Good morning from Paul & Graham!

Today I noticed for the first time this year, that it's just starting to become daylight outside, when my alarm gives its second and final time to get up message. That's a nice positive milestone!

Podcast - here's the link for the audio of this weekend's podcast. I'm not typing up transcripts any more, as they take too long. Also there seems to now be very good software available for transcription, so hard of hearing people who need transcripts, can hopefully get their own generated using such software.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda/Summaries

Paul’s Section:

Journeo (LON:JNEO)

140p - market cap £23m

Journeo plc (AIM: JNEO), a leading supplier of information systems, software and services to transport operators and local authorities is pleased to provide an update on trading for the year ended 31 December 2022.

Guidance for FY 12/2022 -

Revenues £21.1m (up 35%)

Order intake of £27m is up 50%, but I can’t see a closing order book figure.

Profit in line with expectations (a note from Cenkos puts this at £0.9m, both pre-tax and post-tax)

Recurring revenues (no figure provided) being received from 10k connected vehicles.

“No material issues” with supply chain.

Acquisition - this seems a game-changer, which makes me wonder why the vendors sold it for such an apparently cheap price?

The acquisition is Infotec, a leader in the rail passenger displays markets, which seems a good fit with JNEO’s existing business for CCTV on public transport.

The acquisition is said to be adding £12m annual revenues, and £2m profit to the enlarged group, thus more than tripling overall profitability. Cenkos is forecasting £3.3m PBT for FY 12/2023. In EPS terms, this is 17.4p, so the PER is still in single digits at 8.0x, assuming the enlarged group hits profit guidance for 2023.

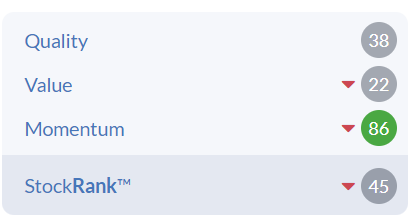

My opinion - this looks superficially attractive. My main worry is that JNEO has been around for a long time as a listed company, previously called 21st Century Systems and the track record was distinctly patchy, with occasional good years fizzling out subsequently. So I’d need a lot of convincing that it’s suddenly morphed into a high quality business.

The acquisition looks strikingly cheap - why was that, I wonder? People selling a business know it better than the buyers. So again, I'd need convincing on this.

The share count was increased from c.9m to c.16m as a fundraise at 105p was used to fund the acquisition. So I’d be careful about chasing the price too much higher than such a recent fundraise.

This share looks to have momentum behind it for now, but I’d need convincing that long-term value exists here, which would need more than one good year’s results.

