Good morning from Paul & Graham!

Here are Graham's latest thoughts, in an excellent & wide ranging interview with Paul Hill.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Quiet today -

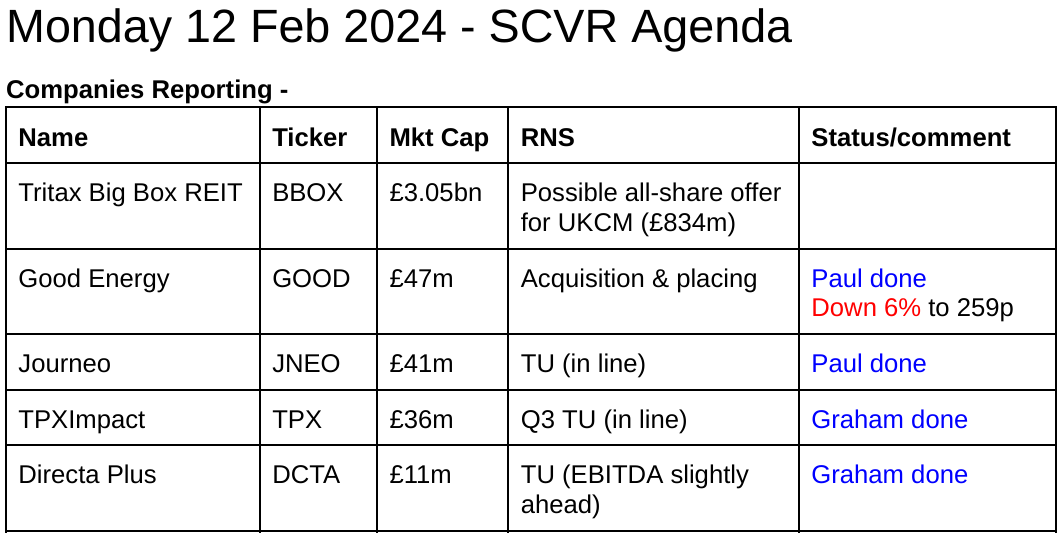

Journeo (LON:JNEO) - 249p (pre-market) £41m - Trading Update [in line] - Paul - GREEN

Trading update for FY 12/2023 is in line with expectations. Valuation still looks reasonable, providing it can keep winning contracts. Outlook comments are vague, but positive-sounding. JNEO seems to have transformed itself in the last year, so looking good, providing that momentum can be maintained.

Tpximpact Holdings (LON:TPX) - up 4% to 41p (£38m) - Q3 Trading Update - Graham - AMBER

This IT services company reports Q3 trading in line with expectations, and reiterates its targets for 2024/2025. These include like-for-like revenue growth of 15-20% next year. Net debt has reached a more manageable level, hopefully allowing for more stability in future.

Good Energy (LON:GOOD) - down 8% to 254p (£43m) - Acquisition & Placing - Paul - AMBER/GREEN

My first look at this energy supplier & services provider, which has announced a reasonable-sized, profitable acquisition today. Earnings seem very volatile, but I like the balance sheet strength, which makes me lean moderatively positively, purely based on an initial review.

Directa Plus (LON:DCTA) - unchanged at 17p (£11m) - Trading Update - Graham - RED

I don’t have a very good impression of graphene stocks up to this point, and Directa isn’t helping as it looks at risk of needing further funds in due course. The cash balance is €2.4m but net cash appears close to zero while the company remains loss-making.

Paul’s Section:

Journeo (LON:JNEO)

249p (pre-market) £41m - Trading Update - Paul - GREEN

Erratic price movements last week rattled some investors -

Although zooming out on the chart to 5-years, this has been a very successful investment for long-term holders, as new contracts and a seemingly very well-priced acquisition have transformed performance for the better -

Trading Update

Journeo plc (AIM: JNEO), a leading provider of information systems and technical services to transport operators and local authorities is pleased to provide an update on trading for the year to 31 December 2023.

Most importantly -

Adjusted profit before tax is anticipated to be in-line with market expectations.

Revenue up 118% to £46.0m (20% organic)

Acquisitions have been transformational -

The acquired businesses, Infotec and MultiQ, have performed well since joining the Group and contributed £21m in revenues during the year.

Cash sounds healthy -

Cash balances at the year-end were £8.1m, including payments in advance of £1.6m (2022: £0.5m). The Company invoice discounting facility of £2.75m was unutilised at the year end.

