Good morning, it's Paul here with the SCVR for Monday.

It's very quiet for small cap trading updates and results again today.

Agenda -

Cake Box Holdings (LON:CBOX) - Trading update

Science (LON:SAG) - Trading update

Panoply Holdings (LON:TPX) - Trading update & significant contract wins

.

Cake Box Holdings (LON:CBOX)

Share price: 174p (up 5.5%, at 08:17)

No. shares: 40.0m

Market cap: £69.6m

Continued trading momentum in store and online

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces its half year trading update for the six months ended 30 September 2020.

I recall that this franchised cake shop retailer put out an impressive update after re-opening, which I reported about here on 1 Sept 2020. Re-reading my notes, it does look good. In particular a previously cancelled dividend of 3.2p was reinstated, as a special divi. LFL sales were up 14.1%, and online was up 74% - remarkably good, considering footfall is well down for retailers. This previous update covered the 5 months to end Aug 2020.

Update today - adds September to the reporting period, now 6 months for the half year to 30 Sept 2020. For the 6 month period, revenue was slightly down, at £8.6m (H1 LY: £8.8m). However, this includes 6 weeks of store closures at the start of the period, so the more meaningful comparison is LFL sales for the period after lockdown, being the 20 weeks to 30 Sept 2020;

Stores: LFL sales up 12.1% (very good, but down from 14.1% reported previously, so Sept has seen a slowing of the growth rate)

Online: up 81%, meaning that growth has accelerated further from the +74% figure previously reported. I would have liked to see the split of total sales between stores and online, because it's difficult to judge how important the online growth is, e.g. if it's coming from a low base.

Store rollout - given the chaotic circumstances of the last 6 months, I'm really impressed that CBOX has continued to roll out more store franchises. To open a cake shop right now, shows a lot of commitment from the franchisees, so they must find the offering compelling, which makes me sit up and take note.

Six new franchise stores were added to the Group's estate during the half year, bringing the total number of stores to 139. Recent store openings included Chatham, Swindon and Hemel Hempstead. In addition, after the period end, three new franchise stores are expected to open imminently.

A lot of the profits for franchise businesses come from up-front fees from selling new franchises. Hence continuing the rollout is important in that regard, to keep profits flowing. Then there's a long tail of franchise fees & service income in future, once a franchise is operating. It's a nice business model, but only works long term if there's a high enough gross margin to support both the franchisor and the franchisee's profitability. Cakes with quite high price points, are probably very high margin, I imagine.

I'm a little confused by this;

The Group has a very strong pipeline of new franchisees, driving confidence that the franchise store rollout programme will return to levels seen prior to the onset of COVID-19.

Currently, the Group has received and is holding deposits for 47 sites across the country.

It doesn't make it clear whether that is 47 new sites in the pipeline, or if it might include any existing stores? I might raise a query with the PR firm, to clarify that point, just to be sure.

Liquidity - £5.0m cash at period end, it's not stated whether this is net cash, or gross cash. I'll have to check the last balance sheet. This showed that there were bank borrowings of £1.6m at 31 Mar 2020. So I would have preferred the update today to give us the full picture, cash and debt.

Although I note that the last balance sheet also includes £4.6m of freehold property, and £1.0m of assets under construction. There was a £1.4m revaluation uplift on the freehold property, it looks like a new head office development. I adore freehold property on balance sheets, as it can hugely improve investment risk:reward, often with investors not even noticing it's there, so you get it free! So this more than offsets the incomplete disclosure about net cash.

For a franchising business, it's always worth checking receivables, in case financially distressed franchisees are building up unpaid invoices. There's no sign of that here.

Overall, the balance sheet is solid, so no problems that I can see here.

Dividends - we already knew that a 3.2p special divi was on the way, but another point has just occurred to me. Looking at CBOX's last year's cashflow statement, the business is generating enough cash to fund an expensive new freehold head office, plus paying divis. Therefore, once the capex programme is completed, there should be a lot more cashflow available to increase the divis. For that reason, whilst the 3.38% forecast divi yield may not look madly exciting, there should be scope for that to rise in future.

My opinion - I continue to be impressed with this company's performance. The share price looks about right for now, but I'm beginning to wonder if this could be a good long-term rollout. That it has managed to continue opening new stores, through franchisees, in these incredibly difficult times, tells me that the business must be pretty good. What sounds like a very strong pipeline of new stores, reinforces that.

Overall - looks potentially interesting, as a tuck away & forget type of long-term investment.

