Good morning from Paul & Graham!

Mello Monday tonight looks interesting, with one of our favourites Warpaint London (LON:W7L) presenting, plus Transense Technologies (LON:TRT) which we were discussing here last week. Also the author of Pigs Get Slaughtered will be on!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

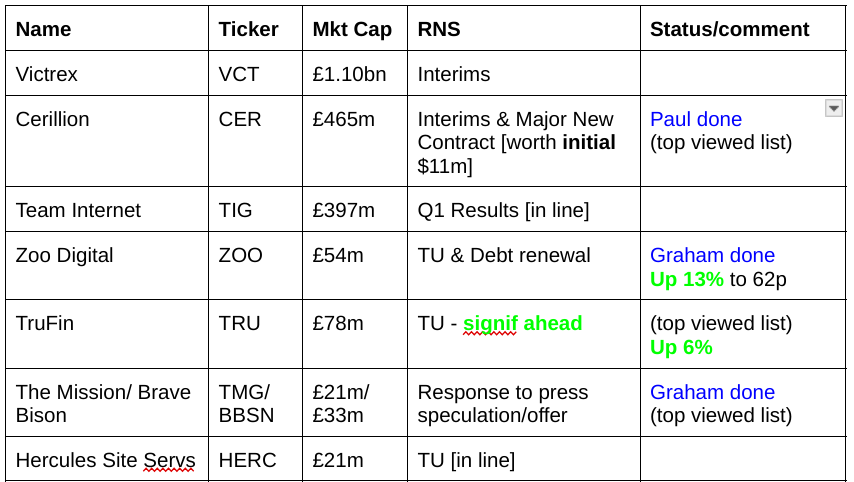

Companies Reporting

Other mid-morning movers (with news)

Mediazest (LON:MDZ) - up 67% to 0.1p (£2m) - Trading Update - Paul - AMBER/RED

Positive-sounding update, but a very quick look into the financial details shows a tiny business that averages around breakeven over the years. It can’t be economic to be listed, so de-listing risk looks high. Balance sheet is weak, running on fumes, and propped up with shareholder loans. Name drops big clients!

Acuity RM (LON:ACRM) - up 16% to 4.35p (£5m) - Contract Win - Paul - AMBER

Might be worth nanocap investors taking a look at this one, it seems to be winning contracts (upselling a renewal in this case) to big clients, including UK Govt. £500k over 3 years is a decent contract for a company this small. Looks like Acuity it was reversed into a cash shell in 2023. Too early to judge, but the flurry of contracts announced suggest there might be something interesting here, but proper research is needed - I’m just flagging interesting-sounding news.

Huddled (LON:HUD) - down 13% to 3.05p (£10m) - FY 12/2023 Results - Paul - AMBER

Trumpets a £13m profit, but it’s actually a loss from continuing operations, more than offset by profit on disposals, as the listed company changed its activities. The strategy is to build a portfolio of small eCommerce businesses - good luck with that, you’re about 25 years late!

Is the balance sheet any good? Actually yes, it is. NTAV of £6.4m, of which £4.3m is cash, and there’s no interest-bearing debt. Total creditors are only £0.75m, so it’s in a very comfortable position. I wonder if more small acquisitions will deplete that cash pile? Outlook comments indicate continuing losses in short & medium term, which rules it out for me.

I’m happy to watch from the sidelines for now, and we can see how it develops. So given the solid financial position, let’s go with AMBER for now. I recall this caused a flurry of interest last year, do any members want to update us with your current views?

Jaywing (LON:JWNG) - down 17% to 2.6p (£3m) - Update - Paul - RED

Trading is weak, in discussions with lenders to increase borrowing facility due to strain on working capital, CEO steps down, strategic review ended as presumably nobody wants to buy the company. Mentions stakeholders (always a red flag). Paul’s view - looking at the last balance sheet, it’s the lenders who’ve got the biggest problem here. Equity looks worthless, so it’s a bargepole I’m afraid.

Summaries of main sections

Cerillion (LON:CER) - 1,575p (pre-market) £464m - Interim Results, Major Contract Win - Paul -GREEN

Good H1 results (against tough LY comps) are slightly ahead of broker expectations. A major contract win announced today seems to further underpin seemingly modest FY 9/2024 expectations. I need to be better understand the nature of revenue/profits, since only about a third of revenues seem to be recurring - not that much for a SaaS business. So a few questions, but overall it's still very much one of my favourite UK growth companies.