Outlook - light on specifics, but sounds positive -

Russ Singleton, Chief Executive of Journeo plc commented:

"I am very pleased with the progress we made in 2023, both organically and through two acquisitions. These developments are fuelling our strategy to broaden our customer base, extend our geographic reach, deepen our capabilities and provide us with access to thematically linked adjacent markets. We have strengthened our recurring revenue alongside our order book and pipeline, providing good forward earnings visibility and a solid base on which grow the business further. Together with significantly improved cash balances, we are investing in our people and technologies to develop innovative products and services that meet our customer requirements, as well as anticipating the future needs of the public transport sector. With a strong sense of momentum and an increasingly compelling customer offering, we look forward to further organic and acquisitive growth."

Forecasts - the StockReport shows 19.8p EPS for FY 12/2023.

On Research Tree the most recent note is from Cavendish, 28/11/2023, which says 20.6p adj EPS (raised 5% at the time).

At 249p/share, this gives a PER of 12.1x, which sounds reasonable, providing earnings can be maintained or increased further - that’s the key question.

A new note from Cavendish has just come through, saying it’s in line, and reiterating 20.6p EPS for this year. It mentions a large contract in New York, and cash being ahead of expectations.

A more modest rate of growth is pencilled in for FY 12/2024, to 23.1p EPS, a PER of 10.8x

Paul’s opinion - the numbers are very impressive, in particular the doubling of EPS from 2022 to 2023, mostly from what seems to have been a shrewd acquisition.

The main line of enquiry for research would be whether these are lumpy one-off type contracts, or whether momentum is building and growth will continue. I don’t have a view on that, but am just flagging its importance.

I was green when we last looked at JNEO, and based on the still-reasonable valuation, and strong progress in 2023, we have to stay at GREEN.

Good Energy (LON:GOOD)

Down 8% to 254p (£43m) - Acquisition & Placing - Paul - AMBER/GREEN

As it’s quiet for news today, I’ll spend some time acquainting myself with GOOD - something we haven’t covered here before. It’s been quite a rollercoaster ride for investors in the last 3 months particularly -

Today’s acquisition news also contains an in line trading update -

Good Energy has continued to trade in line with the Board's expectations following its last update to the market in November 2023.

What does GOOD do?

Good Energy Group PLC ("Good Energy" or the "Company") (AIM: GOOD), the 100 per cent. renewable electricity and energy services provider…

There seem to be several activities -

Electricity supply is by far the biggest, and only significantly profitable part of the business, as you can see from the H1 results segmental analysis table below -

It owns 49.9% of Zap Map - an app for finding electric vehicle charging points. That seems to be loss-making, but might have some future potential maybe?

WessexECO Energy was acquired in June 2023, and is a small-scale installer of solar panels. It also acquired a small heat pump installation business. Neither look significant at this stage, so I’ll ignore them.

Smart meter installations - 44k so far, again this looks very small.

The main business seems to buy in renewable energy from solar and wind farms, then sell it on.

H1 (to June) 2023 was superbly profitable, but it sounds a one-off -

Gross profit increased due to a strong H1 2023 performance and cost advantages from our power purchase agreements. However, we anticipate a one-off loss in H2 2023 due to lagging commodity costs and tariff reductions.

· Operating profit of £14.1m (H1 2022: -£0.5m loss). Some of this is expected to unwind in H2 given the falling commodity cost environment since late last year.

It’s quickly becoming apparent that this share is impossible to value, because earnings are so volatile. This is why I tend to avoid energy suppliers, because there’s been so much disruption, many have gone bust, and they can’t fully control input or output prices.

Broker forecast - there’s a useful note from Canaccord available on Research Tree. This forecasts most of the H1 profit will be given back in H2, so FY 12/2023 is £264m revenues, and a PBT of only £4.5m, or 21.4p EPS - giving a PER of 11.9x. Note that H1 profit was 72p, so highly volatile earnings, and difficult to see any trend.

Note that on 28 Nov 2023, GOOD said -

"Following a strong first half of the year, the Company's trading to the end of October has been ahead of expectations. If seasonal normal weather and stable commodity market conditions continue for the remainder of the year, Good Energy expects to deliver earnings ahead of the Board's expectations for the full year seeing a profit before tax of at least £4m."

Bear in mind the 2023 forecast profit includes absorbing £3.0m losses from the energy services part of the business. So we could strip out those losses, and do a sum-of-the-parts valuation as an alternative to a PER-based valuation (which can give poor results when a group has some profitable bits, and other loss-making elements being developed).

