Good morning from Paul & Graham!

All done for today!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

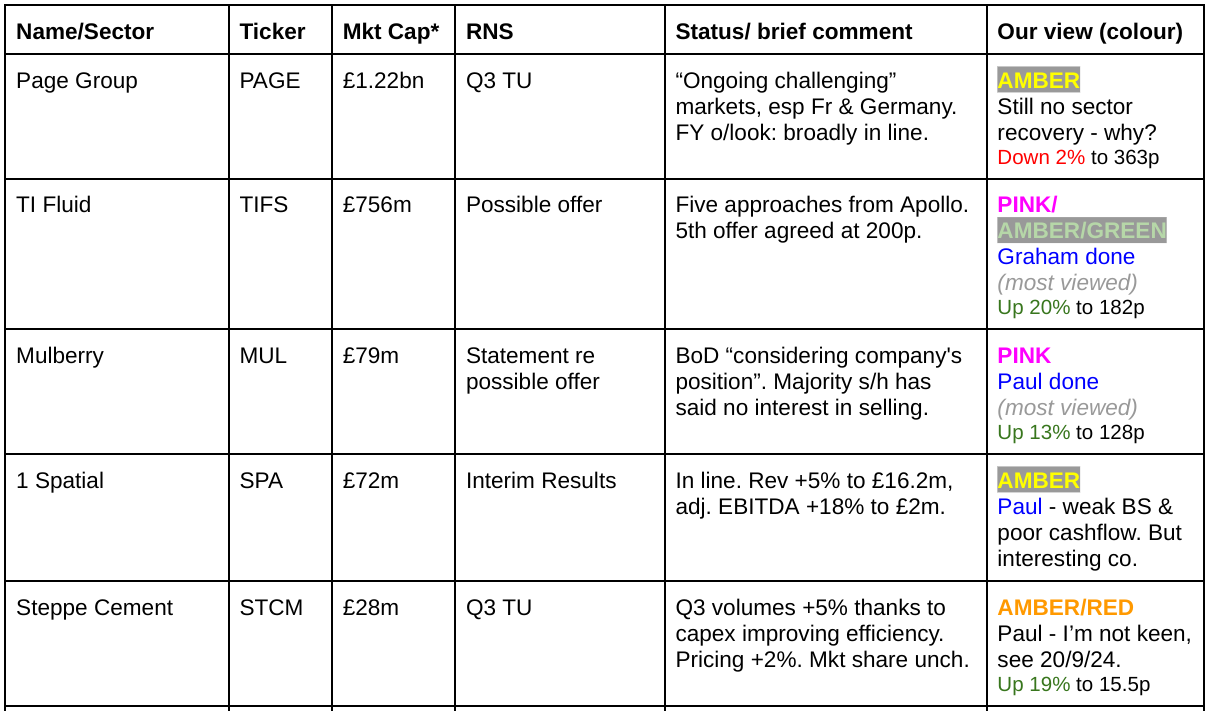

Companies Reporting

Summaries

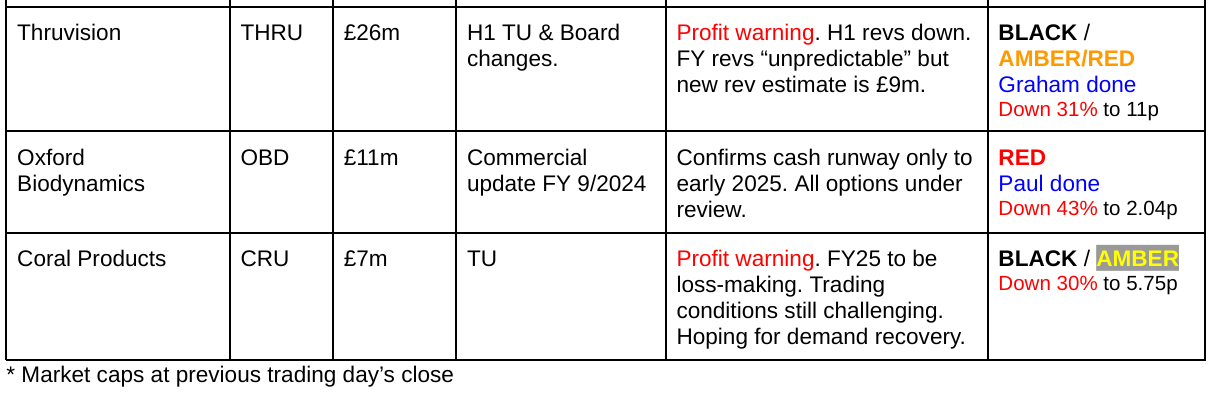

Thruvision (LON:THRU) - down 6% to 15p (£24m) - Trading Update and Board Changes - Graham - AMBER/RED

It’s a profit warning as this provider of people screening equipment fails to catch any large orders in H1, and it can’t predict what large orders it might secure for H2. With the cash balance below £2m and losses at the adj. EBITDA level, this one seems very risky to me.

Mulberry (LON:MUL) - 113p (pre-market) £79m - Statement re revised offer from Frasers - Paul - PINK / AMBER/RED on fundamentals

I run through recent events in FRAS trying to bully a majority shareholder into selling, and so far drawing a blank. Meanwhile MUL reported dire recent results, and a £10m emergency equity raise.

Oxford Biodynamics (LON:OBD) - down 43% to 2.04p (£6.5m) - Strategic Review - Paul - RED

I'm quite surprised to see OBD shares take another nosedive today, given that it's only reiterating what we already knew - that the cash runway is rapidly running out, and set to overshoot and crash into the undergrowth on the airport outskirts in early 2025 - very soon, in fundraising terms. They're looking at all available options, so let's hope mgt can pull something out of the hat, and fast. Otherwise existing shareholders could be lambs to the slaughter.

TI Fluid Systems (LON:TIFS) - up 19% to 181.8p (£903m) - Statement re: revised offer - Graham - AMBER/GREEN

Exciting news for TIFS as we learn of three additional bids for it, from a private equity-backed automotive parts supplier. Two bids were previously disclosed, so there are now five in total. I expect this deal is likely to go ahead at 200p as I think the biggest TIFS shareholder wants out.