Brave Bison (LON:BBSN) - down 3% to 2.45p (£31m) - Graham - GREEN

Mission (LON:TMG) - up 6% to 24p (£22m) - Graham - RED

These marketing agencies were in the weekend press: BBSN are interested in taking over TMG on an all-share basis, with TMG shareholders owning 45% of the combination. I leave our RED & GREEN stances unchanged but on the basis of their respective balance sheets, I do see merit in the BBSN proposal.

Zoo Digital (LON:ZOO) - up 14% to 62.8p (£61m) - Trading and Debt Facilities Update - Graham - AMBER

A very reassuring and positive update from ZOO as the company’s bank extends its (undrawn) facility for a year. Furthermore, its broker upgrades FY March 2025 EBITDA expectations thanks to a very strong Q1 performance with good visibility for the next few months. I can see both sides of the argument here.

Paul’s Section:

Cerillion (LON:CER)

1,575p (pre-market) £464m - Interim Results, Major Contract Win - Paul -GREEN

Cerillion, the billing, charging and customer relationship management software solutions provider…

H1 numbers look fairly good, but not spectacular. We have to be more picky now the valuation is so much higher than in previous years. Liberum reckons H1 is slightly ahead of expectations, and points out the tough prior year comparative.

Outlook is confident -

"Cerillion's interim results again set new records for our key performance indicators in any six-month period and demonstrate the strong momentum in the business and the significant growth opportunities available.

"With an ever-growing sales pipeline, increasingly strong demand amongst telcos for digital transformation via SaaS solutions, and some exciting innovation in our product suite, we expect to continue to grow strongly. Given the Company's progress - including the major new contract announced today - and prospects, we believe it is well-placed to deliver market expectations for the full year and beyond, and we view the future with confidence."

Order book & pipeline details also good -

Forecasts look modestly set, and it’s looking increasingly likely that CER should beat forecasts, which Liberum hints at in an update today. We have H1 actual of 27.6p (adj basic EPS above), and Liberum pencils in 47.6p (on a fully diluted basis) for FY 9/2024, which looks too low. Surely something like 60p might be more realistic?

Valuation (based on 1575p/share) -

Liberum’s 47.6p = PER 33x

My guess of 60p = PER 26x

So as we always say, CER shares are certainly not cheap on a PER basis, but I wouldn’t expect them to be, as it’s an exceptionally good growth company. If my guess on earnings is close to the outcome, then I think the valuation looks OK.

It all hinges on what future growth is like of course. I think the story here is very credible - that CER has the right software (standardised, hence high margins because it doesn’t need to be re-written for each client), and is clearly on a roll winning bigger contracts with each contract win providing another reference site to help win more customers. I find that a compelling investment case, that we can all understand without needing any technical expertise about the products - the numbers and contract wins do the talking.

Recurring revenues - this is my main area of questioning, and I hope we can get more colour from management on the webinar (details below). The £45m forecast revenues for FY 9/2024 (probably too low) compares with annualised recurring revenues of £15m at 31/3/2024. So only about a third of revenues seem to be contractually recurring.

From memory I seem to recall that CER is still heavily reliant on up-front licence fees from some contracts. So I need to better understand the mix of SaaS, and one-off licence fees. Ie does CER have to keep winning major contracts just to stand still? This could mean the risk of a profit warning if say a future year doesn’t get as many big contract wins as expected. Also it can be dangerous to chase up a valuation, based on not necessarily recurring very high margin profits.

I’m only asking the question, not expressing a view here. It’s absolutely key to the valuation to get this right.

Balance sheet - looks very strong, as usual. NAV £42.5m, less intangibles of only £4.5m (it hasn’t done much in acquisitions, and doesn’t capitalise much development spending, so nice clean numbers). Hence NTAV £38m, which is plenty for the size of company. Remember there are no inventories and little fixed assets at software companies, so NTAV can be quite small, or even modestly negative. Hence £38m NTAV is more than enough here. I think it needs that rock solid balance sheet though, to provide increasingly large customers with the confidence CER is at zero insolvency risk (vital when it’s entrusted with running business critical cloud-based systems). Hence paying out the cash in say a special divi would be a mistake I think, it's better to hoard a nice cash pile for any eventuality.

