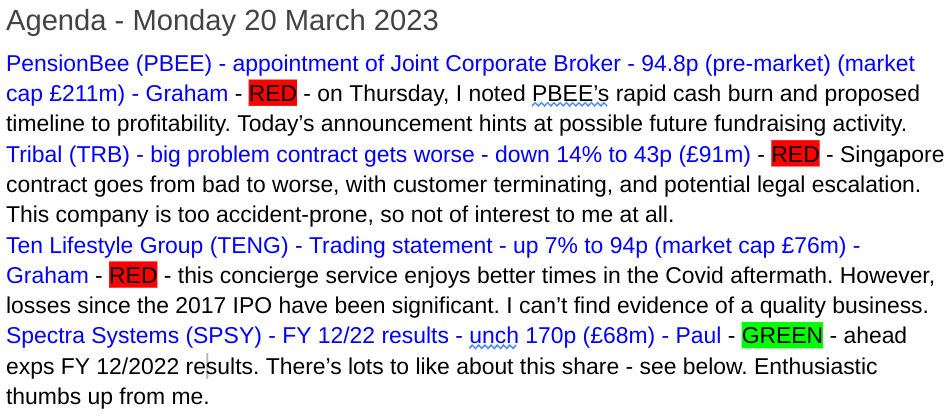

Good morning from Paul & Graham!

Today's report is now finished.

This weekend's podcast went up on Sunday. Here's the link, or it's available through podcast platforms too (called "Small caps podcast with Paul Scott". I kept it down to 32 minutes this week, covering my thoughts on the banking crisis, budget, plus all the company updates from last week.

More turmoil with the banks. I see the weekend press is reporting that UBS has bought out Credit Suisse, combining Switzerland's two largest banks. Stock market futures initially reacted positively, but have since (07:08 today) turned ugly again, with the FTSE 100 futures indicating an open here about 100 points down, at around 7,210. So looks like we need to keep those hatches battened down.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Tribal (LON:TRB)

43p (down 14% at 08:34)

Market cap £91m

Singapore Contract Update and Revised Date for Full Year Results

Tribal Group plc is a pioneering world-leader of education software and services. Its portfolio includes Student Information Systems; a broad range of education services covering quality assurance, peer review, benchmarking and improvement; and student surveys that provide the leading global benchmarks for student experience. Working with Higher Education, Further and Tertiary Education, schools, Government and State bodies, training providers and employers, in over 55 countries…

The current financial year is FY 12/2023.

I last reported on Tribal here on 1 Dec 2022, when it issued a profit warning due to a large contract going seriously wrong. So badly wrong, that to my mind it makes the shares uninvestable (expected loss of £12m over life time of the contract with Nanyang Technology University ("NTU") in Singapore).

Tribal again updated the market on its Singapore contract on 23 Feb 2023, saying that things had deteriorated further -

As announced on 1 December 2022, the Group's trading performance has been impacted by implementation delays on the Singapore contract, due to changing scope and complexity, resulting in substantially increased ongoing costs and lower recognisable revenue. Discussions with the customer have not progressed satisfactorily and we remain in significant disagreement over the detailed scope of the contract. We no longer expect a resolution in the near term and will provide an update as and when appropriate.

Today’s update sounds like a complete breakdown of the client relationship, which now seems to want to abandon Tribal’s software altogether -

Tribal received notification on 17 March 2023 that NTU has purported to terminate the contract and reserved its rights to claim damages. Tribal rejects NTU's right to terminate and is considering its options regarding appropriate next steps. The contract requires the parties to participate in mediation in an attempt to achieve a resolution.

Whether the contract terms would necessarily be binding in Singapore, who knows? It depends how their legal system works.

Accounts delayed - it’s only a few days, so no great shakes. But this does suggest to me that there’s likely to be an increased provision required against the problem contract -

The Company now expects to release its audited results for the year ended 31 December 2022 on 24 March 2023. This allows appropriate time to consider the impact of the contract termination, in particular the accounting treatment of a £4.5m onerous contract provision contained within previous expectations, set out at the time of the trading update released on 23 February 2023.

No doubt that will be adjusted out, in the hope that investors will ignore it, but I think this is a very serious issue - it’s telling me that Tribal’s software, and ability to implement it, just isn’t very good - at least in this one particular case. It would be interesting to hear from other customers whether they’re happy with Tribal’s software & service or not. Do any readers have experience of using Tribal software, or know people who do? First hand user experience is far more valuable than anything companies say about themselves, I find!

My opinion - I don’t see how investors can possibly overlook this serious problem.

There’s a wide range of possible outcomes now, ranging from an amicable mediation settling things, to a protracted and expensive legal battle. That makes it difficult for us to value the shares.

Solvency doesn’t seem to be an issue, with year end debt previously reported at only £3.4m.

I’ve been following Tribal for years, and there always seems to be something going wrong.

I can see there would be some value in the business, due to its recurring revenues, and long standing customer relationships. As mentioned before software companies (even lousy ones!) often attract takeover bids. However, Tribal's financial performance is so erratic, and this latest problem sounds potentially expensive, that I personally am not interested in getting involved in this share. Why leap into the unknown?

Spectra Systems (LON:SPSY)

170p (unchanged at 09:09)

Market cap £68m

Previous SCVR notes -

Positive view here on 3 Oct 2022 (positive contract update, and upped forecasts).

Positive view here on 12 Sept 2022 (good interim results, cheap valuation, good divis, strong balance sheet, and upside potential from strong pipeline).

