Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

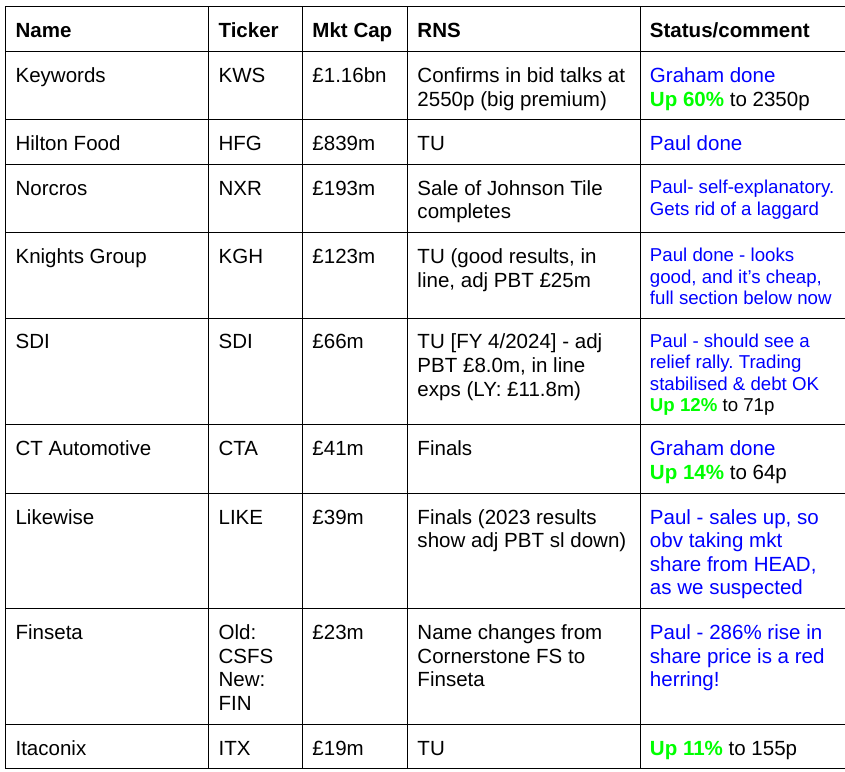

List of Companies Reporting

Other mid-morning movers (with news)

Kainos (LON:KNOS) - up 11% to 1179p (£1.49bn) - Results FY 3/2024 - Paul - AMBER/GREEN

Impressively prompt reporting of FY 3/2024 results. Market clearly likes the figures & outlook. Adj PBT up 14% on 2% revenue rise. Adj EPS up 9% to 46.5p = historical PER 25.4x (should fall with further growth). Good outlook, and backlog up 11%. Dividend: 27.3p. Note that c.9% of profit goes on share options charges, and is adjusted out, which seems questionable. Healthy, ungeared balance sheet. Looks a good company, with excellent long-term track record, and further growth expected. I’m not sure of the colour, but AMBER/GREEN feels only fair, just based on a quick review.

Victorian Plumbing (LON:VIC) - up 7% to 91.6p (£299m) - Acquisition of Victoria Plum - Paul - AMBER

Acquisition - AHK Designs Ltd, trading as Victoria Plum - an online-only competitor in the bathroom fitting market. Price is £22.5m, funded from VIC’s cash reserves. As a reader questions below, I also wonder if VIC has overpaid for a failed competitor? -

“The Company's expectation is that Victoria Plum will be broadly break even in the second half of 2024. Given that Victoria Plum has recently been through an administration and there is already a cost reduction programme in progress, the Company intends to continue to trade the business as normal initially, pending finalisation of our integration plan.”... For the six months ended 31 March 2024, unaudited management accounts indicate that Victoria Plum had book value gross assets of £15.8m and losses of £3.3m.

Administrators are usually desperate to sell businesses as a going concern as fast as they can, so the price does surprise me. Maybe there were other parties with deep pockets sniffing around? Rules seem to require reporting gross assets, which of course is meaningless! It’s net assets that matter.

The only information at Companies House about AHK Designs, shows what looks like an almost dormant shell company, which only filed micro company accounts up to 9/2022, which seems odd.

Paul’s view - I quite like VIC, as it’s profitable and has a sound balance sheet. It can afford this acquisition, although I am curious as to why they’ve paid so much for a bust competitor? We need more information to explain the rationale for the deal. Management know their sector far better than any of us, so we have to trust they’ve made the right move. I was amber/green on 22/11/2023, and Graham was amber (but sounded quite positive in his remarks) on 27/2/2024. Since I’m not certain this deal is a good use of the cash, I think it’s safe to go with AMBER for the time being, until we have better information. It would be good if they do a webinar to discuss this deal.

