Good morning from Paul, and welcome back Graham!

I see several companies have announced their brokers have changed, due to a merger of Liberum and Panmure Gordon. It's good to see more consolidation in the sector, and I wish both firms well as a larger group. I rely on Liberum's excellent research a lot through Research Tree, so I very much hope the combined entity will adopt Liberum's approach of getting their research out to the people who create the liquidity and set the share prices for small caps - private investors!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

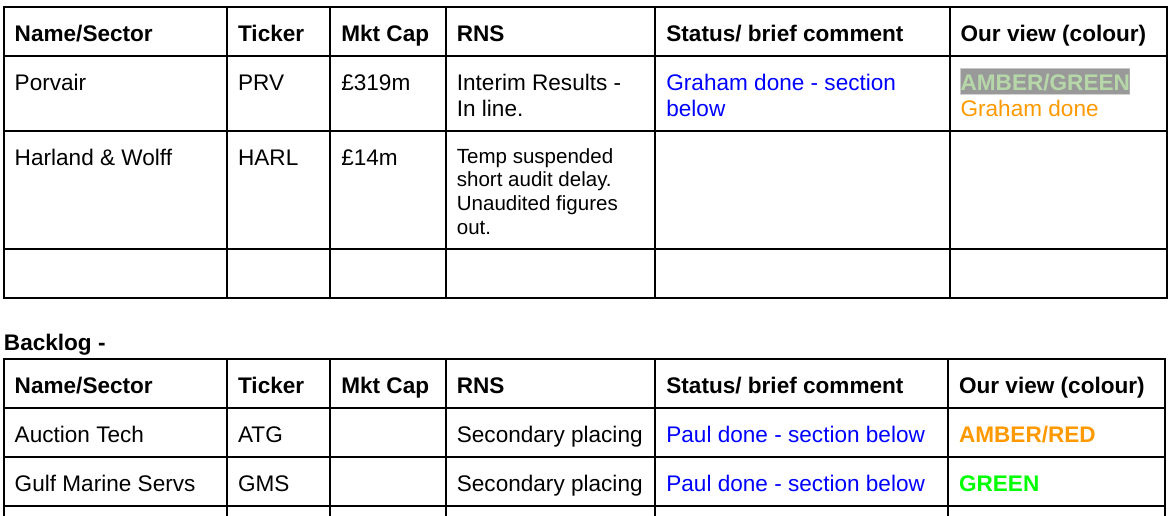

Companies Reporting

Extremely quiet today, so a nice leisurely return to duties for Graham!

Summaries

Auction Technology (LON:ATG) - 501p (£610m) - Secondary Placing - Paul - AMBER/RED

Late last week this share price was hit by about 10% after JP Morgan sold 5% of the company for the original private equity backer, at a c.5% discount. This raises questions, which I discuss below. A wider review of the company doesn't impress me, so I'm uneasy about possible warning signs here.

Gulf Marine Services (LON:GMS) - 17p (Friday's close) £182m - Secondary Placing - Paul - GREEN

A similar situation here, with a big shareholder selling a chunk at a 15% discount. After a long gap, I get up-to-speed with this previous SCVR favourite, and like what I see. Not entirely risk-free, but to me, risk:reward looks potentially very good. So this 15% discount might be a buying opportunity perhaps, but please do your own much more detailed research, as always.

Porvair (LON:PRV) - up 2% to 676p (£323m) - Interim Results - Graham - AMBER/GREEN

Performance has been in line with expectations, according to management. Underlying sales growth is negative but acquisitions in 2023 and 2024 have helped to boost the numbers. The balance sheet remains in net cash (just) and overall little has changed: this is a fine company, perhaps not far from fair value?

Paul’s Section:

Discounted Secondary Placings

This was something I noticed on Friday, which is a bit of a concern. We’ve talked a lot about how the UK small caps market has suffered over the last c.2 years from client redemptions. These force small cap fund managers (those operating open-ended funds) into selling shares in the market. This type of fund outflows seem to be diminishing now at last.