Paul's Section:

Gambling Sector

I noticed that several mid-large cap gambling shares have dropped sharply this morning, eg -

Entain (LON:ENT) [Ladbrokes] down 14% to 659p (reducing its market cap c.700m to £4.2bn

Evoke (LON:EVOK) [888, highly geared] - down 14% to 56p (£251m mkt cap)

Flutter Entertainment (LON:FLTR) [Paddy Power & others, also highly geared] - down 8% to 17,125p (£27.6bn)

The newswire says the reason is -

“media report the Labour government is mulling a 3 billion pound ($3.92 billion) tax raid on the gambling sector to shore up public finances.”

I’ve found a Guardian article, key excerpts -

“Treasury officials are understood to be weighing up proposals, put forward by two influential thinktanks and backed by one of the party’s top five individual donors, to double some of the taxes levied on online casinos and bookmakers…

Sources familiar with the discussions said the Treasury had yet to make a decision but appeared receptive to tweaking the UK’s complex regime of betting and gaming duties to raise extra funds of between £900m and £3bn, despite opposition from industry lobbyists.

“It’s definitely on the map,” said a source familiar with Treasury thinking. “There’s no obvious pushback to it.”

Paul's view - here’s another good reason to avoid shares in this horrible sector.

Mulberry (LON:MUL)

113p (pre-market) £79m - Statement re revised offer from Frasers - Paul - PINK / AMBER/RED on fundamentals

This is a strange situation mainly because of its absurd shareholding structure, where there is hardly any free float thanks to the 2 major shareholders owning 93.5% of the company. If AIM has a long-term future, surely this is one of several obvious areas for reform, to increase free floats to a sensible minimum, and improve liquidity?

