Good morning, and welcome to the first SCVR of Christmas week! Just Paul today. Today's report is now finished - very quiet for news.

Over the next couple of weeks, every day the UK stock market is open, then there will be a SCVR here. I've got a very quiet Xmas planned, so distractions will be few and far between.

Agenda -

Paul's Section:

Sopheon (LON:SPE) - this software company expects to comfortably meet expectations for FY 12/2021. The trouble is, that's barely above breakeven. A very poor trend in growth (none basically in the last 3 years) and profits (which have disappeared) since 2018. Does it matter though? That's up to you.

Fireangel Safety Technology (LON:FA.) - a trading update that seems muddled, and doesn't give enough information. This company has performed badly for several years now. It might be able to execute a turnaround, but that's not something I want to punt on. Why take the risk?

Preamble from Paul

Looking at the futures, it seems we're heading for more market turbulence - hardly surprising I suppose, with omicron spreading incredibly quickly. I've been keeping on top of the covid news through health analyst Dr John Campbell's youtube channel. He's got a good track record of explaining covid in simple terms, coming from a teaching background. His daily videos run through published material from reputable sources, and he always provides a link to the research papers, etc, that he's explaining.

Anyway, his latest videos have been explaining how omicron is incredibly contagious, and therefore the world is at the point of a huge new wave, that probably can't be stopped. However, data from South Africa shows that it's milder than previous strains, and a recent study suggests that it doesn't move down to the lungs as readily as previous covid, thus being less deadly. Also cases apparently seem to peak after just 3-4 weeks, then we could end up with herd immunity here at some point in Jan 2022. But obviously nobody knows for sure.

In the meantime a lot of people are going to be off work, mainly with cold or flu-like symptoms (the symptoms have changed from previous strains). Therefore we can expect another month of disruption to businesses (especially hospitality, travel, retail, etc) - you know the drill. After that, who knows, it's too early to say, and not even the experts can predict the future.

In terms of shares, I think (as mentioned previously here) we should expect more profit warnings. The problem is, we don't know which companies have enough padding in their forecasts to sail through and remain in line with market expectations. The flipside is which companies were already struggling to meet forecasts, but thought they might be able to recoup a shortfall by year end, which will now need to warn on profits? Lots of uncertainty.

There could be plenty more opportunities to buy decent companies on short-term, temporary disappointments, at attractive prices. I think it's important to banish feelings of despair in market downturns like this, and instead salivate at the buying opportunities. Today's pain could be next year's big profits, selectively. That's what happened in previous panic sell-offs, although nobody knows what the exact low point will be. There did seem to be some tentative buying in small caps last week though.

Supply chain costs remain a problem, as does wage inflation in particular. Although looking around me, I don't see empty shelves in the shops, and life seems to be carrying on, despite all the previous dire warnings of shortages & panic buying. Supply chains have actually seemed more robust than perhaps we imagined previously. Earnings might be suppressed this year, and maybe next year, from the massive cost of freight charges, but at some stage that unwinds, and supply chains return to normal, and company profits should rise. That's a big opportunity for investors who are calm, and take a long-term view, in my opinion.

I am worried about wage inflation though. Jack was discussing Royal Mail (LON:RMG) in an interesting video (see/hear below) with Paul Hill (a very successful private investor, analyst, and all round nice guy), and David Thornton (highly experienced small caps expert, who writes Growth Company Investor, which I enjoy reading, and also a nice guy, in fact they're all nice guys, and clever!)

I took a look at RMG shares over the weekend, and it looks superficially cheap. However, half its costs are "people costs". You can quickly work out that if people costs were to rise by 10%, then that would wipe out all RMG's profits. Given the company's history as a nationalised industry, complete with a bolshy workforce prone to going on strike in the past, and a them & us culture, what's the betting that wage costs rise considerably? So there are 2 key issues - are there any arrangements in place already for agreed pay rises, which might soften the blow? Secondly, what scope has RMG got to raise its selling prices, to recoup higher costs? Pricing power is the biggest single question to ask companies right now. The companies that can raise prices promptly, should be the winners in an inflationary environment. Does inflation peak, and then reduce next year? No idea. Nobody knows.

I should add that the pension scheme disclosures in the notes to the last annual report for RMG look potentially scary, with vast schemes, and it's not at all clear whether they're in surplus, or deficit. Seemingly both, depending on whether you look at actuarial or accounting figures.

.

.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Sopheon (LON:SPE)

935p (pre market open) - mkt cap £98m

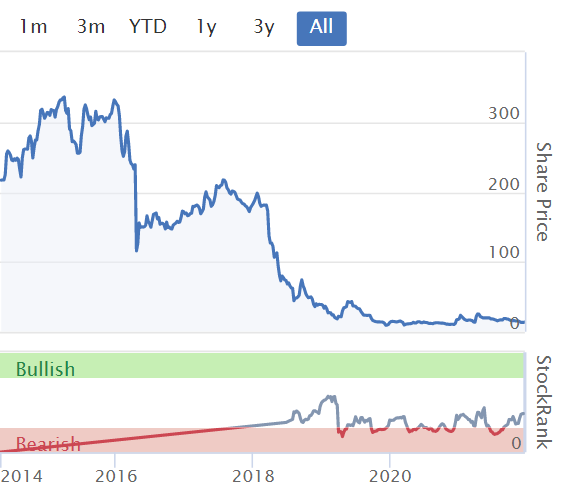

I’ll start with this software company, because it’s popular with private investors. Looking at the 3-year chart below, SPE has been remarkably resilient in the small caps sell-off in recent months, but is still down on the peak it reached 3 years ago. The problem seems to be that revenue growth has gone nowhere since 2018, and the big profits from 2017-18 seem to have largely disappeared. Given that being the case, I’m surprised the share price has held up so well. So far investors seem to accept the bull case, that the switch to SaaS revenues is suppressing short-medium term profitability.

