Good morning, it's Paul & Roland here today! Many thanks to Roland for joining me today, as Graham needed some time for another project.

Update at 13:18 - I'm still working on CNIC, so will carry on until that's finished.

Update at 16:39 - I've just finished reviewing CNIC, but it's too late for today's report. So I'll type it up now, and put it into tomorrow report first thing. Took me a lot longer than anticipated, sorry about that!

Today's report is now finished.

Podcasts - from Paul, went up on Saturday morning as usual. Gave me a good chance to have a moan about a couple of little things that have been irritating me (!), and to run through the usual recap of small companies news. It's great taking stock each weekend, as the blizzard of company news stops for two days. I'm told my podcasts are popular with dog walkers, and gym members!

Tonight - Mello Monday investor show online, is free! More details here. I'm looking forward to the Q&A with Sosandar (LON:SOS) management (I hold).

Mello Chiswick - I'm looking forward to attending next week, I'll be there both days, in the afternoon/evenings, and look forward to seeing old friends, and new - do come and say hello if you're there, I love meeting Stockopedia subscribers in person!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

The list looks manageable today -

Summaries of main sections

(more detail below)

Restore (LON:RST) - down 15% to 249p (£349m) - TU (profit warning) - Roland - AMBER

A 25%-30% slowdown in PC/laptop sales has resulted in a slump in demand for Restore’s IT recycling services. The remainder of the business is said to be performing well. Another warning is a risk, but I can see some signs of value here.

Currys (LON:CURY) - up 6% to 59.7p (£672m) - TU (ahead) - Roland - AMBER

Currys expects results for the year to 29 April to be ahead of expectations. But the relaxation of a key lending covenant suggests the outlook for the year ahead is uncertain. A cash-sucking pension deficit is another worry. I think the shares are deservedly cheap.

Cerillion (LON:CER) - up 2% to 1220p (£360m) - Interim Results - Paul - GREEN

Superb interim results, and confident outlook. I suspect a beat of FY 9/2023 forecasts is more likely than just meeting expectations (as indicated today). Lovely balance sheet, with the cash piling up, giving options. In summary, I like everything about this share, apart from the price! (which is challengingly high, but I suspect it's justified in this case).

Quick Comments

John Wood (LON:WG.) - down 34% to 144p (£1.0bn) - Apollo not bidding - Paul - AMBER

Apollo ($598bn funds under management) announces that it does not intend making a takeover bid for this consulting & engineering group. No reasons are given. Looking back, Wood announced on 22 Feb 2023 that Apollo had approached it 3 times, with indicative takeover bids of up to 230p, which Wood said “significantly undervalued” its shares. We can now buy them at 144p, so are the shares a bargain?

Paul’s opinion - it’s difficult to see much appeal to this share from the rather erratic historical performance, or the valuation. Revenues are massive, but it seems to have struggled to generate reliable profits in the past. Maybe there’s hidden value, because I can’t find anything obviously good, on a quick review. Have any readers looked at this share? If so, do post a comment.

Frp Advisory (LON:FRP) - up 3% to 114p (£284m) - FY trading update (ahead) - Roland - AMBER

This business advisory services group says revenue for the year ended 30 April is expected to be up by 9% to £104m. Adjusted underlying EBITDA (!) is expected to be 5% higher, at £27m. Both “slightly ahead of current market consensus” of £100.5m/£25.8m. Restructuring, insolvency, and corporate transactions are the main growth areas highlighted.

Roland’s view: FRP’s revenue growth has been strong since its AIM listing in 2020, but reported profits have been broadly flat, due mainly to hefty share-based incentive employee payments. However, profit margins are still high at this business and FRP has generated a c.30% return on equity over the last 18 months. With the shares now trading on 14x earnings with a 4% yield, I can see some potential attractions.

Paul's Section:

Cerillion (LON:CER)

Up 2% to 1220p

Market cap £360m

Cerillion plc, the billing, charging and customer relationship management software solutions provider, today issues its interim results for the six months ended 31 March 2023.

Cerillion specialises in the telecoms sector, with sticky client contracts.