One query is note 5. This shows a big increase in long-term receivables, up to £9.3m, called “accounts recoverable on contracts”. I think the double entry here is CR: revenue/profit on the P&L, and DR: receivables on balance sheet - ie the profit has been booked, but the cash hasn’t yet been received. This is worth querying with management, as I don’t normally see receivables in the non-current section of assets. There’s another £12.6m of receivables in current assets, which again seems a lot.

I vaguely recall management previously saying that they sometimes sweeten deals by allowing customers deferred payment terms, given CER’s cash rich position.

The rest of the balance sheet looks OK, with a very comfortable cash pile of £26.6m, and no interest-bearing debt.

Cashflow statement - about a third of the positive cash generation is sucked into working capital again - mainly increased receivables. I suppose that’s to be expected at a high margin business growing sales quite fast, but links into my points about extended receivables above.

Only £560k capitalised development spend in H1 is nice and prudent accounting (in practice companies have tons of wiggle room to fit into the fairly loose accounting rules on this), so a low figure here shows they’re prudent I think.

Dividends paid are modest, and easily affordable - it has considerably greater dividend paying capacity I think. Hence the 0.8% yield could improve in future years, once the growth rate has slowed maybe.

Another big contract win today -

Cerillion, the billing, charging and customer relationship management software solutions provider, is pleased to announce it has agreed a major new contract, worth an initial $11.1 million, with a leading provider of connectivity solutions in Southern Africa. The contract is for an initial five years and has scope to develop further over time…

Under the terms of the agreement, Cerillion will be supplying, implementing and maintaining its flagship BSS/OSS solution on a SaaS basis.

I’m confused here. Does that mean the licensing revenues will be spread over 5 years (SaaS basis), or will some be up-front? Was this already in the forecasts for this year, or not?

Webinar - should be interesting and hopefully people might ask some of the questions I mention above -

Shareholders and potential investors can register to join the online presentation through this link: https://bit.ly/CER_H124_results_webinar

Paul’s opinion - this all looks good to me. I see the share price is up slightly +1.6% at 1,600p (09:00) which strikes me as about right. CER shares are already on a punchy valuation, and I think might have dropped a little today on the interims and only in line outlook. Once shares are richly valued, they have to keep out-performing. The $11m new contract win saved the day though, and who knows, could lay the groundwork for another upgrade in due course? I suspect it’s set up to beat existing forecasts, but it needs to be.

So long as CER can keep the contract wins rolling in, then I could see this share continuing a very impressive long-term up-trend. Things have to pause for breath, and retrace a bit in between of course.

I need to better understand some aspects of the business model, but from everything I’ve seen we have to stay GREEN here, maintaining my very positive comments previously on 16/10/2023, 2/1//2023, 20/11/2023, and 22/4/2024.

Graham’s Section:

Brave Bison (LON:BBSN) - down 3% to 2.45p (£31m) - Graham - GREEN

Mission (LON:TMG) - up 6% to 24p (£22m) - Graham - RED

Possible all-share offer for The Mission Group (RNS by BBSN)

Response to Press Speculation & Possible Offer (RNS by TMG)

An article in yesterday’s Sunday Times noted that these rival marketing and advertising agencies could potentially be set to merge, with Brave Bison taking interest in Mission.

Here at the SCVR, we last covered Mission in December when I took a RED stance on the basis of the company’s large debt balance and slim profitability.

Mission’s last-reported net debt balance (for end-Feb 2024) is £19.5m. “Headline” (i.e. adjusted) profits for last year translated into large actual operating losses after impairments.

The situation at Brave Bison is quite different with Paul taking a GREEN stance in January on the back of strong results with the company also reporting a net cash balance of nearly £7m.

All of which brings us to today’s news.

Possible all-share offer for Mission

Key points about the offer as outlined by Brave Bison:

Combined group would have 2023 revenues of £120m and adj. EBITDA c. £14m, before allowing for any synergies.

This larger size “would present a more attractive investment opportunity to institutional shareholders than either standalone company leading to the possibility of the enlarged Brave Bison trading at a higher multiple of earnings” (GN note: BBSN currently trades at 10x trailing adjusted earnings.)

They point out that according to the Dec 2023 results, Mission had gross obligations of around £30m (bank loans etc.), and that a combination with BBSN “would result in a strengthened balance sheet and improved debt and covenant ratios”.