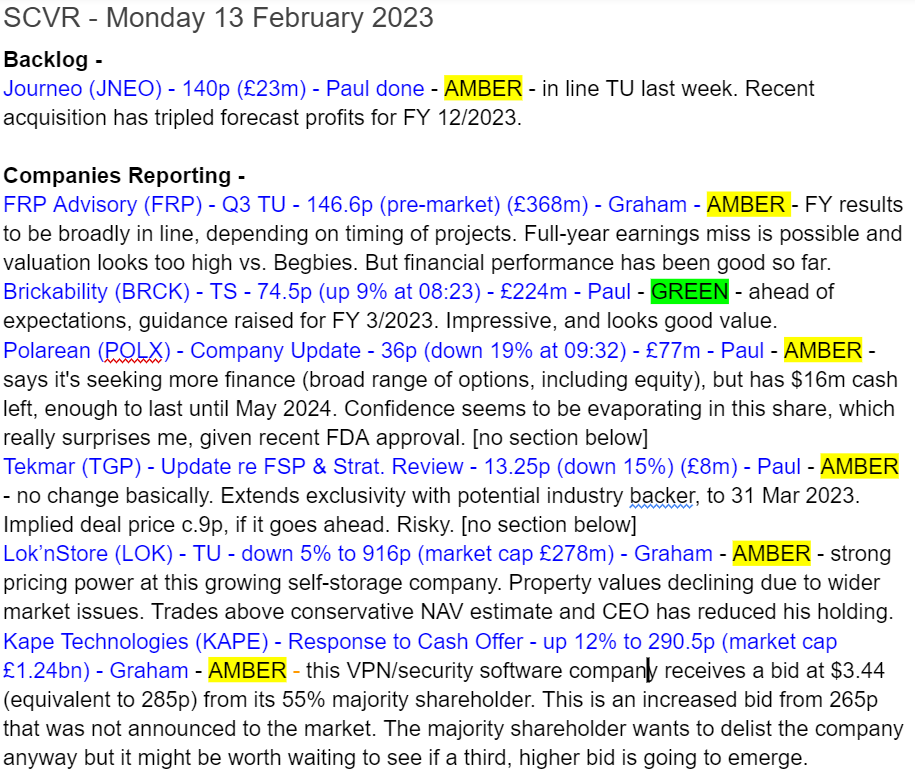

The StockRank system also looks a bit sceptical - flagging that this share is running mainly on momentum, and not so much on quality or value -

Nearly 18 years as a listed company -

Brickability (LON:BRCK)

69p (pre market open)

Market cap £206m

Brickability Group plc (AIM: BRCK), the leading construction materials distributor, today announces the following update on trading for the financial year ended 31 March 2023.

This strikes me as a positive surprise, in a sector I would have imagined to be struggling right now -

Following the release of the Group's interim results for the six months ended 30 September 2022, Brickability has continued to deliver a strong performance across all of its business divisions. As a result, the Brickability Board is pleased to announce that it now expects to report an adjusted EBITDA1 of a least £47 million for the full year to 31 March 2023, ahead of current market expectations2.

2. Current consensus analyst forecasts are FY23 EBITDA of £44.7 million (with a range of £44.5 million to £44.9 million)

It’s so helpful when companies provide a footnote, so we can quickly see that the latest guidance is £2.3m ahead of consensus forecasts, or a 5.1% beat against consensus.

Thanks also to Cenkos, who translate EBITDA into real profits (adj PBT) of £40.1m, and 10.8p adj EPS.

That gives us a PER of 6.4x (69p share price, divided by 10.8p EPS) - clearly that’s cheap, if you think earnings can be maintained at this level. The current share price seems to be implying that the market is sceptical about future earnings strength. Or it could be a mis-pricing, with the recent downward share price trend having overshot on the downside?

I see the market price has just opened 9% up at c.75p (at 08:04), a good start to the day.

Note that higher corporation tax is kicking in for next year, which has quite a sharp impact on EPS (this point is relevant for many/most companies). So Cenkos is leaving FY 3/2024 forecasts unchanged, with profitability flat vs this year, but EPS down from 10.8p to 10.2p, mainly due to higher corp tax.

Outlook - vague, but this sounds fairly upbeat in tone, and it doesn’t sound as if the group is seeing an immediate downturn -

Whilst mindful of the short term impacts on our sectors that a challenging macro-economic environment could bring, the Board remains confident that the Group is well placed to continue delivering on its strategic objectives and the underlying growth of the business.

My opinion - this looks encouraging to me.

BRCK floated in the year before covid struck, and the share price is now very similar to then. Although note there are c.300m shares in issue, more than the c.230m when it floated - not an excessive increase in share count, given the rapid expansion of the business through acquisitions. I’d say shareholders now are getting a lot more for their money, than people who backed the IPO.

Note that there’s no asset-backing, with a balance sheet that carries £150m of goodwill, bringing NAV of £154m down to only £4m NTAV. Although we could probably also write-off the (usually related to goodwill) deferred tax creditor of £17m, so that would increase NTAV to £21m.

Another point to note on the balance sheet, is that BRCK owns few inventories, as I believe the business model is more based on drop-shipping (acting as an intermediary, but not actually holding the physical stock). That means it doesn’t actually need a lot of asset backing, providing manufacturers are happy to continue tolerating an intermediary that skims off some of the profit.

Are the shares attractive? That depends entirely on your macro view. If you expect a deep & prolonged slowdown in construction, then this sector would be best avoided altogether. If you’re more sanguine, then this could be a good value entry point. I’m personally leaning more towards the latter, so I’ll mark this one down as something I see broadly positively on balance, because the shares have already de-rated a lot, and yet the company seems to be trading well & doesn’t sound too worried about the outlook. Hence buyers are able to buy at a price which already factors in some downside protection from lower future earnings.