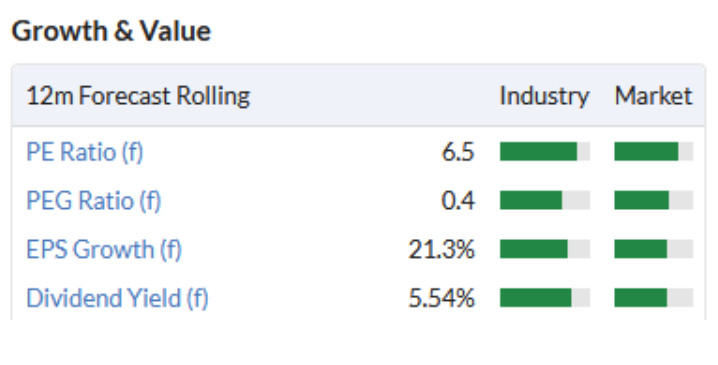

It’s one of my favourite GARP shares. Although the RP (reasonable price) bit of that is challenging, with a forward PER of 28.8x. I was talking about this in my latest podcast over the weekend, that in a higher interest rate environment, it’s very difficult to justify any PER over about 20 (an earnings yield of 5% or less), when the risk-free return on cash is now c.4-5%, and future cashflows are discounted using a much more challenging interest rate compared with the 15 year era of zero interest rates. My worry is that maybe some investors haven’t yet reduced their valuation criteria, as old habits take a while to unlearn?

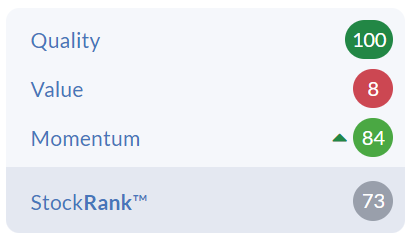

So my starting point with CER, before looking at the figures, is that it’s a smashing growth company (organic too), one of the best growth companies on the UK small caps market, but shares are expensive.

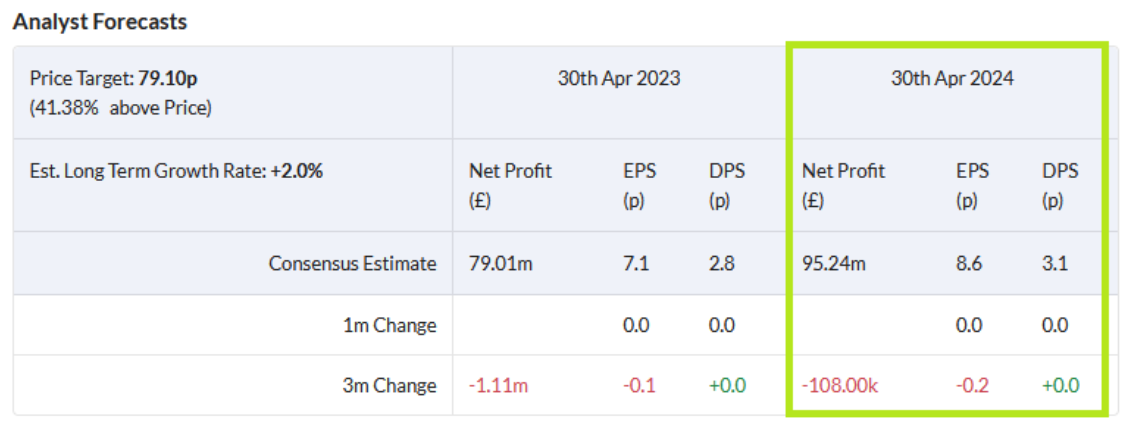

Stockopedia’s algorithms say the same thing, in far fewer words!

On the the numbers & commentary for H1 (6m to 31 March 2023) - note the prompt reporting, which is good.

