Good morning, it's Paul here.

I knew it was going to be a bad day today, at approximately 06:52, when I knocked a tumbler of water all over my iPhone, trying to turn off the alarm. My late grandmother always told me that bad things happen in threes - which always struck me as possibly not the most soothing thing you can say to someone who has just experienced their first bad thing of the day.

Thankfully, I have since accidentally poured cold water into my cafetiere, and spilt a carton of milk all over the kitchen floor. Therefore my quota of 3 bad things is now complete, and today should just get better from here.

Or so I thought, until looking at my share prices. Let's hope that doesn't constitute the start of a second batch of 3.

A profit warning from perennially over-priced Asos seems to have caused some problems this morning. Therefore, despite being a larger cap, I'll check out what Asos is saying, looking for sector read-across. I'll also later look at the update this morning from Boohoo (LON:BOO) .

There seems to be a pattern emerging of (some) clothing retailers saying that November trading was poor - e.g. Sports Direct said that trading was "unbelievably bad" in Nov. Bonmarche Holdings (LON:BON) put out a horrible profit warning recently. As did Superdry (LON:SDRY) .

Therefore it seems likely that others could be following suit with profit warnings. Hence why it's carnage in the whole sector at the moment, re share prices. The market tends to shoot first, and ask questions later.

ASOS (LON:ASC)

Share price: 2539p (down 39% today, at 11:27)

No. shares: 83.87m

Market cap: £2,129.5m

Trading update (profit warning)

This online fashion retailer announces a slowdown in Q1 (Sep-Nov 2018) sales growth.

Last year (ending 08/2018) Asos achieved +24% revenue growth. This growth rate has slowed to +13% (at constant currency, or +14% as reported) in Q1. Note that;

- November was particularly difficult (as others have reported) - not helped by unseasonably mild weather (which does genuinely have an impact, as people don't buy higher value outerwear)

- Conventional retailers would die for revenue growth of +14%, so this is still a good performance, just not as good as the market was expecting - hence the share price being clobbered, as expectations are lowered

- The UK is actually the strongest market segment, with +19% revenue growth. So nobody can blame this on Brexit! (although no doubt some people still will, as generally I find that people tend to believe what they want to believe)

- EU sales growth is +14% (at CC), with France & Germany being difficult, but the rest of Europe better (at +24%)

- Margins also down, by 160 bps - which is often the case (revenue growth & gross margins tend to move in tandem, because lower sales then require price discounting to shift slow-moving inventories)

Asos has a relatively low gross margin to start with, as it shifts a lot of third party inventories (lower than own-buy product).

Higher costs

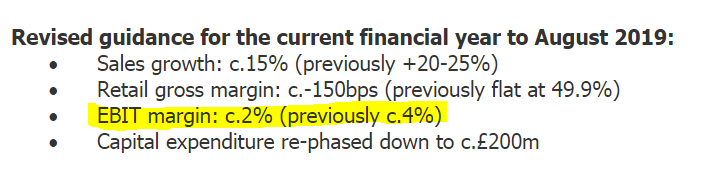

Put that lot together, and the EBIT margin (which wasn't good to start with) has halved. Revised guidance for this year;

Other points;

- Capex is being reduced - but is still enormous, at £200m this year - being warehouse automation mainly

- Significant headroom on banking facilities - the fact this is mentioned at all is a worry

- H1/H2 profit weighting is usually 30%/70% - will be even more pronounced this year (thus increasing risk H2 could disappoint further)

My opinion - Asos doesn't generate any free cashflow, and has never paid dividends. So what exactly is the point of it? Mind you, people have been saying that about Amazon's cashflow for years too, and that hasn't held it back.

At this size, the business should be highly cash generative, but isn't. That's concerned me for a long time. The market didn't worry about this, whilst growth was stellar, but it's coming more info focus now that growth is slowing down.

The key question is whether this is a temporary dip, or whether online sales growth has now peaked? I saw an article recently which suggested that online is levelling off in Germany, as everyone who wants to buy online is possibly now doing so. Whereas in the UK, consumer appetite for online purchases shows no signs of abating.

In the past, a pre-Xmas wobble in retailing shares has, selectively, been a buying opportunity. My experience (admittedly now becoming historic) was that Xmas sales always happen, they just get later & later every year. I think Black Friday has been a terrible American cultural import (aren't they all?!) - it just incentivises customers to hold back on spending in Oct & Nov, to anticipate Black Friday discounts.

Large eCommerce companies like Asos (and increasingly BooHoo) become so large, that their warehouses become inefficient. Therefore both are spending lots of capex on automation. Whilst expensive short term, that should give considerable efficiency and cost savings, once up & running. So there should be upside to come through in due course for both companies.