Attractive valuation scores below right -

Graham’s Section:

Frp Advisory (LON:FRP)

Share price: 146.6p (pre-market)

Market cap: £365m

FRP Advisory Group plc, a leading national specialist business advisory firm, today announces a trading update for the nine months to 31 January 2023 and declares its Q3 quarterly dividend.

Paul neatly summarised FRP’s H1 results here. Here are the key points from this morning’s Q3 update.

“Financial Advisory” - the company has launched this new “pillar”, to go along with its other four existing services (Restructuring, Corporate Finance, etc.). This is just a reorganisation of the services already offered, as the Financial Advisory pillar replaces and includes the pillar that was called Pensions Advisory.

Trading - FY 2023 results are expected to be broadly in line with consensus expectations (revenue £101m, adj. EBTIDA £26.7m), “with the outcome subject to the timing of completion of several FRP Corporate Finance transactions around the year end.”.

I would interpret this as a mini-profit warning, as I take it to mean that the company is more likely to miss expectations than it is to exceed them.

Trading does sound reasonably busy:

As mentioned in the Company's interim results, the volume of work in the higher value restructuring and administration market is still to recover to pre-Covid levels and the Group expects to see increased activity in these areas during 2023. The Group has seen an increase in the number of liquidation mandates in line with the widely reported increase in the overall number of insolvencies for companies during 2022.

Q3 dividend is 0.85p (vs. 0.8p last year).

My view

In general, I think that companies in this sector should trade on cheap multiples (it’s better to work for them than to own them, in my view) and that is why I’ve been worried that Begbies Traynor (LON:BEG) is at risk of becoming overvalued.

However, according to the StockReport, Begbies trades at a PER of 13x and a Price to Sales multiple of 1.8x.

FRP’s StockReport, on the other hand, suggests a PER of 18.5x and a Price to Sales multiple of 3.6x.

Those metrics strike me as very worrying and so I’m tempted to take a negative view on this stock. But I’ll stay neutral for now, as the company’s financial performance has been fine so far, since its 2020 IPO (this explains its very high QualityRank of 85).

Lok'n Store (LON:LOK)

Share price: 916p (-5%)

Market cap: £278m

This self-storage company provides an H1 update. The full-year ends in July, so H1 ended in January.

I reviewed last year’s results here, if you’re interested.

H1 highlights:

Same store revenues +10.3%, price per square foot +9.2%.

Same store occupied unit space +2.6%

NAV to be “broadly unchanged at year end”

So there’s good pricing power and improved utilisation, but NAV isn’t going to move much this year - and could even move lower?

Here’s the reason for that: lower property valuations generally, and higher interest rates:

Our trading assets will be independently revalued at our 31 July 2023 year end. The maiden valuations of three new stores combined with continuing strong trading should materially offset any changes in exit yields and discount rates that we are seeing in the market.

Or in other words, the company’s underlying growth and profitability (which increase NAV) should nearly match the reduction in NAV caused by higher interest rates.

I noted previously that the company had deleveraged its balance sheet, and it confirms today that its LTV is still very very low at just 8.8%. Rising rates therefore have little effect on its own day-to-day cash flow, even if they do affect the valuation (on paper) of its properties.

The company also doesn’t seem too worried about inflation:

…we are seeing some cost pressure, specifically in the areas of business rates and energy. We believe these cost movements are shorter term and expect the rate of cost growth to return to more normalised levels in due course. Beyond that we would expect any increases in absolute cost levels to be driven mainly by the increasing number of stores.

The company has four new “landmark” stores in the pipeline, and sees further opportunities “beyond the secured pipeline”.

My view

I still think there’s a lot to like about this one. Self-storage is a niche whose future I believe in, as population density only seems to be going in one direction.

I’ve spent a few minutes this morning checking how the company calculates its “adjusted net asset value”, and there’s a huge number left out of the calculation: potential tax liabilities on gains from rising property values.

In the 2021 results, adjusted NAV was £7.42 after making provisions for these taxes, a very different figure to the £9.72 headline number.

After making this realisation, I’m going to have to take a neutral view on this stock. I’d be much more positive if it was trading around or below NAV (conservatively estimated). However, at its current share price, it is trading at a meaningful premium.

It’s also very expensive against earnings:

And the founder-CEO appears to have reduced his holding since the last time I checked:

Therefore, even though I like many aspects of it, I’m neutral on this stock for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.