Note that the Directors have a lot of skin in the game here, but it looks as if a £6.4m sale occurred recently, raising a question mark. The downside of Directors holding lots of shares, is that liquidity can be a problem. The quoted market spread of 167p Bid, 180p Offer, is enough to put off many potential buyers. You can often get well inside the spread, but even so it's very off-putting.

A sideways trending share price since listing. Note that the Stockopedia computers like it, with a high StockRank.

.

.

Science (LON:SAG)

Share price: 248p (up 5.5%, at 09:58)

No. shares: 41.77m

Market cap: £103.6m

It's helpful when companies give a short description of their business at the start of trading updates, which nearly everyone does. SAG seems to have forgotten to include that in today's update, so this is how it described itself in the recent interim results announcement;

Science Group is an international, science-led services and product development organisation with a significant freehold property asset base. Following the Frontier acquisition in 2019 and an organisation restructuring, the Group now comprises three operating divisions: R&D Consultancy; Regulatory & Compliance; and Frontier Smart Technologies.

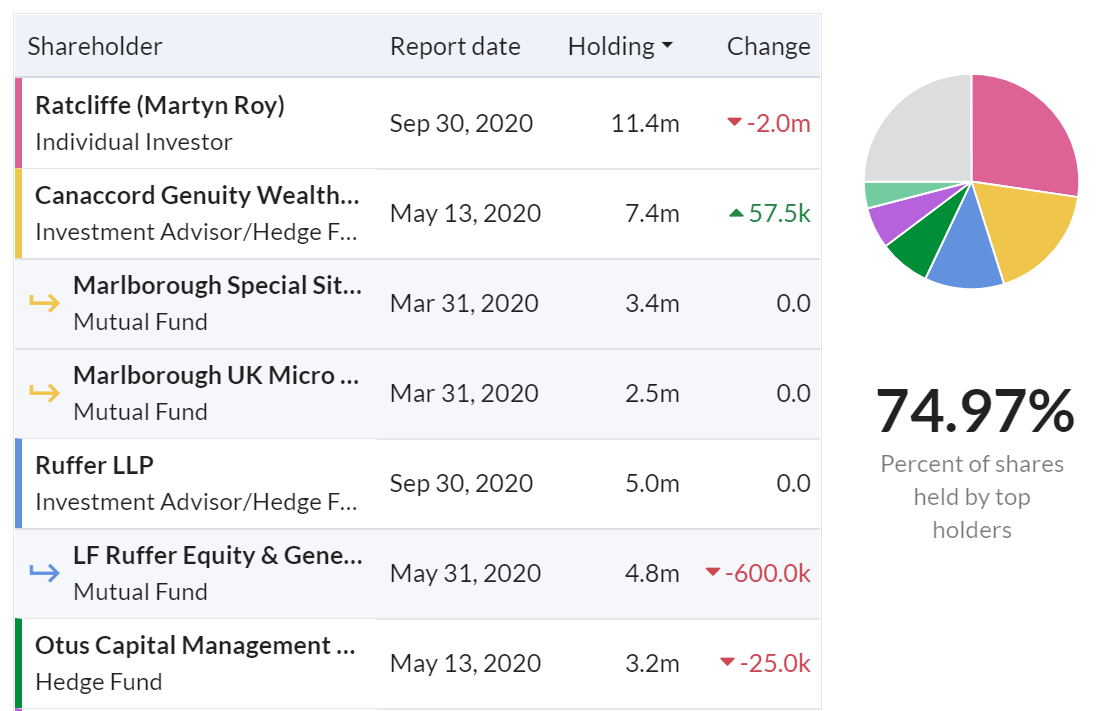

Here is my review from the SCVR on 31 July 2020, of SAG's last interim results. I came away impressed. It's an unusual combination of businesses. Also noteworthy is that the long-standing Executive Chairman is still the largest shareholder, despite top-slicing his holding recently. Great to see so much skin in the game, but as with CBOX above, that does lead to poor market liquidity, with a small free float;

.

( see here for the full list, I've clipped this to make it fit into the article)

.

Today's update sounds very good during such a difficult year;

Science Group announces that, following its trading update on 10 September 2020, revenue across the Group has continued to be at the higher end of the Board's expectations. In particular, the performance of Frontier is noteworthy in terms of both revenue and, due to an enhanced product mix, an improved operating margin. While the Board is using the opportunity to increase investments in the operating businesses, it is now apparent that the Group's adjusted operating profit for the year ended 31 December 2020 will exceed the Group's expectations as set out at the start of the year.

That's particularly noteworthy because the beginning of this FY 12/2020 would have been pre-covid. So to be beating pre-covid expectations is a very strong performance. Plenty of other companies are beating market expectations, but often because the forecasts were slashed earlier this year. Not so here with SAG.