Record Six-month Period and Strong Prospects

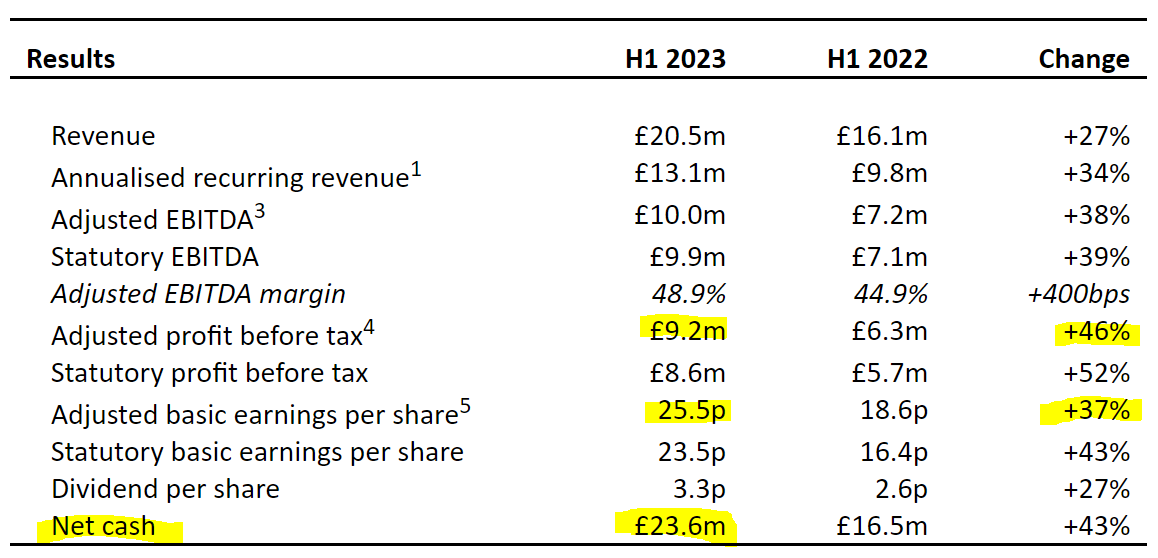

Outstanding highlights table -

Note the very high profit margin (£9.2m adj PBT, divided by £20.5m revenues) of 45% - not many companies achieve this high level of profit margin -

Remember these are just H1 figures, so P&L items should roughly double for a full year.

Really excellent profit & earnings growth too and a nicely building cash pile too.

Lots to like in the table above!

Order book - is up a more modest 8% to £43m - is growth slowing now perhaps?

2 Back-order book of £43.0m consists of £34.7m of sales contracted but not yet recognised at the end of the reporting period plus £8.3m of annualised support and maintenance revenue. It is anticipated that 75% of the £34.7m of sales contracted but not yet recognised as at the end of the reporting period will be recognised within the next 12 to 18 months.

Customer pipeline - obviously only part of this is likely to turn into actual orders, and this measure is wide open to manipulation, but from a company I trust, with a good historic track record, I’m willing to attach at least some importance to this measure -

New customer pipeline up 23% to a record £212.0m (H1 2022: £172.0m)

Adjustments in the P&L are small, and perfectly reasonable in my view, so the adjusted numbers are reliable for valuation purposes.

Outlook -

The Board believes that the Group is well-positioned to deliver its full year targets

From a market perspective, we are continuing to see strong investment in 5G and broadband infrastructure. This will create substantial opportunities for Cerillion as communications service providers seek to monetise those new assets and gain more value from their network real estate.

Looking ahead over the balance of the current financial year, we remain very confident of continuing progress, supported by our strong back-order book and new customer sales pipeline.

We believe that Cerillion remains well-positioned to achieve its full year targets, supported by existing major implementation projects, the healthy back-order book, and our strong new customer pipeline, which includes a number of advanced-stage new contract discussions.

The Company's robust balance sheet, which carries no debt, and the increasing level of recurring income, provide a strong underpinning for the business as it continues to grow and develop. The Board views near and mid-term growth prospects very positively.

Dividends - are stingy, with only about 1% forecast yield, well below the 4-5% you can get in cash, so investors here are betting on capital growth, not income -

As previously stated, the Board aims to distribute between a third to a half of the Group's free cash flow as dividends each year, subject to the Group's performance and the Board's assessment of the trading environment.

Share based option charges are very modest, which is nice to see.

Note the founder CEO holds 30.5% - so very much the owner’s eye, but not so large that small shareholders are lambs to the slaughter.

Balance sheet - looks lovely. NAV is £31.8m. From that, I deduct intangible assets of £4.2m, giving us NTAV of £27.6m.