Summaries of Main Sections

Keywords Studios (LON:KWS) - up 60% to 2350.8p (£1.86bn) - Statement re Possible Offer - Graham - PINK (takeover approach) - AMBER on fundamentals

Shareholders wake up to what seems (in my opinion) a generous potential offer from an enormous private equity company. By my sums, the earnings multiple on current year forecasts is around 24x. Not only would I sell KWS at that price, I’d even consider selling out today at a discount, to lock in some gains.

Knights group (LON:KGH) - up 4% to 147p (£126m) - FY 4/2024 Trading Update - Paul - AMBER/GREEN

An in line year end update looks pretty good, and shares look attractively cheap. Digging further I do find some less pleasing aspects in the numbers, but overall I think bull points outweigh bear points. So AMBER/GREEN today.

CT Automotive (LON:CTA) - up 23% to 69p (£51m) - Final Results - Graham - AMBER/GREEN

Excellent results from this supplier of vehicle components, manufacturing out of China, Mexico and Turkey for most of the world’s largest vehicle producers. I study the financial performance in some detail and do have some concerns, but there is little doubt that the company is now in a vastly improved position.

Hilton Food (LON:HFG) - up 1% to 945p (£846m) - AGM Trading Update - Paul - AMBER

In line with expectations. I struggle to see why this share has strongly recovered from last autumn's lows, when it seems an unattractive, low margin business. Are buyers expecting it to beat forecasts, perhaps? It hasn't done today. Recently reviewed Premier Foods (LON:PFD) looks a far better quality business, if you have to own a food company, in my view.

Paul’s Section:

Knights group (LON:KGH)

Up 4% to 147p (£126m) - FY 4/2024 Trading Update - Paul - AMBER/GREEN

Knights, the legal and professional services business, today provides a trading update for the year ended 30 April 2024.

Going back through our archive, and looking at the share price, this was a fully valued firm of lawyers until 22/3/2022, when it plunged 50% to 186p on a profit warning which blamed the pandemic, and a fall in general business confidence. Here we are just over 2 years later, and the share price has still not recovered all of its losses, as just 147p. However, on the StockReport metrics, it’s now looking cheap, and has respectable quality measures too -

Today’s news, key points (for FY 4/2024) -

Revenue £150m (double H1), up 6% vs LY

Good underlying PBT of £25.0m+ (up 16%), usefully up on £11.6m in H1, so looks like margins improved in H2.

Profit is “within range of market expectations”, but no footnote.

Debtor days claimed to be 28 days (down from 30 days LY), but I challenge this number as it looks like only relates to invoices billed. The H1 balance sheet showed a larger number of unbilled receivables. So this looks a little bit like a positive spin to me, that collapses under scrutiny!

Net bank debt of £35.2m is well within its £70m facility. It’s stated after absorbing £11m of acquisition-related payments including buying Convex Capital off RBG Holdings (LON:RBGP) (I hold). I feel the debt is a little warm, and would like to see it come down somewhat.

More acquisitions being planned.

Outlook - vaguely positive, saying “well positioned for further growth” in 2025.

Valuation - no broker notes available to us, which the company should address. Stockopedia shows consensus PAT of £19.0m, which is consistent with the company’s latest guidance of underlying PBT of £25.0m. That ties in almost exactly, if we take a standard 25% corporation tax off PBT. Forecast EPS of 21.5p therefore looks reliable, giving an attractively low PER of 6.8x

Although bear in mind net bank debt is about 28% of the market cap, so I would adjust this up to a PER of ballpark 8-9x accounting for debt, still an undemanding valuation I’d say.

Although note KGH is keen on adjusting out “non-underlying operating costs” in its headline numbers, which are hefty at £2.8m in H1, and £6.8m LY. So this is a key point you need to get comfortable on before buying this share, I suggest.

Balance sheet - fairly threadbare, due to KGH liking repeated acquisitions. Although NTAV still positive at c.£7m, and net debt whilst large, is not dangerously large (but could become so if trading falls off a cliff again).

It’s not unusual for listed firms of lawyers and accountants to get into trouble from doing too many acquisitions on bank debt. In fact it’s worryingly frequent!

Paul’s opinion - I’m impressed by the growth, strong H2, high PBT margins, and of course a low PER.

Less keen on - thin balance sheet, a bit too much debt, lots of adjustments every year.

