small cell networks (including 5G). The Company will focus, primarily, on digital infrastructure investments which are operational and with an existing customer base.

It will be managed by Triple Point Investment Mgt LLP, an experienced manager.

MGC Pharmaceuticals - Intention to List - “working through now the final steps” to join the Main Market. Dual listing (London & Australia). Expected to complete in February. Operates in cannabis sector. Tiny company, revenues in 2020 of AU$2.1m. Floated by Turner Pope. Moving on…

Auction Topco - Expected Intention to Float - Auction Technology Group - claims to be the operator of world-leading online auction marketplaces, operating 6 websites. Claims that its “proprietary technology is a key strength”. Revenues of £52.3m in FY20, so quite small. £22.3m adj EBITDA. No mention of what proper profits were! Partial exit by existing shareholders.

Edit - sorry I’ve just found more detailed financial information further down in today’s update. The figures don’t look great - it seems to have made escalating pre-tax losses: 2018 £(2.9)m, 2019 £(7.5)m, 2020 £(18.5)m. The balance sheet looks horrendous, stuffed full of debt, and intangibles, so hopefully that would be sorted out in the IPO, as it would be bargepole job as it stands.

I’ll keep an open mind, and wait to see the Admission Document for more detail. At this stage though, it doesn’t look much good.

Supreme (SUP) - last new company, this has actually listed today, AIM Admission & First Day of Dealings -

Supreme, a leading manufacturer, supplier and brand owner of fast-moving consumer products… Supreme supplies products across five key categories; batteries, lighting, vaping, sports nutrition & wellness, and branded household consumer goods.

It’s raised £7.5m in new money, and £60.0m for selling shareholders, at 134p per share.

The AIM Admission Document is here. Whilst these documents look daunting at first, they’re worth a thumb through, you only have to skim the key bits, which only takes about 10-20 minutes, not read the whole thing. Then if it looks interesting, re-read it more carefully (especially disclosures at the back, which can be interesting!).

I’ll possibly have a look at this later, once more urgent things are done.

.

Bidstack

down 31% today - mkt cap £29m

A highly speculative company, with an interesting product - advertising within computer games.

Trading update today for FY 12/2020.

Big % rise in revenues, but from a low base £1.7m (LY: £140k), so a very early stage business

Loss before tax increased to £(7.18)m (LY: £(5.36)m) - awful

“Available cash” of £2.76m most recently, at end Jan 2021

Commentary throws in a few big client names & generally upbeat words.

This sounds concerning - an opportunity, or just under-performance? You decide -

Bidstack has now run native in-game campaigns in over 30 countries. While this undoubtedly proves the system works, in 2020 fill rates for native in-game advertising remained in low single digits. As the Bidstack sales team matures there remains significant scope for organic growth.

Pandemic is lengthening sales cycles

Anyone know what this means? -

To address this, Bidstack's strategy will be to concentrate on the appropriate implementation of its technology even if this is at the expense of some short term opportunities.

Claims to be the leader in its field.

My opinion - today’s update dodges the big issue, the elephant in the room - that it’s rapidly running out of cash. Rather than ignore this, the update should have said what the company is doing to raise the next wave of cash funding?

We’re in a bull market, so I imagine another placing should be do-able.

Bidstack won’t be able to get its 2020 accounts signed off without another fundraising, so there’s probably one already underway, in secret, I imagine.

If this is going to work, then the company needs proper funding, i.e. £20m+, enough for 3 years or more, in my opinion. Lurching from one placing to another, is a hopeless way to fund jam tomorrow companies, but all too often that’s what happens on AIM. Why be a lamb to the slaughter, in funding early rounds, when you know the company will need repeat funding, often at lower & lower valuations, as targets are inevitably missed by practically everything of this nature that lists?!

I don’t want to take a risk on this, whilst it has an obvious funding requirement in the short term. The market cap is far too high, for something that’s a pure punt at the moment.

Note the speculative frenzies that this share attracts from time to time, 3 year chart below. Also note the resolutely poor StockRank, with the Stockopedia computers reminding us constantly that this is a jam tomorrow, loss-making share, hence usually poor risk:reward for that category of share, on average.

.

Porvair

down 4% to 530p - mkt cap £245m

For FY 11/2020

Resilient performance in challenging circumstances, optimism for the future.

Considering what a badly disrupted year it was, these numbers do indeed look resilient, as the company claims.

- Revenues down 7% to £135m

- Adj profit before tax down 15% to £12.6m

- Adj basic EPS down 14.6% to 21.6p - a PER of 24.5

- Dividends of 5.0p (up slightly), yielding a modest 0.9%

Outlook -

"Until the pandemic recedes, near-term trading remains unpredictable and the Group continues to withhold earnings guidance. But the results for the year turned out to be better than initially feared in our contingency planning…

We entered 2021 with a strong balance sheet and a lower cost base than a year ago, which will be helpful while we wait for vaccinations to bring the pandemic under control. The next few months may continue to be difficult, but beyond that we are increasingly optimistic.

Investments made over the last few years will help margins and our new product development pipeline is strong for the near term.

Prospects for the medium term are good and Porvair should return to its historical levels of growth once the pandemic retreats."