The cash pile has grown to £23.6m, and looks genuinely surplus cash, so CER has plenty of scope to raise divis, do share buybacks, and/or acquisitions, should management wish to.

A big cash pile also reassures customers & potential customers, who look for financial strength in a supplier, if they’re going to commit to buying a business critical software package. Plus of course, with higher interest rates, CER can now earn a nice return on interest receivable, which could be heading for say £1m pa?

Cashflow statement is simple and clean. Note that it only capitalises £0.5m of R&D in each half year, indicating prudent accounting.

Paul’s opinion - very positive indeed. This is clearly a cracking growth company, with the right products at the right time. Very sticky client contracts too, which lowers risk. So it's a thumbs up from me.

My interview with the CEO in Nov 2022 is still relevant, and dug into the business model, to understand what is driving the superb growth achieved in the last 3 years.

How to value this share, that’s the tricky question!? That’s ultimately down to each investor. I do find the current valuation a bit challenging, at almost 30x this year’s forecast FY 9/2023. However, the forecasts look quite modestly set, so I imagine an earnings beat could occur.

Also, as we always say here, you’re not just buying this year’s earnings in isolation. We’re buying all future earnings forever, if we become a part-owner in the business. With that in mind, I think it could be worth taking the plunge here, and paying top whack for a very high quality business, which also seems to have continuing growth potential.

A fantastic share, for investors who have had the patience to buy & hold. I recall Graham flagging this share a few years ago, and I had a call with management which impressed me, and I think they were about one-tenth of the current price at that time! But the facts have changed since then, very much for the better. So we couldn't possibly have foreseen that it would 10-bag! With multibaggers it's often just a leap of faith in the early stages -

Roland’s Section:

Restore (LON:RST)

Share price: 249p (-15% at 08.05)

Market cap: £342m

Today’s update from this document management and information services group is a mild profit warning.

management now expects the Group's adjusted PBT to be below their previous expectation and in the range of £41-43 million for the year.

The shares have already lost a third of their value over the last year, so it looks like investors were already taking a cautious view on the outlook for this business.

Let’s see what the damage is in today’s trading update, which covers the four months ended 30 April 2023.

Revenue rose by 4% to £92.8m during the first four months of the year, compared to the same period last year.

Digital and Information Management: these divisions deal with paper records archival and digital workflows such as document scanning.

The company says it put through price increases at the start of the year and is also seeing increased activity from new customers. This progress is offsetting the loss of a large, one-off public sector contract in H1 last year.

A contract with the BBC (the largest in the company’s history) is said to have started well.

Net box growth is said to be positive and within the guided range of 1-2%.

Secure Lifecycle Services: this division deals with shredding confidential documents, IT disposal and recycling and commercial relocation. These operations are all said to be ranked either first or second in their respective markets.

Activity in the group’s Datashred and Harrow Green (relocation) businesses are said to be in line with expectations.

In Technology, demand is said to be strong for “ultra secure IT Destruction and IT Relocation projects”, which represent 20% of technology revenue.

However, the group has seen a “slower than anticipated recovery in hardware recycling volumes”. Management say this is consistent with market reports of a 25-30% fall in new PC/laptop sales, after elevated pandemic demand.

Cost savings: plans to reduce the group’s cost base by £3m are continuing to be rolled out.

Outlook: Restore’s management have helpfully provided updated financial guidance in today’s update, so we’re not left guessing.

Revenue and adjusted EBITDA are now expected to rise by around 5% this year, suggesting figures of £293m and £85.6m.

Previous consensus estimates were for an increase of 10% in revenue and EBITDA.

Adjusted pre-tax profit is now expected to be in a range £41m-£43m, compared to previous consensus figures I can see of £45m. So a reduction of 5%-10%.

My view: this looks like a fairly mild profit warning, with perhaps a 5% reduction to expected earnings to c.23.5p per share.

The reduction is blamed solely on the slump in PC recycling – all other elements of the business appear to be performing in line with expectations.

On the face of it, I don’t see too much to be concerned about. Corporate PC buying cycles were distorted during the pandemic by the need to supply staff for home working. It’s not entirely surprising to see that sales levels are now slowing.