Scrolling down through this RNS, I also find the following comment by BBSN on Mission’s debt load:

The Board of Brave Bison believes these debt levels are unsustainable based on the historical free cashflow generated by Mission in the past three years. Even with substantial improvements to operating cashflows, the Board of Brave Bison believes Mission will struggle to repay outstanding liabilities without a combination of asset sales, which would reduce the scale and may reduce attractiveness of an investment in Mission, or an equity fundraising, which would be dilutive to non-participating shareholders. The prospect of both asset sales and an equity fundraising were mentioned in Mission's final results announcement on 28 March 2024.

Response by Mission

Mission have revealed that at the end of April, they already received a conditional proposal of 11.5 BBSN shares for every Mission share, which translated to a value of 29p.

The bid was rejected on the basis that it undervalues Mission; here are the key points from their side of the story:

Mission shareholders would own 45% of the combined group, which “does not fully reflect the inherent value in Mission”. They argue that for 2023, Mission would have contributed 81% of revenues, 71% of adj. EBITDA and 54% of adj. PBT to the combined group.

They say that BBSN are considering a £10m fundraise, after the proposed merger, to strengthen the combined group’s balance sheet. This could result in further dilution for Mission shareholders.

The proposed Board of the combined group would only see one of Mission’s NEDs joining the Board.

In short, the proposal is not “transformational”, is “earnings dilutive” for Mission’s shareholders, and there is “no certainty” that it would result in a re-rating of the combined group’s shares.

Graham’s view

Here at the SCVR we tend to emphasise balance sheet strength, and clearly BBSN are in the much stronger position in that regard. In that sense, their offer could be considered “opportunistic”, but it might also make sense from the point of view of giving Mission shareholders a chance to resolve their debt problem.

Mission today have disclosed that their net debt as of 30 April 2024 increased to nearly £27m, mostly relating to bank loans but also HMRC and acquisition payments (some of which can be settled in shares rather than cash).

Let’s add on their net debt figures to their market caps to see what the rejected proposal from BBSN looks like in terms of enterprise values.

Mission: shareholders would get a total of 1.06 billion BBSN shares, at a value of 2.5p each that’s a total value (before any re-rating) of nearly £27m.

Add on the net debt figure and the enterprise value for Mission is £53m.

Brave Bison: at 2.5p, its market cap is £32m.

Deduct last-reported net cash and the enterprise value for BBSN is £25m.

Therefore, in terms of their enterprise values, the deal values Mission at about 68% of the total (£53m out of £78m total).

From that point of view, it seems about right if the companies are being valued on their adj. EBITDA (Mission would provide 71% of total adj. EBITDA for last year). If the companies are being valued on adj. PBT, then it’s generous to Mission (Mission would provide 54% of adj. PBT for last year).

If you think these companies should be run on a debt-free basis, then, I would say that this is a very reasonable offer from BBSN. The combination of BBSN’s existing cash plus an equity fundraise would wipe out most of Mission’s debts, leaving a manageable amount that could hopefully be paid off through the group’s combined cash flows.

On the other hand, if you are comfortable with these companies being run on debt, and if you think Mission can trade its way out of its net debt position, then you would naturally want to hold onto Mission’s shares and see its market cap improve as its debt load reduces.

Mission’s valuation metrics are depressed, probably due to a combination of the debt load and the fact that its profits are very unclean with lots of adjustments needed to make them look good:

I am happy to maintain our existing stances on these shares:

BBSN: GREEN

TMG: RED

As for the deal, I would say it’s a reasonable offer because my view is that these companies should have a net cash balance (as they don’t have the quality or predictability of earnings to run on debt, in my view) and so I think the offer from BBSN is a reasonable solution to Mission’s predicament, that could ultimately benefit both companies. But at this stage, barring a shareholder rebellion, it seems likely that Mission will prefer to go it alone.

(Paul adds: Thanks Graham, a very interesting situation. I wonder what scale of cost savings could be achieved by combining the two small listed companies? A fair bit I would imagine, from clearing out duplicates from 2 sets of NEDs & advisers, and listing fees. Also after the merger of TPFG and BLV recently, I think there's a strong argument for forming a larger business with better liquidity in the shares. Institutions are apparently not interested in market caps below c.£250m, so getting a bit closer to that might help re-rate the shares of the combined entity onto a higher PER, which was a key rationale for the TPFG/BLV merger. Another key question is the relative skills of the top management? Absorbing a bigger business could be a challenge for BBSN management. Does anyone know much about their background, and whether they're likely to add value, or flounder under the difficulties of managing a much bigger group, and possible push-back against the deal? A risk is that key rainmakers at TMG might walk away and set up their own competing businesses, taking clients with them - a big risk at people businesses. I see that BBSN is 20% owned by Lord Ashcroft, which I think adds weight to the proposal in that it might be perceived as giving BBSN more clout. Usually when a minnow tries to bid for a larger company, it can look impertinent and foolish, but not if you have a billionaire backer. All interesting to ponder anyway! I'm not generally a fan of all-paper deals, as it can create indigestion with a lot of people holding shares that don't really want to. Although the TPFG/BLV deal has gone well - although that a merger of equals really, whereas BBSN is a good minnow swallowing a larger but troubled group.)