Results presentation slides (only 15 pages) are worth a look, here. This is much easier than ploughing through the whole RNS, so I’m skimming them now. Nicely laid out & good info.

Balance sheet - looks sound overall.

Investors will need to adjust the valuation downwards to take into account the cash outflows related to the pension deficit.

Cashflow - looks OK. Note that it's spending about a third of cashflow on capex. It made an acquisition (£9.8m) last year, so that might be flattering growth figures a bit this year.

My opinion - this is only a quick review of the figures, I haven’t ploughed through all the detailed commentary, otherwise each company would take me hours to get through.

I do quite like this business. It’s always looked expensive, but the rest of the market seems to have caught up, hence PRV no longer seems particularly over-valued. Once you factor in a recovery from covid, then EPS might rise to say 25-30p, helped by reduced costs, meaning that a share price of possibly up to 600p might be justified in due course. That’s a bit of upside on the current 530p, but not enough to get me excited.

I’m impressed with how resilient profitability was in 2020 (looks in line, or slightly above forecasts), so Porvair has proven itself as a safe haven if similar events were to recur. That justifies a premium on the price. A lot of its products are specialised consumables, hence demand continues regardless of the macro situation.

Overall then, it gets a thumbs up from me, as looking a sound, fairly safe investment for the long-term, but not something I feel the urge to rush out and buy now.

A possible bid target, I wonder?

Directors seem rather too fond of cashing in their share options. I thought the whole point of share options was to enable them to build up long-term meaningful stakes, not to be a lucrative bonus scheme?

Sideways trending share price since mid-2017. So is it actually as good as people think? Particularly as very little has been paid out in divis over that time.

Excluding acquisitions, is this actually a growth company at all?

.

.

Zytronic (LON:ZYT)

140p (up 6%) - mkt cap £22m

Tender offer at 145p (sorry, earlier typo corrected)

This is a method of returning £10m surplus cash to shareholders. You can tender as many shares as you hold, but the basic entitlement that's guaranteed to be paid out at 145p, is 43%.

The idea is that the share count will drop by 43%, so you'll still own the same % of the company as you did before, if you tender your basic entitlement of 43%, but will have received cash for the shares you tender.

Companies can pay out excess cash to shareholders through special dividends, buybacks, or tender offers. Maybe a tender offer is more tax efficient, I don't know.

It's a sensible move, as the company built up far more cash in the good times than it needed, and wasn't doing anything with it, so this makes sense.

This is how it would look (at 140p per share, being the current share price);

Before tender offer: 16.0m shares in issue, market cap £22.4m

After tender offer: 9.1m shares in issue, market cap £12.7m (and the business would still have c.£4m net cash remaining).

Of course there's no guarantee the share price would remain at 140p. Once the tender offer has been done, the share price would freely float again. A tender offer tends to anchor the share price in the short term, whilst it's underway.

If you hold ZYT shares, your broker will write to you, asking for your instructions on how many (if any) shares you want to tender. It's up to you whether you find the tender offer price an acceptable price to sell at, or not. This sums it up neatly, from the announcement today -

Qualifying Shareholders may choose whether they want to tender some, all or none of their shareholdings, and are not obliged to tender any of their Ordinary Shares if they do not wish to do so.

.

Trading update - issued on 22 Jan 2021.

Zytronic, a leading specialist manufacturer of touch sensors, provides the following trading update.

I reviewed its accounts for FY 09/2020 here on 8 Dec 2020. Even though sales have crashed, it's reduced costs mean it looks to be trading at a run rate of a bit below breakeven. Therefore it should survive, and who knows maybe win new orders, and start to rebuild profits? That's the bull case anyway.

Today it says -

The downturn in sales experienced in the second half of last year has now levelled out at approximately £2.0m for the quarter to 30 September 2020 and the first quarter of this financial year to 31 December 2020.

That's ambiguous wording, but it means a run rate of c.£8m p.a. revenues - way down on historic levels, in the twenty millions.

Outlook -

... However, with the constraints imposed by the Coronavirus pandemic, that are affecting our major overseas markets such as Gaming, it is difficult to foresee a return to profits in this financial year, and a recovery to historic levels will depend on how quickly there is an effective vaccination programme enabling a return to normality.

My opinion - my worry is that the share price might slip back down again after the tender offer.

A further worry is that Zytronic will be such a small business, revenues only c.£8m, trading at a small loss, that why would it remain listed on the stock market? What's the point of all those costs & hassle of maintaining a listing, when they do nothing with it?

On the upside, it should still have c.£4m net cash remaining after the tender offer, and there could be upside if it wins new orders & returns to meaningful profitability.

The real reason this company has done badly, is not covid. It's end of life products. It needs to win new business. Since I can't possibly predict if/when new orders would be won, then I've got to say I'm neutral on this share, and personally would be inclined to tender at least the 43% basic entitlement, if I held any (which I don't). For larger holders, the tender offer is a liquidity event which may never repeat, hence I imagine institutions would be likely to tender all their holdings, thus leading to over-tendering, and scale backs on the excess.

.

I'll leave it there for today's report, and we'll hit the ground running tomorrow morning with some additional sections from today, which I'll write up this evening.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.