All else being equal, this should just be a temporary headwind. However I can see a couple of risks that might be worth considering for anyone researching this stock in more detail:

Restore has been quite acquisitive in recent years. The group made eight acquisitions in 2021 and five in 2022. A number of these were aimed at expanding capacity in the Technology business, which is now suffering a slowdown. If I was considering investing in Restore, I’d probably want to go back and take a closer look at these deals.

The reduction in PC sales might also be a sign of a broader slowdown in service-related sectors of the economy. So weakness could persist for a little while yet.

I estimate that today’s share price fall has left Restore shares trading at around 11 times 2023 forecast earnings.

That doesn’t seem expensive to me given that this business generated more than £30m of free cash flow in each of the last two years. That gives the stock a tempting trailing free cash flow yield of around 9%. Debt levels don’t look excessive, although they have been rising.

I’d need to do further research to understand the moving parts of this business. I’m also aware that the first profit warning often isn’t the last.

For these reasons, I’m going to stay neutral for now. But I can see some potential signs of value here, so Restore could be worth a closer look.

Currys (LON:CURY)

Share price: 58p (+4%)

Market cap: £659m

Stronger UK&I business drives better than expected results

Electrical and tech retailer Currys has upgraded its guidance for full-year profit guidance for year ended 29 April 2023:

Adjusted pre-tax profit is now expected to be £110m-£120m, compared to previous guidance of £104m.

Year-end net debt is now expected to be around £100m, compared to £100m-£150m previously.

However, this increase in profit appears to have been driven mainly by improved margins, rather than higher volumes. The company says full-year like-for-like sales were down by 7%, which appears to be broadly in line with consensus forecasts.

In an inflationary market, falling revenue implies a reduction in sales volumes. The pandemic boom is still unwinding here, I think.

Higher profits are still good news, though.

UK & Ireland: management say trading was better than expected, especially in the final two months of the year. Gross margins are said to have improved, suggesting Currys may be benefiting from reduced shipping costs and perhaps better pricing from suppliers.

One-off benefits from the wind-down of the group’s legacy mobile operations are also said to have been “higher than prior year and forecast”. In FY22, mobile debtors resulted in a £22m working capital inflow. A smaller figure was previously guided for FY23.

UK&I operating profit is expected to have risen by >40% in FY23, which I calculate should be at least £100m (FY22: £71m).

International: operating profit from the international business is expected to be materially lower than last year, driven by a slowdown in the Nordics. The group’s “market-leading business” in Greece is said to have delivered another “robust performance”.

Balance sheet: lower-than-expected net debt is obviously good news. Currys also ended the year with a 10% reduction in stockholdings.

Reducing inventories should aid short-term cash generation, but this process may need to be reversed before the Christmas peak trading season.

I wonder if this is one reason why Currys tells us today that it’s negotiated a relaxation of a key covenant on its £500m revolving credit facility “for the measurement periods from 28 October 2023 to 26 October 2024”.

This suggests to me that CEO Alex Baldock is taking a fairly cautious view on the outlook for the next 18 months.

Today’s update did not mention current-year trading, so we don’t know if the outlook has changed. Broker forecasts suggest a recovery in earnings this year, but I’m not sure how this squares with the relaxation of lending covenants.

My view: Currys is one of the biggest players in its sector in the UK. I don’t think it’s a bad business, but I don’t see much attraction to the firm as an investment.

This is always going to be a low margin box-shifter in a highly competitive sector. A growing customer credit offering may help to improve margins slightly, but it isn’t without risk either.

The relaxation of lending covenants leads me to think that Currys’ balance sheet is not as strong as its lenders would like it to be.

Another worry is the group’s large pension scheme. Cash contributions to reduce the deficit are running at £78m per year – last year this accounted for 15% of operating cash flow.

Annual pension benefits of c.£50m are being paid due from scheme assets that were valued at £987m in October 2022. My guess is that deficit reduction payments will need to continue for a little while yet.

The shares look temptingly good value, but Stockopedia’s algorithms also classify Currys as a Value Trap. I think this could be accurate and I can see some risk to the dividend.

I think there are better opportunities for investors elsewhere.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.