Frasers (LON:FRAS) has been increasing its stake, and mooted a takeover bid, but there’s no point in doing that unless it persuades the majority shareholder to sell.

Previously, on 30/9/2024, FRAS issued a statement critical of MUL, saying it (a supportive major shareholder since 2020) had not been consulted until the last minute about the company’s 100p fundraise, and that FRAS would have been prepared to invest more, potentially on better terms. FRAS indicated it would be prepared to buy the whole company for 130p.

Shortly before that, on 27/9/2024, Mulberry issued terrible (FRAS has publicly called the figures “catastrophic”!) results for FY 3/2024, reporting a £(34)m loss before tax. The going concern statement included a “material uncertainty” over banking covenants in a downside trading scenario. So this is clearly a financially distressed situation, but it has the support of banks and major shareholders, so should be survivable.

NTAV at 3/2024 was only just positive, and was in freefall, so I suspect unless the new CEO takes drastic cost-cutting action, the current equity fundraise probably won’t be the last.

The value in the shares is the brand name, which did have extraordinary success selling expensive handbags from 2010-17, but fashion risk being what it is, those glories have not been repeated yet.

On 1/10/2024 both MUL’s Board, and its controlling shareholder rejected the previous 130p approach from FRAS, saying -

“The Board believes that the combination of the recent appointment of Andrea Baldo as CEO alongside the recently announced Subscription and Retail Offer (together, the "Capital Raising") provides the Company with a solid platform to execute a turnaround and, ultimately, to deliver best value for all Mulberry shareholders. In light of this, the Board has concluded that the Possible Offer does not recognise the Company's substantial future potential value. In addition, the Board has been informed that Challice is supportive of the Company's strategy and has no interest in supporting the Possible Offer. As a result of the above, the Board has rejected the Possible Offer.”

On 4/10/2024 FRAS took up its entitlement to subscription shares, under the clawback arrangement from the original 10m shares issue to Challice, this maintaining its position at c.37% of the whole company.

The latest news - on Friday, FRAS issued another pugnacious announcement, increasing its possible offer to 150p. It also contrasts this offer with the 100p fundraise, which of course is conflating two completely different types of transaction (a fundraise, and a takeover bid).

FRAS dismisses MUL’s turnaround plan -

“Frasers is clear that there is no current commercial plan, turnaround or otherwise.”

Today, MUL itself issued another response, which seems to have softened in tone (maybe over worries of legal action, if Directors are not seen to be acting in the best interests of the company or minority shareholders, I wonder?), saying -

“In light of the above, the Board is working with advisers to consider the Company's position and will provide a further announcement in due course.”

Paul’s opinion - FRAS is using its characteristic strong-arm tactics to try to steamroller through a bid for Mulberry. However, it’s up against an immovable object - a majority shareholder that would have to agree terms before any takeover approach stands any chance at all of succeeding.

So it all depends on how rich Challice is, and its ability and preparedness to continue funding losses at Mulberry, plus me resisting the temptation to think up a pun involving poison!

For now then, it doesn’t really matter what the Board of MUL says re the offer - they could recommend it if they want, but the majority shareholder is the sole decision-maker here. For that reason, this bid approach currently looks highly unlikely to succeed. Even if FRAS buys out all the other minority shareholders, it will still be unable to force through anything in the face of a 56% majority shareholder. It is interesting though that FRAS sees considerable value in the brand, despite its lamentable current trading.

On fundamentals, I would be forced to see MUL as AMBER/RED, since its current trading and financial position are both very weak.

Long-term chart shows the stunning effect of its handbags becoming fashionable for a while -

Oxford Biodynamics (LON:OBD)

Down 43% to 2.04p (£6.5m) - Strategic Review - Paul - RED

“Growth in test sales over the year, new sales model initiated and resources focused on PSE. Business restructured to maximise runway, with a material reduction in costs.”