.

Acquisition and Trading Update

Sopheon, the international provider of software and services for Enterprise Innovation Management solutions, is pleased to announce the acquisition of the business and assets of ROI Blueprints LLC ("ROIB"), a cloud-based solution focused on detailed enterprise planning and execution. The Group is also providing a trading update for the current year ending 31 December 2021.

Initiation of M&A strategy coupled with solid execution of revenue objectives for the year

Acquisition - is very small, at $1.5m initial cash (ample cash pile of $24m at 30 Nov 2021). A further earn-out of $1.5m is contingent on 3-year performance.

The key reason for this acquisition seems to be this, which sounds sensible -

We see this as a technology acquisition that will improve our time to market for a key product capability. I believe it would have taken us at least two years of material investment to develop equivalent capability in house."

Trading update - this sounds reassuring -

In our half-year report issued on 25 August 2021, we reported rising commercial traction across our core performance metrics as we migrated the business to a more recurring model.

We are pleased to report that we expect revenues and EBITDA for the year ended 31 December 2021 to be comfortably in line with market expectations, coupled with solid progress on building annual recurring revenue. The closing weeks of the year remain busy with commercial activity. The Board will update shareholders further on the full year outturn at the end of January.

Broker update - Progressive Equity Research has issued a short note this morning, saying no change to forecasts. The trouble is, forecast revenues of $32.7m (still less than 2018 peak revenues, but up 9% on 2020), and adj PBT is not much above breakeven at $0.5m (peak profit in 2018 was $6.9m).

My opinion - does short term profitability matter? Maybe not in this sector, but the reality is that these are deeply unimpressive graphs -

.

.

Fireangel Safety Technology (LON:FA.)

13p (down c.3%, at 08:45) - mkt cap £24m

FireAngel (AIM: FA.), a leading developer and supplier of home safety roducts, announces a trading and business update.

This is the most important bit -

The Company announces that it remains on target to meet market expectations for adjusted loss before tax for the year ending 31 December 2021 ("FY21"), which represents a significant improvement on 2020.

This is a badly worded announcement e.g -

It doesn’t give a footnote as to what market expectations are, just that it’s a loss

Net debt is “ahead of market expectations” - ahead? Does that mean ahead as in more net debt than expected, or ahead as in better? Again, no figure provided.

We’re only 11 days from year end, but it’s still casting doubt over whether it can actually achieve market expectations! So why put out an update now, if there’s uncertainty?

The remaining risk to the Company achieving its market expectations for FY21 is from developing COVID-19 related measures in any given country and related shipping variability.

Gross margin - self help measures underway, but it’s still only generating a lamentable gross margin of 22-24% (LY: 19.8%). That says to me the company has little pricing power.

Supply chain issues - “continued to intensify” in H2 - but “slight improvement” more recently

German partnership for new products going well.

Chinese production of entry level products is progressing - margin enhancing in 2022.

Working capital - sufficient for its needs (no figures given)

Outlook -

"It is disappointing that the global supply chain issues have continued during the second half and continue to impact the world economy. However, we have made good progress against our strategic priorities, in particular our gross margin improvement plan. The growing interest and demand we are seeing for our Connected offering further reinforce our confidence in the long-term opportunity for FireAngel. We look forward to providing a further update in late January 2022."

My opinion - there aren’t enough figures in this update to enable me to form an updated opinion. This was a really good, profitable, cash generative business a few years ago, but more recently it’s been a catalogue of errors and deterioration. Maybe it’s just been overtaken by competitors?

Maybe there’s recovery potential here, but it’s not something I’d want to speculate on. Why take the risk, when there are so many better companies currently being offered at discount prices?

An absolutely dismal track record of shareholder value destruction, as you can see below.

.

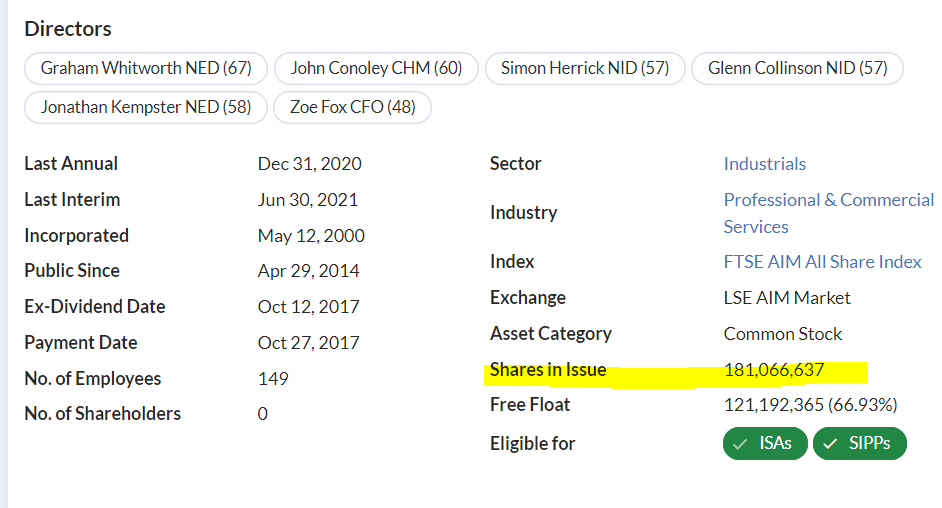

Due to dilution from issuing new shares, to prop up the company in recent years, there's now no realistic chance of the share price fully recovering, even if performance does turn around.

.

These are averages remember, so you also need to check the latest figure for shares in issue, which has increased further to 181.07m shares, at the bottom of the StockReport here -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.