Zoo Digital (LON:ZOO)

Up 14% to 62.8p (£61m) - Trading and Debt Facilities Update - Graham - AMBER

ZOO Digital Group plc (AIM: ZOO), a leading provider of end-to-end cloud-based localisation and media services to the global entertainment industry, today provides an update on trading and its debt facilities.

These shares have already almost trebled from their low in March. It was at nearly 200p last year, before a major collapse:

Here are the contents of today’s update:

Debt facility

The $3m facility with HSBC (currently undrawn) has been renewed for another 12 months, giving ZOO “enhanced financial flexibility for working capital purposes in an improving market environment”.

Net cash finished the financial year to March 2024 at $5.3m (vs. $3m expectations, according to Singers).

It’s a relief for shareholders who may have feared that the company was about to run out of liquidity: $5m of cash plus a $3m facility means $8m of headroom. However, that would surely be used up if the company had another terrible year; this brings us to the trading update.

Trading update

Firstly in relation to FY March 2024, ZOO says that they are “confident of at least meeting FY24 market expectations”.

Paul already commented on ZOO’s FY 2024 figures here with revenues expected to be down by more than 50% to around $40m and an adj. EBITDA loss of $13.5m.

As for FY March 2025, it has started well:

Customer demand has continued to recover with March 2024 invoicing the highest month since April 2023 following acceleration of the Company's pipeline. Work has continued to expand throughout March and April 2024 and visibility extends to September 2024. Revenues for FY25 Q1 are expected to be 36% up on FY24 Q4 which, together with recently implemented cost savings, is expected to result in EBITDA at break-even in Q1.

The broker’s EBITDA forecast for FY March 2025 is accordingly upgraded from $5.8m to $6.3m.

Graham’s view

This is excellent news and I think I can offer an improved stance of AMBER (vs. Paul’s AMBER/RED in March).

The company’s prospects of avoiding equity dilution appear to have greatly improved, following today’s news flow:

A better net cash balance than expected.

Extension of banking facilities for a year.

Upgrades to the adj. EBITDA forecast, implying that the company’s cash performance in the current financial year might be ok.

Ultimately I agree with Paul that this is probably not a very high-quality business from an investment perspective - how could a company build an enduring competitive advantage in dubbing/subtitling services? I also think it would be difficult for ZOO to have much bargaining power relative to its customers in the entertainment industry.

However, in normal conditions, it should be able to generate an acceptable level of profitability. FY March 2023 did see it generate an excellent financial performance, suggesting that its quality might be improving with its increasing scale, before it was hit by Hollywood strikes.

Now that it's in recovery mode, I do think it will get back to breakeven sooner or later, and it has a realistic chance of avoiding equity dilution. So I’m happy with a neutral stance.

(Paul adds: It's been a stunning % rebound from the lows in March 2024, for sure. Does that make it a good company though? The jury's still out on that, and I remain unconvinced, because even after the strong rebound (as expected from the ending of the Hollywood strikes), the March 2025 forecast is only now just below breakeven at adj PBT loss of £(0.1)m. Why pay £60m for a business that is only expected to improve to breakeven? That doesn't attract me at all. Clearly bulls must be betting that a much stronger recovery is in the offing (based on promising-sounding contract wins).

The big risk here was that it would run out of cash, after squandering the money raised for an acquisition on huge losses in FY 3/2024 (Why? Surely its costs should have been variable, hence scaled down when revenues dropped? This has not been adequately explained). Hence with insolvency risk apparently receding with enough cash headroom, I think it makes sense for Graham to move us up from amber/red to AMBER, as risk seems to have reduced - although I'd like to see what the full figures look like, to make sure the year-end cash figure hasn't just been window-dressed by locking up the chequebooks for a few weeks!).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.