We flagged here on 14/3/2024 that the last 9p fundraise would only last until early 2025, due to the high cash-burn.

Looking at the historical numbers below, and combine this with the current wider malaise in AIM, then OBD is clearly now in a very tight spot -

Today it announces a strategic review and confirms what we already knew, that it’s rapidly running out of cash -

“The Board acknowledges that access to capital in the UK market is limited and the burn rate of the Company has been high in order to get to its current position.”

“Notwithstanding the measures being taken to reduce the cost base, the Company will require additional cash resources by early Q1 of 2025. The Board has therefore launched a comprehensive review of the strategic options open to the Company. In addition to exploring available funding options, the review will consider a range of potential actions, including but not limited to a licensing or sale of Company assets - such as the EpiSwitch NST and EpiSwitch SCB tests - and a possible hive-off of the Company's US business into a separately funded entity. Currently, the strategic review does not envisage an offer for the Company under the City Code of Takeovers and Mergers."

I find in situations like this, it’s best to sit on the sidelines and wait for either a refinancing (often at a deep discount), or some other event (such as de-listing or insolvency). Existing shareholders who do nothing are usually lambs to the slaughter.

OBD also benefited in the past from Odey backing a fundraise at a premium, which probably won’t happen again as his funds were being shut down I think?

Occasionally though, we do get a surprise, and an apparently almost-bust company manages to sell off something unexpectedly that raises a lot of cash. OBD’s technology does sound quite interesting, but how on earth can we value it? Particularly as the company is only c.3 months away from running out of cash. By the time legals get done, it will probably have its back against the wall, so all the bargaining power is surely now with anyone who is prepared to put in fresh funds.

Paul’s opinion - I’m quite surprised that this share is down almost half today, as there’s not really anything new in today’s update. We had previously already been told that it was likely to run out of cash in early 2025.

Obviously I haven’t got any choice other than to flag the high risk here with RED.

We can look at OBD with fresh eyes if/when it’s refinanced.

Let's just hope that no more IPOs happen for early stage companies. The IPO market (and AIM generally) has almost been killed by greedy advisers floating trash at inflated valuations. No wonder there's so little interest in the London market now, when most of it is populated by companies making the depressing journey from hype and over-expectations, to the grim reality of achieving little to nothing, and needing more cash from investors who don't want to keep pouring more funds into failed ideas.

OBD now down >99% from its early days high -

Graham’s Section:

Thruvision (LON:THRU)

Down 6% to 15p (£24m) - Trading Update and Board Changes - Graham - AMBER/RED

Thruvision is “the leading international provider of walk-through security technology”, and its H1 period runs to the end of September.

Here’s the two-year chart: it’s down by 50% from the high.

Key points from today’s trading update:

Revenues of £1.9m (H1 last year: £3.5m). There were no material Customs orders in the period, whereas last year there was a £1.9m order to boost revenues.

The current order backlog is only £0.3m, compared to £1m at the same stage last year.

The Outlook statement gives with one hand and then takes away.

There is “a healthy pipeline across all our markets, with particularly significant near-term opportunities in Entrance Security and Retail Distribution”. There is also growth in the sales pipeline arising from THRU’s partnership with Sensormatic.

Against that, full year revenue depends on “the timing of significant contract awards, which is unpredictable”. And even if these significant opportunities are won, they will probably slip into the next financial year.

The result is that the new revenue forecast is £9m (last year: £7.8m).

Estimates

We have a note out from Progressive, confirming that their previous revenue forecast for FY March 2025 was £10.9m.

Even at the previous revenue forecast, Progressive were expecting THRU to post a loss at the adj. EBITDA level. The new revenue forecast sees the loss estimate expand to £1.7m.