With slower growth at Asos, it is likely that investors will focus more on conventional valuation measures, principally PER. That could see Asos shares potentially tumble a lot further.

Are the problems closer to home with Asos, as opposed to industry-wide, or a bit of both? An update from BooHoo this morning seems to indicate that Asos could be making some of its own problems, or just isn't competitive enough any more, maybe?

Boohoo (LON:BOO)

Share price: 156.6p (down 14.4% today)

No. shares: 1,149.5m

Market cap: £1,800m

This is another online fashion retailer, with 3 brands: BooHoo, PrettyLittleThing, and Nasty Gal.

No doubt in response to Asos's profit warning, BooHoo rushed out at 8:08 this morning a brief update on its own trading. Everything's fine basically;

Boohoo group plc (AIM: BOO), a leading online fashion group, is pleased to confirm that the group's trading performance remains strong, with record Black Friday sales across the group and continues to trade comfortably in line with market expectations.

The group will provide an update for the four month trading period to December 31st on January 15th 2019.

So why on earth is its share price down over 14% today? That doesn't seem to make sense to me.

Why is BooHoo not being affected by the sector slowdown? Probably because it's so aggressive on price. BooHoo's strategy has always been to lead the charge against conventional retailers, by under-cutting them on price, and achieving better speed to market, with the test & repeat business model.

Hence I can see why BooHoo would weather the current storm better than others.

Read across to other retailers

This is very difficult to determine. The share price of Marks and Spencer (LON:MKS) is plumbing new lows, so my previous enthusiasm for the turnaround story there has obviously waned somewhat. There's no point standing in front of an express train, hoping that it will stop before it hits you, so I've had to bow to market forces and close my long position there, for now. Although the (I believe safe) dividend yield is now highly attractive.

Similarly, and as mentioned at Mello, I've been looking for a point to re-enter Next (LON:NXT) but it really doesn't feel like the right time there either.

As regards Sosandar (LON:SOS) the share price fall today of 15% to 29p doesn't make any sense at all. We've heard from management very recently (in interim results & presentations) that business is booming, across all product sectors. They're very upbeat about how things are going, and broker revenue forecast have been raised recently from £3.9m to £4.15m for y/e 03/2019.

Given the incorrect market read-across, I think it would make sense for SOS to follow the example of BOO, and also put out a brief update. Crunching the numbers myself, and looking at how quickly many lines sell out on Sosandar's website at full price, I reckon they should be on track for a substantial beat against broker forecast revenues of £4.15m. They achieved £1.85m revenues in H1, and the H2 seasonal uplift should be huge. Therefore I'd be surprised if anything under £5m revenues for the full year are reported.

SOS is achieving these big sales increases on 55% gross margins, way ahead of the 48.4% gross margin being achieved by Asos. That's because SOS product sells through very fast, at full price - an extremely bullish indicator that the company is designing products which are highly attractive to its core customer, and that demand exceeds supply.

Another point to bear in mind, is that a tiny eCommerce fashion business like SOS can carve out a niche in a gigantic market, irrespective of market conditions, if the product is right. Whereas it's more difficult for bigger players to buck macro trends.

Incidentally, if you've not seen it, there is an excellent video here from 3 Dec 2018, briefing private investors on Sosandar's recent interim results. This is well worth a look, for people interested in deepening your understanding of the company. I had a more detailed meeting with management a couple of weeks earlier, which was also very upbeat in tone. There's no read-across at all to Sosandar, from today's Asos profit warning, in my opinion.

Therefore overall, my view is that I'll be avoiding Asos, even after this big plunge. Whereas both BOO and Sosandar (in which I have a long position) look like buying opportunities to me. I'm also minded to avoid all conventional retailers for now. There might well be some bargains out there, but we just don't really know which ones are bargains, and which ones are disasters waiting to happen.

So much business is leaking away online, that conventional retailers with a small/poor online offering are looking very vulnerable indeed.

Whereas niche & online retailers continue to do well. Joules (LON:JOUL) was an example of a business that is bucking the trend, with a positive recent update.

Isn't it annoying when waiters try to memorise your order, instead of writing it down? There's literally zero upside for the customer from this annoying practice. There's only downside risk, that something will go wrong, which it very often does.

I ordered 3 items, solo dining today, for a late lunch. Guess how many arrived? One! Yes, the waiter managed to forget 2 of the 3 items I ordered. There were only about 4 other people in the restaurant, so it wasn't like he was rushed off his feet.

Although 2 of those other people were a couple of very attractive Italian young ladies. (I was going to say "birds", but apparently that's not allowed these days). The waiter was also Italian, and let's just say that I've noticed Italian waiters' blood tends to flow away from their brains, when attractive women are in the vicinity.