Owner/manager David Beech stands out as a shrewd man who knows how to sell high (in huge size), and buy back low (in much smaller, but still significant size!).

Overall, I think the positives outweigh the negatives, so I’m comfortable at AMBER/GREEN, based on the information available today. I keep having to stress this to a handful of readers - that I’m not able to time travel into the future, and tell you what happens next! My friend Gina is a clairvoyant though, so I'll ask her what she thinks the share price here will do! Probably along the lines of, "I see a chart bottoming out, which might be gooooood" -

Hilton Food (LON:HFG)

Up 1% to 945p (£846m) - AGM Trading Update - Paul - AMBER

This very low margin food producer has never interested me, but we always look at each share with fresh eyes, and change our minds when the facts change here at the SCVR. The share price has put in an impressive c.50% rise since the autumn 2023 lows, so buyers must see something interesting here. Let’s see if I can figure out what it is!

Hilton Food Group plc ("Hilton Foods" or the "Group"), the leading international multi-protein food business, today provides a trading update for the period from 1st January 2024 to date, ahead of its Annual General Meeting to be held at noon today.

Trading in line with expectations; volumes and sales ahead of last year

More granular detail is provided, but I’m only interested in the overview, which is in line.

Outlook -

Hilton Foods' trading performance since the start of 2024 has been in line with the Board's expectations. The business remains well-positioned for the year ahead despite the continued challenging market environment and economic conditions.

Our short and medium-term growth prospects are underpinned by the strength of our multi-category offer and continued progress in our UK Seafood business. We are well placed to deliver long-term value to all stakeholders through our customer partnerships and with our strong financial position we continue to explore further growth opportunities and wider geographic expansion.

Paul’s opinion - there’s not really a lot to add to my AMBER view of the FY 12/2023 results here on 3/4/2024. HFG makes a tiny profit margin, and a lot of that is absorbed by finance charges, leaving a paltry 1.5% PBT margin.

The bull case must rely on people thinking that margins can be increased significantly - so it’s easy to see how even small margin improvements on £4bn pa revenues, could transform the profit numbers. So maybe that’s the key area to research?

I looked recently at Premier Foods (LON:PFD) - a food manufacturer with brands, and decent pricing power, making vastly superior margins compared with HFG. There’s no contest in the quality of the businesses (compare their gross and net margins!) , PFD wipes the floor with HFG in my view.

Do any readers hold HFG? If so, why? I’d be interested to hear what the bull case is.

Graham’s Section:

Keywords Studios (LON:KWS)

Up 60% to 2350.8p (£1.86bn) - Statement re Possible Offer - Graham - AMBER

Bombshell news from Keywords as they confirm that the company:

…is in advanced discussions with a fund which is part of the EQT Group ("EQT"), a purpose-driven global investment organisation, regarding a possible cash offer of 2,550 pence per share

Interestingly, there were four previous unsolicited proposals from EQT in recent months, all of which were rejected by the Keywords Board.

However, they “would be minded to recommend” the latest possible offer.

It’s important to emphasise that the offer has not materialised yet - it sounds like they are still early in the process.

As usual, the potential buyer has 28 days to announce a firm intention to make an offer, or to walk away. That gives EQT until 15th June.

About EQT: EQT is described as a “purpose-driven global investment organisation” in today’s RNS. It’s one of the top 10 PE firms in the world, originally from Sweden and listed on the Stockholm stock exchange. Of course it’s a huge thumbs up for Keywords that it caught the attention of such an outfit.

Graham’s view

We’ve not been huge fans of this share in the SCVR, believing at times that it was overpriced. But when I covered it in December 2023, I thought that it had arguably grown into its valuation during the post-Covid era, with the PE Ratio having fallen to 13.5x, and I took a neutral stance.

Coincidentally, that’s about the same as the multiple it was trading at last night, before this potential offer was announced:

Paul also checked it out in March, upgrading to AMBER/GREEN (well done), on the back of good full-year results which included revenue growth of 13%, or 5.6% organic growth, and a very strong outlook statement.

If they do the deal at 2550p per share, EQT will be paying 24x the EPS estimate for the current year (using the estimates on the StockReport, and converting Euro cents to pence).

Granted that I’ve been a little sceptical of Keywords in the past, but personally I would be satisfied to cash in on Keywords at this price. The results have tended to be very heavy in adjustments, so the company isn’t posting “clean” profits and therefore cashing in at a PER of 24x would be attractive to me.

Organic growth is expected to improve in the current year, but from a modest level.