Frontier Smart Technologies - this acquisition has gone well. I won't repeat the detail here, but here's the summary;

... In summary, Frontier has exceeded the Board's expectations in its first year post-acquisition.

This was a turnaround acquisition, with costs cut, and it seems to have worked, so kudos to SAG management & their team.

Outlook - too uncertain, so concentrating on cashflow & prudence.

Science Group also benefits from its strong balance sheet including gross cash (excluding client held funds) at 30 September 2020 of £25.0 million and net funds of £8.2 million, with the debt secured on the Group's substantial freehold property (office and laboratory) assets. This capital base enables the Board to continue to explore acquisition opportunities although, as always, there can be no certainty that any acquisitions will be completed.

I reviewed the last balance sheet here. It's OK, but the cash position is flattered by high creditors. Overall NTAV is fairly modest at £8.5m. The freehold property could be worth more than book value though.

My opinion - remember that I only do a quick review in these articles, to look for good & bad things. Based on the solid interim results, and today's strong trading update, I think this looks a decent share for readers to spend some time taking a deeper look at yourselves. The valuation looks reasonable, and it's particularly impressive to find companies like this, that seem to have traded well in 2020, despite covid & lockdown.

Overall then, I like the look of this one.

.

.

Panoply Holdings (LON:TPX)

Share price: 137.5p (up 12%, at 10:44)

No. shares: 67.3m

Market cap: £92.5m

Pre-close trading update and significant contract wins

The Panoply Holdings PLC, the technology-enabled services group focused on digital transformation, provides an update on its trading for the six months ended 30 September 2020 ("H1 2021").

I last reviewed this share here on 14 Sept 2020. It sounds like an interesting, acquisitive group, in a sexy area. My main reservations are;

- Weak balance sheet - the most recent accounts show NAV of £27.3m, but deduct £44.3m goodwill/intangibles, and NTAV is negative, at £(17.0)m

- Sizeable deferred/contingent liabilities for acquisitions

- Rapid rise in share count

- Expanding too fast?

Those things might not matter in the long run, if the business trades well. I'm just flagging these things as potential concerns, which readers might want to dig deeper to form your own view.

Update today - some impressive-sounding growth here, but quite small numbers for a £92m mkt cap company;

- H1 revenues £20.5m (up 18% on a LFL basis )

- Adj EBITDA (oh dear) up c.25% to £2.4m

- "Strong balance sheet" (no it's not) with £6.4m cash, £1.0m net debt - which of course doesn't tell us the whole picture

- Two more acquisitions made

- Positive outlook comments, including that it expects an H2 weighting to profits

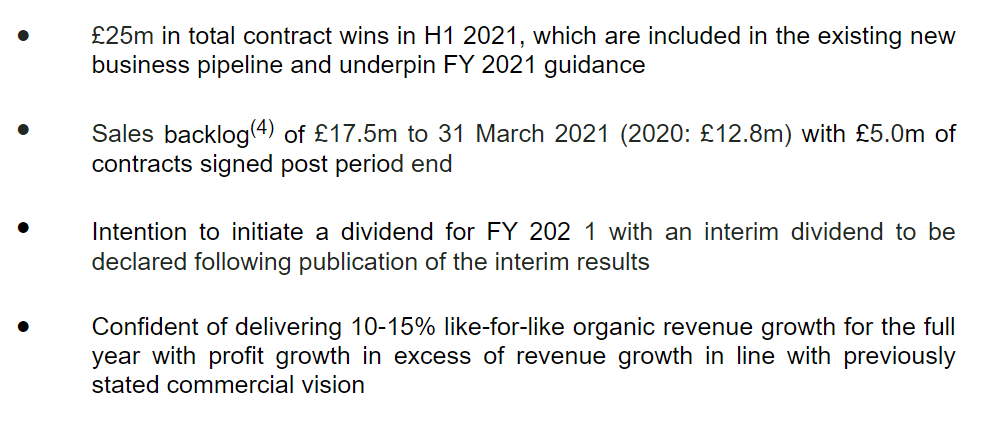

To save me typing more, here are the remaining bullet points, which sound upbeat;

.

My opinion - neutral at the moment. There are enough negatives to make me want to steer clear at this stage, and the valuation is looking stretched to me.

However, I do recognise that growth sounds strong, and that management talk a great story about digital transformation for the public sector, and the extensive contacts that the various subsidiaries have, when combined, so cross-selling is easier.

Let's see how it develops. Not for me at this stage, as I'm generally not keen on rapid expansion through acquisitions, but I can see why some people might find the story interesting.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.