However, Friday last week demonstrated that there can be other selling overhangs, where a large shareholder wants to sell, but there’s inadequate market liquidity. Hence a secondary placing needs to be conducted by a broker, to shift the overhang of shares, at a discounted price. No money passes to the company remember, it’s just a mechanism to shift a block of shares from one shareholder to buyers.

What concerns me is that these are happening at a price discount. A couple of examples below, one of which ATG makes me nervous, and the other GMS I reckon could be providing a buying opportunity. Maybe! You need to do your own more detailed research, as always.

Auction Technology (LON:ATG)

501p (£610m) - Secondary Placing - Paul - AMBER/RED

Proposed Sale of Shares (27/6/2024)

Shares closed at 556p last Thursday 27/6/2024, then JP Morgan announced after hours that it had been appointed to organise a secondary placing -

Quantity for sale - c.5% of the whole company (6.1m shares).

Seller - TA Associates (private equity) - largest shareholder with 17.6% (21.4m shares)

Price - to be determined by a book build (ie JPM ringing round asking for orders/prices from potential big buyers).

Lockup of 60 days for seller.

Result of Placing (28/6/2024)

Announced at 07:00 the following morning, as is usual with placings, as they’re usually secretly almost buttoned up by the time the first announcement comes out, but might pick up some more stragglers. As an aside, I’ve been with a broker friend in the pub when this type of deal happens, and he frantically makes & receives calls for about half an hour, writing down client orders on any receipts he can find in his pockets! Then I sit there laughing, as he tries to remember who ordered what, and in a flustered state tries to get the consolidated order in to the main broker doing the deal. I will never reveal his identity, as he's a mate! Anyway back to ATG.

Quantity sold - as expected, 6.1m shares.

Price - 525p, which seems to be a discount of 5.6%

Value - £32m shares sold to new owners.

TA Associates now holds a lower 15.3m shares (12.6% of the company).

Paul’s comment - this seems to have been badly received by the market, with ATG shares closing at 501p (down almost 10% on the day) on Friday 28/6/2024, or c.507p (down about 9% on the day, if we ignore the large 16:35 auction uncrossing at 501p). That’s well below the 525p placing price, so buyers who thought they were getting a bargain are instead sitting on an immediate loss.

What does TA Associates intend doing with its remaining 15.3m shares once the 60-day lockup has expired? Will it come back and sell another tranche at a discount, clobbering the price again? Who knows.

ATG shares were originally floated by TA Associates, formerly its 100% owner. The Feb 2021 IPO was at 600p, and it quickly soared to peak at almost 1600p in late 2021, but has since lost two-thirds of that peak price. So it’s surprising the original private equity backer is dumping shares at a discount now. I wonder if this means they no longer believe in ATG, or just want out, almost irrespective of price? Maybe they want the funds for something else, which is usual for private equity? Who knows, but this deal is bound to harm sentiment, at least in the short term.

Checking our previous notes,

Roland covered its profit warning on 3/12/2023.

Graham went green on 31/1/2024 on a good TU.

Paul went down to AMBER on 17/4/2024 H1 TU, pointing out a weak, heavily indebted balance sheet, and an apparent lack of growth.

I think we also had reader comments, saying that online auctioneers were facing stiff competition from a challenger under-cutting them, and some readers thought ATG had been too greedy on fees, this damaging client relationships & losing business possibly.

Broker forecasts have recently moved in the wrong direction -

With the original private equity holder now seemingly keen to get out, and offering a discount, I’m wary about where this is going - with an already sick-looking chart -

I’ve had a quick look back at ATG’s last H1 results (6m to Mar 2024) and its balance sheet is weak. Dominated by $583m goodwill (overpaid for acquisitions maybe?) plus $256m other intangibles. Eliminate both those, and NTAV is negative $(178)m mainly due to too much debt (net debt was $142m at 31/3/2024).