Today’s update is -

Spectra Systems Corporation (the "Company"), a leader in machine-readable high speed banknote authentication, brand protection technologies, and gaming security software, is pleased to announce its results for the twelve months ended 31 December 2022.

Key numbers - Revenues $19.6m (up 18%)

Adj PBT $7.8m (up 17%)

Adj EPS 14.5 US cents (Allenby points out this is comfortably ahead of forecasts which were raised 3 times in 2022). This is 12 pence EPS, so the PER is 14.2 - seems cheap to me, providing earnings can be maintained or continue growing.

The annual dividend (there’s no interim divi) is 11.5p US cents, or about 9.5 pence, which at 170p mid price, gives a smashing yield of 5.6%.

The big cash pile means it’s not straining itself to pay a decent divi either.

Balance sheet looks excellent, with c.$18m of net current assets, almost all of which is the $17.5m cash pile. So, whilst it’s helped by deferred income (getting paid up-front), I would say we can safely see the cash pile as being genuine, and likely to be sustained. Particularly as the company has such low overheads - so even if trading suddenly dropped (always a risk with a small company dependent on a few big contracts), then it would probably just be a case of a smaller profit, but remaining cash generative at a lower level. Not loss-making or cash burning. So this is a nice setup.

Outlook sounds encouraging -

"The Board therefore believes that the Company is on track to achieve record earnings and meet market expectations for 2023."

Other points -

Shrewd investors in this share.

Tightly held - little liquidity.

High StockRank

My opinion - As always, I’m just reviewing the numbers, not trying to give a view on the much more detailed work necessary to assess the company’s future potential, which is always partial guesswork anyway.

The numbers stack up very nicely, and there are lots of irons in the fire which could deliver future upside, see the commentary today.

It gets an enthusiastic thumbs up from me.

Graham’s Section:

Pensionbee (LON:PBEE)

Latest share price: 94.8p (pre-market)

Market cap: £211m

I covered this pension app in some detail on Thursday and noticed this morning that they published an “appointment of joint corporate broker” update.

This type of announcement always looks innocuous and it can be entirely inconsequential. But depending on the context, it can make me think that fundraising could be on the cards. After all, why would a small company need two brokers, if it was not planning to use them?

In this particular case, I noted in Thursday’s article that Pensionbee’s cash position more than halved during 2022, from £43.5m to £21.5m. They are hoping to start generating positive adjusted EBITDA by the end of 2023, so bottom-line profitability is still some distance away.

According to Equity Development, the after-tax loss is expected to be £10.8m in 2023, before the company almost achieves breakeven in 2024.

Pensionbee might hit its targets, achieve genuine bottom-line profitability in 2025, and find that it never needs to raise equity again. But that’s probably not the base case scenario that I would assume, based on its financials. And with an extra broker on board, it appears less likely again.

Ten Lifestyle (LON:TENG)

Share price: 94p (+7%)

Market cap: £79m

This describes itself as “the platform driving customer loyalty for global financial institutions and other premium brands”. It provides a premium concierge service to customers of these institutions - including travel, dining and entertainment benefits.

Covid probably didn’t help, but the financial track record here was not particularly good in the first place:

This morning we have a trading update for H1 (the period ending February 2023).

Key points:

Revenue £30.9m showing a very healthy progression against the previous six-month periods (H1 2022: £20.8m, H2 2022: £26.1m)

Similar progress in the number of Active members to 316k (H1 2022: 221k, H2 2022: 275k).

Less positively, net cash has fallen from £3.2m to £0.5m over the six months, but the company has an explanation:

This reflects the Group's normal (pre-COVID-19) seasonality, to consume working capital in the first half of the year and was adversely impacted by a late client receipt of £1.0m, which has now been received.

That sounds perfectly reasonable, but there is more new info re: the balance sheet:

An invoice discounting facility was signed during the period with the Group's bank (H1 2023: £2.1m drawn down), in addition to the Group's £4.6m of loans (FY 2022: £3.4m), to underpin the Group's working capital requirements. The Group expects to generate net cash in H2 2023.

TENG doesn’t seem to have raised much fresh equity since its 2017 IPO. Given that it also hasn’t generated much by way of profit since then, it’s not surprising to see that it now needs loans and an invoice discounting facility (it had net cash of over £20m in 2018).

My view

There is not much more to go on in today’s update, so it’s time to wrap this up.

Unfortunately, I can’t find any evidence of a high-quality business here - financially there are signs of lots of cash burn, a weakened balance sheet, and only some “adjusted EBITDA” for comfort. The company’s statement that it will generate net cash in H2 can be interpreted as seasonality rather than much more than that.

Reflecting on the business model, it seems that TENG itself has very little brand visibility. Rather, it provides a service whose main mission is to enhance the brands and the customer loyalty enjoyed by other companies.

Is it possible to build a competitive advantage / pricing power in the provision of this type of service? I’m not sure - it seems likely to me that TENG’s corporate customers will always be able to negotiate quite hard, since they are the ones who own the relationships with the end-users.

Indeed, I’ve looked up the 2022 financial report and found that two of TENG’s corporate clients accounted for more than 10% of TENG’s revenue for the year: they generated £9.5m out of TENG’s £48.7m of total revenue. With this level of client concentration, I doubt that TENG enjoys very much pricing power at all.

I’m going to have to give this stock the thumbs down for now.

Chart since it listed -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.