2024 and 2025 forecasts show a sharp reduction in revenue, so it does look as if there’s been some energy crisis related volatility here. Who knows what normal will look like in future?

Balance sheet - given that I have no idea how to value this share based on erratic & unpredictable earnings, let’s see if there’s any balance sheet substance?

The last balance sheet was 30 June 2023, in the interim results here.

NAV was £50.6m at end June 2023. This included £5.5m intangible assets, so that reduces to £45.1m NTAV. That’s slightly higher than the £43m market cap, which is better than I was expecting.

Note there is an £11.4m asset for “equity investment in associate” - which is where a group owns 20-50% of another company, it appears as a single line being the amount invested, less any impairment (very subjective). I’m assuming this is ZapMap - which is the sort of thing that could either turn out to be worthless, or very valuable, we just don’t know which at this stage!

If we write that off (since it is loss-making), then NTAV drops to £31.6m, still not bad for a £43m market cap, and I am taking a very cautious approach by valuing Zapmap at zero.

Current assets were £113m, including £35m cash and £8.5m restricted cash.

Current liabilities were £80m, so there’s a decent surplus on net current assets, this looks healthy to me, although I’m not familiar with the sector dynamics, as in how much cash & liquidity electricity suppliers generally need to have.

Overall then my scrutiny of the balance sheet is positive, GOOD looks stable and quite well financed.

Latest acquisition - this is the news today.

This is a fair size acquisition for GOOD -

JPS Renewable Energy Ltd ("JPS") , a specialist solar and storage installation and distribution business, and its wholly owned subsidiary, Trust Solar Wholesale Limited ("Trust"), a standalone distribution and procurement business based in Maidstone, Kent (together "JPS Group" or the "Acquisition"). The Acquisition is on a debt-free, cash-free, basis for an initial consideration of £7.0 million (the "Initial Consideration") with further deferred consideration of up to £6.75 million, payable in cash over a two-year period (the "Deferred Consideration"), subject to certain performance conditions. Together, the total maximum consideration is £13.75 million (the "Total Consideration").

Payment of the £7.0m initial consideration is split -

Cash on completion is £3.7m,

New GOOD shares, 1,322,000 notionally priced at 250p = £3.3m (this is a 7.8% enlargement of the share capital)

Of these new shares, 842k are being sold by the vendors of JPS, presumably to institutions, at a discount of 9% to the market price. You might validly ask why the share price mysteriously fell sharply in the last fortnight?

The balance of 422k vendor shares will be subject to a 12-month lock-in.

The brief trading performance figures given for JPS look pretty good, it seems to be a proper business, making profits -

For the financial year ended 30 April 2023, JPS's solar and storage installation division reported revenue of £9.8 million and profit before tax of £0.5 million and is currently on track to deliver revenue of £9.7 million and profit before tax of £1.0 million for the year ending 30 April 2024.

Paul’s opinion - please bear in mind this is my first review of GOOD shares, so based on only limited knowledge.

I actually quite like it. The balance sheet support is key for me, because my main concern is that profitability seems so volatile - a large profit in H1, most of which is then being lost in H2 2023.

It’s a horrible sector too - trendy ideas tend to attract wild valuations, but often turn out to be completely unviable businesses - Pod Point group (LON:PODP) was a good example of this.

Also, electricity suppliers seem to operate in a boom or bust sector, where mistakes with hedging (or not) can be ruinous. The Government seems to be terrified of more suppliers going bust, hence might be allowing them to make super-normal profits in the short-term? Hence why I just think it’s impossible to work out (unless you’re a sector expert) which ones are worth backing, and which ones avoided?

Given its decent balance sheet though, I think GOOD is something that might be an interesting punt, so for risk-takers, I can see why this might appeal. Hence I’ll push the boat out a bit, and go AMBER/GREEN.

Graham’s Section:

Tpximpact Holdings (LON:TPX)

Share price: 41p (+4%)

Market cap: £38m

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled services company focused on people-powered digital transformation, provides an update on trading for the three months ended 31 December 2023 ("Q3").

This trading update is in line with expectations.

Paul covered TPX in September, providing some remarks on a debt-reducing disposal (value: £7.5m).

In simple English, this is an IT consultancy serving the public sector, private sector and “third sector” (charities and NGOs).

Key points from today’s update:

Q3 like-for-like revenues up 32% to £20.2m, YTD up 25% to £61.8m.

Net debt further reduces from £12.8m to £10.7m.

Leverage multiple falls below 3x, and TPX “comfortably satisfied its banking covenants”.