Although we could be kind and also eliminate the deferred tax liability of $43m, which would help NTAV to a still poor $(135)m.

Cash generation doesn’t look particularly strong in the last accounts.

There seem to me some warning signs here, and the original private equity owner wanting to sell adds to that.

This might be controversial, but I think I’ll shift down to AMBER/RED, which will be too harsh if it achieves current forecasts, as the forward PER is only 14.5x. But why would it be higher valued, given that the business looks ex-growth, has a lousy over-geared balance sheet, is seeing broker forecasts reduced, and now its original financial backer is selling?

Gulf Marine Services (LON:GMS)

17p (Friday's close) £182m - Secondary Placing - Paul - GREEN

The same thing happened at this company last week.

Zeus capital announced that major (28.5%) shareholder Seafox has instructed it to sell $10m of shares (about 4% of the company) at a minimum price of 17p - a hefty 15% discount to the 20p share price before this announcement. The price peaked at 24.6p in April 2024.

Lockup of 75 days.

Result of secondary placing - 51.1m shares sold, slightly more than planned at 4.8% of the company, but at the bottom price of 17p.

Seafox remaining holding is 23.7%, which is not comfortable for other shareholders, knowing that the largest shareholder might think it’s fully priced, and may want to ditch some more, perhaps? Also it worries me that demand seems to have been quite weak, since buyers demanded the full 15% discount, and got it.

Looking back at our archive, I see my view in 2019 (at 8.3p) was very bearish, since its debt problems seemed insurmountable, with covenant breaches.

However by Oct 2021, I remember that an experienced & successful investor briefed me that GMS looked like it could gradually resolve its debt issues, and trade out of trouble. I’d even bought a few myself (at 4.6p) and peppered my Oct 2021 report here with risk warnings, rightly so, as it was high risk.

It wasn’t until June 2023 that the shares really began to zoom up, but unfortunately by that point I seemed to have lost interest & moved on.

It’s quite interesting sometimes to look back, and see how special situations work out. This one certainly played out very well.

After that trip down memory lane, what’s the recent news?

Debt reduction 13/5/2024 - reads positively, with net debt down to $256m in Q1, and down again to $250m after a recent payment. The leverage ratio is down to 2.96x EBITDA. Whilst this bit below sounds positive, I’d need more details on the debt refinancing plans -

“Achieving a senior net leverage ratio below three times puts GMS in a stronger position to obtain favourable terms on its debt refinancing. It also allows the Company to benefit from a ten-basis points reduction in funding costs, effective from 1 April 2024, as per the current debt agreements.”

Contract update on 10/6/2024 says the order backlog is $431m, but gives no context or comparisons. Without knowing the timescales of orders, it’s difficult to interpret order book numbers for most companies.

FY 12/2023 Results -

A very impressive 3-year progression, although laid out the opposite way around to what I’m used to -

You can see how decisively the net leverage ratio is falling, very impressive I’d say.

On closer inspection the 2023 results suffer from a much higher finance cost, and seem to benefit strongly from impairment reversals, so those areas need careful scrutiny.

Impressive outlook too -

Balance sheet - total equity is $330m, about £260m, which is well above the market cap of £182m.

Now the risk has receded considerably, and its assets (specialist ships) are clearly in demand, with high utilisation rates and improving fees, then I could see a persuasive argument for the market cap rising to be at or above NTAV of £260m. Imagine if this share re-rates to something more like Ashtead Technology Holdings (LON:AT.) ?!

Paul’s opinion - on a quick skim, I think the big institution dumping shares at 17p could be providing us with a possible buying opportunity.

Given how cash generative GMS is, then I imagine it should be able to refinance, hopefully at cheaper rates too. But that’s obviously the main risk, if something untoward goes wrong that we’re not aware of. Another risk is that, now these special ships are in demand again, then competitors might start building new ones, thus reducing charge out rates.

Overall I think it looks intriguing, and there could be good upside on this, if demand continues to be strong, and the debt can be further reduced. Some risk, but this looks good to me. GREEN.