CEO is leaving at the end of this month, “to further his non-executive directorship portfolio”. The founder of Thruvision is still on the Board and will be Exec Chairman until a new CEO is found.

Graham’s view

Paul upgraded this to AMBER a year ago (link) as the company had raised some funds (£3.2m) in a placing to stabilise things, after a profit warning in October 2023.

Here we are with another profit warning and I note that the cash balance has reduced to £1.8m (down by £0.6m year-on-year).

This is despite the company seeing its outstanding receivables shrink by nearly £2m year-on-year, which boosts cash, and is also despite the aforementioned placing. The company notes that it has an undrawn overdraft facility of nearly £1m.

I don’t think a neutral stance makes sense here in light of all of the above. I am therefore going to be AMBER/RED on this today.

Small, order-driven businesses can make for very difficult investments even when they are profitable and firing on all cylinders. When they are unprofitable and have light balance sheets, my personal view is that it’s best to just avoid them.

The StockReport doesn’t like what it sees here, either:

TI Fluid Systems (LON:TIFS)

Up 19% to 181.8p (£903m) - Statement re: revised offer - Graham - AMBER/GREEN

We haven’t given this too much coverage since August when I’m relieved to see that I kept my positive stance on this share.

At the time, I noted that the shareholder register included some potentially weak hands. There was also a large debt load (nearly €700m/£600m) and negative organic growth. The result? A very weak valuation with a single-digit PER. Which brings us to…

16th September: The board of TIFS confirms that it received two offers for the company, the first at 165p and the second at 176p.

The proposals came from ABC Technologies, “a leading manufacturer and supplier of custom, highly engineered, technical plastics and lightweighting innovations to the global automotive industry”. ABC’s headquarters are in Toronto and it is majority owned by the private equity giant Apollo.

The response from TIFS? The proposals “significantly undervalued” TIFS and its prospects.

Today: we learn that ABC has made three more bids for TIFS! First at 188p, then at 195p, and then at 200p. So there are five bids in total, with the most recent one being 21% higher than the first one.

The directors at TIFS are now persuaded:

The Company remains confident in its strategy. However, having considered the Proposal … [the Board] would be minded to recommend it to shareholders.

This means there is an extension to the “put up or shut up” deadline, to give time for due diligence, documentation, etc.

ABC has until 8th November to make a firm offer.

Graham’s view

If the deal goes ahead at 200p, that will generate another c. 10% return over the current share price. So if I was holding TIFS shares because I truly believed in the company, I would probably continue to hold and wait for 200p and that extra 10%. But my bias as a shareholder is to take no action, so others may prefer to bank some immediate gains!

There is always the risk that the deal falls down at some hurdle between now and the finishing line.

As for whether or not the deal should go through, some may be uncomfortable seeing another stock taken off the UK market and into the arms of private equity. In terms of valuation, I’m inclined to think that ABC/Apollo are probably getting a good deal at 200p.

A quick view of valuation:

And the StockRanks are nearly perfect:

But there’s not much that can be done to stop the deal going ahead, I think. The major shareholder at TIFS is a private equity fund which I assumed was looking for an exit from their investment. It now looks like they are going to get that, and in fairness to them, they didn’t let the directors at TIFS jump at the very first opportunistic bid from Apollo.

The buyer will have to contend with the large debt load mentioned above and a business that has stalled (excuse the pun) when it comes to growth. It might also be argued that the real profitability at TIFS is quite a bit lower than the headline numbers suggest (at the interims, real net income was €40m vs. a headline number of over €70m).

I was GREEN on this before. Now in a takeover situation with the company potentially leaving the market at 200p, I’ll nudge my stance down to AMBER/GREEN. I would ordinarily be neutral with a takeover on the cards, but there is still a meaningful gap of nearly 20p between the current share price and the fifth bid that might be worth holding out for. Of course there is always the risk that the proposed acquisition gets delayed or even falls through completely.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.