3x is the magic number for the leverage multiple for most companies. Having crossed below that threshold, TPX’s lenders (HSBC) can hopefully breathe a little easier.

Outlook for FY March 2024: revenues of £80-85m (like-for-like revenue growth 15-20%), adj. EBITDA £4-5m.

Outlook for FY March 2025: like-for-like revenue growth 10-15%, with further margin improvement. TPX’s committed/backlog revenues for FY 2025 are already £65m. A year ago, the committed/backlog revenues for FY 2024 were only £50m.

CEO comment is upbeat:

"Although our budgeting process is still underway, the extent of committed revenues for next year provides a solid foundation for achieving next year's targets as they currently stand, building on our impressive new win rate this year and the successful execution of our strategy and three-year plan. The outlook remains positive, irrespective of the short-term uncertainty that may occur due to a general election, and I am grateful to all our people for their efforts and commitment to our goals and values."

Graham’s view

I tend to shy away from this sector (IT consultancies) due to low-ish margins and a sense that competition tends to keep it that way.

The forecasts at TPX reinforce this view for me, as £80m+ of revenues are set to produce less than £5m of adj. EBITDA - with real profits presumably lower than this.

The FY March 2025 forecasts are a little better with higher adj. EBITDA margins baked into estimates, but they still don’t come close to what I would consider to be a high-margin performance.

Valuation - adding on net debt, the enterprise value here is c. £50m, implying an EBITDA multiple of c. 10x for the current year and maybe 7x for next year.

I’m not sure that I would even be willing to pay that much in this sector, but perhaps TPX has some distinguishing features that could justify it?

Customer concentration - according to the 2023 annual report, TPX’s largest customer represented 6% of total revenue. It’s always worth checking for this, to understand the risk from particular contracts and customers. Customer concentration risk doesn’t seem too bad, but I’ll check it again in the 2024 annual report.

Overall, I’m neutral on this one, perhaps leaning slightly more towards a negative view than a positive one. But given the strong like-for-like revenue growth, I’ll take an AMBER stance on it.

Directa Plus (LON:DCTA)

Share price: 17p (unch.)

Market cap: £11m

A quick look at the StockReport tells me I should probably be cautious with this one.

3-year chart:

Financial record:

StockRank:

Paul covered this stock in September with the share price at 56p, giving it a RED.

It produces graphene products.The only other graphene company I previously studied in any depth was Versarien (LON:VRS). So I’m already very wary!

Let’s get into today’s trading update for 2023. Key points:

Revenues €11m (no mention of 2022 revenues, but it looks like they were about the same). This is below market expectations of €12m.

An improvement in the adjusted EBITDA loss of at least 20% from 2022, “slightly ahead of consensus market expectations”.

According to Singers this morning, their adjusted EBITDA forecast for 2023 is a €2.3m loss, improving to a €0.4m forecast loss in 2024.

Cash at the end of 2023 is expected to be €2.4m. However, this isn’t net cash. If you check the Singers note, net cash is expected to have finished 2023 around zero (€0.1m).

The company does have some impressive-sounding contracts:

Highlights in the year include a €5.5m three-year contract with LIBERTY Galati in the Group's Environmental division and, in Textiles, the Group agreed a significant expansion of its exclusive supply agreement with MC Armor in Latin America in addition to longstanding customer Grassi doubling its orders from the previous year.

And the near-future sounds promising:

With momentum and increased engagement across all verticals, and a strengthening pipeline of opportunities, the Board is also optimistic of delivering potential new material contracts in the short term. The current order book for delivery in 2024 stands at c. €7.8m, mostly made of recurring clients, further reinforcing the Board's confidence for increased traction in the year ahead.

That order book for delivery in 2024 covers just less than half of forecast 2024 revenues (€16.5m). Still a lot of work needed to hit those forecasts, then.

Graham’s view

I don’t need to spend any more time on this, as I already know that I’m going to give this stock the thumbs down. Sadly, without any meaningful net cash and with another adj. EBITDA loss pencilled in for the current year, the risk of another fundraising is simply too great to allow me to take any other stance.

It’s true that the adj. EBITDA loss is forecast at only €0.4m, implying that the company could be close to breakeven in terms of operating cash flow. But free cash flow is another matter.

Additionally, with the company missing its revenue forecast for 2023 and with the order book covering less than half of the 2024 forecast, I would be nervous about the company’s ability to hit its targets in 2024.

I’ll keep an open mind in case the situation improves during the current year. But for now I have to say that this one is a RED, in my view

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.