Graham's Section

Porvair (LON:PRV)

Up 2% to 676p (£323m) - Interim Results - Graham - GREEN

These results are in line with expectations:

Porvair plc ("Porvair" or the "Group"), the specialist filtration, laboratory and environmental technology group, announces its interim results for the six months ended 31 May 2024 ("H1 2024" or the "period").

Some key bullet points:

Revenue up 8% at constant currencies to £94.6m

Adj. operating profit up 2% to £12.5m

Adj. PBT down 3% to £11.5m

Unfortunately, the company doesn’t mention organic growth (i.e. growth excluding the benefit of acquisitions) in its headlines. The operating review reveals that underlying sales were down 3% at constant currencies, once you exclude acquisitions.

The company’s comments on shrinking underlying sales:

… underlying sales revenue was down 3% at constant currency as industrial and laboratory consumables markets adjusted to lower inventory levels and more normal lead times through 2023 and into 2024. The Board's view is that underlying market growth will be more evident in the second half.

Net cash of £4.1m is down from nearly £20m last year. The company notes that £12.7m was spent on capex and acquisitions, but I immediately wonder a) how much of the capex spend was replacement capex, not growth? b) why didn't the company generate any cash to at least partially offset this spending?

Before getting into the cash flow performance in more detail, here are the CEO’s comments:

2024 is unfolding as expected. Over the first six months, strength in aerospace and petrochemical markets, helped by the benefit of 2024 acquisitions, has offset weakness in industrial and laboratory consumables and foreign exchange headwinds. This has been in line with management expectations. The trading outlook for the second half of the year is positive…

The Group's fundamental demand drivers have not changed. Porvair remains well positioned to take advantage of tightening environmental regulation; the growth of analytical science; the need for clean water; the development of carbon-efficient transportation; the replacement of plastic and steel by aluminium; and the drive for manufacturing process quality and efficiency….

Cash flow statement for the six month period shows:

£10m spent on acquisitions

£5m of cash generated from operating activities (after tax)

£2.4m of capex and nearly £2m spent on lease payments in the “financing” section of the cash flow statement.

Therefore, the cash generated from operating activities was barely enough to cover capex and lease payments - and that’s before counting the cost of acquisitions.

But if we drill into it a little more, we find the real culprit in the footnotes: there was a nearly £8m cash drain from receivables, i.e. from rising amounts owed by customers.

Referring back to the CEO’s notes:

The Group normally sees an outflow of working capital in the first half of the year. Working capital increased by £7.0 million (2023: £5.0 million) in the period.

The working capital outflow was about £5m in both 2023 and 2022, so this explanation makes sense (although it’s unfortunate that the working capital outflow was even bigger this year than in previous years)..

Graham’s view

Paul has been positive on this one and included it in his top 20 stock list for 2024. I also have a generally favourable impression of the company, for a variety of reasons.

For one example, the company highlights its return on capital employed as a KPI and calculates that it earned a ROCE of 14% in H1. The ROCE is much higher if you write off goodwill and other items, but I’m not sure that it’s entirely fair to do that. In any case, the company does have a good track record of generating acceptable returns. Here is Stockopedia’s view:

From a macro point of view, I tend to agree with Porvair that it is well-placed for the future with likely increasing demand for filtration/environmental products.

The stumbling block here is nearly always price: how high is too high?

The share only gets a ValueRank of 31, due to a high PE Ratio, an expensive PEG ratio, and a low yield:

Today’s results show earnings per share of 18.1p for six months, while the share price is now 676p.

And the sequence of earnings upgrades may have flattened out a little:

If underlying revenue growth was positive I could maybe hold my nose and stick with a GREEN stance, but with underlying sales in reverse I don’t think I can quite manage that. Therefore, this one is AMBER/GREEN for me. Hopefully the management forecast will hold true and we can start to see some underlying growth again later in the year.

In summary: I view this as a nice stock to hold, but this doesn’t strike me as an appetising entry point.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.