Which restaurant was it, I hear you ask? Franco Manca! (in which I hold a long position - part of Fulham Shore (LON:FUL) ). The gluten-free pizza base was awful too, so they haven't got that right either. Never mind, usually it's much better, so I can forgive them one mishap.

Safestyle UK (LON:SFE)

Share price: 85p (up 4.3% today, at market close)

No. shares: 82.8m

Market cap: £70.4m

What a bizarre year, this PVCu replacement windows & doors company has had. Trading fell off a cliff, when a founder & a load of staff left, to set up in competition. Then, they were enticed back with a mixture of carrot & stick.

Things now seem to be picking up;

Since the Commercial Agreement announced on 22 October 2018, the Group has experienced a significant increase in its contracted workforce across its canvass, sales, surveying and installations operations. This has resulted in an improved sales order intake that is in line with the same six week period last year.

Higher short term costs, and lost business earlier this year, has resulted in a thumping great loss for this year (today forecast by the company at between £8.2-8.6m pre-tax loss). This looks to be in roughly the same ballpark as Stockopedia's (post tax) forecast loss of -£6.5m.

Outlook - this sounds more promising;

... the Board is confident that the recovery and performance in 2019 will be ahead of current market expectations.

The only figures I have, are £4.5m after tax profit in 2019, which equates to 4.62p EPS. That's the Thomson Reuters data shown on Stockopedia.

There are 2 new broker updates out today, available on Research Tree. These move up 2019 EPS forecasts to a range of 4.9p to 6.4p, with a further increase pencilled in for 2020.

My opinion - it sounds as if the business is getting back on track.

However, for me, the damage is done. The events of the last year have demonstrated how fragile the business model is. Key staff can up sticks at any time, set up in competition (there are not many barriers to entry), and quickly wreck the business they came from. I suppose there's a risk of that happening in many areas, but normally staff are more loyal, and the key ones are locked in through appropriate bonus schemes, share options, etc.

For me it has all been a good reminder of why I'll never invest in anything to do with double glazing ever again. There isn't any kind of moat. Staff do not appear to be loyal. Business practices can often be at the sharp end of acceptable (high pressure selling, etc). It's highly cyclical. Profits can vanish very quickly, the list goes on & on.

Photo-Me International (LON:PHTM)

Share price: 88p

No. shares: 377.7m

Market cap: £332.4m

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces its results for the six months ended 31 October 2018.

Figures from this photo booth & other booths group, slipped through the net last week. So this is a catch-up section.

The most striking feature from the StockReport is the forecast 9.5% dividend yield. Anything over the borderline range of 6-7% is usually a sign that there may be trouble ahead - i.e. that a dividend cut could be in the offing. 9.5% yield is well into danger territory. In recent years, the market has actually been very good at predicting dividend cuts (through excessive dividend yields). So amber lights are already flashing in my mind.

Key features from PHTM's interims;

Adjusted profit before tax down 7.9% to £26.7m in H1

Seasonality - it's good to see this spelled out clearly in note 3 (all companies should do this);

Historically, the first half of the financial year is seasonally the strongest for the Group in terms of profits, and this is expected to be the case again for the current year ending 30 April 2019.

Outlook - sounds OK, with a proviso;

The Group maintains its guidance for the FY2019 and expects to report profit before tax of £44 million, net of restructuring costs in Japan and excluding any movement in the value of Max Sight Holdings.

The Group's ability to meet guidance will be reliant on normalised trading conditions in its key markets.

Balance sheet - I'm scratching my head over this. The cash pile has grown tremendously, to £88.6m. Yet is has bank debt too - of £57.1m. Why?

I don't understand it. You could argue that big dividends are being paid (at least partially) from bank borrowings. Yet bank borrowings seem to be more than covered by cash balances. That doesn't make sense to me.

My opinion - I rarely (if ever, actually) flag the risks section of the narrative, in results statements. Maybe we should collectively look more closely at these?

In this case, perhaps PHTM shares might be cheap because European Governments might try to undermine this UK-based company post-Brexit? s it's involved with Govt ID, that's not as daft as it sounds.

That's me done for now.

Another year goes by, and it's been a pleasure! I'd like to thank Graham for being such a pleasure to work with, and of course the team at Stockopedia who put up with me being me - as always, hopefully the positives out-weigh the negatives - that's what it's all about, none of us are perfect!

Above all, thanks to the 3/4 of all SCVR readers who are Stockopedia subscribers! It's very much appreciated. To the other 1/4 - what's the matter with you, why do you think you should get our lovely insights free? Cheapskates!

The rest of this week is mainly fun-filled lunches & parties for me, so I'll leave you in the capable hands of our Graham! Then into January of course, it's the grim winter period of Dry January. Doctors orders this year, I've got to do Dry February too, to grow some new liver cells. Well it's for the best!

See you on the other side :-)

Love, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.