And the balance sheet is not a fortress: the company has used some borrowings to fund acquisitions (net debt last seen at €68m), and has negative NTAV.

EQT might very well have a successful investment at 2550p, but I’d rather be the seller at the price. I’d even consider cashing in some KWS shares today at a discount to that level, in case the deal falls through.

Paul adds: major multibagger from 2014 to 2018 - here's the chart since it floated -

CT Automotive (LON:CTA)

Up 23% to 69p (£51m) - Final Results - Graham - AMBER/GREEN

CT Automotive, a leading designer, developer and supplier of interior components to the global automotive industry, today announces its results for the year ended 31 December 2023 ("FY23").

This is a 2021 float; after a terrible beginning to life as a listed company it has more recently been on the rebound. Paul turned GREEN on it in June 2023, and the shares have approximately doubled since then:

It supplies components to nearly all (22 out of 23) of the biggest vehicle manufacturers in the world, spanning both premium and mainstream brands, and ICE/BEV/PHEV. 57 car models are currently receiving components from CT Automotive.

(For context, major car manufacturers have thousands of suppliers each - I’ve seen an estimate that a large manufacturer could have as many as 18,000 suppliers!)

The company manufactures out of China for the most part, but also Turkey and Mexico.

Today’s results for 2023 are quite late, aren’t they? But here they are:

As flagged, these are terrific results: revenues up 15%, an enormous swing from losses into profitability, and a big reduction in debt. But remember that the company raised $9.6m in new equity, and so it would be shocking if they didn’t succeed in reducing its debt.

Profits in 2023 were greatly boosted by an improvement in gross margins, so let’s hone in on this for a moment:

Improvement in gross margin is a key ongoing focus. In 2023, our gross margin grew from 12% to 22%, an excellent achievement due to the hard work of all employees across the Group. This expansion came from measures taken to reduce unit labour costs as volumes recovered, as well as from a significant improvement in raw material costs. Whilst undoubtedly, margins benefitted naturally from volume improvement in a more normal market environment, a significant proportion of the recovery came from internal actions to improve production efficiencies, the full impact of which is still coming through in 2024.

So a combination of both internal factors (efficiency/cost-cutting) and external factors (higher demand) enabled the company’s success last year.

As we are already nearly halfway through 2024, let’s now skip ahead to the outlook section.

The company is currently trading in line with expectations for 2024 (emphasis added):

In line with our expectations demand volumes have moderated as OEMs align inventory levels with normal market conditions

This will be partially offset by our new business pipeline, building on wins with Ford, Marelli and Rivian

Margin improvement initiatives made in FY23 will annualise in FY24 with ongoing cost programmes expected to further benefit profitability in the current year

We are currently in advanced negotiations to secure a new debt facility

In summary: the Covid era saw exceptionally slow demand, then 2023 saw a surge in catch-up orders, and now 2024 is a more “normal” year.

Balance sheet

CTA has net assets of $17m, almost fully tangible. Inventories ($26m) and receivables ($31m) are substantial: both are much larger than PPE ($7m) but I would say they are at reasonable levels given the revenue they are supporting.

Cash flow

The cash performance was vastly improved in 2023: $8m generated from operating activities, with only $3m spent on capex, leaving a positive margin of $5m (last year: only $5.5m generated from operating activities, with $3.5m spent on capex).

However, overall, I still don’t think the cash performance was all that good in 2023.

According to the company’s own calculations, its conversion of EBITDA (a fairly pointless metric for a manufacturer) to cash was 59%.

When I look at the cash flow statement, I’m drawn to the interest bill ($2.5m) and lease payments (of which $3m are included in “cash flow from financing activities”).

When I include these items in the calculations, I’m left with the conclusion that the business generated very little cash during the year.

I also note that very little or no corporate income tax seems to have been paid, which is giving the company a temporary boost.

Net debt: the company finished the year with a low net debt figure but it was still carrying $9m of trade loans and $4m+ in invoice financing, even after applying some of the money it raised to reduce its invoice financing facility.

Graham’s view

It won’t come as a surprise that I think CTA should be trading at a cheap earnings multiple, given the industry we are dealing with and some of my concerns around its cash performance mentioned above.

But perhaps the market was pricing this too cheaply last night, given that the company is enjoying positive momentum in revenues and profitability. Hence we had another pop in the share price this morning:

I’d like to see the company generate real cash by itself this year, without a further equity injection from investors. If I saw that, I’d happily go GREEN at the current valuation. However, for now I’m much more comfortable with Paul’s AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.